Key Takeaways

- Emphasis on sustainability and operational efficiency could enhance margins through emission cuts and cost savings.

- Cloud-based software transition stabilizes revenue with a focus on recurring income, boosting earnings predictability.

- Materialise faces revenue and margin pressures due to uncertain markets, declining profitability, foreign exchange impacts, and rising R&D expenses without immediate returns.

Catalysts

About Materialise- Provides additive manufacturing and medical software tools, and 3D printing services in the Americas, Europe and Africa, and the Asia-Pacific.

- There is a significant focus on sustainability, with Materialise aiming to cut emissions by 55% by 2029. Improved operational efficiency, such as a reduction in CO2 emissions already achieved, can lead to cost savings and potentially improve net margins.

- The medical segment has been experiencing strong growth, notably in personalized medical solutions, which grew by 19%. Increasing revenue from high-growth areas such as orthopedics and other personalized healthcare solutions can positively impact overall revenue.

- Materialise's software transition towards cloud-based and subscription models has led to more than 80% of software revenue becoming recurring. This transformation is expected to stabilize revenue and potentially enhance earnings predictability over the long term.

- Innovations in software like Mimics Flow and improvements in manufacturing software (e.g., the release of Magics and new build processors) are intended to reduce costs and improve the adoption of 3D printing technology. These advancements may lead to increased sales and revenue growth.

- The expansion into the defense sector and strengthening the aerospace segment, with sales already up 23%, could open up new revenue streams, enhancing overall revenue and potentially boosting future earnings.

Materialise Future Earnings and Revenue Growth

Assumptions

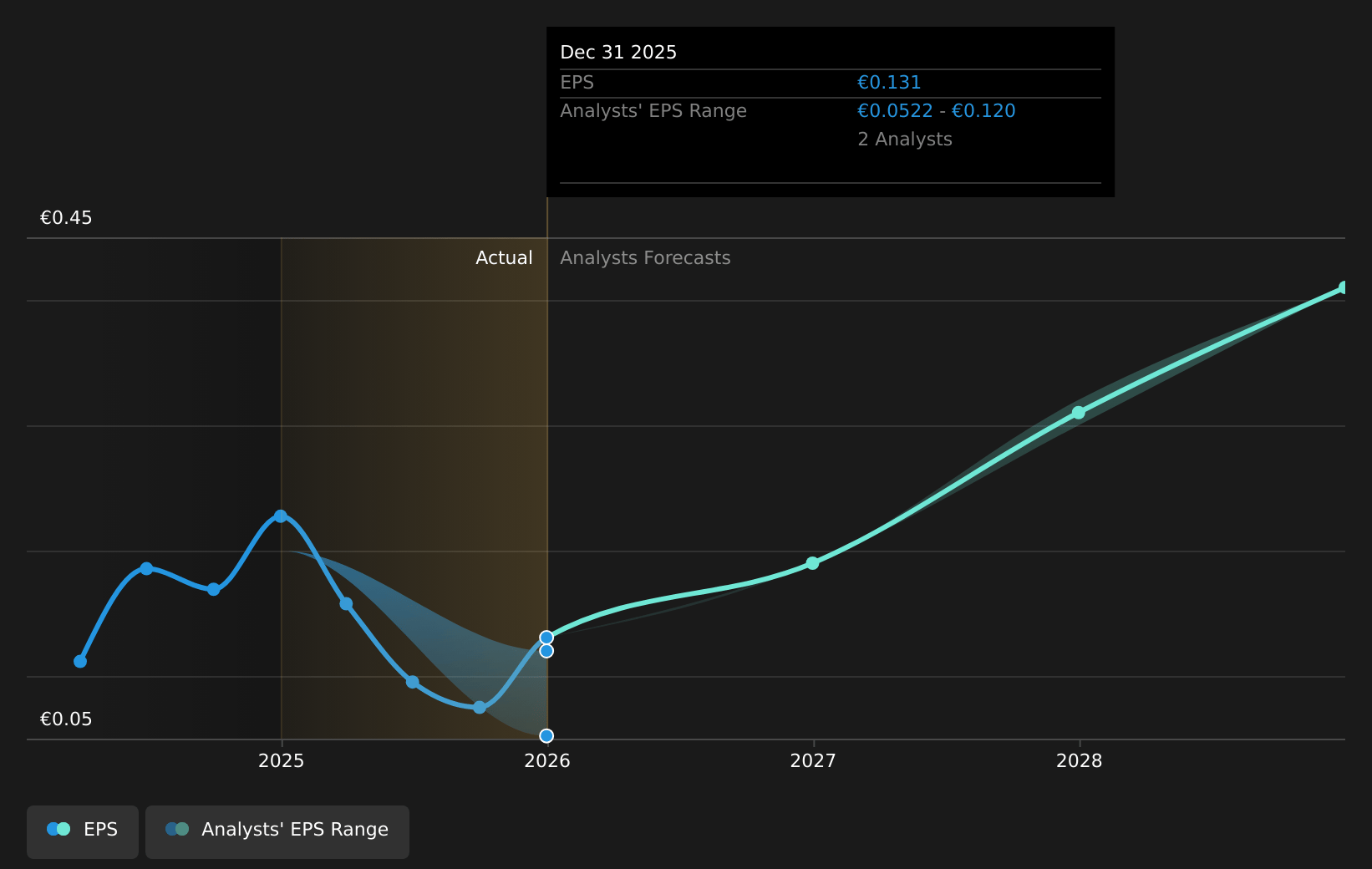

How have these above catalysts been quantified?- Analysts are assuming Materialise's revenue will grow by 6.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.5% today to 5.7% in 3 years time.

- Analysts expect earnings to reach €18.5 million (and earnings per share of €0.35) by about May 2028, up from €9.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.9x on those 2028 earnings, up from 29.0x today. This future PE is greater than the current PE for the US Software industry at 31.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.96%, as per the Simply Wall St company report.

Materialise Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Materialise's manufacturing segment experienced a decrease in revenue by 5.5% in the first quarter of 2025, highlighting challenges in the investment climate due to macroeconomic uncertainty, which could continue to affect revenue.

- The decrease in EBIT from €2.7 million in the first quarter of 2024 to €0.6 million in the first quarter of 2025, representing a significant drop in margins, indicates pressure on profitability and could impact net margins.

- The company reported a net loss of €0.5 million for the quarter compared to a net profit of €3.6 million in the corresponding period last year, reflecting negative impacts on earnings due to unfavorable foreign exchange fluctuations.

- Challenges in the Software and Manufacturing segments, both reporting around a 6% revenue decrease amidst uncertain market conditions, could negatively affect revenue growth and stability.

- Increased operating expenses, especially in R&D by almost 12% amidst decreasing margins, may pressure earnings unless these investments lead to significant future revenue gains.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $9.111 for Materialise based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €327.5 million, earnings will come to €18.5 million, and it would be trading on a PE ratio of 32.9x, assuming you use a discount rate of 9.0%.

- Given the current share price of $5.21, the analyst price target of $9.11 is 42.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.