Circle is building the payment rails for the digital dollar era, in a world where Bitcoin is the new gold.

Company Overview

Circle is the issuer of USDC, the world’s second-largest stablecoin. As of July 2025, USDC has:

- $62.3B in circulation

- $25.5T in cumulative on-chain transaction volume

- Zero depegs during market stress

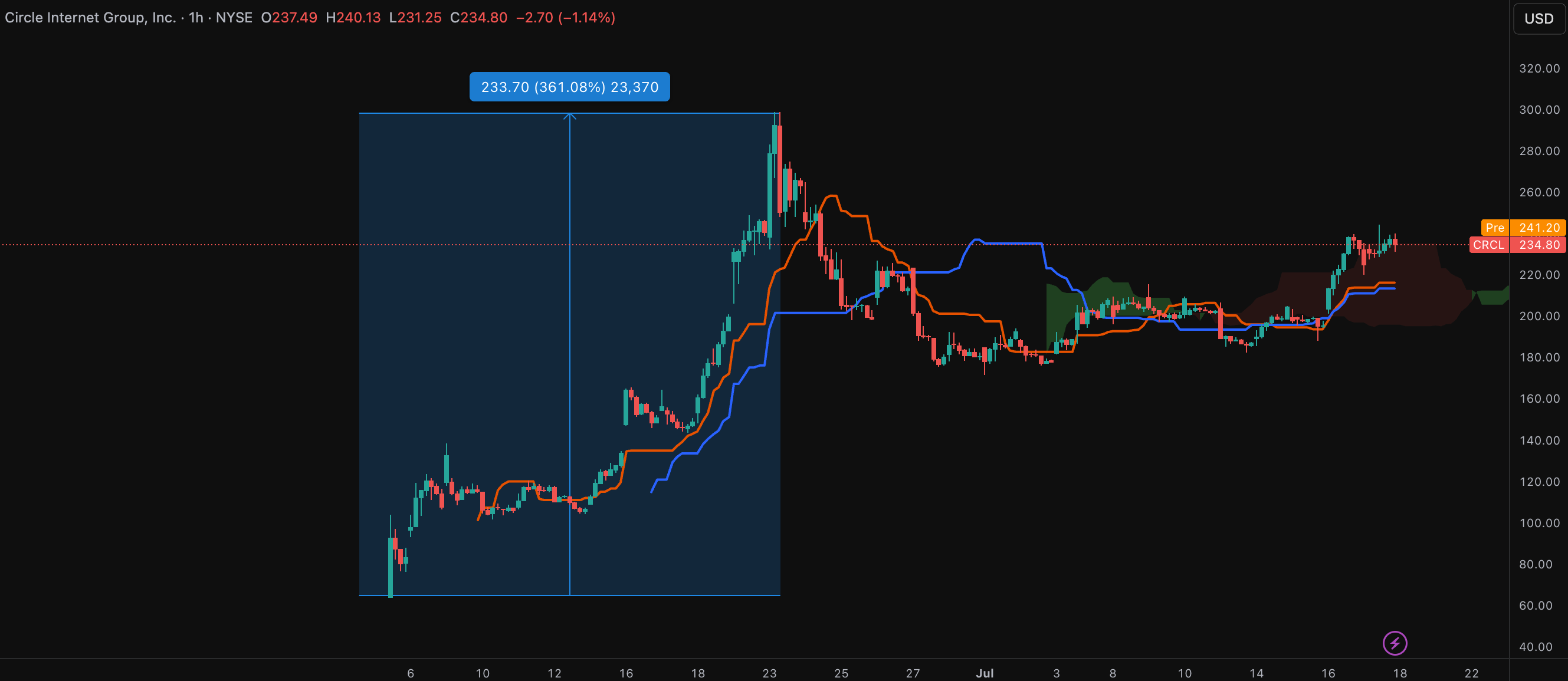

Circle went public in July 2025 under the ticker CRCL, after years of operating privately and disclosing financials through SEC reports. The IPO was incredibly successful with price appreciating by several multiples in a matter of a few days.

Its business model is elegantly simple and highly profitable. Circle issues USDC tokens backed 1:1 with cash and short-duration U.S. Treasuries, earning risk-free yield on that float.

In 2024:

- $1.7B in revenue

- $156M in net income

- $10.1B average reserves held (mostly U.S. Treasuries)

This is essentially a digital money market fund at global scale, with no lending, no crypto risk, and no fees for users.

How Stablecoins Work and Why They Matter

Stablecoins like USDC are not speculative assets. They serve as infrastructure, programmable dollars that:

- Increase demand for U.S. Treasuries. Every $1 of USDC minted is matched by $1 invested in U.S. debt. This is increasingly important as major foreign holders like China have been selling U.S. Treasuries while accumulating gold. This is one of the main reasons why the US gov is so supportive.

- Provide synthetic dollar access globally. In countries like Argentina, Nigeria, or Turkey, stablecoins offer a way to save and transact in USD without bank exposure or capital controls.

- Enable financial inclusion. All that is needed is a smartphone and a wallet app.

- Power the liquidity layer of crypto. Stablecoins represent the majority of trading volume in crypto markets.

What Visa did for plastic cards, Circle and Tether are doing it for digital dollars, and the addressable market is global.

Growth Catalysts

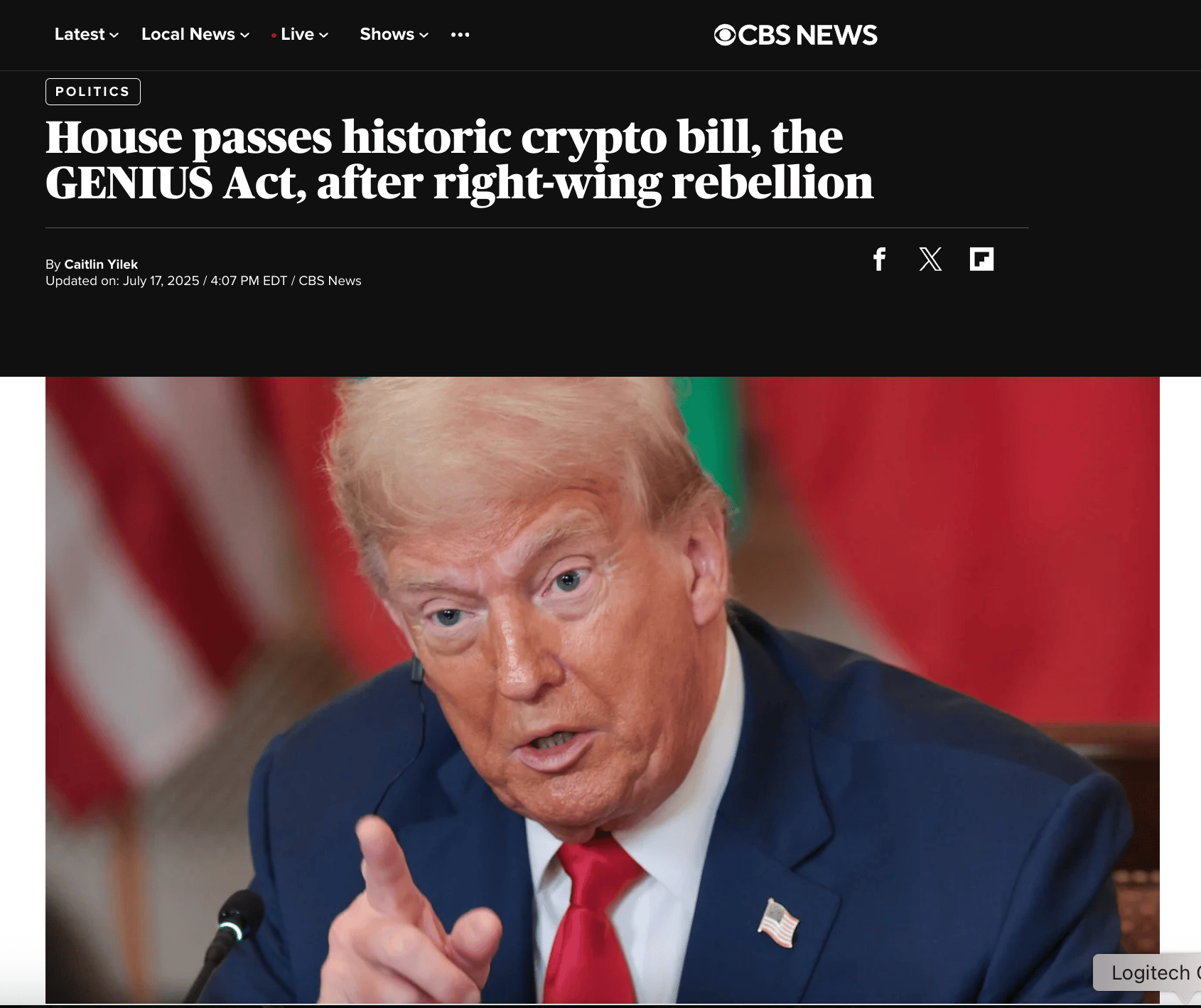

- GENIUS Act Passed (July 2025) The U.S. House passed the GENIUS Act, providing the first federal regulation for stablecoins. Circle now has regulatory clarity and a license to operate across the United States. This provides a first-mover advantage over competitors like Tether, which remains offshore and unregulated. https://www.cbsnews.com/news/house-vote-crypto-genius-act-stablecoin-regulations/

- Rising international demand Over 80 percent of USDC volume now comes from outside the United States. Stablecoins are being adopted in emerging markets for both commerce and savings. USDC is evolving into a modern version of the eurodollar.

- Rebuilding the Global Financial RailsThe existing cross-border payment system, built around SWIFT, is slow, expensive, and outdated. Transactions can take days, involve multiple intermediaries, and come with high fees, especially for emerging markets and unbanked populations.Circle’s USDC offers a faster, cheaper, programmable alternative that can settle in seconds across borders. With growing institutional interest and government discussions around blockchain infrastructure, stablecoins are increasingly seen as the foundation for the next-generation global payment network.As geopolitical tensions rise and countries like Russia and China push away from SWIFT, the U.S. has a strong incentive to support dollar-backed stablecoins like USDC as a way to preserve the dollar’s dominance and modernise the system on American terms.This is not just a tech upgrade. It’s a potential paradigm shift in how global value moves and Circle is positioned to be one of its key operators.

- Partnership with Coinbase (COIN) Circle and Coinbase split USDC reserve revenue equally. Coinbase serves as the front-end distribution engine. Circle handles compliance and treasury, it is the infrastructure layer.

- Enterprise traction Circle Mint offers real-time USDC minting and redemption for institutions. Partnerships with Stripe, Visa, Nubank, and Mercado Pago embed USDC into payments.

Risks

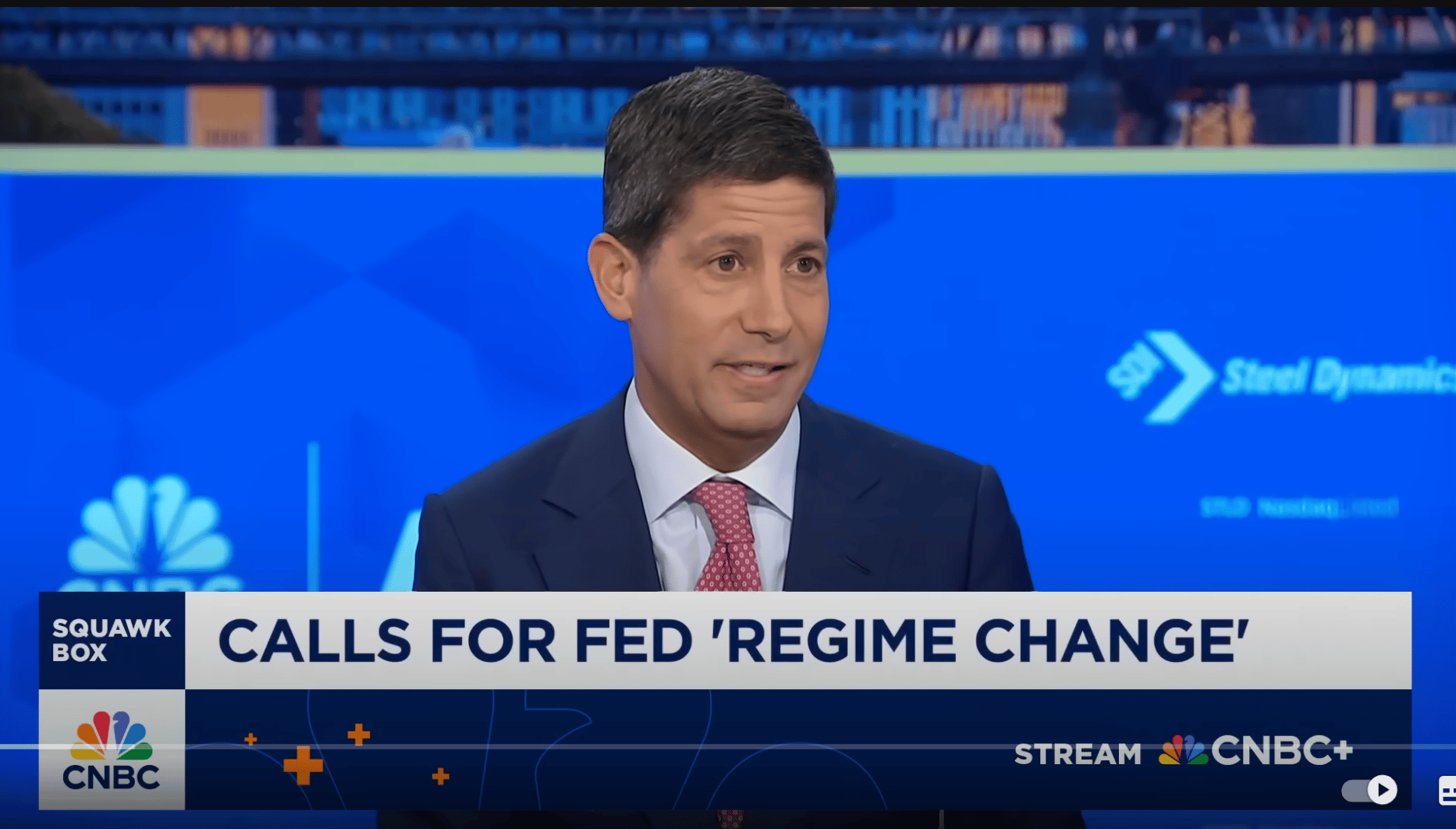

- Falling interest rates. Circle earns revenue primarily by investing USDC reserves in short-duration U.S. Treasuries. In 2024, with rates near 5%, this model generated over $1.7B in revenue. But the company is heavily exposed to interest rate cycles. A 100 basis point cut could reduce annual revenue by approximately $800M.The risk of cuts is rising fast. Federal Reserve Chair Jerome Powell is expected to step down in mid-2026, if not earlier. Donald Trump has made no secret of his dissatisfaction with Powell’s rate policies. One of the frontrunners to replace him is Kevin Warsh, a former Fed governor and advisor to billionaire investor Stanley Druckenmiller.In a recent CNBC interview, Warsh openly criticised the Fed’s current framework, called for regime change, and suggested we are entering a structural decline in prices. That backdrop would support multiple rate cuts.This aligns with a broader political shift toward looser monetary policy aimed at stimulating growth and countering deflationary forces like AI-driven productivity and global supply chain improvements. If Warsh or someone like him takes over, rate cuts could happen faster and more aggressively than the market currently expects. This presents a clear risk to Circle’s yield-driven revenue model.

https://www.youtube.com/watch?v=4QFkauEI3XI

- Coinbase revenue sharing. Circle shares 50 percent of its yield with COIN. Any change in this relationship could affect profitability or unlock more margin.

- Competition from Tether. Despite regulatory opacity, Tether remains dominant in Asia and offshore markets. Tether's 2024 profit was reportedly $13B, making it one of the most profitable companies in the world per employee.

