Last Update 05 Dec 25

FSLY: Future Returns Will Depend On Proving Security Gains Amid CDN Pressure

Analysts have modestly trimmed their price target on Fastly to approximately $46.07 from about $48.63, citing the need for recent security segment momentum to prove durable amid ongoing pricing pressure in the core CDN business.

Analyst Commentary

Recent commentary highlights a balanced view on Fastly, with analysts recognizing progress in execution while remaining cautious on the durability of recent gains and the challenges in its legacy business.

Bullish Takeaways

- Bullish analysts point to the acceleration in security revenue over the past two quarters as evidence that Fastly is gaining traction in higher value, more defensible parts of its platform, which could support a premium valuation if sustained.

- Operational improvements, including more disciplined cost management and clearer product focus, are seen as early signs that management can execute more consistently, potentially narrowing the gap to higher quality infrastructure peers.

- The growing contribution from security is viewed as a pathway to diversify away from commoditized CDN pricing. If successful, this could stabilize gross margins and support a higher long term growth profile.

- Some bulls see the current, more modest price target as leaving room for upside if Fastly can demonstrate several consecutive quarters of stable to accelerating revenue growth from its newer offerings.

Bearish Takeaways

- Bearish analysts emphasize that the recent security momentum is still considered an early win, and they want to see multiple quarters of consistent growth before assigning a higher valuation multiple.

- Ongoing high teens year over year pricing pressure in the core CDN business is viewed as a structural headwind, limiting overall revenue growth and constraining Fastly’s ability to expand margins.

- Concerns remain that gains in security may not be sufficient to fully offset declines in legacy CDN revenue, raising questions about the durability of mid term growth targets.

- Until there is clear evidence of sustained execution across both security and CDN, more cautious analysts expect the stock to trade closer to a “wait and see” valuation, rather than reflecting a full turnaround scenario.

What's in the News

- Fastly plans to transfer its primary stock exchange listing from the New York Stock Exchange to the Nasdaq Global Select Market, effective December 09, 2025 (company announcement).

- The company launched the Fastly Certified Services Partner Program to train and certify partner security professionals in deploying and managing Fastly’s advanced security solutions, expanding go to market reach and implementation capacity (company announcement).

- Fastly issued revenue guidance for the fourth quarter of 2025 of $159 million to $163 million, and full year 2025 guidance of $610 million to $614 million (company guidance).

Valuation Changes

- Fair Value Estimate unchanged at 10.42, indicating no revision to the intrinsic value assessment.

- Discount Rate edged down slightly from 9.69% to 9.69%, implying a marginally lower required return.

- Revenue Growth effectively unchanged at 7.51%, suggesting a stable outlook for top line expansion.

- Net Profit Margin risen modestly from 6.61% to approximately 6.98%, reflecting a slightly more optimistic view on future profitability.

- Future P/E reduced from about 48.63x to 46.07x, indicating a modestly lower valuation multiple applied to forward earnings.

Key Takeaways

- Growth in advanced security and edge computing solutions, along with cross-selling strategy, drives higher-margin revenue and increases customer retention.

- Expanded enterprise focus, international investment, and operating efficiency boost diversified recurring revenue and support continued margin improvement.

- Intensifying competition, revenue concentration risks, and escalating costs threaten Fastly's pricing power, margins, and ability to achieve sustained, profitable growth.

Catalysts

About Fastly- Operates an edge cloud platform for processing, serving, and securing its customer’s applications in the United States, the Asia Pacific, Europe, and internationally.

- Ongoing adoption of advanced security solutions-including next-generation WAF, DDoS, and bot mitigation-positions Fastly to capitalize on rising enterprise demand for resilient edge security as cyber threats escalate, supporting future revenue growth and higher-margin service lines.

- The acceleration of cloud migration and edge computing, combined with Fastly's increased product velocity (especially in Compute and adaptive observability analytics at the edge), expands the company's addressable market and underpins durable multi-year revenue growth.

- Successful execution of a platform-based cross-sell and upsell strategy (with nearly 50% of customers now using 2+ products and these generating over 75% of revenue) boosts wallet share, increases net retention rates, and supports higher revenue per customer.

- Improved go-to-market alignment and expanded leadership, including segmented sales targeting enterprise clients beyond digital-native firms and investments in international expansion (particularly in APJ and Europe), diversifies and expands recurring revenue streams, reducing customer concentration risk and supporting top-line growth.

- Sustained focus on operating efficiency-with slower OpEx growth relative to revenue, disciplined cost controls, and improved cash collection-is driving operating leverage, setting the stage for continued margin improvement, a path to non-GAAP operating profitability, and stronger free cash flow.

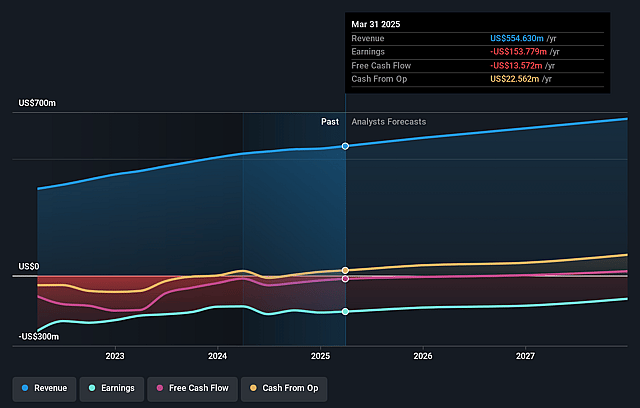

Fastly Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Fastly's revenue will grow by 6.7% annually over the next 3 years.

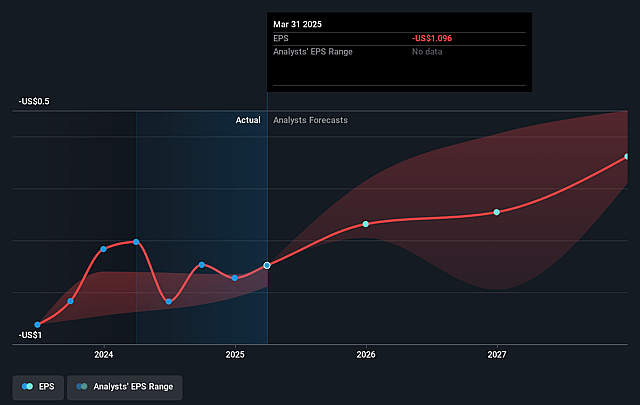

- Analysts are not forecasting that Fastly will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Fastly's profit margin will increase from -25.8% to the average US IT industry of 6.4% in 3 years.

- If Fastly's profit margin were to converge on the industry average, you could expect earnings to reach $44.3 million (and earnings per share of $0.26) by about September 2028, up from $-147.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.1x on those 2028 earnings, up from -7.4x today. This future PE is greater than the current PE for the US IT industry at 32.4x.

- Analysts expect the number of shares outstanding to grow by 5.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.91%, as per the Simply Wall St company report.

Fastly Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Fastly's core content delivery network (CDN) market is commoditizing and facing increasing competitive pressure from hyperscalers (Amazon, Google, Microsoft) that can bundle CDN, security, and compute into integrated solutions, which may compress Fastly's pricing power and negatively impact revenue and net margins over time.

- The company has a history of volatile security revenue growth and remains dependent on a concentrated set of large customers (top 10 still represent 31% of revenue), leading to continued risk around revenue stability and susceptibility to customer churn or declining usage, potentially resulting in revenue volatility and difficulty sustaining long-term earnings growth.

- Ongoing industry consolidation and the exit of smaller players like Edgio may be a short-term boost, but larger industry players could eventually erode Fastly's market share given their broader offerings and scale, impacting Fastly's long-term revenue and competitive positioning.

- Fastly's need for continual investment in R&D, network infrastructure, and expansion into new security and compute products could keep operating margins depressed; if revenue growth does not consistently outpace these costs, the company may continue to experience prolonged negative net margins and delayed profitability.

- Increasing regulatory scrutiny on data privacy, cross-border data flows, and compliance (especially in regions like the EU and APJ) could raise Fastly's operational complexity and costs, limiting international expansion and potentially constraining future revenue and margin improvement.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $7.667 for Fastly based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $694.5 million, earnings will come to $44.3 million, and it would be trading on a PE ratio of 39.1x, assuming you use a discount rate of 9.9%.

- Given the current share price of $7.36, the analyst price target of $7.67 is 4.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Fastly?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.