Narratives are currently in beta

Key Takeaways

- Strong advertising growth in e-commerce and travel, plus AI innovations, position Opera for significant future revenue and earnings growth.

- Focus on high-value users and strategic partnerships boosts ARPU and engagement, particularly within Western markets and gaming, potentially enhancing margins.

- High marketing costs and focus on high-value Western users could squeeze margins, while AI investments may pressure earnings without immediate returns.

Catalysts

About Opera- Provides mobile and PC web browsers and related products and services in Norway and internationally.

- Opera is experiencing robust growth in its advertising revenue, particularly in the e-commerce and travel sectors, driven by performance-based offerings. This aids in expanding monetization efforts, which could significantly enhance future revenue.

- The company is heavily investing in AI integration within its product line-up, such as the Opera One browser. The integration of AI features aims to boost user engagement and provide innovative solutions, potentially impacting future revenue and earnings growth.

- Opera is focusing on high-value users, particularly in Western markets, leading to growth in average revenue per user (ARPU). This strategic focus is expected to positively impact net margins by driving higher monetization from a quality user base.

- The expansion of the Opera GX browser and strategic partnerships, such as with League of Legends, are expected to increase engagement and open opportunities for revenue growth, especially within the gaming sector, which has promising long-term potential.

- Opera's focus on maintaining strong cash flows and a strategy of cautious guidance aligning with dynamic growth opportunities suggests an environment supportive of sustained EBITDA margin improvements, offering potential for increased future earnings.

Opera Future Earnings and Revenue Growth

Assumptions

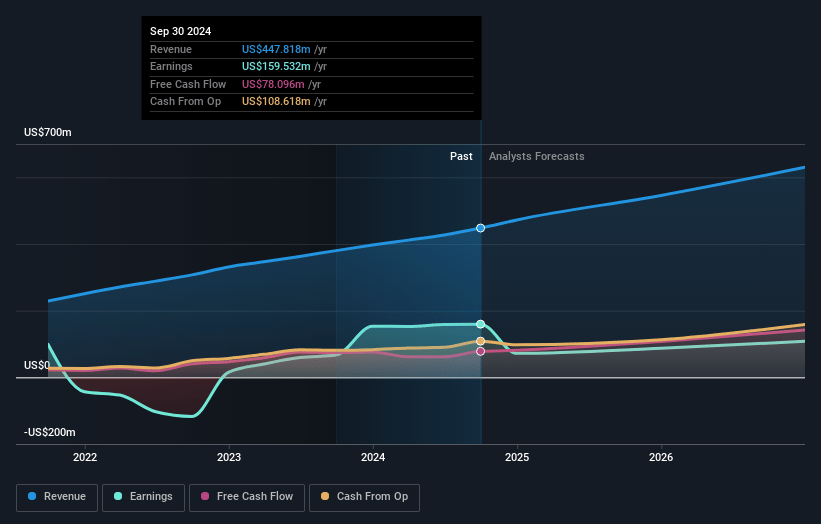

How have these above catalysts been quantified?- Analysts are assuming Opera's revenue will grow by 16.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 35.6% today to 17.8% in 3 years time.

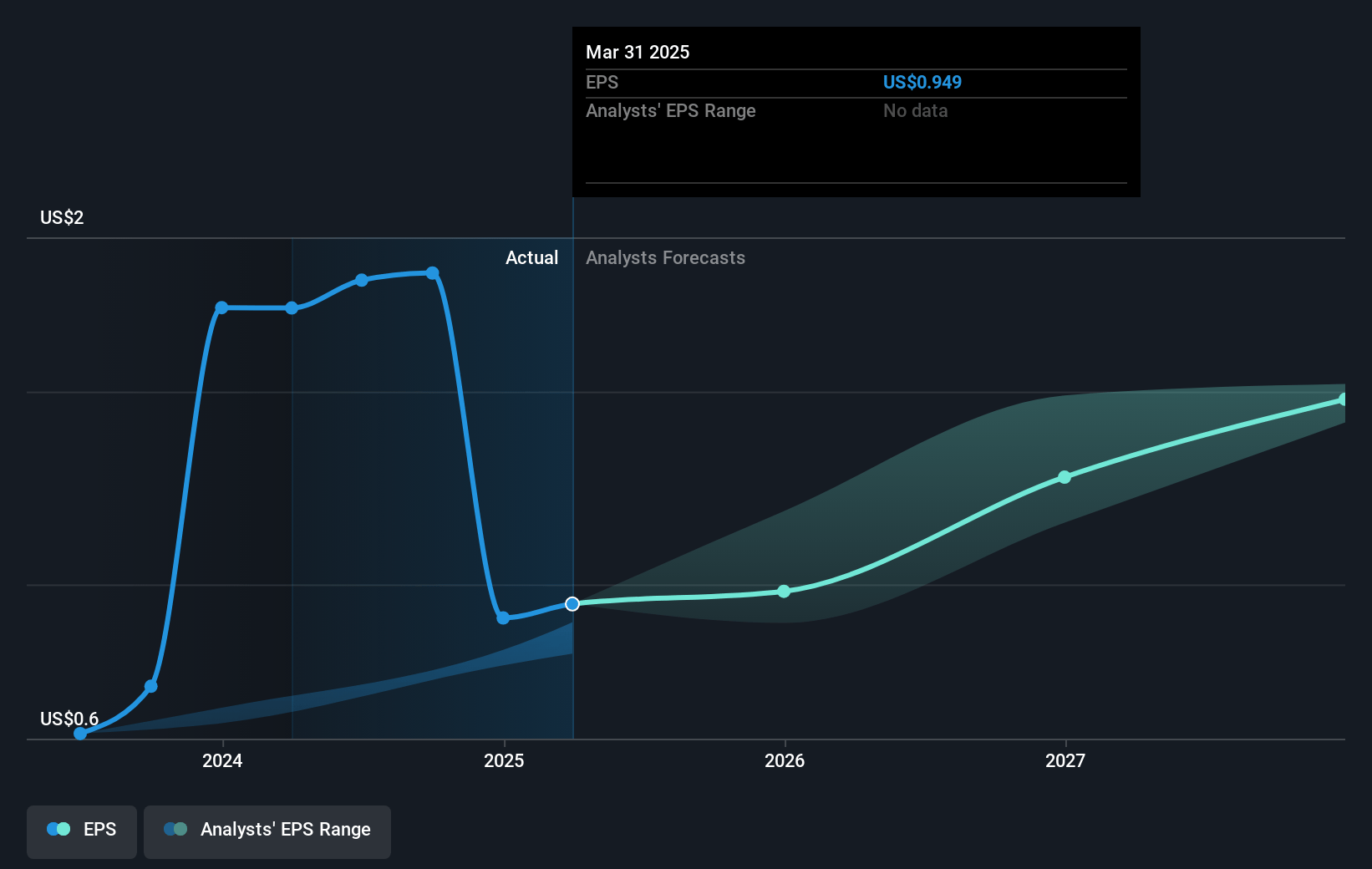

- Analysts expect earnings to reach $125.1 million (and earnings per share of $1.44) by about November 2027, down from $159.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.3x on those 2027 earnings, up from 10.9x today. This future PE is lower than the current PE for the US Software industry at 41.0x.

- Analysts expect the number of shares outstanding to decline by 0.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.9%, as per the Simply Wall St company report.

Opera Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The e-commerce revenue growth, while strong, is based almost entirely on performance, which might make it more volatile and challenging to sustain over time, potentially impacting future revenues.

- Opera's increasing focus on high-value users in Western markets, accompanied by rising marketing costs, suggests that retaining user engagement will be costly, potentially squeezing net margins as marketing budgets grow.

- The AI and browser feature enhancements may not produce immediate financial returns, and the extensive development and marketing investments involved could exert pressure on operating expenses and net earnings.

- There is a reliance on the growth of high-value user segments and the premium nature of their engagement, which could limit user base expansion and make revenue streams riskier if user trends shift.

- The uncertain valuation and divestment timeline of Opera's OPay stake, which is quite significant, pose a risk to financial stability and market perceptions about the company's financial health.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $24.17 for Opera based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $28.0, and the most bearish reporting a price target of just $23.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $700.9 million, earnings will come to $125.1 million, and it would be trading on a PE ratio of 20.3x, assuming you use a discount rate of 6.9%.

- Given the current share price of $19.73, the analyst's price target of $24.17 is 18.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives