Key Takeaways

- F5's expansion in software subscriptions and multi-cloud solutions suggests increased revenue growth through higher recurring revenues and demand for secure application infrastructures.

- Strategic positioning in AI and security advancements positions F5 for revenue and earnings growth by capturing market share from underinvested competitors.

- Reliance on AI infrastructure, competitor pressures, and hardware risks may impact F5's revenue growth and net margins amid macroeconomic uncertainties.

Catalysts

About F5- Provides multicloud application security and delivery solutions in the United States, Europe, the Middle East, Africa, and the Asia Pacific region.

- F5's strong expansion of software subscriptions, driven by customer renewals and broad adoption, points to future revenue growth by capitalizing on subscription-based models which offer higher recurring revenues.

- The company's ability to tailor solutions for hybrid multi-cloud environments places it favorably within secular trends, suggesting a path to increased revenue through capturing growing demand for simplified and secure multi-cloud application infrastructures.

- F5's unique differentiation in application and API security consolidation into a single integrated platform indicates potential improvement in net margins as customers seek cost-efficient, simplified security management.

- With growth in AI creating new infrastructure demands, F5's advancements in high-performance data delivery and AI model security enable the company to capture growth in IT spending, suggesting potential EPS gains through strategic positioning in AI-driven workloads.

- F5’s focus on competitive displacement, especially in the hardware segment with next-generation products, positions the company for revenue growth and enhanced earnings by capturing market share from rivals who have underinvested in key technologies.

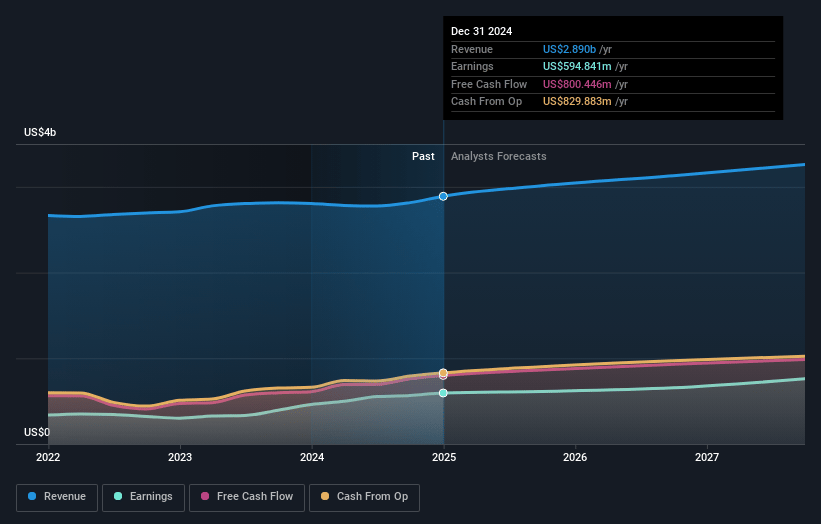

F5 Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming F5's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 20.6% today to 24.5% in 3 years time.

