Key Takeaways

- The Enercon acquisition strengthens Bel Fuse's position in defense and aerospace, potentially driving significant future revenue growth.

- Facility consolidations and procurement improvements are set to enhance cost savings, potentially improving net margins and expanding revenue streams.

- The Enercon acquisition, increased debt, trade tariffs, and geopolitical risks threaten Bel Fuse's revenue growth, margins, and financial stability.

Catalysts

About Bel Fuse- Designs, manufactures, markets, and sells products that power, protect, and connect electronic circuits.

- The acquisition of Enercon, a key transaction for Bel Fuse, has bolstered its position in the defense and aerospace sectors, which are expected to be strong growth drivers. This expansion is likely to positively impact future revenue growth.

- Successful facility consolidations have already resulted in significant cost savings, with additional benefits expected once the ongoing projects are completed in the first half of 2025. This initiative is anticipated to improve net margins.

- Improved sales strategies, such as enhanced commission structures and efficiency tools, are anticipated to drive revenue growth by expanding customer depth and breadth.

- The appointment of a new Global Head of Procurement is expected to streamline supplier bases and leverage consolidated purchasing power, leading to further cost savings and potentially improved net margins.

- Potential revenue synergies between Bel Fuse’s Cinch business and Enercon are underway, which could augment future revenue streams as these opportunities are realized.

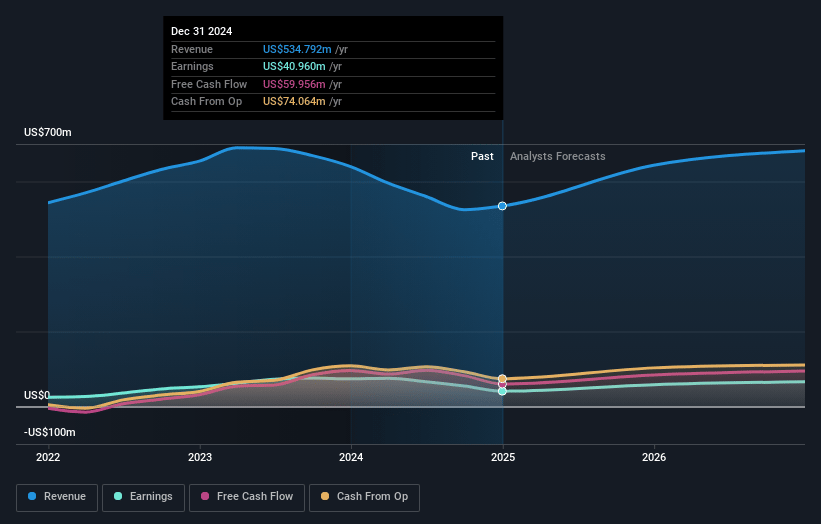

Bel Fuse Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bel Fuse's revenue will grow by 12.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.7% today to 10.9% in 3 years time.

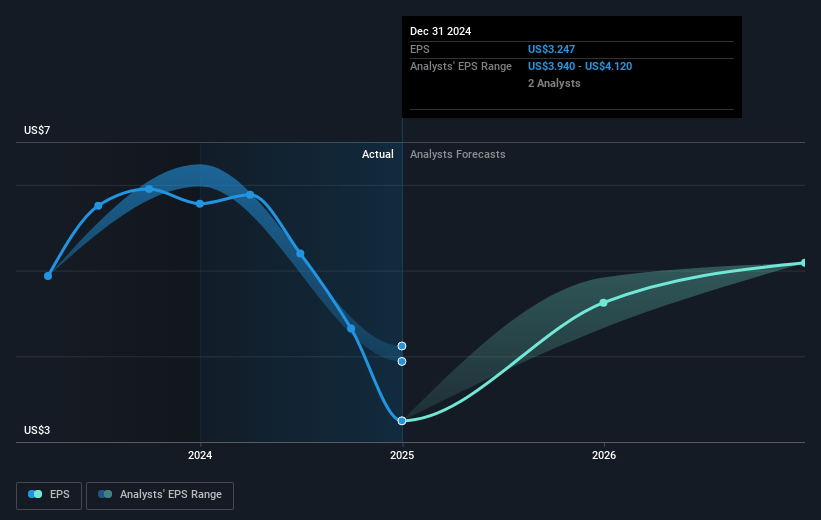

- Analysts expect earnings to reach $83.0 million (and earnings per share of $6.25) by about April 2028, up from $41.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.7x on those 2028 earnings, up from 19.3x today. This future PE is greater than the current PE for the US Electronic industry at 19.3x.

- Analysts expect the number of shares outstanding to decline by 0.64% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.19%, as per the Simply Wall St company report.

Bel Fuse Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The acquisition of Enercon, the largest in Bel Fuse's history, involved significant financial commitments, including $86 million in cash and $240 million in new borrowings. This increased debt load could pressure net margins and earnings due to rising interest expenses.

- The company faces geopolitical risks, such as tariffs on imports from China and potential new tariffs from Mexico, which affect 12-13% and under 4% of Bel Fuse’s revenue, respectively. These could impact future revenue and profit margins if passed onto customers or absorbed by the company.

- The U.S. government’s trade restrictions on a Chinese supplier have already caused a $6 million loss in sales, and this struggle is expected to continue through mid-2025. This impacts revenue growth and may result in difficult year-over-year financial comparisons, affecting earnings.

- The macroeconomic environment and uncertainty due to tariffs, geopolitical tensions, and global defense postures present continuous risks. Changes in these areas could impact revenue, cost, and profits unpredictably.

- Enercon integration poses an execution risk; cross-selling opportunities may take longer to realize due to slow-moving defense contract cycles, which could delay anticipated increases in revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $113.0 for Bel Fuse based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $759.5 million, earnings will come to $83.0 million, and it would be trading on a PE ratio of 20.7x, assuming you use a discount rate of 8.2%.

- Given the current share price of $63.09, the analyst price target of $113.0 is 44.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.