Last Update 06 Dec 25

Fair value Decreased 0.29%DT: Expanded Cloud Partnerships Will Drive Strong Future Upside

Narrative Update on Dynatrace

Analysts have slightly trimmed their price target on Dynatrace from approximately $61.24 to $61.06, reflecting marginally higher discount rate assumptions and modestly lower long term growth and profitability expectations, while still assigning a robust future valuation multiple.

What's in the News

- Expanded collaboration with AWS, including new integrations for cloud operations, DevOps, security, and agentic AI, and recognition as AWS Public Sector Technology Partner of the Year in LATAM, alongside achieving the new AWS Agentic AI Specialization (company announcement).

- Launched real time observability integration with Amazon Bedrock AgentCore, giving AWS customers deep visibility, alerting, and governance across autonomous agent workflows (company announcement).

- Introduced next generation cloud operations solution for Microsoft Azure, now in preview. This adds AI driven observability, auto prevention, auto remediation, and auto optimization for Azure environments (product announcement).

- Became the first observability platform to integrate with Microsoft Azure SRE Agent. This enables smarter detection, automated operations, and proactive reliability for large scale Azure workloads (company announcement).

- Raised full year fiscal 2026 revenue guidance to a range of $1.985 billion to $1.995 billion, implying 17% to 17.5% growth, while also reporting progress on its share repurchase program (guidance and buyback update).

Valuation Changes

- Fair Value Estimate: edged down slightly from approximately $61.24 to $61.06 per share.

- Discount Rate: rose modestly from about 8.40% to roughly 8.48%.

- Revenue Growth: essentially unchanged, easing marginally from about 14.82% to 14.82% on a long term basis.

- Net Profit Margin: virtually flat, dipping slightly from roughly 17.67% to 17.66%.

- Future P/E Multiple: trimmed marginally from about 48.34x to 48.31x, indicating a very small reduction in the long term valuation multiple.

Key Takeaways

- AI-powered observability and a unified platform are deepening customer integration, driving product adoption, and supporting strong gross margins and recurring revenue.

- Targeted go-to-market changes and value-based pricing are generating a higher-quality sales pipeline, positioning for sustained revenue growth and improved customer retention.

- Competitive pressures, customer concentration, longer sales cycles, global risks, and dependence on continued AI innovation all threaten Dynatrace's growth, pricing, and market relevance.

Catalysts

About Dynatrace- Engages in the advancement of observability for digital businesses, which transforms the complexity of modern digital ecosystems in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

- Dynatrace is well positioned to capture incremental share of the expanding addressable market created by enterprises accelerating digital transformation and cloud modernization initiatives, as evidenced by multi-million dollar, end-to-end observability deals and a pipeline heavily weighted toward large, strategic consolidations-catalyzing sustained revenue growth and increased average ARR per customer over time.

- Investments in AI-driven observability-including significant advancements in agentic AI and integration of predictive, causal, and generative AI-are increasing differentiation and embedding Dynatrace more deeply into enterprise IT operations, which enhances pricing power and supports gross margin stability.

- The company's unified platform approach, particularly the growing success of Grail-powered log management (over 100% YoY log consumption growth and targeting $100M in annualized consumption), is driving multi-product adoption and higher customer stickiness, which should improve net retention rates, recurring revenue, and long-term earnings predictability.

- Recent go-to-market strategy changes (focusing sales coverage on strategic, high-propensity-to-spend accounts and building out strike teams for key product areas) are yielding a substantially larger and higher quality expansion pipeline (pipeline for deals >$1M more than doubled YoY), positioning Dynatrace for accelerated revenue and earnings growth from existing customers.

- The ongoing shift in the industry toward value-based, consumption-driven pricing models-with Dynatrace's DPS contracts now accounting for 65% of ARR and driving higher platform adoption and faster consumption-supports higher long-term revenue growth, improved customer lifetime value, and the potential for margin expansion.

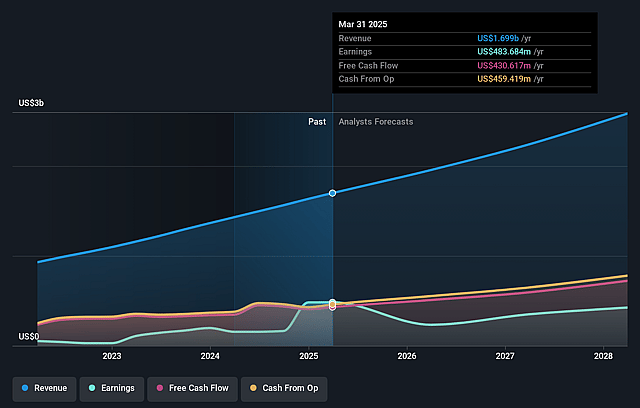

Dynatrace Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Dynatrace's revenue will grow by 15.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 27.7% today to 19.2% in 3 years time.

- Analysts expect earnings to reach $521.4 million (and earnings per share of $1.55) by about September 2028, up from $493.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $716 million in earnings, and the most bearish expecting $314.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 47.8x on those 2028 earnings, up from 31.0x today. This future PE is greater than the current PE for the US Software industry at 36.2x.

- Analysts expect the number of shares outstanding to grow by 1.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.41%, as per the Simply Wall St company report.

Dynatrace Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition from both hyperscalers (like AWS, Azure, Google Cloud) and other best-of-breed observability vendors, along with the risk of commoditization of basic observability tools and the increasing adoption of open-source alternatives (such as OpenTelemetry and Prometheus), could pressure Dynatrace's pricing power, erode its market share, and negatively impact both revenue growth and net margins over time.

- Growing deal sizes and increasing reliance on large, strategic enterprise expansions focus the company on fewer, higher-value opportunities, introducing timing variability and customer concentration risk; delays or churn in these deals could lead to significant volatility in revenues and earnings.

- The shift towards integrated end-to-end observability platforms is creating larger, multi-faceted sales motions, which, while beneficial for account growth, also result in longer deal cycles and higher execution risk-if Dynatrace fails to close these deals at expected rates, or if customers defer or reduce IT spend due to macroeconomic uncertainty, revenue and ARR growth could be negatively impacted.

- Heavy weighting of expenses in euros and global operations expose Dynatrace to ongoing foreign exchange headwinds, geopolitical instability, and regulatory fragmentation (such as data sovereignty laws), all of which could limit the company's ability to scale efficiently across global markets and compress margins.

- While current traction in AI observability and log management is strong, the company's long-term success is highly dependent on continued rapid innovation in AI-driven automation and agentic AI; if Dynatrace cannot keep up with the fast pace of technological evolution or fails to broaden adoption as AI adoption patterns shift, product irrelevance or disintermediation could cause deterioration in revenues and future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $63.094 for Dynatrace based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $55.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $521.4 million, and it would be trading on a PE ratio of 47.8x, assuming you use a discount rate of 8.4%.

- Given the current share price of $50.65, the analyst price target of $63.09 is 19.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Dynatrace?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.