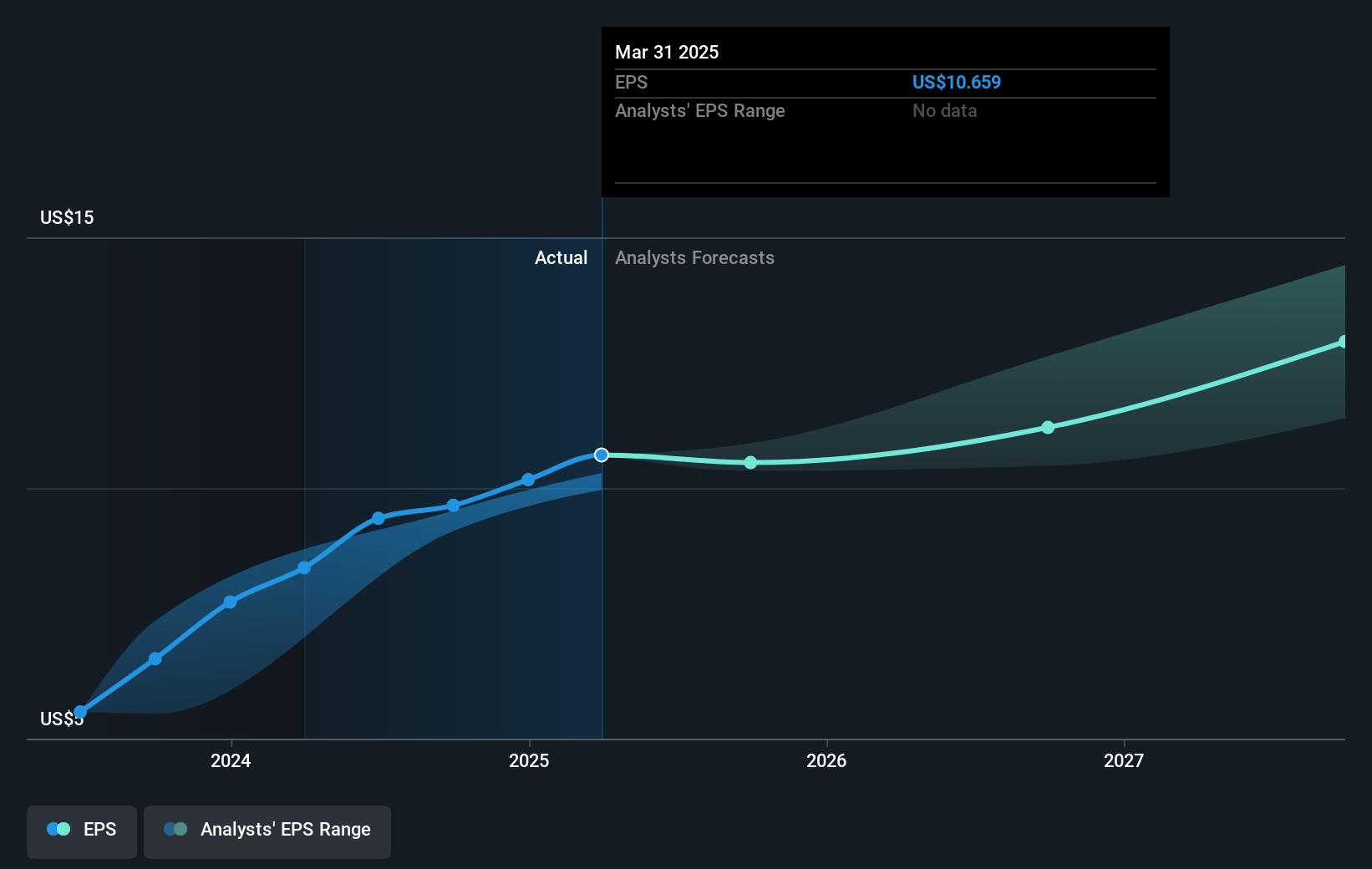

- Analysts expect earnings to reach $822.5 million (and earnings per share of $14.06) by about April 2028, up from $594.8 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $667.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.6x on those 2028 earnings, down from 25.1x today. This future PE is lower than the current PE for the US Communications industry at 24.8x.

- Analysts expect the number of shares outstanding to decline by 1.64% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.94%, as per the Simply Wall St company report.

F5 Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increasing reliance on AI infrastructure presents challenges such as compliance, networking, and security, which could strain F5's ability to keep up with demands, potentially impacting future revenue growth.

- Aggressive competition in the cybersecurity and application delivery industry may pressure F5 to continuously innovate, incurring higher R&D expenses and impacting net margins.

- F5's commitment to hardware and hybrid environments could risk overextension, with a possible shift towards cloud-native solutions from rivals affecting long-term revenue stability.

- The alignment with significant secular trends relies on broader enterprise shifts, which could be disrupted by macroeconomic factors, impacting revenue projections.

- The heavy dependence on expansion within existing customer bases for software revenue growth may be unstainable if customer renewal or expansion rates falter, threatening earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $294.236 for F5 based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $360.0, and the most bearish reporting a price target of just $260.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.4 billion, earnings will come to $822.5 million, and it would be trading on a PE ratio of 23.6x, assuming you use a discount rate of 6.9%.

- Given the current share price of $258.98, the analyst price target of $294.24 is 12.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.