Narratives are currently in beta

Key Takeaways

- Strategic AI focus and acquisitions are set to significantly enhance revenue, net margins, and client base, bolstering the company's market position.

- Expansion into high-growth regions supports revenue diversification, ensuring robust earnings and long-term growth potential.

- Reliance on AI and regional expansion pose execution risks, while currency fluctuations and vertical slowdowns could affect revenue and profitability.

Catalysts

About Globant- Provides technology services worldwide.

- Globant is poised for significant revenue growth driven by strong demand in major sectors, expected to reach a 15% increase in revenue for 2024 and robust double-digit growth in 2025, fueled by their expanding market share and strategic bookings. This should positively impact revenue and earnings.

- The company's strategic focus on AI, with AI-related work already generating over $250 million in revenue (a 120% increase year-over-year), positions it well to capture a substantial share of the forecasted $175 billion to $250 billion generative AI market by 2027. This is expected to boost both revenue and net margins.

- Expansion into new and high-growth regions, particularly in the Middle East and APAC, which have shown significant revenue growth of 53.1% year-over-year, suggests a strong potential for revenue diversification and growth, positively impacting overall earnings.

- Globant's emphasis on M&A, such as the acquisition of Blankfactor, may contribute 2-3% of revenue growth in 2025 by integrating specialized expertise and expanding the company’s client base, particularly in financial services, enhancing overall revenue and profitability.

- The deployment of AI tools internally and within client projects, aiming to enhance efficiency and productivity, not only improves operational margins and project delivery but also sets a foundation for sustainable earnings growth by optimizing internal and client outcomes.

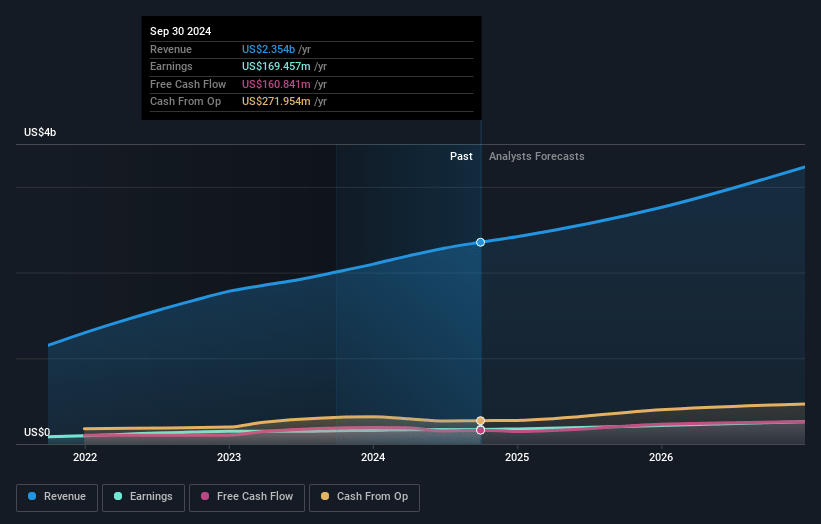

Globant Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Globant's revenue will grow by 16.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.2% today to 9.7% in 3 years time.

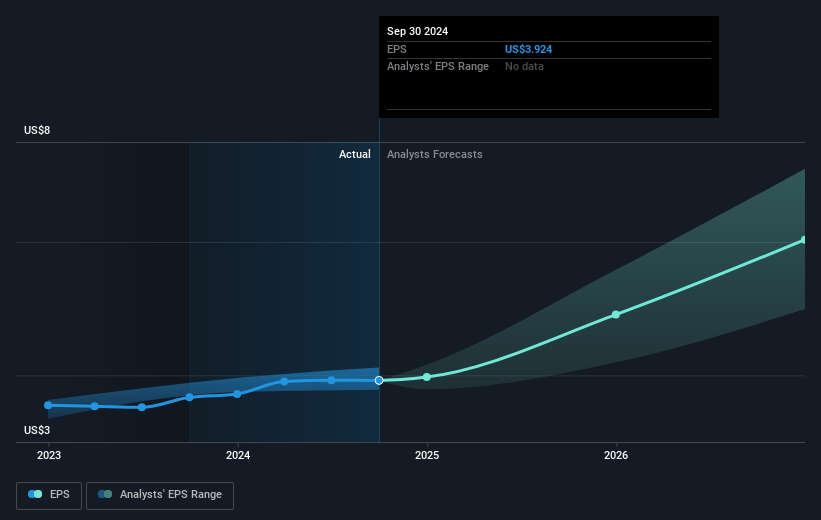

- Analysts expect earnings to reach $363.4 million (and earnings per share of $7.75) by about November 2027, up from $169.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.3x on those 2027 earnings, down from 53.1x today. This future PE is lower than the current PE for the GB IT industry at 44.8x.

- Analysts expect the number of shares outstanding to grow by 2.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.34%, as per the Simply Wall St company report.

Globant Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Globant's reliance on AI for revenue growth could backfire if the adoption of AI by businesses and governments does not meet expected levels, potentially impacting revenue growth projections.

- Expansion into new regions, such as the Middle East, involves execution risks and cultural adaptation challenges, which could strain profitability and operational margins.

- The fluctuation and devaluation of Latin American currencies against the U.S. dollar could impact revenue and increase financial volatility, affecting net earnings and margins.

- While Globant shows strong growth projections, the historical slowdowns in key verticals like BFSI (Banking, Financial Services, and Insurance) could resurface, which might adversely affect revenue and earnings targets.

- The increasing investment in AI could lead to underestimation of associated costs and inefficiencies in its integration, potentially affecting net margins and overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $232.04 for Globant based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $284.0, and the most bearish reporting a price target of just $140.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.7 billion, earnings will come to $363.4 million, and it would be trading on a PE ratio of 36.3x, assuming you use a discount rate of 7.3%.

- Given the current share price of $208.55, the analyst's price target of $232.04 is 10.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives