Key Takeaways

- Strong demand for AI observability and integration with AI Ops is driving future subscription revenue through automation and efficiency gains.

- Go-to-market expansion and partner engagement are expected to drive new customer acquisitions and larger deals, boosting revenue growth.

- Revenue unpredictability from the DPS model and strategic deal variability could affect growth, with FX headwinds and customer expansion weaknesses further challenging earnings.

Catalysts

About Dynatrace- Provides a security platform for multicloud environments in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

- Dynatrace is benefiting from strong demand for AI observability and its integration with AI Ops, providing automation and efficiency gains that position the company well for increased future subscription revenue.

- The company is capitalizing on a trend towards consolidation in observability tools, which presents an opportunity for significant market share growth, likely contributing to higher revenue and net margins due to economies of scale.

- Dynatrace's next-generation log management solutions expand their market potential by integrating varied data stores, potentially driving revenue growth through broader platform adoption.

- Expansion in go-to-market strategy and increased engagement with partners are expected to drive new customer acquisitions and larger deals, providing an upside to revenue growth.

- The Dynatrace platform subscription (DPS) model is increasing consumption rates compared to the legacy model. The ease of access and broader adoption facilitated by DPS could drive higher subscription revenue and increased average revenue per customer.

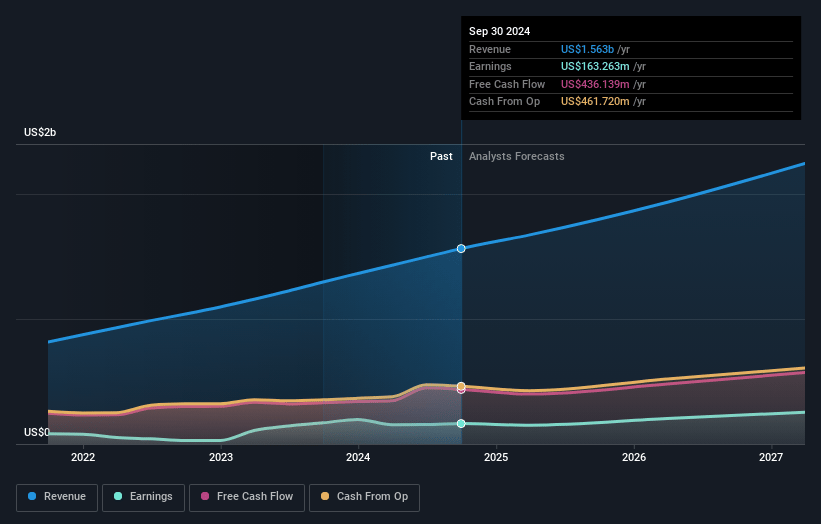

Dynatrace Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Dynatrace's revenue will grow by 15.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 29.5% today to 17.3% in 3 years time.

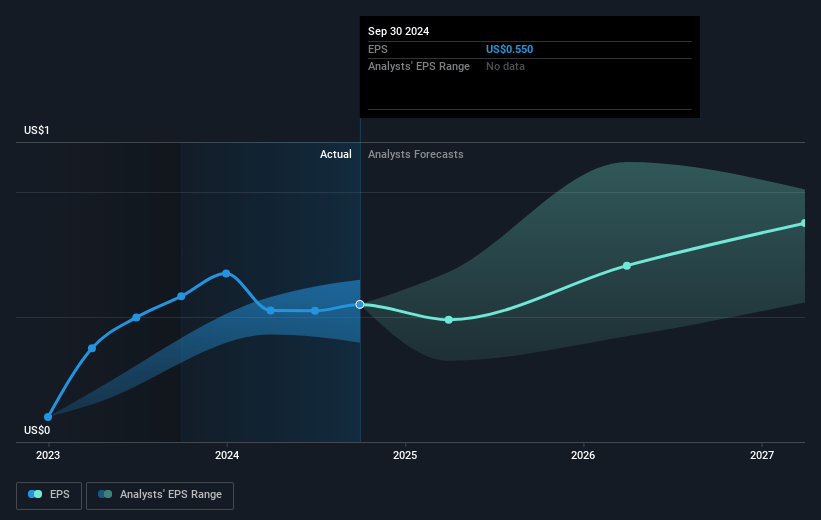

- Analysts expect earnings to reach $437.8 million (and earnings per share of $1.4) by about May 2028, down from $482.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $654.5 million in earnings, and the most bearish expecting $185.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 53.3x on those 2028 earnings, up from 29.4x today. This future PE is greater than the current PE for the US Software industry at 33.3x.

- Analysts expect the number of shares outstanding to grow by 0.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.63%, as per the Simply Wall St company report.

Dynatrace Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing shift to a DPS (Dynatrace Platform Subscription) model introduces unpredictability in revenue recognition due to on-demand consumption that is not captured in ARR or NRR metrics, potentially leading to uncertainty in forecasting revenue growth. This could impact how revenue is recognized and predictability of earnings.

- The shift towards larger, more strategic deals that are heavily weighted in the sales funnel could introduce increased variability in terms of deal closure timing and certainty, which may lead to fluctuations in quarterly revenue growth and affect net margins.

- There is a noted weakness in the commercial customer segment, particularly in terms of expansion rates, which could limit growth in customer base and subsequent revenue expansion opportunities.

- While the company has a strong focus on high-quality, large initial lands, the volume of new customer logos has decreased, which could slow future ARR growth rate if not offset by larger deal sizes.

- The strength of the U.S. dollar creates a significant foreign exchange headwind, projected to negatively affect ARR and revenue by substantive amounts, thus impacting earnings growth and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $61.379 for Dynatrace based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $44.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.5 billion, earnings will come to $437.8 million, and it would be trading on a PE ratio of 53.3x, assuming you use a discount rate of 7.6%.

- Given the current share price of $47.35, the analyst price target of $61.38 is 22.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.