Key Takeaways

- Growing demand for AI solutions in defense and commercial markets is expected to boost OSS's revenue and earnings significantly from 2025.

- New customer-funded programs and GPU solutions for data centers present multiyear growth opportunities with significant revenue and margin impacts.

- Significant margin drop, inventory inefficiencies, and defense contract reliance pose risks to profitability and financial stability amid government spending uncertainties.

Catalysts

About One Stop Systems- Engages in the design, manufacture, and marketing of high-performance compute, high speed storage hardware and software, switch fabrics, and systems for edge deployments in the United States and internationally.

- The growing adoption of artificial intelligence, machine learning, sensor processing, and autonomy in defense and commercial markets is creating significant demand for OSS's products, leading to expected revenue growth and improved earnings starting from 2025.

- The company's efforts in developing customer-funded programs that transitioned to larger-scale orders are expected to significantly increase revenue and improve net margins as these multiyear programs mature.

- The opportunity to deliver high GPU concentration solutions to data centers represents a potential $200 million multiyear pipeline, which could drive substantial revenue growth and earnings in 2025 and beyond.

- OSS's engagement with defense contractors and the possibility of obtaining production orders for the rugged situational awareness systems for the U.S. Army creates a potential $200 million opportunity, which could significantly impact revenue and margins.

- Continued focus on operational efficiency and an expected improvement in gross margins to the targeted 30%+ range for 2025, paired with projected 20% year-over-year growth in revenue for the OSS segment, is likely to enhance profitability and earnings.

One Stop Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming One Stop Systems's revenue will grow by 11.5% annually over the next 3 years.

- Analysts are not forecasting that One Stop Systems will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate One Stop Systems's profit margin will increase from -26.4% to the average US Tech industry of 5.7% in 3 years.

- If One Stop Systems's profit margin were to converge on the industry average, you could expect earnings to reach $4.3 million (and earnings per share of $0.19) by about July 2028, up from $-14.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.0x on those 2028 earnings, up from -8.2x today. This future PE is greater than the current PE for the US Tech industry at 19.5x.

- Analysts expect the number of shares outstanding to grow by 2.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.85%, as per the Simply Wall St company report.

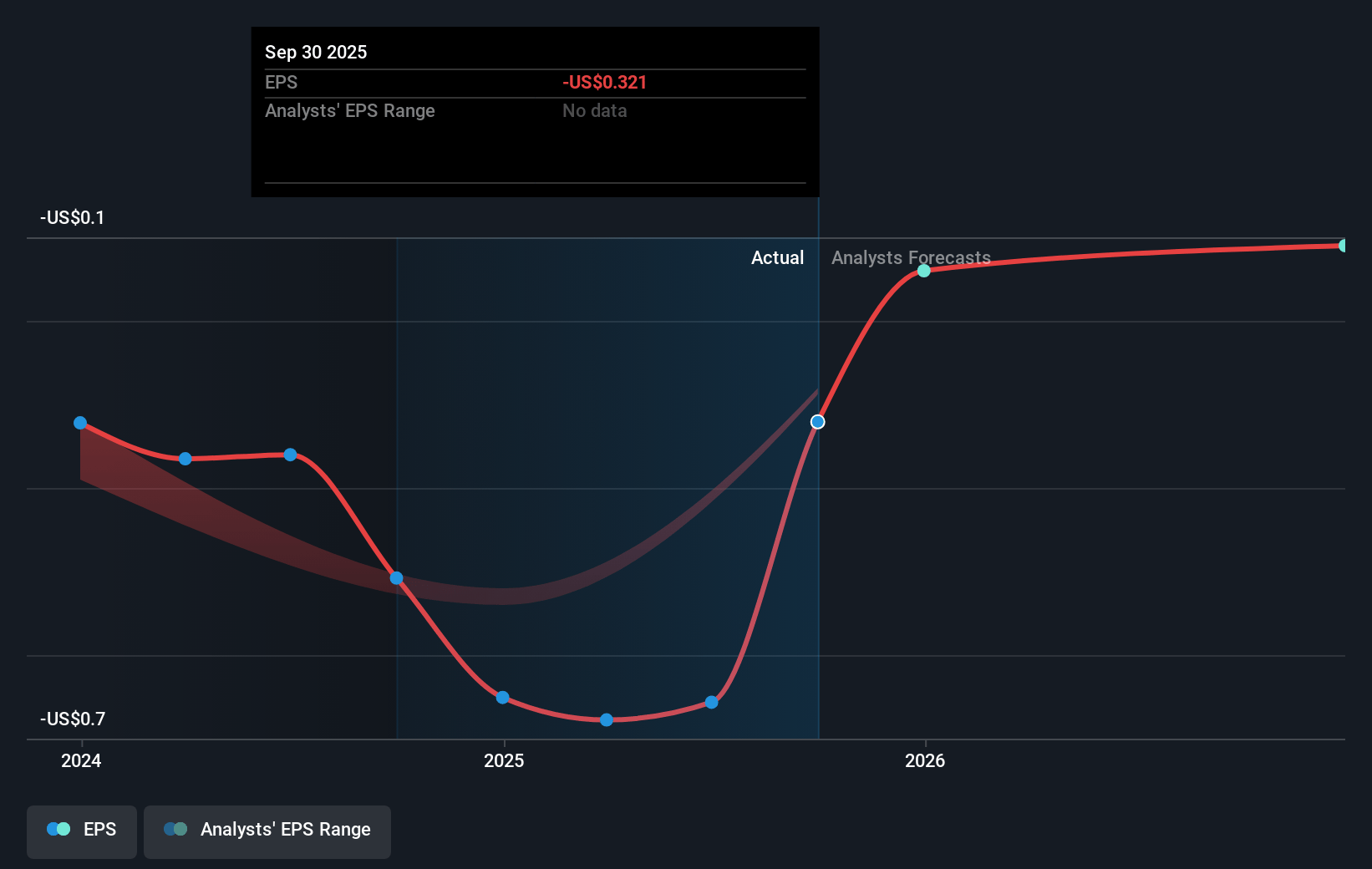

One Stop Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- OSS experienced a significant impact on its gross margin, a drop from 45.9% to 9.4% (excluding onetime charges) in the OSS segment compared to the previous year, reflecting a less profitable mix of products, potentially affecting future profitability.

- The company faced substantial inventory charges of $7.1 million due to obsolete or slow-moving inventory, which indicates potential inefficiencies in inventory management and could negatively impact net margins and financial results if not properly managed in the future.

- OSS anticipates order delays in the first half of 2025 due to government spending uncertainties and budget issues, which could affect revenue recognition timing and result in cash flow disruptions.

- The OSS segment has experienced a net loss despite revenue growth. The company's ambitious growth initiatives may require sustained investment and could continue to weigh on earnings if anticipated demand does not materialize as expected.

- The company's reliance on defense contracts, subject to government approval and budget allocations, presents a risk, especially with potential disruptions from continued resolutions affecting timing and size of revenue streams, impacting OSS's ability to achieve stable financial growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.333 for One Stop Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.0, and the most bearish reporting a price target of just $4.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $75.3 million, earnings will come to $4.3 million, and it would be trading on a PE ratio of 36.0x, assuming you use a discount rate of 7.8%.

- Given the current share price of $5.41, the analyst price target of $5.33 is 1.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.