Key Takeaways

- Pega GenAI Blueprint and AgentX focus on replacing legacy systems and enhancing operations, potentially boosting revenue and reducing costs.

- Strategic cloud focus and market investments aim to increase revenue via cloud migrations and new client acquisitions.

- Increased investments and competitive pressures might limit revenue growth and profit margins, with operational challenges in transitioning legacy systems posing risks to future outlook.

Catalysts

About Pegasystems- Develops, markets, licenses, hosts, and supports enterprise software in the United States, rest of the Americas, the United Kingdom, rest of Europe, the Middle East, Africa, and the Asia-Pacific.

- The introduction of the Pega GenAI Blueprint is expected to drive transformative legacy system replacements and accelerate business logic onto modern cloud architecture, which could boost revenue through increased adoption and implementation speed.

- Significant emphasis on the development and integration of transformative generative AI capabilities, specifically with Pega AgentX, is aimed at enhancing operational efficiency and customer engagement, potentially improving net margins by reducing costs related to managing traditional processes.

- The growth target of 12% for annual contract value (ACV) in 2025, driven by Pega Cloud expansion, indicates a focus on cloud-based solutions that could lead to substantial revenue growth from cloud migrations and increased customer penetration.

- The completion of the subscription transition in 2023 and the consistent focus on a Rule of 40 balance, blending growth with profitability, is likely to drive improved earnings due to sustained cash flow and disciplined financial management.

- Strategic investments in expanding sales and marketing initiatives, particularly targeting new client acquisitions with Pega GenAI Blueprint, suggest potential revenue growth through increased market share and enhanced go-to-market execution.

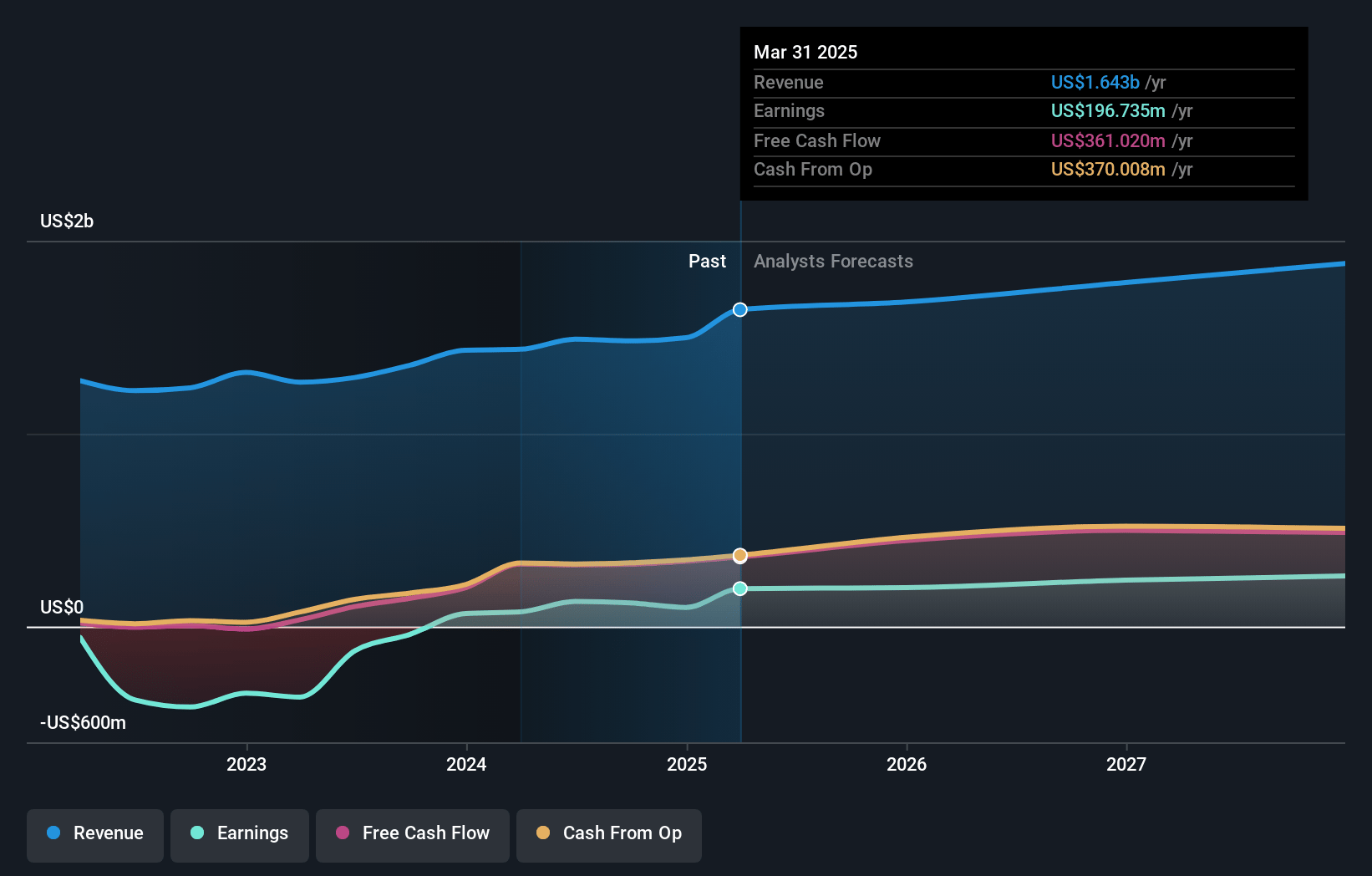

Pegasystems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pegasystems's revenue will grow by 7.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.6% today to 14.7% in 3 years time.

