Narratives are currently in beta

Key Takeaways

- Strategic focus on hybrid multicloud solutions and partnerships with NVIDIA positions F5 to capture growth from emerging AI infrastructure opportunities.

- Increased software focus and growing recurring revenue provide greater revenue visibility and support long-term earnings potential while stabilizing cash flow.

- Economic uncertainty, market competition, and software renewal dependency could impede F5's revenue and earnings growth despite AI investments and hybrid cloud challenges.

Catalysts

About F5- Provides multi-cloud application security and delivery solutions in the United States, Europe, the Middle East, Africa, and the Asia Pacific region.

- F5's focus on the growing demand for hybrid multicloud solutions aligns with current industry trends. This strategic alignment is expected to drive top-line growth as more enterprises seek comprehensive and secure application services across diverse environments. This is likely to impact revenue positively.

- The company's increased software focus, illustrated by 19% YOY software revenue growth in Q4 and a shift toward subscription models, enhances revenue visibility and supports future earnings growth. The expected acceleration in software renewal opportunities should bolster total revenue and contribute to expanding net margins.

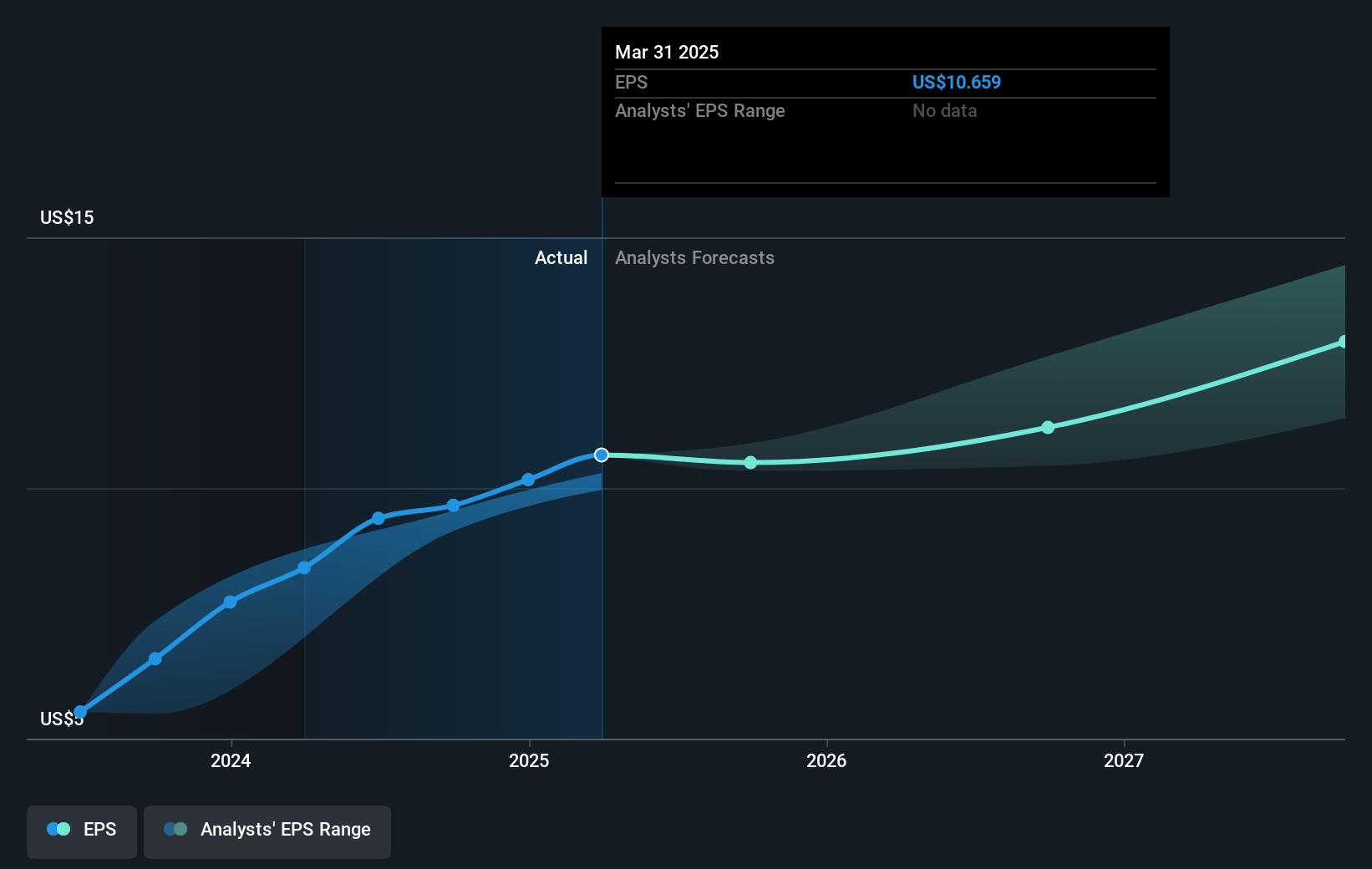

- F5 is optimistic about improving operating margins and driving 5% to 7% earnings growth in fiscal year '25. This expectation is based on continued operating discipline and a substantial software revenue base, indicating potential improvement in net margins and EPS.

- The partnership with NVIDIA to integrate F5's software with advanced AI technologies like NVIDIA's BlueField-3 DPUs positions F5 to seize emerging AI infrastructure opportunities. This strategic initiative could unlock new revenue streams over time and provide a margin boost through software and AI-related solutions.

- F5's growing recurring revenue, which accounts for a substantial part of total revenue, aids in stabilizing cash flow and reducing earnings volatility. This recurring revenue initiative is vital for sustaining long-term revenue growth and enhancing earnings predictability.

F5 Future Earnings and Revenue Growth

Assumptions

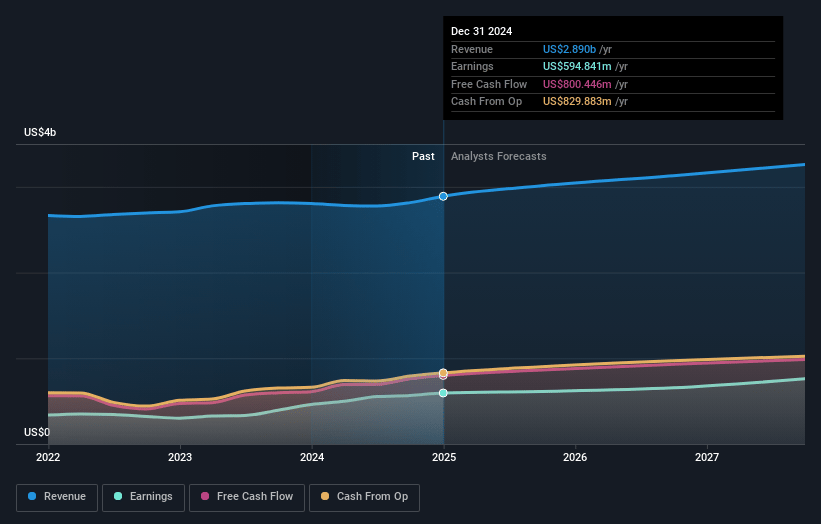

