Key Takeaways

- Growth in electrification, automation, and renewable energy markets, alongside design wins and M&A, provides sustained momentum for higher revenues and expanded end-market opportunities.

- Operational efficiency initiatives, product portfolio optimization, and focus on R&D strengthen margins, earnings resilience, and competitive positioning across evolving global markets.

- Geopolitical tensions, regulatory changes, and market cyclicality threaten Littelfuse's margins and earnings growth, compounded by rising competition and concentration in volatile end markets.

Catalysts

About Littelfuse- Designs, manufactures, and sells electronic components, modules, and subassemblies worldwide.

- Upticks in design wins and momentum across electrification of vehicles, automation, and data center applications suggest Littelfuse is poised to benefit from multi-year content growth as automotive, industrial, and electronics markets transition toward higher voltage, increased connectivity, and electrification; this underpins high visibility into future revenue expansion.

- As global investments in renewable energy, energy storage, and distributed power infrastructure accelerate, Littelfuse’s recent wins in solar and storage applications in North America and China directly support expectations of expanding addressable markets, providing a strong backdrop for sustained top-line growth.

- Ongoing cost scaling actions and operational efficiency initiatives—including footprint optimization, working capital improvements, and targeted cost reductions—have already driven sequential margin expansion in the second half of 2024 and are expected to further increase net margins and earnings resilience as volume recovers.

- Structural business changes, including active product portfolio pruning and recent M&A activity (such as the acquisition of the Dortmund semiconductor fab), provide incremental revenue streams, broaden the company’s end-market reach, and open new margin opportunities, strengthening operating leverage and long-term earnings growth.

- The company’s ability to capitalize on rising safety standards, miniaturization of electronics, and supply chain localization trends—combined with sustained investments in R&D and custom high-value solutions—fortifies pricing power and competitive positioning, supporting continued improvement in gross margins and earnings per share.

