Narratives are currently in beta

Key Takeaways

- Anticipated release of Titanium X and new AI capabilities are set to boost SaaS adoption, cloud revenues, and margins.

- Strategic partnerships and operational efficiencies aim to drive revenue growth and improve capital returns, supporting higher EPS.

- OpenText faces revenue volatility from weaker Q1, dependence on strategic partners, SaaS transition risks, and economic instability in key markets.

Catalysts

About Open Text- Engages in the provision of information management products and services.

- The development and anticipated release of Titanium X, OpenText's next-generation autonomous information management platform, is expected to drive future growth by increasing cloud revenues through SaaS adoption, higher margins, and faster time to market.

- The company's strategic investments in its enterprise and SMB go-to-market strategies, alongside increased focus on customer success, are expected to significantly contribute to revenue growth in the second half of the fiscal year.

- OpenText is making substantial efforts to expand its partnerships with major cloud providers like SAP, Google, and Microsoft, which is anticipated to enhance sales and drive revenue growth by integrating new AI and security capabilities into its offerings.

- The roll-out of new AI capabilities, including GenAI Aviators and Ali.AI, is positioned to boost sales productivity and increase cloud bookings, thus positively impacting revenues and net margins.

- The company's focus on operational efficiencies and divestiture of the ultra-high-margin AMC business is expected to improve adjusted EBITDA and free cash flow, supporting higher returns of capital via dividends and share buybacks, which can potentially enhance earnings per share (EPS).

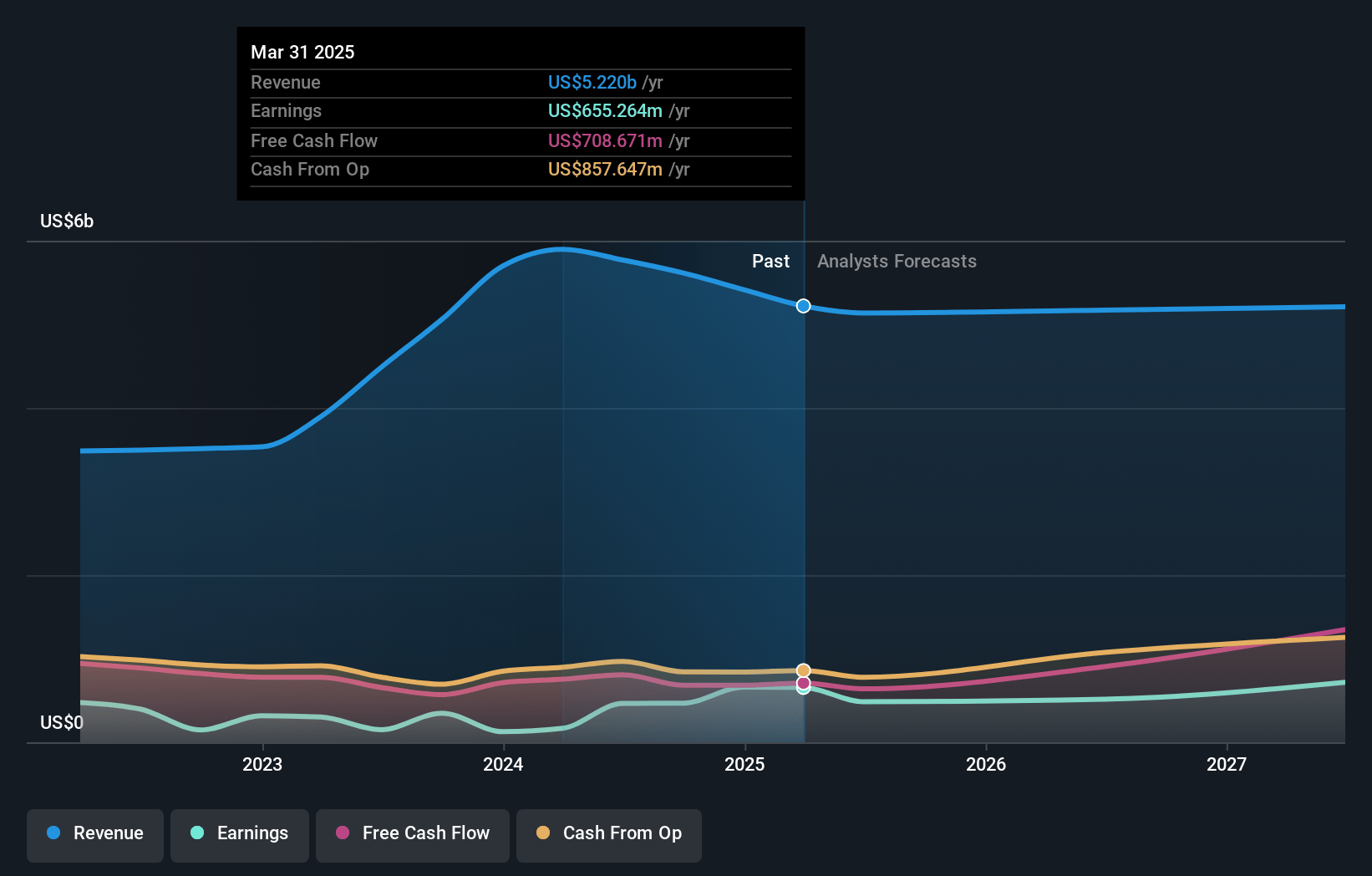

Open Text Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Open Text's revenue will decrease by -1.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.3% today to 12.0% in 3 years time.

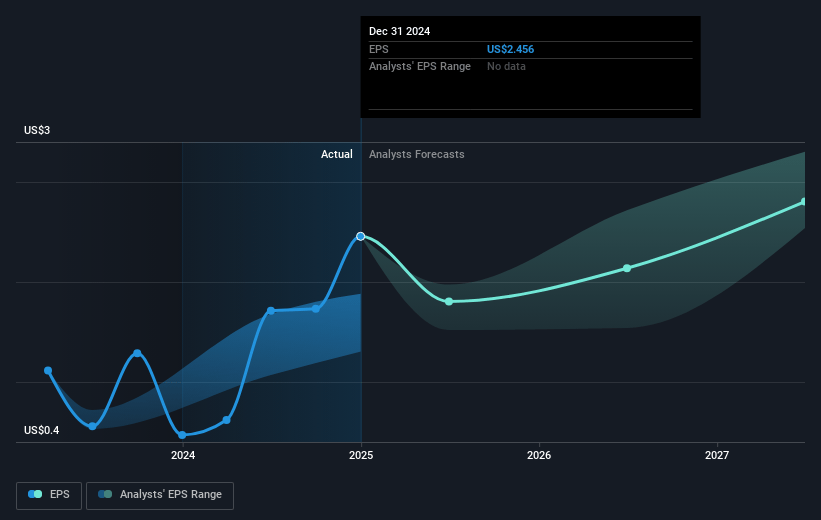

- Analysts expect earnings to reach $654.5 million (and earnings per share of $2.41) by about November 2027, up from $468.6 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $722.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.5x on those 2027 earnings, up from 16.0x today. This future PE is lower than the current PE for the CA Software industry at 41.0x.

- Analysts expect the number of shares outstanding to grow by 1.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.79%, as per the Simply Wall St company report.

Open Text Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The seasonality observed in OpenText’s revenue, particularly a weaker Q1, could indicate volatility and fluctuations in financial performance throughout the year, potentially impacting revenue and earnings stability.

- Despite a large cloud bookings pipeline, the slower growth in cloud revenue suggests challenges in converting the pipeline into actual sales, which might affect short-term revenue growth targets.

- Dependence on strategic partnerships with companies like Microsoft, SAP, and Google poses a risk, as changes in these partnerships or market dynamics could impact revenue and earnings streams.

- The transition from on-premise to SaaS involves execution risks that may lead to delays or unexpected costs, impacting revenue growth and potentially affecting net margins if not managed efficiently.

- Economic volatility in key markets such as Europe, North America, APAC, and Japan poses external risks that could impact revenue and overall financial performance if the demand environment changes unexpectedly.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $36.6 for Open Text based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $48.0, and the most bearish reporting a price target of just $32.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $5.4 billion, earnings will come to $654.5 million, and it would be trading on a PE ratio of 19.5x, assuming you use a discount rate of 8.8%.

- Given the current share price of $28.56, the analyst's price target of $36.6 is 22.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives