Key Takeaways

- Accelerating automation and advanced AI-powered products are expanding Cognex’s market reach, supporting sustained growth and increased profitability through broader adoption in logistics and manufacturing.

- Strategic focus on user-friendly solutions and recurring revenue is driving customer expansion, operating leverage, and stronger earnings consistency as Industry 4.0 adoption accelerates.

- Mounting competitive pressures, cyclical market exposure, and industry shifts toward integration threaten Cognex’s market share, pricing power, and long-term profitability.

Catalysts

About Cognex- Provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide.

- Rapid adoption of advanced AI-powered machine vision products, such as Cognex’s first AI-enabled 3D smart cameras and transformer-based deep learning software, is significantly expanding the range of complex inspection tasks that can be automated in manufacturing and logistics, positioning Cognex to capture new customers and applications. This increased capability is expected to drive top-line revenue growth and unlock new addressable market segments previously unreachable with legacy solutions.

- The acceleration of automation and robotics across global manufacturing, logistics, and e-commerce is fueling broad-based demand for Cognex’s solutions, particularly as logistics revenue grew 20% year over year with strong wins from leading e-commerce and regional parcel providers. As more companies prioritize automated fulfillment and item-tracking, Cognex’s leadership in logistics barcode reading and modular vision tunnel solutions is poised to deliver sustained double-digit revenue growth and stable gross margins.

- The move toward easier-to-deploy, user-friendly machine vision products, supported by an expanded and transformed sales force targeting underpenetrated and mid-tier customers, has already resulted in the addition of over 3,000 new customers in 2024. This strategy is expected to broaden Cognex’s recurring revenue streams, drive higher operating leverage, and improve earnings consistency as adoption scales.

- Ongoing R&D investment in AI-enabled smart cameras, transformer-based deep learning, and modular vision systems positions Cognex as the clear technology leader as electronics and automotive components become increasingly miniaturized and complex. Addressing the growing need for precision inspection across these evolving end markets is likely to support premium pricing, increased market share, and sustained gross margin improvement.

- As global manufacturers and logistics providers embrace smarter factories and Industry 4.0 initiatives, Cognex is well-positioned to benefit from the intensifying need for intelligent vision systems and integrated software platforms. This trend will drive greater integration of Cognex’s software-enabled, subscription-based solutions, leading to higher recurring revenue, improved operating margins, and stronger free cash flow conversion over the long term.

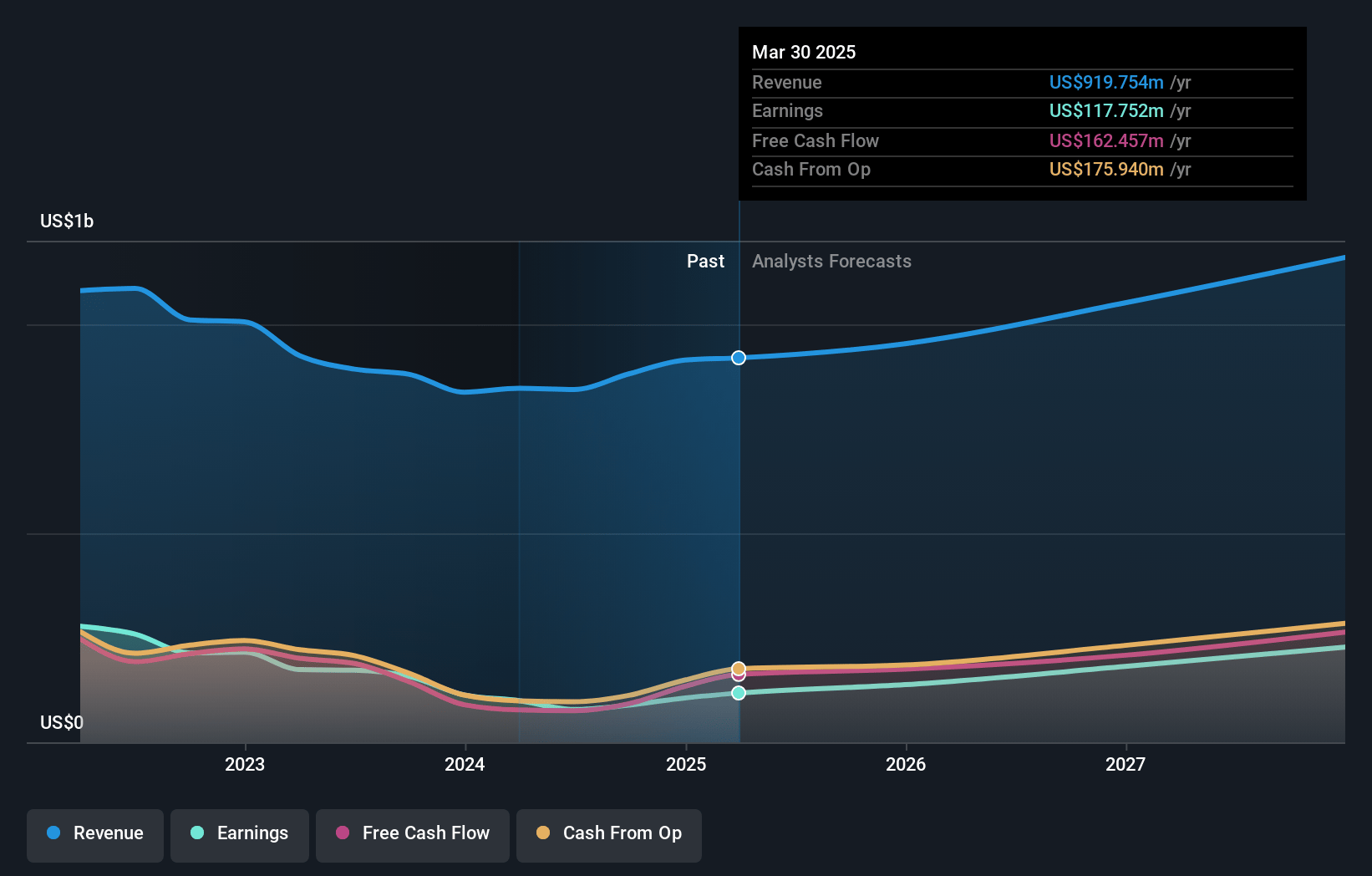

Cognex Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Cognex compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Cognex's revenue will grow by 13.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 11.6% today to 17.5% in 3 years time.

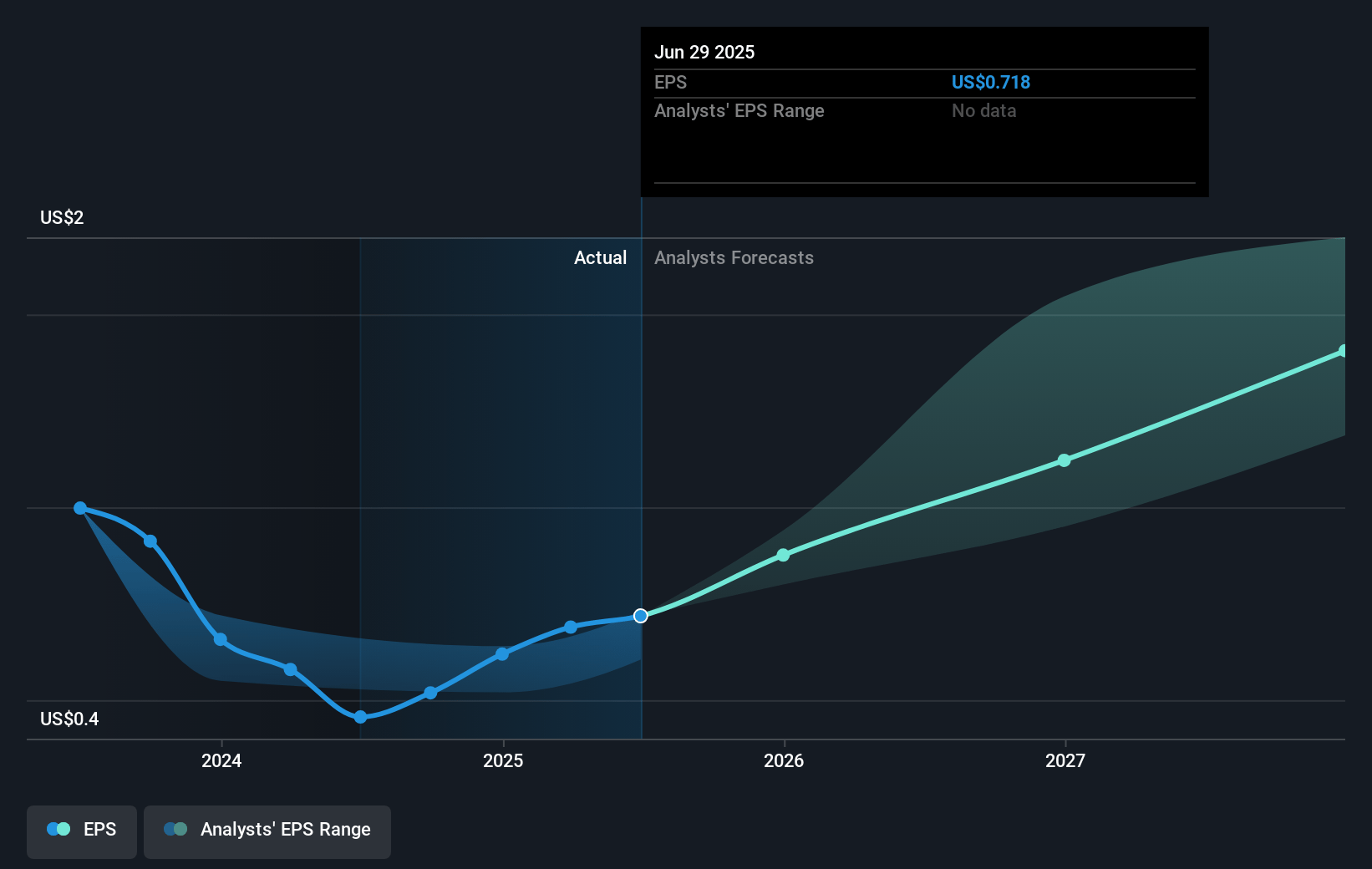

- The bullish analysts expect earnings to reach $233.1 million (and earnings per share of $1.35) by about April 2028, up from $106.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 48.4x on those 2028 earnings, up from 38.6x today. This future PE is greater than the current PE for the US Electronic industry at 19.3x.

- Analysts expect the number of shares outstanding to decline by 1.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.3%, as per the Simply Wall St company report.

Cognex Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing deglobalization and the trend toward reshoring in key markets like the US and Europe may shrink Cognex’s total addressable market for factory automation and reduce demand for its products, potentially leading to slower revenue growth and increased regional earnings volatility.

- Heightened competitive pressure, especially from lower-cost Asian machine vision providers, is forcing Cognex to accept pricing headwinds in important markets such as China, leading to margin compression and threatening the company's ability to sustain gross and net margins over the long term.

- Cognex’s significant exposure to cyclical end markets—such as Automotive, which experienced a pronounced step-down with a 14% year-over-year revenue decline, and Consumer Electronics, where revenues remain soft—creates vulnerability to sharp demand fluctuations and unpredictable earnings, particularly during broader industry downturns.

- The ongoing commoditization of hardware in the machine vision industry could erode average selling prices and make it harder for Cognex to maintain premium pricing, especially as new AI technologies make simple machine vision tasks easier to replicate, potentially leading to declining profitability unless Cognex can successfully differentiate with advanced, integrated solutions.

- The shift toward more integrated industrial automation platforms, where vision technology is bundled with robotics and software by single vendors, risks marginalizing “pure play” providers like Cognex, potentially resulting in lost market share and future revenue challenges if Cognex does not adapt its business model.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Cognex is $55.69, which represents two standard deviations above the consensus price target of $38.46. This valuation is based on what can be assumed as the expectations of Cognex's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $56.0, and the most bearish reporting a price target of just $26.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $233.1 million, and it would be trading on a PE ratio of 48.4x, assuming you use a discount rate of 7.3%.

- Given the current share price of $24.17, the bullish analyst price target of $55.69 is 56.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:CGNX. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.