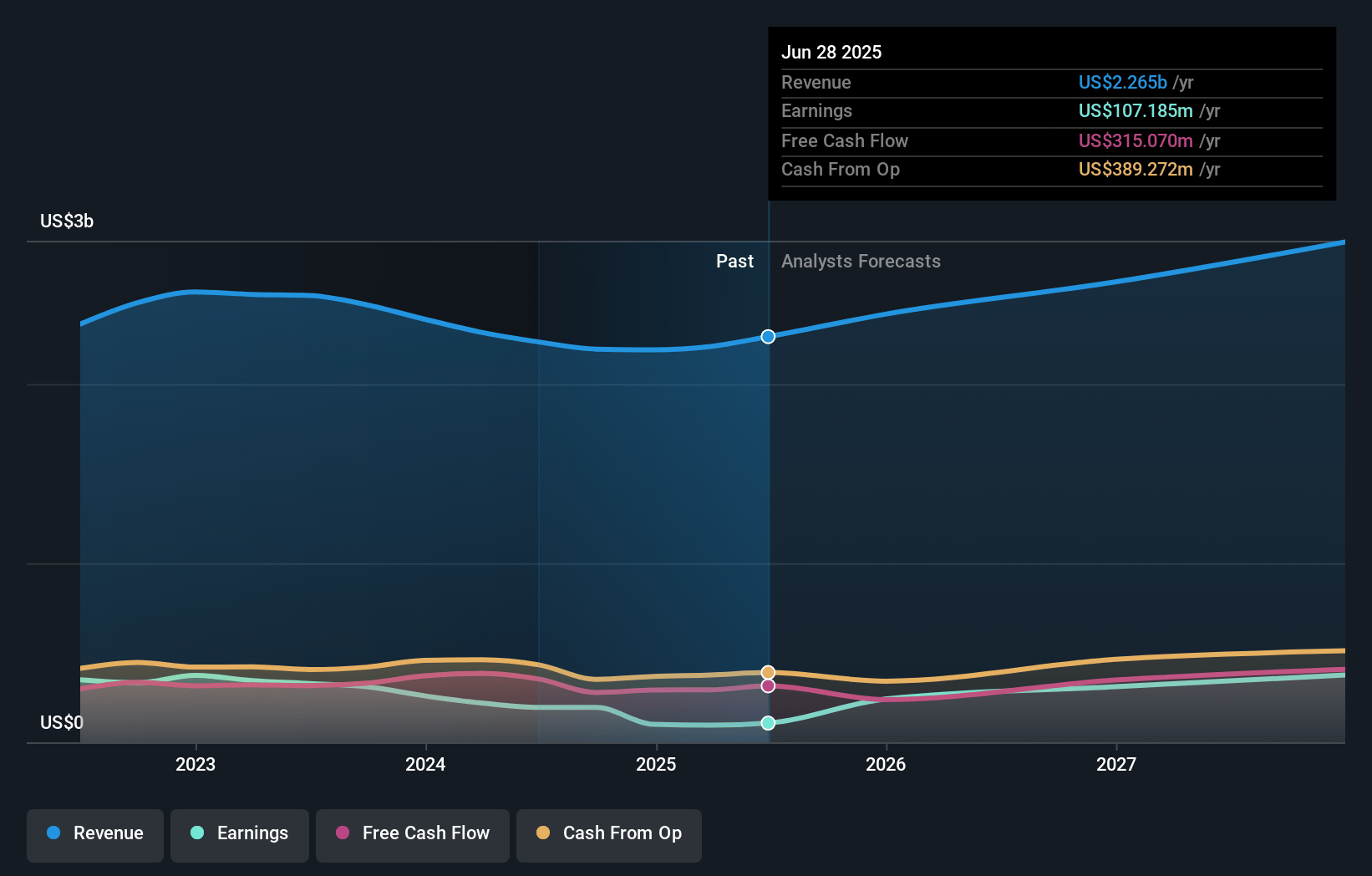

Littelfuse Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Littelfuse compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Littelfuse's revenue will grow by 6.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.6% today to 14.2% in 3 years time.

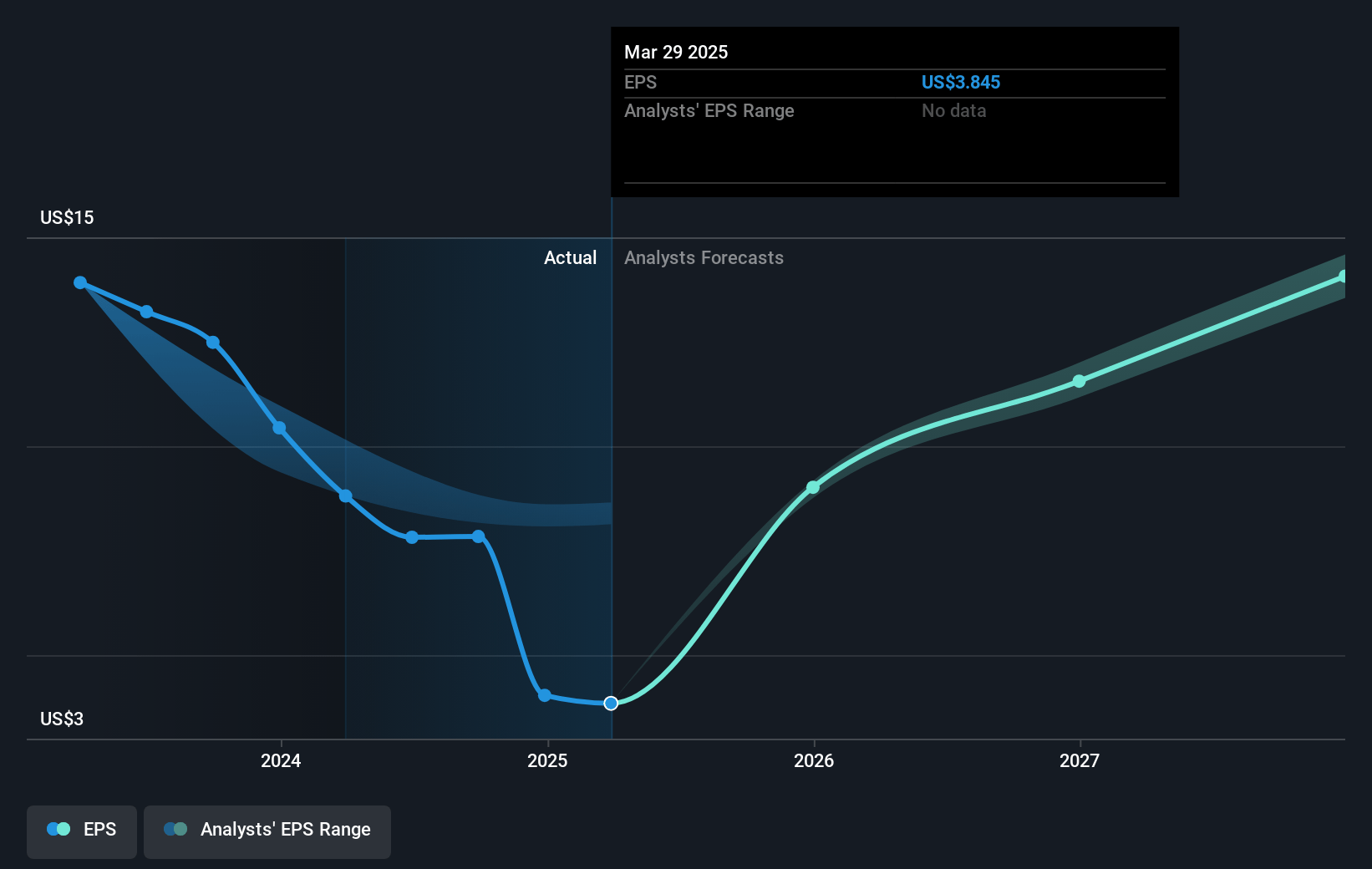

- The bullish analysts expect earnings to reach $377.0 million (and earnings per share of $15.47) by about April 2028, up from $100.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 24.7x on those 2028 earnings, down from 40.2x today. This future PE is greater than the current PE for the US Electronic industry at 19.4x.

- Analysts expect the number of shares outstanding to decline by 0.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.81%, as per the Simply Wall St company report.

Littelfuse Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent global trade tensions and the potential for new tariffs could disrupt Littelfuse’s supply chains, raising input costs and creating margin headwinds, as highlighted by the company’s ongoing scenario planning and comments on past tariff impacts and manufacturing footprint realignment. This could weigh on gross margins and operating profits over time.

- Littelfuse’s strategy of aligning manufacturing with customer regions may become less effective if geopolitical shifts force additional onshoring, potentially undercutting the efficiencies of its globally distributed model and leading to margin compression in future periods.

- Intensifying environmental regulations and evolving requirements for sustainable materials could mandate substantial reinvestment in product redesign and manufacturing, as noted by increased focus on sustainability and customer solutions. This would divert capital away from growth and R&D, negatively impacting long-term earnings expansion.

- The company remains heavily exposed to economically sensitive end markets, with management acknowledging revenue concentration in automotive, industrial, and commercial vehicles—all of which exhibited volatility, softening, or outright declines across various geographies in fiscal 2024. This leaves Littelfuse vulnerable to cyclical downturns, impairing earnings predictability and revenue growth.

- Margin pressure from growing price competition and commoditization in electronic components is evident, particularly as the company reported ongoing weakness in its semiconductor business, challenges in sustaining premium pricing, and segment margin softness during downcycles. This trend threatens gross margins and the durability of long-term earnings growth if product differentiation lags.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Littelfuse is $310.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Littelfuse's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $310.0, and the most bearish reporting a price target of just $182.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $377.0 million, and it would be trading on a PE ratio of 24.7x, assuming you use a discount rate of 7.8%.

- Given the current share price of $162.95, the bullish analyst price target of $310.0 is 47.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:LFUS. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.