Key Takeaways

- Oracle's expansion in cloud power capacity and strategic partnerships are set to significantly boost revenue through increased AI demand and database migration.

- Substantial growth in performance obligations and increased investment in infrastructure highlight strong demand, promising enhanced earnings and service delivery.

- Delays in cloud expansion and execution risks could strain Oracle's financials, while currency volatility adds further pressure on earnings margins.

Catalysts

About Oracle- Offers products and services that address enterprise information technology environments worldwide.

- Oracle's cloud region expansion and increased power capacity are expected to accelerate revenue, as the company plans to double available power capacity this year and triple it by the end of the next fiscal year. This rapid growth supports future revenue increases, particularly driven by demand for AI training and inferencing.

- The substantial growth in remaining performance obligations (RPO), rising to $130 billion, indicates strong future demand for Oracle Cloud services. Approximately 31% of this will be recognized as revenue in the next 12 months, boosting future earnings.

- Oracle is benefiting from high demand for AI capabilities, such as its AI data platform, which enables existing database customers to leverage AI models. This is set to drive large new business opportunities and impact future revenue growth positively.

- Oracle's strategic multi-cloud partnerships with AWS, Google, and Azure are rapidly growing, with a reported 200% growth in the past three months. This is expected to drive database migration to the cloud, significantly contributing to revenue growth.

- The company's commitment to increasing CapEx, expected to more than double from the previous year, positions Oracle to address the high demand effectively. This strategic investment ensures the necessary infrastructure to support growing cloud services, promising enhanced future earnings through sustained service delivery.

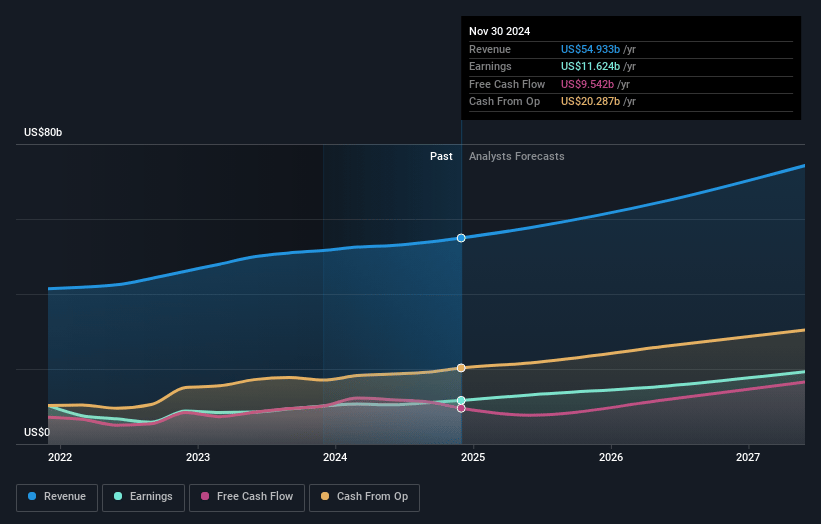

Oracle Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Oracle's revenue will grow by 15.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 21.8% today to 22.5% in 3 years time.

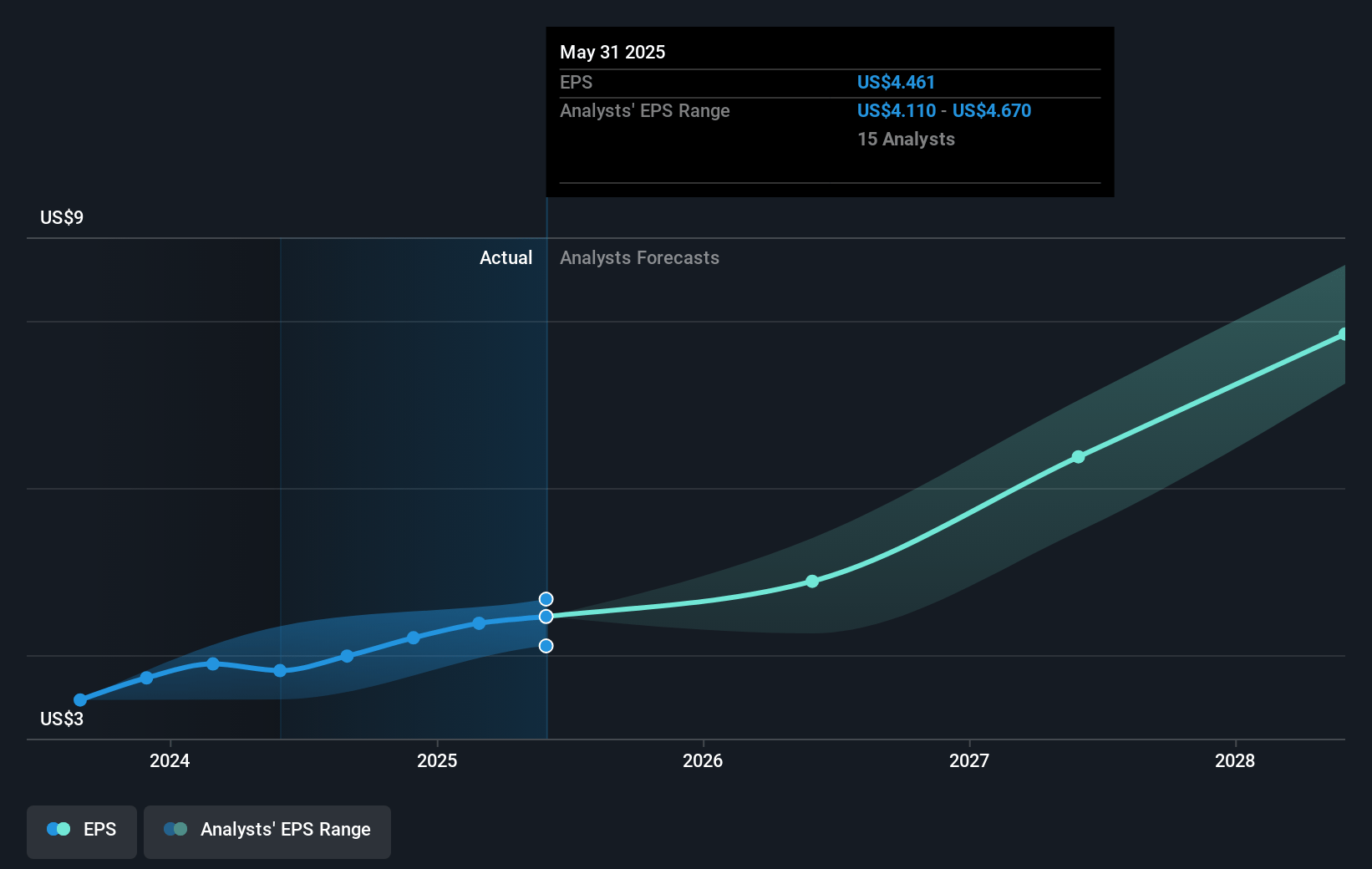

- Analysts expect earnings to reach $19.5 billion (and earnings per share of $6.87) by about May 2028, up from $12.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $15.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.3x on those 2028 earnings, up from 34.1x today. This future PE is greater than the current PE for the US Software industry at 33.3x.

- Analysts expect the number of shares outstanding to grow by 1.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.32%, as per the Simply Wall St company report.

Oracle Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- While Oracle appears to have strong booking momentum, component delays have slowed cloud capacity expansion, potentially impacting future infrastructure revenue growth.

- The exit from Oracle's advertising business had an adverse effect on total cloud revenue growth by 2% this quarter, which could indicate vulnerabilities in diversified revenue streams.

- Oracle's substantial capital expenditure plan, with a goal of doubling from last year, suggests a heavy dependency on scaling infrastructure to fulfill demand, which may strain free cash flow if demand projections do not meet expectations.

- Exposure to currency headwinds (noted as affecting EPS and revenue) introduces additional financial volatility risk, which could impact net earnings margins if currency fluctuations persist.

- The rapid build-out of new cloud infrastructure and data centers involves significant execution risk, which might pressure operating margins if capacity is not efficiently aligned with demand trends.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $178.118 for Oracle based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $246.0, and the most bearish reporting a price target of just $130.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $86.7 billion, earnings will come to $19.5 billion, and it would be trading on a PE ratio of 34.3x, assuming you use a discount rate of 8.3%.

- Given the current share price of $147.7, the analyst price target of $178.12 is 17.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.