Key Takeaways

- Challenges in renewal rates and cloud transition could hinder revenue and earnings growth if not swiftly addressed.

- Shorter renewal terms and currency volatility may obscure revenue visibility and impact earnings expectations.

- Informatica's robust cloud growth and leadership provide strong competitive positioning, enhancing revenue, customer retention, and operational efficiency, supporting sustained long-term growth.

Catalysts

About Informatica- Develops an artificial intelligence-powered platform that connects, manages, and unifies data across multi-vendor, multi-cloud, and hybrid systems at enterprise scale worldwide.

- Informatica's lower than forecast renewal rates are causing concerns about revenue stability. As the company works through its transition to a cloud-only model, execution issues related to renewals could negatively impact both revenue and earnings growth in 2025 if not addressed quickly.

- The increased pace of on-premises to cloud modernization deals presents short-term challenges as accounting treatments lead to lower net new Annual Recurring Revenue (ARR). This dynamic may limit revenue growth potential as it results in a temporary drag on ARR.

- The reduction in renewal term lengths for self-managed subscription contracts, due to customers seeking faster transitions to cloud solutions, leads to a negative impact on GAAP revenues under ASC 606 accounting standards. This could pressure revenue allocations and obscure earnings potential.

- Informatica has faced a decline in professional services revenue along with unfavorable foreign exchange conditions, creating additional headwinds to overall revenue growth. This could lead to projected earnings not meeting expectations if currency volatility continues.

- Guidance for 2025 has been adjusted downward due to anticipated lower renewal rates, higher modernization deal percentages, and shorter renewal terms. These factors indicate potential difficulties in achieving the previously expected growth in total ARR and GAAP revenue, impacting both revenue and earnings projections.

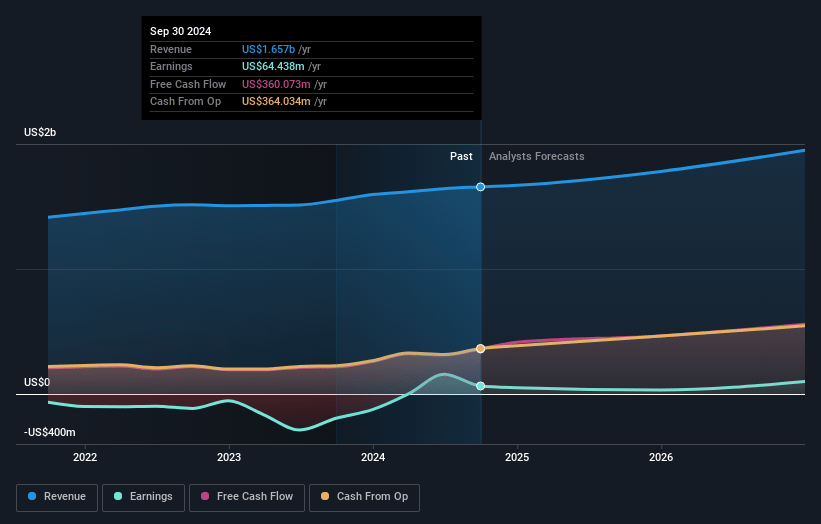

Informatica Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Informatica compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Informatica's revenue will grow by 3.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 0.6% today to 8.9% in 3 years time.

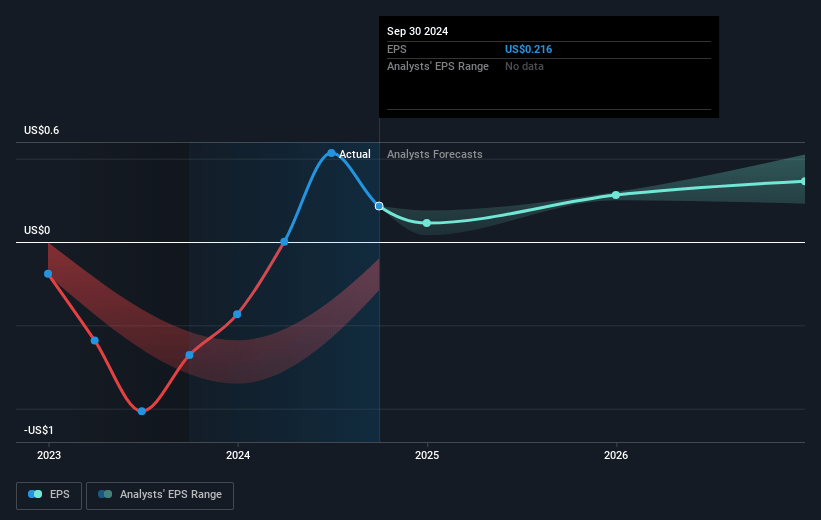

- The bearish analysts expect earnings to reach $160.6 million (and earnings per share of $0.37) by about April 2028, up from $9.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 44.5x on those 2028 earnings, down from 571.9x today. This future PE is greater than the current PE for the US Software industry at 31.4x.

- Analysts expect the number of shares outstanding to grow by 0.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.52%, as per the Simply Wall St company report.

Informatica Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid growth in cloud subscription ARR, which increased 34% year-over-year in Q4, suggests strong revenue growth, potentially countering declines in other segments.

- Informatica's cloud net retention rate was at an impressive 124%, indicating strong customer retention and recurring revenue which positively impacts earnings.

- The large and rapidly growing cloud segment, along with ongoing cloud migrations, is expected to hit $1 billion ARR in 2025, pointing to sustained revenue growth momentum.

- Informatica's leadership in industry reports, such as being named a leader in Gartner's Magic Quadrant, reinforces its competitive positioning, potentially supporting stronger revenue and net margins.

- The significant 28% year-over-year growth in adjusted unlevered free cash flow after tax indicates strong operational efficiency, enhancing net income and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Informatica is $18.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Informatica's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $30.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $160.6 million, and it would be trading on a PE ratio of 44.5x, assuming you use a discount rate of 8.5%.

- Given the current share price of $18.77, the bearish analyst price target of $18.0 is 4.3% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NYSE:INFA. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.