Last Update 19 Feb 26

ROP: Software Cash Flows And Buybacks Will Support Multiple Re Rating

Roper Technologies' updated analyst price target reflects a reset across the Street, with multiple firms trimming their views by $32 to $141 as analysts recalibrate for cooler organic revenue trends, slightly adjusted discount and growth assumptions, and a modestly lower expected future P/E multiple.

Analyst Commentary

Recent Street research on Roper Technologies clusters around two main themes, with most analysts cutting price targets and a few adjusting ratings as they reassess growth and valuation expectations. You are seeing both cautious and constructive takes emerge from the same reset.

Bullish Takeaways

- Some bullish analysts describe the recent selloff as overdone, suggesting that the share price now embeds more conservative assumptions on organic growth and execution than before.

- Even with lower targets, certain firms maintain positive ratings on the stock, indicating they still see room for upside if Roper can deliver steady execution on its existing software and tech portfolio.

- Commentary on vertical software points to what some view as exceptional opportunities in the space after a harsh selloff, which, if realized, could support Roper's long term growth narrative without requiring aggressive assumptions.

- Where targets are trimmed rather than ratings downgraded, bullish analysts appear to be resetting valuation multiples and discount rates rather than abandoning confidence in the business model.

Bearish Takeaways

- Several bearish analysts have moved to more cautious ratings, citing cooling organic revenue trends and organic growth challenges that make prior growth trajectories and valuation levels look too optimistic.

- Multiple firms have reduced price targets by wide ranges, from around $32 to $141, which signals a broad reset of earnings power expectations and the P/E multiple investors may be willing to pay.

- Downgrades from research houses that previously had more positive views reflect concern that execution will need to be stronger to justify earlier premium valuations, especially if revenue momentum stays cooler.

- Some cautious voices highlight that 2026 is described as a tough slate for fundamentals in the industrial software and defense tech space, which could limit how quickly sentiment and valuation on Roper rebounds even after target cuts.

What’s in the News

- From October 23, 2025 to December 31, 2025, Roper Technologies repurchased 1,120,000 shares, representing 1.04% of shares, for a total of $500 million under its buyback program. (Key Developments)

- The company reported completion of this buyback authorization, with the full 1,120,000 shares acquired for $500 million under the program announced on October 23, 2025. (Key Developments)

Valuation Changes

- Fair Value: Model fair value remains unchanged at $462.19, reflecting a stable central estimate despite other input tweaks.

- Discount Rate: The discount rate has risen slightly from 9.14% to 9.15%, signaling a modestly higher required return in the updated framework.

- Revenue Growth: The revenue growth assumption is essentially unchanged, holding around 7.83%, which keeps the long term top line outlook consistent with prior modeling.

- Net Profit Margin: The net profit margin assumption has risen slightly from 20.11% to 20.24%, indicating a small uplift in expected profitability over time.

- Future P/E: The future P/E multiple assumption has edged down from 31.36x to 30.87x, reflecting a modestly lower valuation multiple applied to forward earnings.

Key Takeaways

- Accelerating adoption of AI-driven, vertical-specific SaaS platforms is expanding margins, boosting subscription revenue stability, and fueling long-term organic growth.

- Significant opportunity remains in under-digitized, data-rich sectors, supporting ongoing market share gains and recurring revenue expansion as digital transformation advances.

- Heavy dependence on acquisitions and niche markets, alongside regulatory, technological, and integration risks, threatens Roper's margin sustainability and future organic revenue growth.

Catalysts

About Roper Technologies- Designs and develops vertical software and technology enabled products in the United States, Canada, Europe, Asia, and internationally.

- The rapid adoption of AI and cloud-native solutions across Roper's portfolio is unlocking significant productivity gains (cited 30% R&D productivity increase in some business units) and enabling monetization of new, AI-driven products and upgrades, which is expected to accelerate organic revenue growth and expand operating margins over time.

- Penetration of under-digitized, data-rich sectors-including faith-based organizations, healthcare, legal, and government contracting-remains nascent, with large TAMs only 50% served in some cases (e.g., Subsplash), indicating substantial runway for recurring revenue and market share gains as digital transformation accelerates within these verticals.

- Increased focus on integrating mission-critical, vertical-specific SaaS platforms that combine software, payments, and network effects is driving higher gross/net customer retention, enabling a higher mix of stable, subscription-based revenues, which enhances earnings predictability and cash flow stability.

- Ongoing, disciplined capital deployment into high-growth, high-margin vertical market software leaders (e.g., Subsplash, CentralReach) is incrementally raising the portfolio's underlying organic growth rate and long-term margin profile, supporting robust free cash flow compounding and the potential for EBITDA margin expansion.

- Secular increases in data proliferation, automation needs, and regulatory complexity, especially within healthcare and compliance-driven segments, are fueling demand for analytics-rich, secure, and integrated software solutions-well aligned with Roper's core offerings, underpinning sustainable revenue growth and margin resilience.

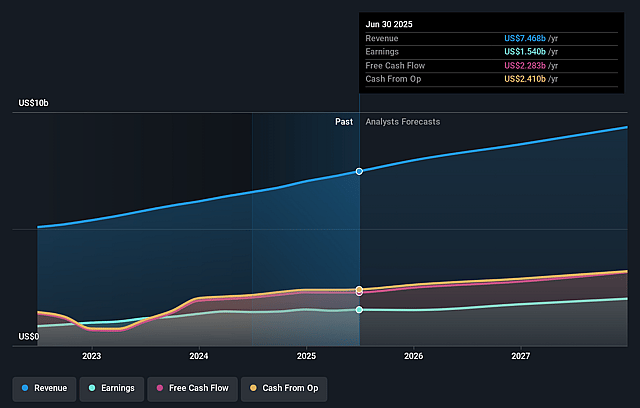

Roper Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Roper Technologies's revenue will grow by 11.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 20.6% today to 21.1% in 3 years time.

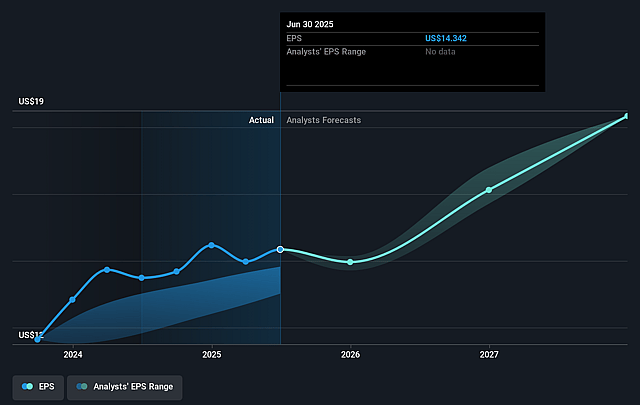

- Analysts expect earnings to reach $2.2 billion (and earnings per share of $19.59) by about September 2028, up from $1.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.1x on those 2028 earnings, up from 36.3x today. This future PE is greater than the current PE for the US Software industry at 36.2x.

- Analysts expect the number of shares outstanding to grow by 0.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.86%, as per the Simply Wall St company report.

Roper Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Roper's continued reliance on M&A-driven growth, as evidenced by their focus on acquiring vertical market software businesses (e.g., CentralReach, Subsplash), increases the risk of integration challenges and may lead to operational inefficiencies or diluted net margins over time, as shown by initial underperformance at Procare and related management turnover.

- The company's outlook assumes market stability and ongoing organic growth in niche verticals such as education, legal, and faith-based organizations; however, these markets may approach saturation, resulting in slowing organic revenue growth and limiting the company's ability to sustain its historic top-line trajectory.

- The rising complexity of regulatory requirements (e.g., healthcare coverage changes, potential government spending volatility) and increased scrutiny on data privacy and cybersecurity could raise compliance costs, expose the company to reputational or operational risk, and negatively impact earnings and margin profiles for its software platforms.

- Intensifying competition and rapid technological change in the software sector-especially from large enterprise software providers and new entrants offering more advanced AI capabilities-pose a threat to Roper's market share, pricing power, and may require increased R&D investment just to maintain current revenue streams.

- The risk of commoditization in business software, particularly as clients expect more AI-native or cloud-integrated solutions, may lead to downward pressure on pricing and margins if Roper is unable to sustain differentiated value, impacting both future revenue growth and long-term net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $636.2 for Roper Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $714.0, and the most bearish reporting a price target of just $460.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $10.2 billion, earnings will come to $2.2 billion, and it would be trading on a PE ratio of 41.1x, assuming you use a discount rate of 8.9%.

- Given the current share price of $519.67, the analyst price target of $636.2 is 18.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Roper Technologies?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.