Narratives are currently in beta

Key Takeaways

- Strategic partnerships and new production investments are expected to enhance capacity and revenue, driving potential improvements in earnings and net margins.

- Focus on efficiency and shareholder returns may elevate net margins and earnings per share through operational improvements and a growth-oriented dividend policy.

- Eltek faces margin pressures from increased wages and unfavorable product mix, while short-term revenue is challenged by decreased demand and delayed benefits from partnerships.

Catalysts

About Eltek- Manufactures, markets, and sells printed circuit boards (PCBs) in Israel, Europe, North America, India, the Netherlands, and internationally.

- Eltek anticipates steady growth in demand for high-end products, particularly in critical sectors like medical and defense due to global trade tensions, which could positively impact revenue and net margins.

- The initiation of co-production partnerships overseas aims to better meet customer demand and improve pricing, suggesting potential improvements in revenue and net margins.

- The company is in the final stages of a new production hall investment, expected to support increased capacity, potentially boosting revenue and earnings.

- An ERP project is underway to streamline operations, possibly improving operational efficiency, which may result in higher net margins.

- The company's dividend policy, distributing up to 25% of net profits, alongside capacity expansion plans, indicates a focus on shareholder returns, potentially enhancing earnings per share (EPS) in the long term.

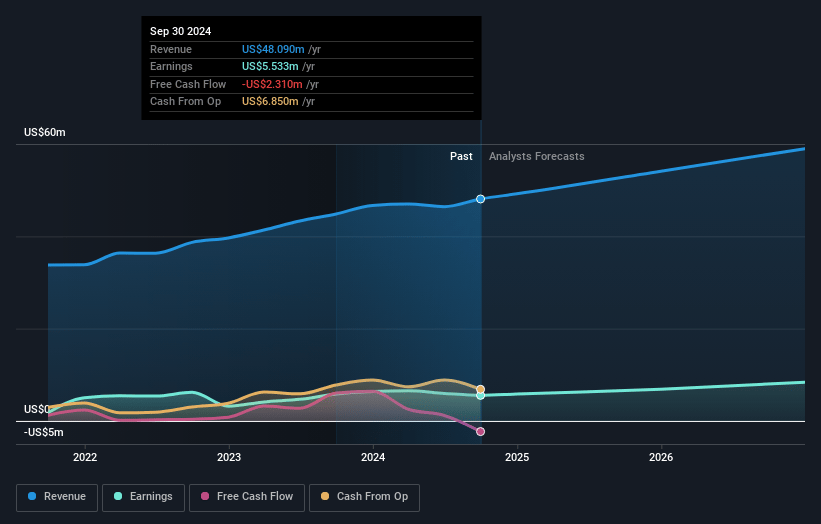

Eltek Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Eltek's revenue will grow by 9.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.5% today to 15.1% in 3 years time.

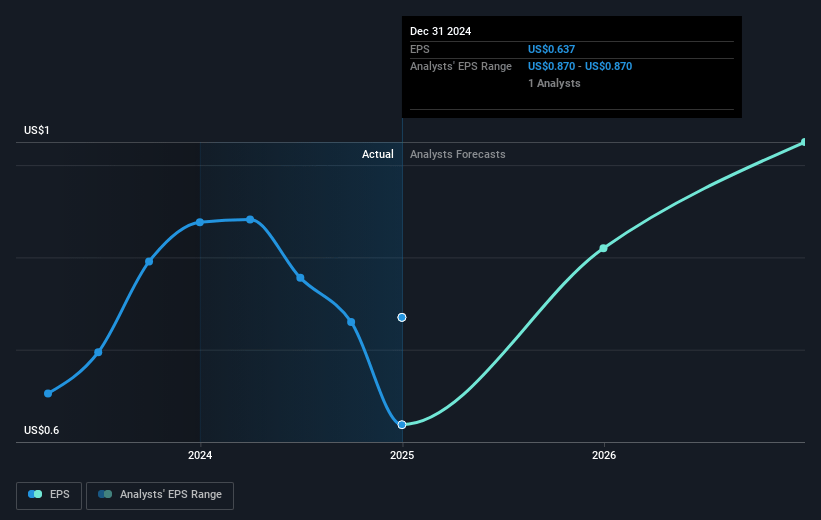

- Analysts expect earnings to reach $9.5 million (and earnings per share of $1.4) by about November 2027, up from $5.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.5x on those 2027 earnings, up from 14.1x today. This future PE is lower than the current PE for the US Electronic industry at 23.4x.

- Analysts expect the number of shares outstanding to grow by 0.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.38%, as per the Simply Wall St company report.

Eltek Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Eltek's gross profit for Q3 2024 decreased compared to Q3 2023, primarily due to a less favorable product mix and increased wages for manufacturing employees. This impacts net margins due to higher input costs without a corresponding increase in product prices.

- While Eltek anticipates a recovery in the industrial segment in 2025, there is currently a slowdown due to reduced demand from primary customers. This can negatively impact revenue in the short term.

- The increase in production worker wages to address labor market conditions in Israel may continue to exert pressure on gross margins if not fully passed on to customers.

- Although the company has initiated co-production partnerships overseas, significant progress in sales from these partnerships has yet to be observed, potentially affecting planned expansion of revenue and earnings.

- The company's substantial upcoming capital expenditures, including $7 million to $8 million in 2025 as part of the accelerated investment plan, could strain cash flows and delay short-term profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $18.0 for Eltek based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $63.1 million, earnings will come to $9.5 million, and it would be trading on a PE ratio of 14.5x, assuming you use a discount rate of 8.4%.

- Given the current share price of $11.63, the analyst's price target of $18.0 is 35.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives