Last Update 05 Nov 25

ONDS: Unmanned Systems Expansion Will Drive Aerospace And Defense Market Upside

Ondas Holdings recently saw its analyst price target increase from $5 to $8 per share, as analysts cite sustained momentum in autonomous systems and optimism around expanding opportunities in the aerospace and defense sectors.

Analyst Commentary

Recent analyst reports reflect strong enthusiasm about Ondas Holdings' prospects but also acknowledge potential risks and factors to consider in assessing its valuation and growth outlook.

Bullish Takeaways- Bullish analysts highlight long-term growth opportunities in Ondas' Autonomous Systems business, pointing to recent successes and new initiatives in the aerospace and defense sectors.

- The company's end-to-end portfolio is seen as well positioned to capture market share in rapidly expanding verticals such as unmanned aerial systems, with a near-term market opportunity estimated at over $5 billion.

- Strong momentum, evidenced by substantial recent share price appreciation, is attributed to traction in defense markets and execution on strategic roadmaps. This indicates confidence in sustained revenue growth.

- Despite significant stock gains in recent months, analysts believe that Ondas’ growth story is at an early stage. They suggest there may be room for further appreciation as the company scales.

- Some analysts note that the stock has experienced a sharp rally exceeding 200% over approximately two months. This could lead to concerns about valuation running ahead of near-term fundamentals.

- While execution has been strong, the ambitious revenue growth trajectory remains susceptible to industry and company-specific risks such as delays in defense contract wins or slower market adoption.

- The size and timing of the greenfield opportunity in target markets may present challenges for delivering consistent and industry-leading growth at scale.

- Current expectations assume continued operational progress, and any setbacks in executing the company’s strategic roadmap could pressure future multiples.

What's in the News

- Ondas Holdings announced the launch of Ondas Capital, a new business unit focused on accelerating deployment of unmanned and autonomous systems for Allied defense and security markets. The initial emphasis is on Eastern Europe and Ukraine (Company announcement).

- Safe Pro Group entered into memoranda of understanding with Ondas Holdings to integrate AI-powered drone imagery analysis into Ondas’ drone platforms. This integration supports military, commercial, and humanitarian missions in the U.S., NATO, and Ukraine (Client announcement).

- Ondas Holdings reaffirmed its full-year 2025 revenue target of at least $25 million in light of recent business and market expansion efforts (Corporate guidance).

- The company has completed multiple follow-on equity offerings, raising a total of over $775 million in recent transactions. The company has also filed additional offerings (SEC filings).

- Ondas Holdings was added to the S&P Global BMI Index and the S&P Telecom Select Industry Index, reflecting increased recognition in the public markets (Index constituent updates).

Valuation Changes

- Fair Value remains unchanged at 9.5, indicating consensus on the company’s intrinsic worth.

- Discount Rate has decreased slightly from 8.09% to 7.93%, reflecting modestly lower perceived risk or improved business stability.

- Revenue Growth is effectively flat, holding steady at approximately 135.1% year-over-year. This signals continued high growth expectations.

- Net Profit Margin has increased from 8.73% to 9.09%, representing a moderate improvement in projected profitability.

- Future P/E ratio has fallen from 175.7x to 168.0x. This indicates a slight reduction in the multiple investors are willing to pay for future earnings.

Key Takeaways

- Strategic partnerships and expanding defense contracts in various sectors are driving significant revenue growth and market diversification for Ondas Holdings.

- Advancements in autonomous systems and private network technologies are set to enhance operational efficiency, potentially improving margins and financial performance.

- High operating expenses and debt reliance are challenges, with conservative revenue expectations and volatile margins posing risks to future profitability and growth.

Catalysts

About Ondas Holdings- Provides private wireless, drone, and automated data solutions in the United States and internationally.

- Ondas anticipates record revenue growth in 2025, primarily driven by Ondas Autonomous Systems (OAS), due to significant backlog and expanding programs with Optimus and Iron Drone systems in defense and homeland security sectors. This will directly impact revenue.

- The strategic partnership with Palantir Technologies aims to leverage advanced AI capabilities to enhance operational efficiencies and scale OAS’s operations, which is expected to support the revenue ramp and broaden their customer base, influencing earnings and margins through improved operational scale.

- The expansion of OAS’s market presence, with increased customer engagement and government contracts in defense sectors in Israel and the UAE, is set to secure additional military customers, suggesting potential revenue growth and improved market diversification.

- Expected improvements in operating leverage as revenues grow, particularly at OAS, are set to recover gross margins, which could reach 50% or better in the second half of 2025, impacting net margins positively.

- Continued strategic value building at Ondas Networks and progress in private wireless network technologies for rail operations, which includes 900-megahertz network rollouts and new product opportunities, aims to unlock further revenue streams and bolster financial performance.

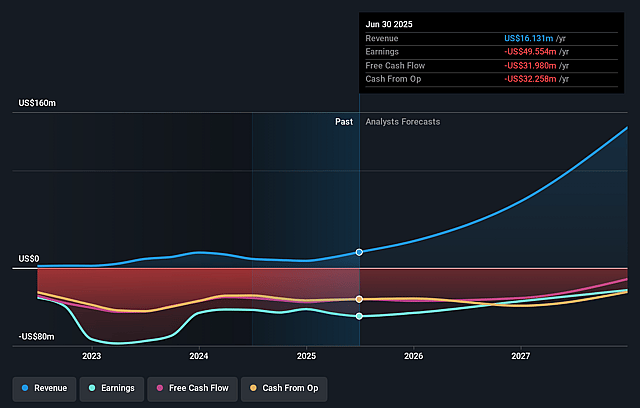

Ondas Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ondas Holdings's revenue will grow by 141.1% annually over the next 3 years.

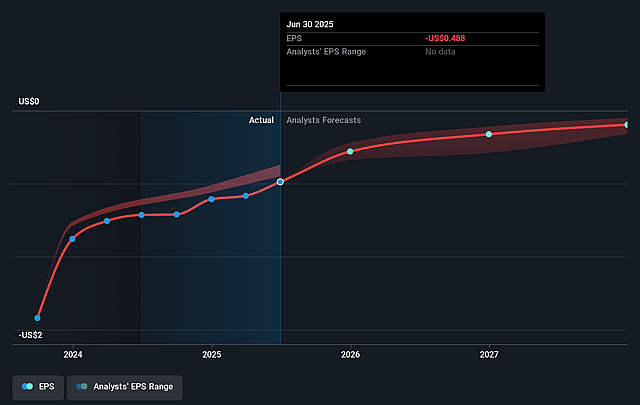

- Analysts are not forecasting that Ondas Holdings will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Ondas Holdings's profit margin will increase from -433.8% to the average US Communications industry of 10.7% in 3 years.

- If Ondas Holdings's profit margin were to converge on the industry average, you could expect earnings to reach $16.3 million (and earnings per share of $0.08) by about July 2028, up from $-46.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.9x on those 2028 earnings, up from -7.8x today. This future PE is greater than the current PE for the US Communications industry at 28.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.59%, as per the Simply Wall St company report.

Ondas Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ondas Holdings faced challenges in 2024, such as extending timelines at Ondas Networks and disruptions due to military activity in Israel, which could impede future revenue growth if similar issues recur.

- The company's revenue expectations for 2025 remain conservative at $25 million, with uncertainties related to Ondas Networks affecting the potential for revenue expansion.

- Gross margins are expected to be volatile due to the early stages of platform adoption and shifts in revenue mix, which may impact net margins and profitability.

- As of 2024, Ondas Holdings reported high operating expenses and adjusted EBITDA loss, with existing revenues not covering these expenses, posing a risk to future earnings if revenue growth does not accelerate as projected.

- The $52 million in debt outstanding and reliance on raising additional funds or extending debt terms might impact the company's financial health and its ability to invest in growth initiatives.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.5 for Ondas Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $3.0, and the most bearish reporting a price target of just $2.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $151.6 million, earnings will come to $16.3 million, and it would be trading on a PE ratio of 40.9x, assuming you use a discount rate of 7.6%.

- Given the current share price of $2.1, the analyst price target of $2.5 is 16.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.