Key Takeaways

- Clear's NextGen Identity platform and automation partnerships enhance efficiency and market reach, leading to potential revenue growth and cost-saving benefits.

- Expansion into non-airport locations and pricing adjustments aim to boost revenue through wider market capture and improved member retention.

- New leadership, pricing strategies, and credit card partnership challenges present risks to operational stability, revenue, and member growth amid macroeconomic uncertainties.

Catalysts

About Clear Secure- Operates a secure identity platform under the CLEAR brand name primarily in the United States.

- CLEAR's rollout of the NextGen Identity platform and EnVe's is expected to enhance operational efficiencies and member experience, potentially leading to improved revenue growth through faster processing times and an increase in membership due to a seamless experience.

- The company's public-private partnership initiatives for deploying end-to-end automated lanes in airports can significantly expand market reach without incurring extra government costs, which should support higher revenues and potentially wider net margins due to the cost-saving advantages of automation.

- CLEAR's expansion efforts via TSA PreCheck enrollments and other initiatives at non-airport locations like retail sites could lead to increased revenues by meeting consumers in convenient locations and capturing a broader market segment.

- CLEAR plans to adjust pricing strategies by monetizing previously free tiers and improving value propositions, which may drive higher average revenue per user (ARPU) and enhance net member retention, thereby positively influencing overall earnings and cash flow.

- The continued emphasis on biometric security solutions and partnerships with enterprises for identity verification could lead to new revenue streams through CLEAR1, by addressing broader industry challenges in fraud prevention and securing workforce access, thereby supporting long-term earnings growth.

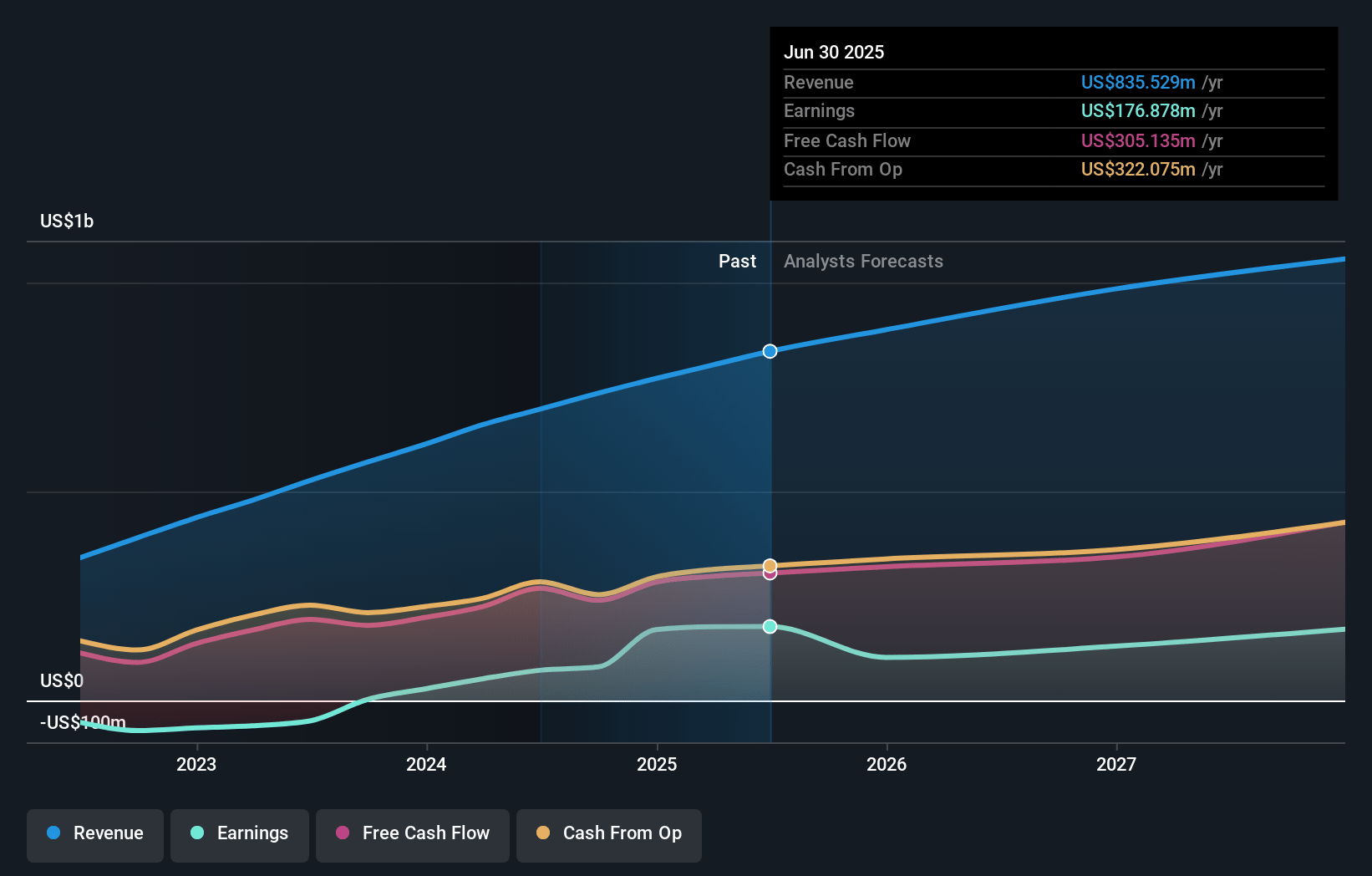

Clear Secure Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Clear Secure's revenue will grow by 11.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 22.0% today to 15.0% in 3 years time.

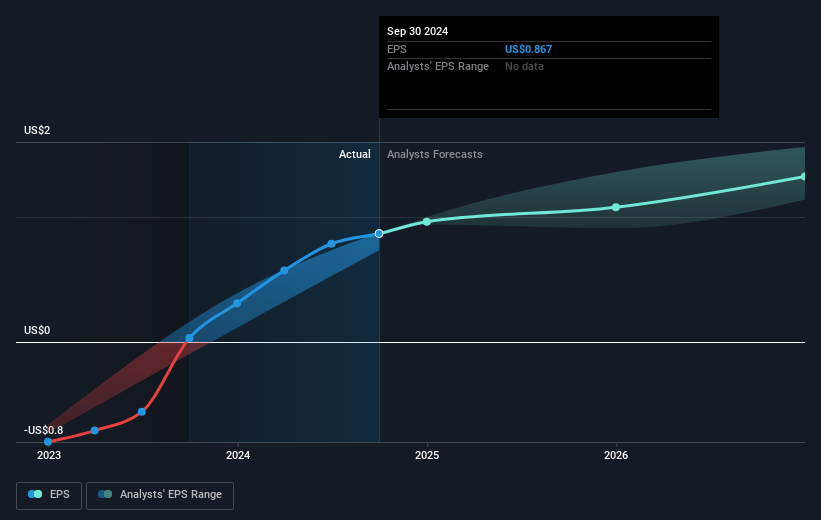

- Analysts expect earnings to reach $160.5 million (and earnings per share of $1.22) by about March 2028, down from $169.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.1x on those 2028 earnings, up from 15.1x today. This future PE is greater than the current PE for the US Software industry at 28.2x.

- Analysts expect the number of shares outstanding to grow by 3.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.46%, as per the Simply Wall St company report.

Clear Secure Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The transition to new leadership with the appointment of a new CFO and President introduces execution risk, which could impact operational stability and financial performance. This may affect net margins and earnings.

- The uneven distribution of membership renewals and seasonality could lead to volatility in quarterly revenue and earnings, especially given the impact on net adds projections for Q1 and Q3 compared to Q2 and Q4.

- Potential challenges in renegotiating favorable terms with credit card partners, like Amex, could depress future bookings and EBITDA if partnership terms remain economically unfavorable. This would impact revenue and operating margins.

- Increasing reliance on pricing strategies, such as raising prices for previously free tiers, might negatively affect member acquisition and retention if not matched by enhanced perceived value, impacting revenue and net member growth.

- Broader macroeconomic factors or changes in travel demand linked to external economic environments may impact growth projections and therefore affect top-line revenue and net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $30.5 for Clear Secure based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $45.0, and the most bearish reporting a price target of just $22.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $160.5 million, and it would be trading on a PE ratio of 35.1x, assuming you use a discount rate of 7.5%.

- Given the current share price of $26.55, the analyst price target of $30.5 is 13.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

Strong potential through partnerships, international expansion and wider application of biometrics

YOU Market Outlook