Narratives are currently in beta

Key Takeaways

- Expansion into B2C web services and international markets aims to boost revenues and diversify geographically, enhancing net margins.

- Strategic focus on AI in B2B skincare and beauty sectors aims to drive revenue, consumer engagement, and margin expansion.

- Transitioning to AI/AR SaaS could affect revenue stability, while increased R&D and marketing costs risk margin compression if growth targets aren't met.

Catalysts

About Perfect- An artificial intelligence software as a service company, provides artificial intelligence (AI)- and augmented reality (AR)-powered solutions for beauty, fashion, and skincare industries worldwide.

- The expansion of Perfect Corp’s B2C web-based services using a credit-based billing model can potentially increase revenues by broadening the total addressable market beyond mobile apps and reducing service fees, enhancing net margins.

- The continuous growth in active paying subscribers for Perfect Corp’s B2C mobile business, particularly in new international markets like Brazil and Italy, indicates potential revenue growth driven by a larger user base and geographic diversification.

- The strategic focus on AI-powered skincare diagnostics and Virtual Try-On technology in the B2B segment positions Perfect Corp to capitalize on growth within the skincare and aesthetic clinic markets, potentially boosting B2B revenue.

- The introduction of PerfectGPT as a personalized AI beauty assistant for B2B clients, anticipated to be widely adopted by beauty brands, is expected to drive both revenue and margin expansion by enhancing consumer engagement and reducing brands' reliance on human beauty advisors.

- Continued investment in AI and AR services and the development of innovative AI-powered features for YouCam apps are anticipated to support sustained revenue growth and operational efficiency, thereby improving net margins and earnings over time.

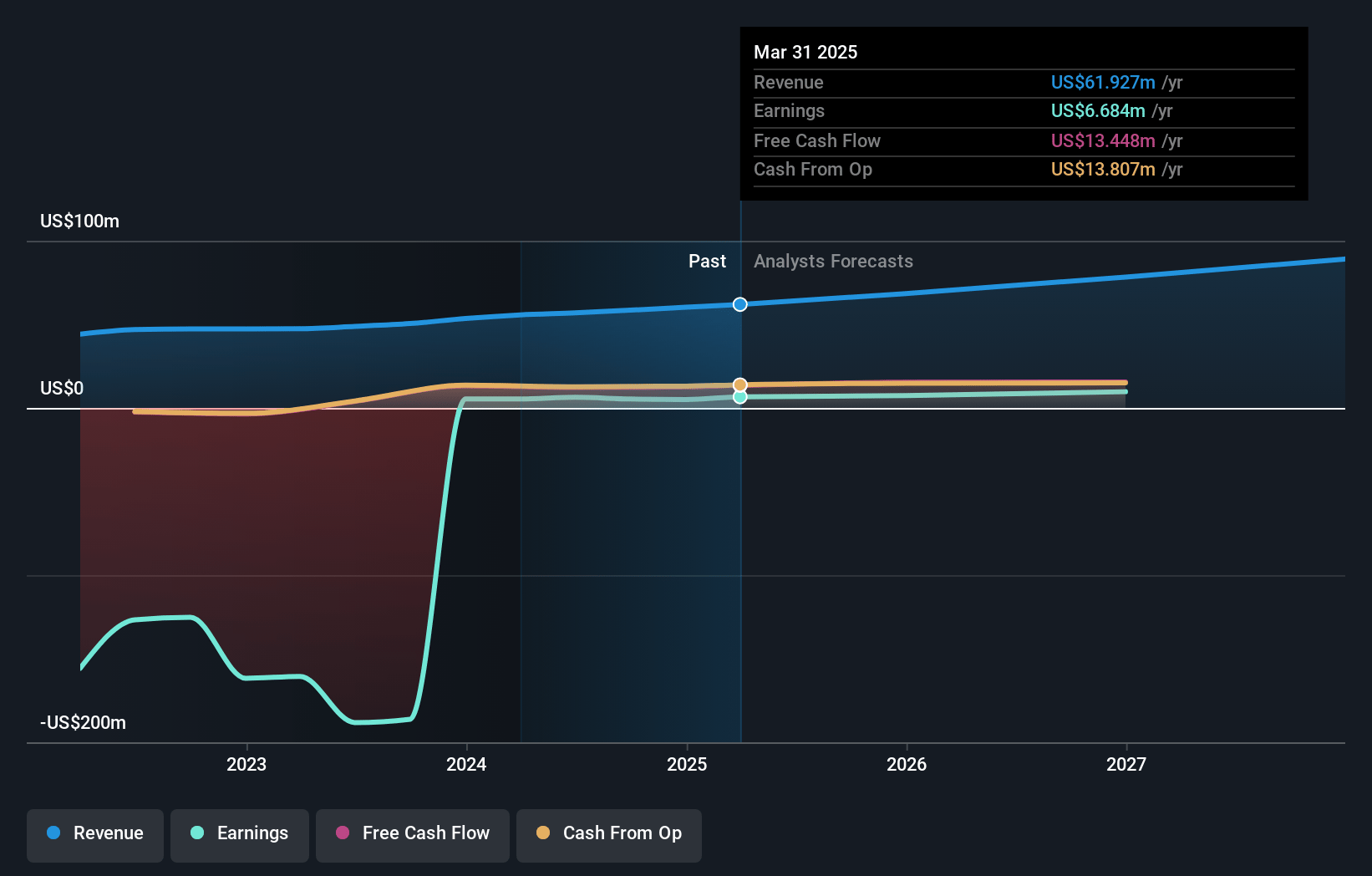

Perfect Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Perfect's revenue will grow by 16.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.1% today to 10.7% in 3 years time.

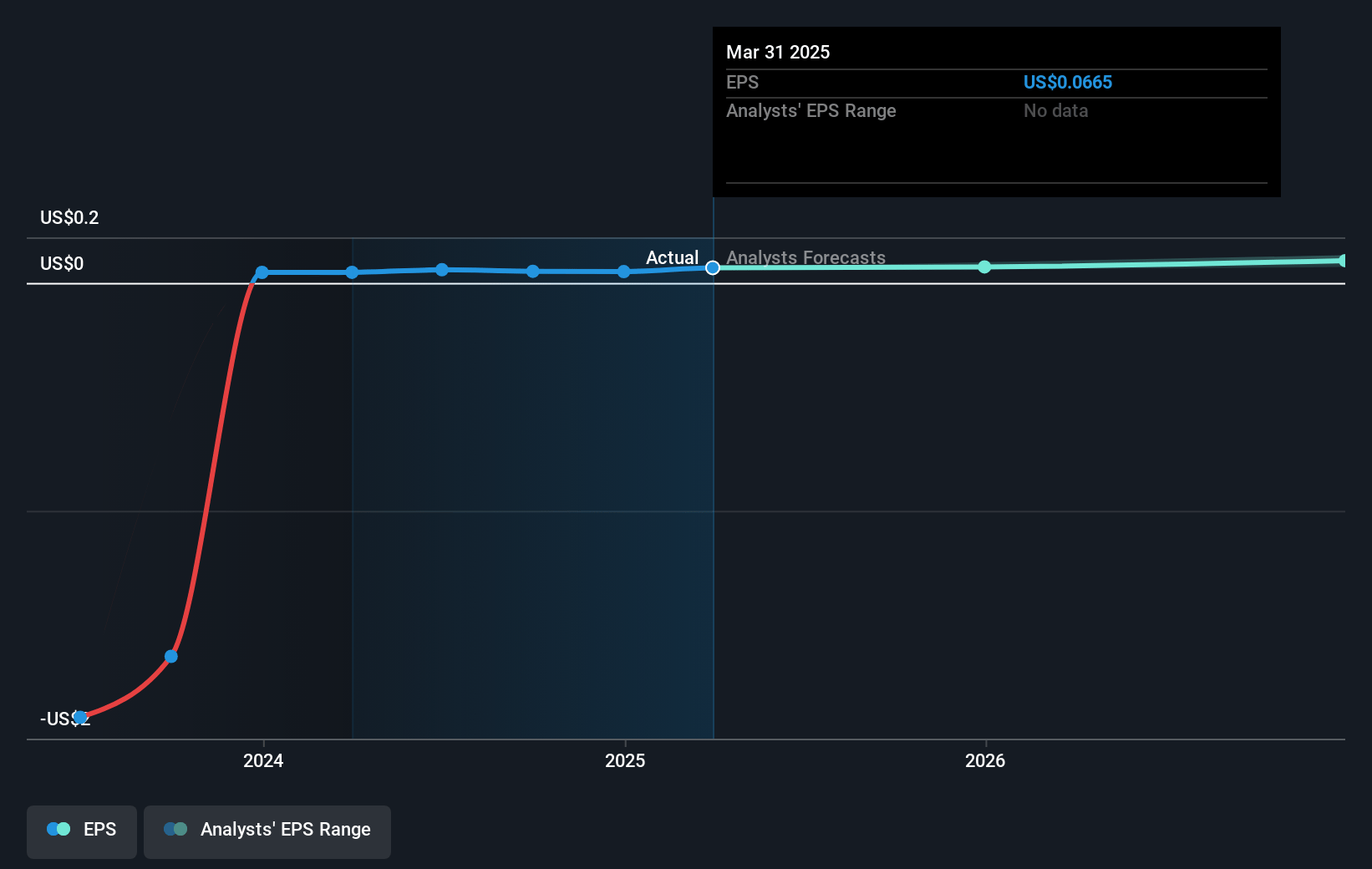

- Analysts expect earnings to reach $9.8 million (and earnings per share of $0.1) by about November 2027, up from $5.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 49.4x on those 2027 earnings, up from 35.8x today. This future PE is greater than the current PE for the US Software industry at 42.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.66%, as per the Simply Wall St company report.

Perfect Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's focus on transitioning traditional business models to AI/AR SaaS subscriptions has led to a decline in licensing revenue by 14.5%, which could impact overall revenue stability during the transitional period.

- Despite its strong cash position, any increase in marketing and R&D expenses to grow their consumer and enterprise segments could potentially compress net margins if revenue growth does not accelerate as expected.

- The B2B segment is experiencing slower growth compared to B2C due to post-recovery challenges, which may continue to affect total earnings if the market rebound is prolonged.

- The introduction of web-based services seems promising, but they need to navigate new competitive dynamics and ensure this shift doesn't cannibalize existing mobile app subscriptions, potentially impacting overall profitability.

- While PerfectGPT presents a new opportunity, the reliance on proof of concept success and potential market adoption uncertainties pose risks that could affect projected earnings growth if not realized as planned.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $3.84 for Perfect based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $5.0, and the most bearish reporting a price target of just $3.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $91.7 million, earnings will come to $9.8 million, and it would be trading on a PE ratio of 49.4x, assuming you use a discount rate of 7.7%.

- Given the current share price of $1.87, the analyst's price target of $3.84 is 51.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives