Last Update 07 Dec 25

Fair value Increased 1.32%ONDS: Aerospace And Defense Expansion Will Drive Backlog And Earnings Upside

Analysts have modestly increased their price target for Ondas Holdings, lifting fair value from approximately $10.86 to $11.00 per share. They cited the accretive Roboteam acquisition, stronger than expected Q3 results, and a robust growth pipeline that supports higher long term revenue and earnings assumptions.

Analyst Commentary

Recent Street research reflects a constructive stance on Ondas Holdings, with several firms revisiting their models following the Roboteam acquisition, stronger than expected Q3 results, and a clearer long term growth roadmap.

Bullish Takeaways

- Bullish analysts highlight the Roboteam acquisition as a strategically accretive move that accelerates revenue growth and supports higher medium term price targets.

- Upwardly revised revenue targets, including expectations that Ondas can exceed its previously stated $110 million goal for next year, are seen as supportive of the recent fair value increase.

- Strong Q3 execution, with revenue growing multiple times year over year and improving gross margin trajectories, reinforces confidence in the company’s ability to scale profitably.

- Analysts point to a growing backlog, an expanding ecosystem of technologies and partners, and continued capital deployment as evidence of a durable growth pipeline that underpins potential valuation upside.

Bearish Takeaways

- Bearish analysts caution that recent share price appreciation has been steep, which raises the risk that expectations may be running ahead of execution in the near term.

- There is concern that integration of Roboteam and other potential acquisitions could introduce operational complexity, which may pressure margins and delay the path to higher profitability.

- Some observers note that the company’s aggressive growth ambitions, including continued capital deployment through 2026, could heighten financing and dilution risks if performance falls short.

- Execution risk remains a key focus, with skeptics watching whether Ondas can consistently convert its backlog and pipeline into realized revenue at the pace implied in current valuation models.

What's in the News

- Stockholders approved an amendment to the Amended and Restated Articles of Incorporation to double authorized common shares from 400 million to 800 million at the November 20, 2025 special meeting (Changes in Company Bylaws/Rules).

- Ondas completed a follow on equity offering totaling approximately $425 million, including common stock, pre funded warrants, and common warrants. This significantly bolstered the company's capital base (Follow on Equity Offerings).

- The company filed an additional follow on equity offering of common stock totaling $200 million, providing further flexibility to fund growth initiatives and potential acquisitions (Follow on Equity Offerings).

- Ondas was added to the S&P Global BMI Index and the S&P Telecom Select Industry Index, expanding its visibility and potential ownership among passive and benchmarked institutional investors (Index Constituent Adds).

- Multiple 60 day lock up agreements covering common stock, restricted stock units, stock options, and warrants are set to expire in November and December 2025. This could increase potential secondary market liquidity (End of Lock Up Period).

Valuation Changes

- Fair Value: risen slightly from approximately $10.86 to $11.00 per share, reflecting modest upside in the updated valuation model.

- Discount Rate: increased marginally from about 7.99 percent to 8.04 percent, implying a slightly higher required return on equity risk.

- Revenue Growth: edged up from roughly 134.13 percent to 134.41 percent, signaling a small upward revision in forward growth expectations.

- Net Profit Margin: dipped modestly from about 10.00 percent to 9.96 percent, indicating a slightly more conservative view on future profitability.

- Future P/E: risen slightly from around 194.15x to 197.02x, suggesting a marginally higher multiple applied to projected earnings.

Key Takeaways

- Strategic partnerships and expanding defense contracts in various sectors are driving significant revenue growth and market diversification for Ondas Holdings.

- Advancements in autonomous systems and private network technologies are set to enhance operational efficiency, potentially improving margins and financial performance.

- High operating expenses and debt reliance are challenges, with conservative revenue expectations and volatile margins posing risks to future profitability and growth.

Catalysts

About Ondas Holdings- Provides private wireless, drone, and automated data solutions in the United States and internationally.

- Ondas anticipates record revenue growth in 2025, primarily driven by Ondas Autonomous Systems (OAS), due to significant backlog and expanding programs with Optimus and Iron Drone systems in defense and homeland security sectors. This will directly impact revenue.

- The strategic partnership with Palantir Technologies aims to leverage advanced AI capabilities to enhance operational efficiencies and scale OAS’s operations, which is expected to support the revenue ramp and broaden their customer base, influencing earnings and margins through improved operational scale.

- The expansion of OAS’s market presence, with increased customer engagement and government contracts in defense sectors in Israel and the UAE, is set to secure additional military customers, suggesting potential revenue growth and improved market diversification.

- Expected improvements in operating leverage as revenues grow, particularly at OAS, are set to recover gross margins, which could reach 50% or better in the second half of 2025, impacting net margins positively.

- Continued strategic value building at Ondas Networks and progress in private wireless network technologies for rail operations, which includes 900-megahertz network rollouts and new product opportunities, aims to unlock further revenue streams and bolster financial performance.

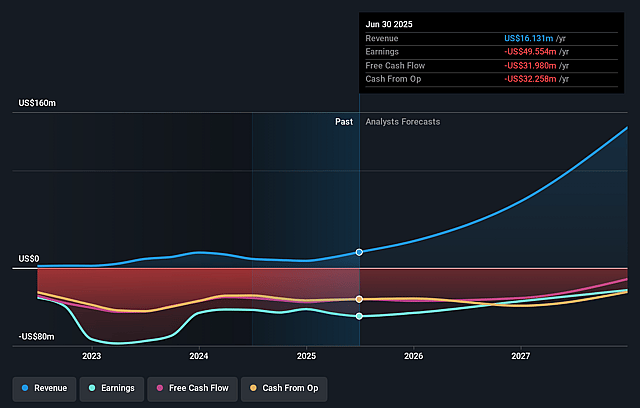

Ondas Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ondas Holdings's revenue will grow by 141.1% annually over the next 3 years.

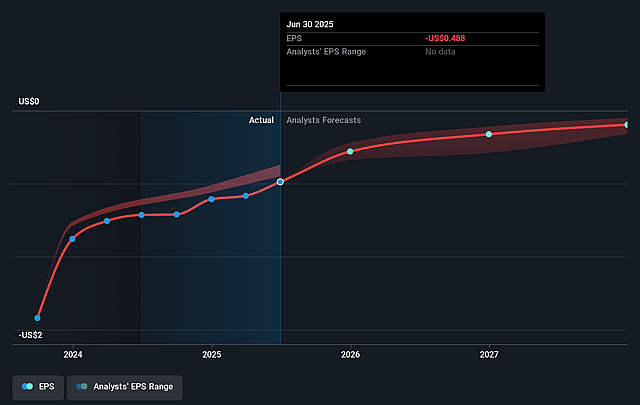

- Analysts are not forecasting that Ondas Holdings will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Ondas Holdings's profit margin will increase from -433.8% to the average US Communications industry of 10.7% in 3 years.

- If Ondas Holdings's profit margin were to converge on the industry average, you could expect earnings to reach $16.3 million (and earnings per share of $0.08) by about July 2028, up from $-46.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.9x on those 2028 earnings, up from -7.8x today. This future PE is greater than the current PE for the US Communications industry at 28.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.59%, as per the Simply Wall St company report.

Ondas Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ondas Holdings faced challenges in 2024, such as extending timelines at Ondas Networks and disruptions due to military activity in Israel, which could impede future revenue growth if similar issues recur.

- The company's revenue expectations for 2025 remain conservative at $25 million, with uncertainties related to Ondas Networks affecting the potential for revenue expansion.

- Gross margins are expected to be volatile due to the early stages of platform adoption and shifts in revenue mix, which may impact net margins and profitability.

- As of 2024, Ondas Holdings reported high operating expenses and adjusted EBITDA loss, with existing revenues not covering these expenses, posing a risk to future earnings if revenue growth does not accelerate as projected.

- The $52 million in debt outstanding and reliance on raising additional funds or extending debt terms might impact the company's financial health and its ability to invest in growth initiatives.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.5 for Ondas Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $3.0, and the most bearish reporting a price target of just $2.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $151.6 million, earnings will come to $16.3 million, and it would be trading on a PE ratio of 40.9x, assuming you use a discount rate of 7.6%.

- Given the current share price of $2.1, the analyst price target of $2.5 is 16.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Ondas Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.