Key Takeaways

- Expanding Olo Pay with improved card-present processing and leveraging FreedomPay partnership aims to boost revenue growth and enhance gross profit through better payment processing.

- Strategy focuses on increasing brand adoption of Order, Pay, and Engage suites to drive ARPU growth, improve margins, and enhance profitability with efficient data use.

- Potential execution risks and reliance on existing projects might hinder Olo's revenue growth and profitability amidst industry uncertainties and conservative location expansion targets.

Catalysts

About Olo- Operates an open SaaS platform for restaurants in the United States.

- The FreedomPay partnership will enable Olo Pay Card-Present functionality to be integrated more broadly and rapidly with over 1,000 POS and payment systems, accelerating Olo's ability to capture a larger share of the $130 billion-plus gross payment volume (GPV) opportunity. This expansion is expected to increase revenue and boost Olo's gross profit growth by benefiting from improved payment processing economics.

- Olo's focus on expanding its Olo Pay functionality, particularly Card-Present processing, represents a significant potential scale and revenue growth opportunity, as the company can capture transaction data from on-premise transactions, which account for more than 80% of the restaurant industry's volume. This is expected to enhance revenue and improve margins due to more efficient processing economics.

- The company's efforts to increase the number of brands using products from all three suites (Order, Pay, and Engage) by demonstrating the tangible benefits of their guest data flywheel strategy is aimed at increasing average revenue per user (ARPU) and driving revenue growth through higher module adoption and improved customer retention.

- With Olo Pay scaling and a strategy focused on profitable traffic, the company aims to improve net margins by leveraging insights from guest data to offer personalized guest experiences and reduce reliance on costly discount strategies, ultimately increasing the overall profitability.

- Increasing traction with Catering+ within both existing and new enterprise customers offers Olo an opportunity to drive additional revenue and improve gross margins, allowing for further upselling of Olo's high-margin software modules, which contributes positively to overall financial growth.

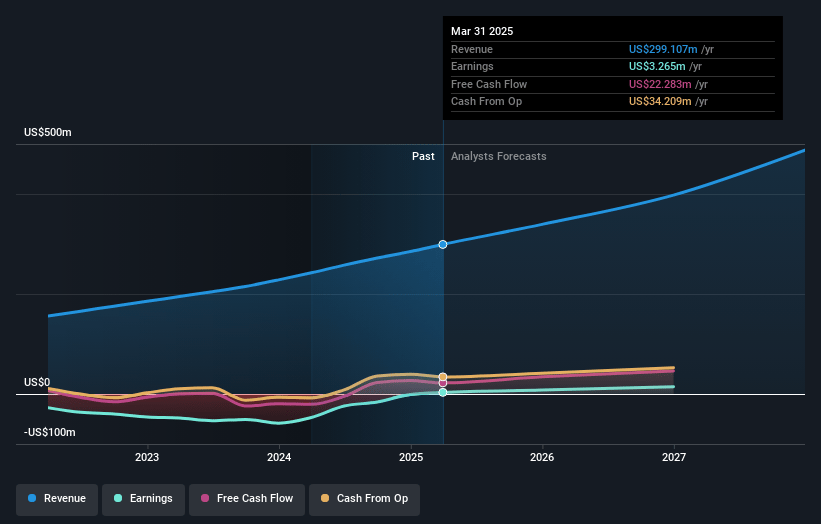

Olo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Olo's revenue will grow by 19.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.3% today to 3.4% in 3 years time.

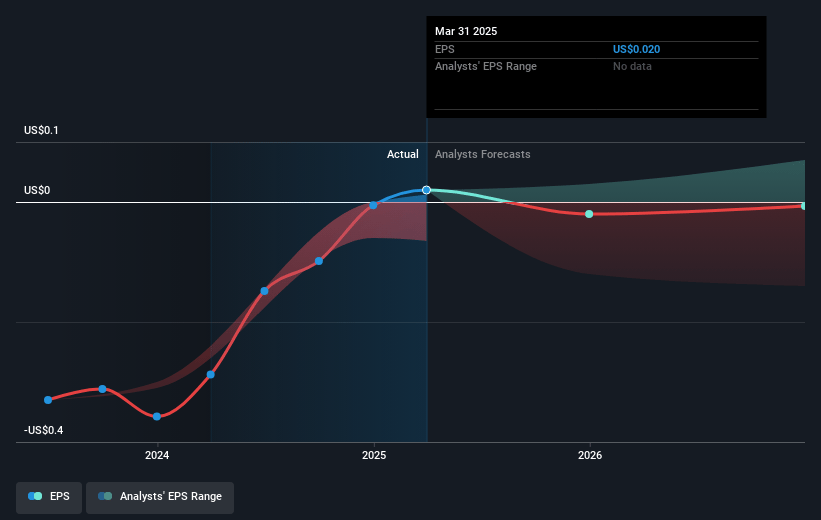

- Analysts expect earnings to reach $16.4 million (and earnings per share of $0.01) by about May 2028, up from $-897.0 thousand today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 121.0x on those 2028 earnings, up from -1167.9x today. This future PE is greater than the current PE for the US Software industry at 31.6x.

- Analysts expect the number of shares outstanding to grow by 3.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.68%, as per the Simply Wall St company report.

Olo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The anticipated gross margin compression by approximately 250 basis points in 2025 due to the scaling of Olo Pay revenue could impact overall profitability despite revenue growth.

- The reliance on expanding Olo Pay and Card-Present functionality with FreedomPay introduces potential execution risks, which could affect future revenue and gross profit growth if adoption does not scale as expected.

- The company expects a high concentration of incremental revenue from existing projects, which may limit the potential for new customer acquisition and could impact overall revenue growth potential if these projects face deployment challenges.

- A significant portion of 2025 revenue is predicated on the same restaurant industry trends as 2024, which introduces uncertainty and risk if these trends do not hold or if macroeconomic factors disrupt industry dynamics, potentially impacting revenue.

- The expected rate of new location growth (5,000 net new locations in 2025) is conservative relative to past performance and could limit overall revenue growth if this target becomes more challenging to meet due to industry or competitive pressures.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $8.7 for Olo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $8.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $487.3 million, earnings will come to $16.4 million, and it would be trading on a PE ratio of 121.0x, assuming you use a discount rate of 7.7%.

- Given the current share price of $6.31, the analyst price target of $8.7 is 27.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.