Narratives are currently in beta

Key Takeaways

- Strategic cloud partnerships and AI-driven solutions enhance growth, supporting modernization and operational efficiency, aligning with demand for automation and cloud transitions.

- Transition to a subscription model boosts financial stability, promoting shareholder value through better cash flow and potential buybacks.

- Transition to Pega Cloud presents challenges, while geopolitical and competitive pressures risk revenue growth and client confidence.

Catalysts

About Pegasystems- Develops, markets, licenses, hosts, and supports enterprise software in the United States, rest of the Americas, the United Kingdom, rest of Europe, the Middle East, Africa, and the Asia-Pacific.

- The introduction of Pega GenAI Blueprint is driving excitement and engagement among clients, potentially leading to increased revenue through digital transformation and deeper sales engagements. This impacts future revenue growth as it becomes integral to client relationships and new market opportunities.

- Pegasystems' focus on helping clients modernize and replace legacy systems with new cloud-native solutions represents a significant opportunity for accelerated growth, particularly in Pega Cloud, which could enhance both revenue and net margins due to increased efficiency and scalability.

- The company's initiative to leverage AI for business orchestration and automation technologies (BOAT) aligns with industry trends towards automation, which may improve operational efficiencies and net margins while fostering long-term revenue growth by meeting emerging client demands.

- Pegasystems' strategic partnership and alignment with major cloud providers like AWS and Google Cloud could potentially expand its reach and support growth in Pega Cloud migrations, positively affecting future revenue and earnings by capturing workloads transitioning to the cloud.

- The completion of Pegasystems' transition to a subscription model is expected to bolster free cash flow growth, enhancing financial stability and supporting shareholder value creation through increased cash flow per share and potential share buybacks, thereby impacting overall earnings.

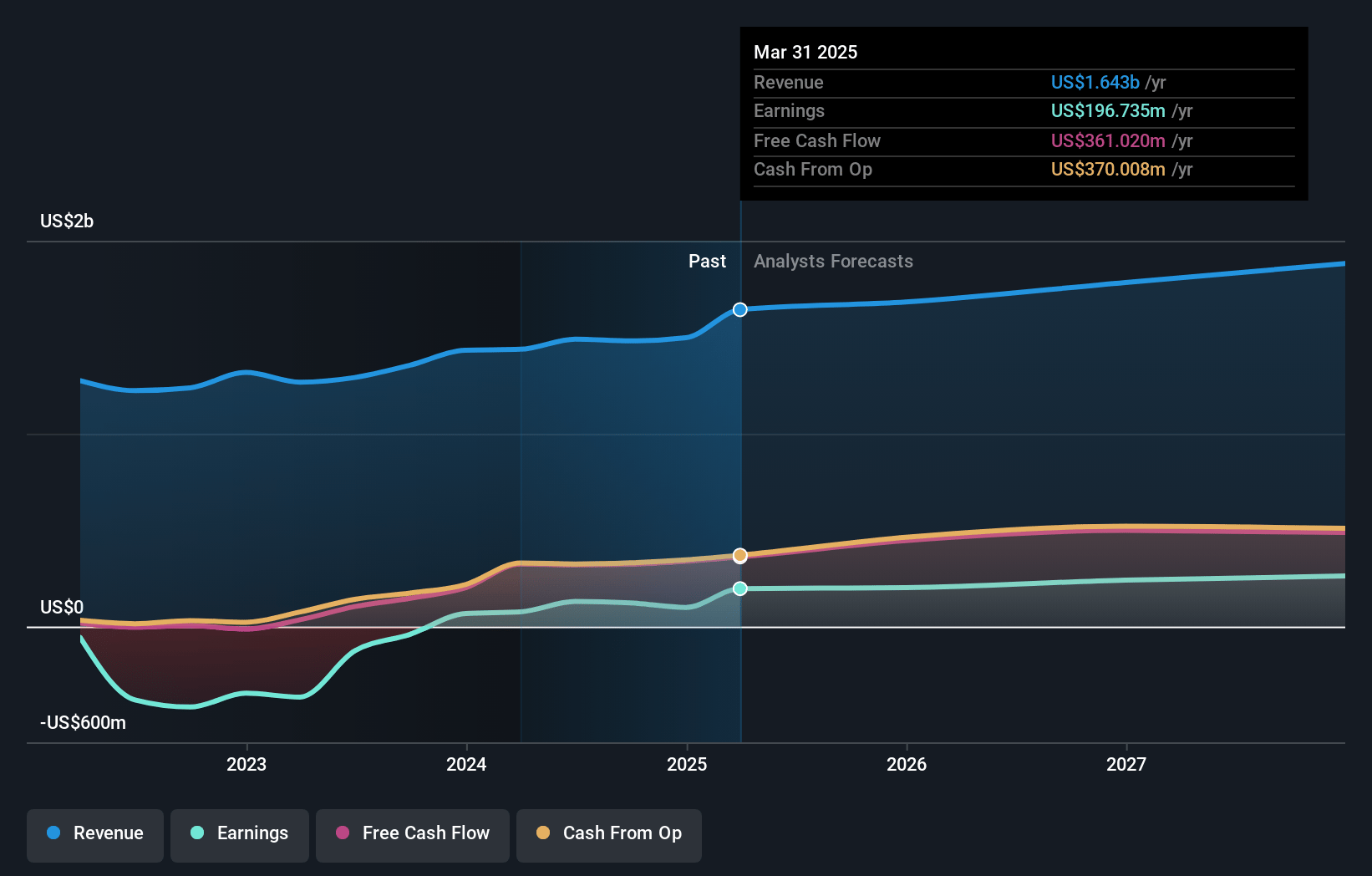

Pegasystems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pegasystems's revenue will grow by 6.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.3% today to 13.8% in 3 years time.