- Regulatory headwinds. While the GENIUS Act is a major step forward, further regulations, such as capital requirements or federal oversight, could increase operational costs or restrict expansion.

Valuation

At the time of writing, Circle (CRCL) trades at $241 per share. Based on a discounted cash flow (DCF) model with the following assumptions:

- Revenue growth of 20% per year for the next five years

- Net margins reaching 18% by year five

- A 10% discount rate

…I estimate a fair value of $326 per share.

While not a deep value play, Circle offers exposure to one of the most profitable emerging business models in fintech. And with the GENIUS Act and macro trends aligning in its favour, a re-rating driven by narrative and institutional capital could push the price higher in the short to medium term.

Final Thoughts

Circle is a long-term play on the stablecoin infrastructure that could reshape global finance. Its growth is backed by real revenue, strong regulatory momentum, and strategic partnerships. But it’s not without volatility.

The stock is prone to hype-driven rallies and sharp corrections. As with many crypto-adjacent names, timing matters. If you’re bullish on the space, it’s wise to wait for pullbacks rather than chase breakouts (especially if late).

This is a high-upside, high-uncertainty bet on the future of money. Worth watching closely.

How well do narratives help inform your perspective?

Disclaimer

BlackGoat is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. BlackGoat has a position in NYSE:CRCL. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.