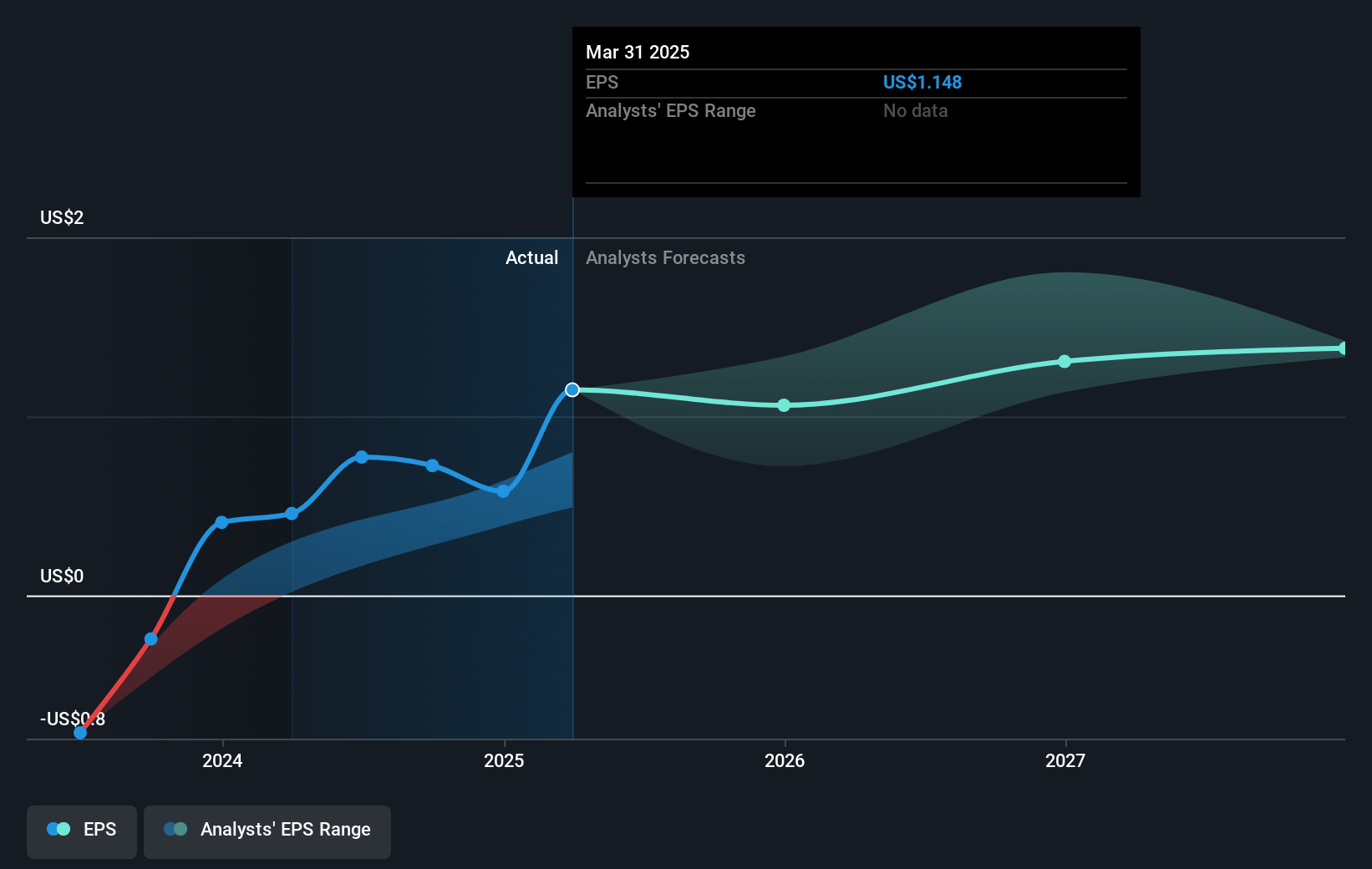

- Analysts expect earnings to reach $270.5 million (and earnings per share of $2.79) by about March 2028, up from $99.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $318.1 million in earnings, and the most bearish expecting $222.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.7x on those 2028 earnings, down from 61.7x today. This future PE is greater than the current PE for the US Software industry at 28.2x.

- Analysts expect the number of shares outstanding to grow by 1.02% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.6%, as per the Simply Wall St company report.

Pegasystems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing transitions and upgrades to legacy systems can pose operational challenges and execution risks, potentially impacting the efficiency of transforming legacy applications, which could affect Pegasystems' future revenue growth.

- Increased sales and marketing investments without a guaranteed return could hinder profit margins if these efforts do not successfully attract new customers or expand existing accounts, impacting net margins and earnings.

- Currency headwinds such as a strengthening U.S. dollar are expected to affect Pega Cloud revenue growth, possibly reducing international revenue contributions and affecting overall revenue.

- The need for continued investments to support cloud migrations may result in flat Pega Cloud gross margins despite increasing revenues, potentially limiting improvements in overall profit margins.

- Competitive pressures in the AI and agent space could arise as other vendors develop innovative solutions, impacting Pegasystems’ ability to retain market share and earn revenue from Pega GenAI Blueprint and AgentX initiatives.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $105.362 for Pegasystems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $125.0, and the most bearish reporting a price target of just $78.12.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $270.5 million, and it would be trading on a PE ratio of 42.7x, assuming you use a discount rate of 7.6%.

- Given the current share price of $71.23, the analyst price target of $105.36 is 32.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.