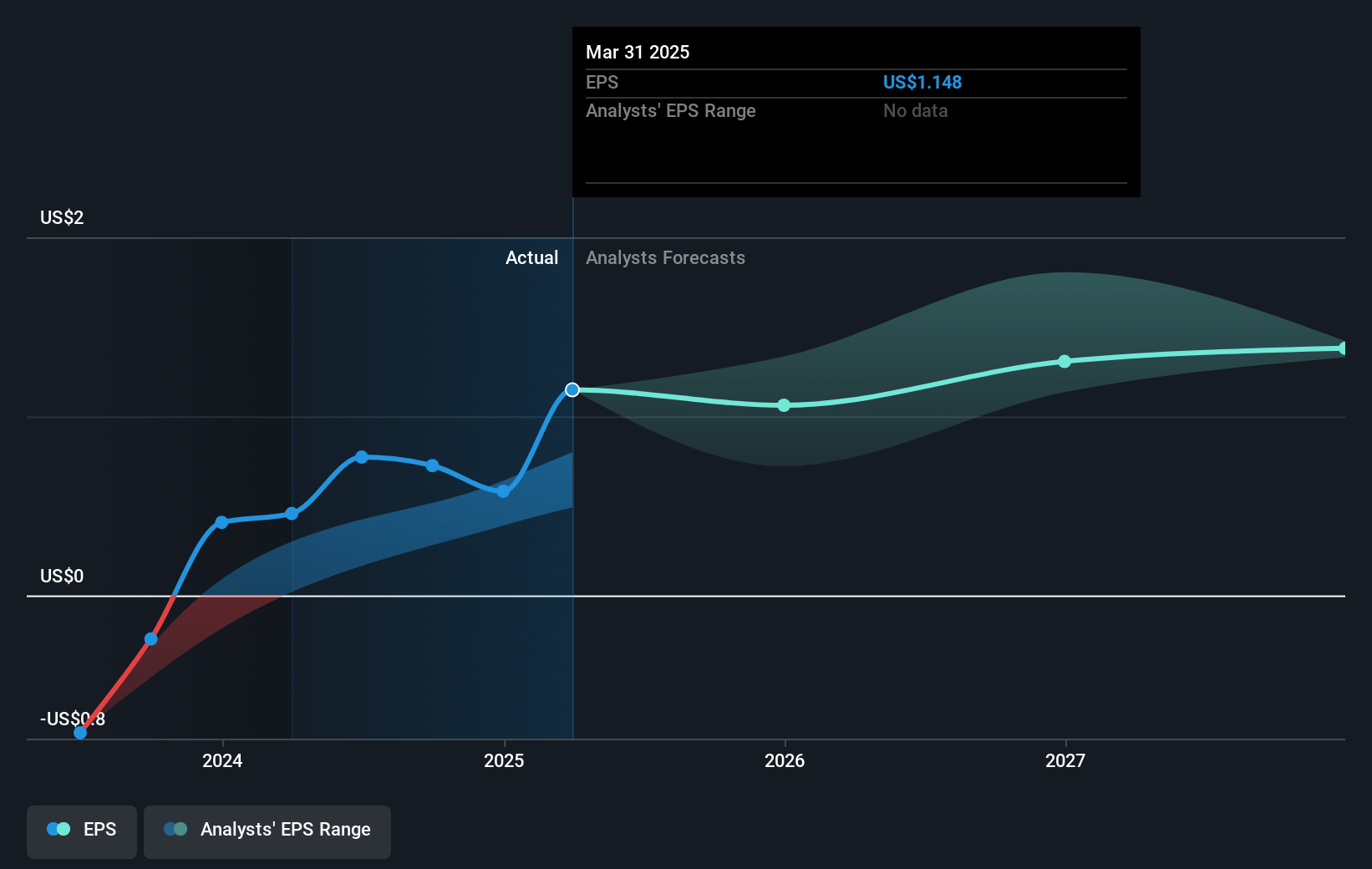

- Analysts expect earnings to reach $247.1 million (and earnings per share of $2.69) by about October 2027, up from $122.8 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $191.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.0x on those 2027 earnings, down from 56.6x today. This future PE is greater than the current PE for the US Software industry at 38.9x.

- Analysts expect the number of shares outstanding to grow by 2.28% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 6.85%, as per the Simply Wall St company report.

Pegasystems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The potential for geopolitical tensions and economic conditions, such as wars, inflation, and other global uncertainties could lead to timid spending decisions by clients, impacting revenue growth and financial stability.

- Maintenance and subscription revenue are expected to decline due to the transition to Pega Cloud, which might not be immediately offset by new cloud revenues, affecting overall revenue projections.

- The dependency on the widespread adoption and monetization of Pega Cloud poses a risk, as delays in cloud migration or slower-than-anticipated client transitions could impact future earnings and revenue streams.

- Despite the excitement around AI offerings like Blueprint, the possibility of competition from players like Salesforce and others who are also innovating in AI and cloud solutions poses a risk to market share and revenue growth.

- The legal and regulatory environment, as seen with previous litigation, may impact client confidence and subsequently affect sales cycles and revenue attainment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $89.1 for Pegasystems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $100.0, and the most bearish reporting a price target of just $80.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.8 billion, earnings will come to $247.1 million, and it would be trading on a PE ratio of 40.0x, assuming you use a discount rate of 6.9%.

- Given the current share price of $80.99, the analyst's price target of $89.1 is 9.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives