Key Takeaways

- Expansion in the K-12 market and a new purchase order solution are expected to drive revenue growth and broaden the addressable market.

- Strategic partnerships and increased marketing investments aim to boost earnings, while shifting to a SaaS model promises higher-margin recurring revenue.

- Increased spending and reliance on partnerships may strain short-term profitability and present risks to earnings and revenue growth during the SaaS transformation.

Catalysts

About Intellinetics- Designs, develops, tests, markets, and licenses document services and software solutions in the United States.

- The expansion of Intellinetics' Payables Automation solution into the K-12 market and the positive pilot program results with school districts indicate a strong pipeline. This is expected to drive revenue growth through wider adoption across 1,300 school districts, capitalizing on operational efficiencies and cost savings that appeal to educational institutions.

- The imminent release of a complementary purchase order solution expands the potential addressable market and adds transaction volume for existing accounts payable customers. This will create additional revenue streams and improve revenue consistency and scalability.

- Strategic collaboration with niche ERP providers, such as partnerships with Constellation HomeBuilder Systems and Software Unlimited, offers growth opportunities by providing tailored solutions that outperform competing generic ones. This relationship-centric approach could boost earnings by leveraging integrated sales and support models.

- Increased investments in sales and marketing efforts, including hiring more sales representatives and expanding trade show presence, are anticipated to drive greater awareness and increase the client base. Though initially depressing EBITDA, these investments aim to accelerate revenue opportunities and earnings growth by late 2025 and into 2026.

- The SaaS business model transition, evidenced by an 11.8% increase in SaaS revenue, indicates an ongoing shift towards high-margin recurring revenue streams. This focus on SaaS solutions aligns with expectations for enhanced gross margins and steadier earnings over time.

Intellinetics Future Earnings and Revenue Growth

Assumptions

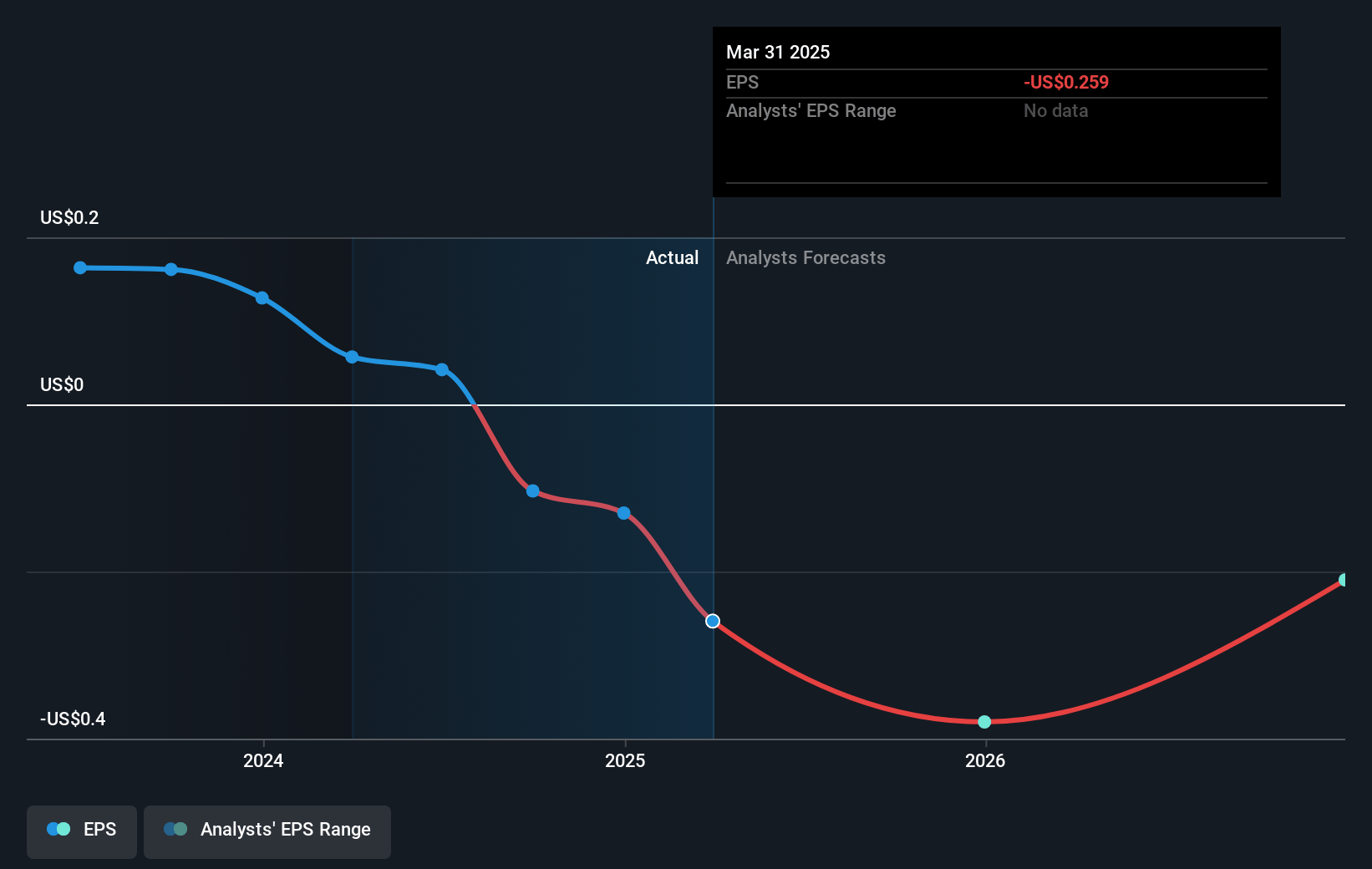

How have these above catalysts been quantified?- Analysts are assuming Intellinetics's revenue will grow by 5.0% annually over the next 3 years.

- Analysts are not forecasting that Intellinetics will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Intellinetics's profit margin will increase from -6.2% to the average US Software industry of 13.2% in 3 years.

- If Intellinetics's profit margin were to converge on the industry average, you could expect earnings to reach $2.7 million (and earnings per share of $0.54) by about July 2028, up from $-1.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.2x on those 2028 earnings, up from -60.7x today. This future PE is lower than the current PE for the US Software industry at 42.7x.

- Analysts expect the number of shares outstanding to grow by 1.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.01%, as per the Simply Wall St company report.

Intellinetics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is witnessing increased operating expenses, particularly in sales and marketing, which rose significantly to support growth initiatives. This may impact net margins and profitability in the short to medium term.

- A net loss was reported for the quarter and the full year, influenced by heightened share-based compensation and increased marketing expenses, indicating a potential risk to earnings.

- There is an expectation of a decreased EBITDA for 2025 due to further investments in sales and marketing, implying short-term financial strain and pressure on profitability.

- The company's reliance on partners, such as Constellation and Software Unlimited, suggests exposure to dependency risk, which could inhibit revenue growth if these partnerships encounter issues.

- The ongoing transformation to a SaaS-driven model necessitates substantial investment in development and scaling, posing a risk of execution failure which could hamper future revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.5 for Intellinetics based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $20.5 million, earnings will come to $2.7 million, and it would be trading on a PE ratio of 38.2x, assuming you use a discount rate of 8.0%.

- Given the current share price of $13.09, the analyst price target of $16.5 is 20.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.