How have these above catalysts been quantified?- Analysts are assuming F5's revenue will grow by 4.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 20.1% today to 25.7% in 3 years time.

- Analysts expect earnings to reach $814.7 million (and earnings per share of $13.65) by about November 2027, up from $566.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.7x on those 2027 earnings, down from 24.8x today. This future PE is lower than the current PE for the US Communications industry at 24.2x.

- Analysts expect the number of shares outstanding to grow by 0.6% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.46%, as per the Simply Wall St company report.

F5 Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Economic uncertainty and a potential lack of substantial growth in IT budgets could hinder F5's ability to achieve anticipated revenue growth, especially impacting new software project initiations. This could lead to stagnation in revenue growth.

- Increasing complexity and cost associated with managing the hybrid multicloud and increasing API distribution could impose challenges on IT teams, risking higher operational costs and potentially affecting F5's net margins if not properly addressed.

- Competitive pressures, particularly from new market entrants or existing stakeholders such as NVIDIA developing alternative solutions, may erode F5's market share in both hardware and software segments, impacting revenue and earnings growth.

- An anticipated deceleration in software growth despite early-stage AI investments poses a risk if AI-driven demand fails to materialize as expected, potentially resulting in lower-than-forecasted software revenue.

- The reliance on large software renewals for revenue visibility suggests that any disruptions or lower-than-expected renewal rates can adversely affect revenue and earnings projections, especially since expansion into new customer bases contributes less to overall growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $237.19 for F5 based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $285.0, and the most bearish reporting a price target of just $180.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.2 billion, earnings will come to $814.7 million, and it would be trading on a PE ratio of 20.7x, assuming you use a discount rate of 6.5%.

- Given the current share price of $239.67, the analyst's price target of $237.19 is 1.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives