Narratives are currently in beta

Key Takeaways

- Expansion into GenAI consulting and acquisition efforts are creating new high-margin, IP-rich revenue streams, likely bolstering future profitability and revenue growth.

- Strategic emphasis on recurring revenue from GenAI and IP services enhances revenue predictability, stability, and prospects for long-term earnings growth.

- Economic uncertainties and increased expenses may compress margins and slow growth, while financial flexibility is impacted by reduced cash from acquisitions and debt payments.

Catalysts

About Hackett Group- Operates as an intellectual property-based executive advisory, strategic consulting, and digital transformation company in the United States, Europe, and internationally.

- The company's expansion into GenAI consulting, particularly through its AI XPLR and the acquisition of LeewayHertz, is creating significant new revenue streams. This is expected to impact their future revenue growth positively as AI adoption increases.

- The integration of GenAI capabilities into Hackett's existing offerings is expected to improve net margins. As these services are high-margin and IP-rich, they could lead to better profitability.

- The establishment of a joint venture focusing on GenAI technology suggests potential annual recurring revenue growth. This could create higher earnings stability and improved earnings prospects over time.

- Expanding sales forces in their Oracle and SAP segments, boosted by new high-value reseller transactions, is expected to drive revenue growth and potentially improve net margins due to increased scale efficiencies.

- The company's strategic focus on recurring revenue from IP-based services, supplemented by GenAI content, is set to enhance its revenue predictability. This approach enables Hackett Group to potentially improve both revenue stability and long-term earnings growth.

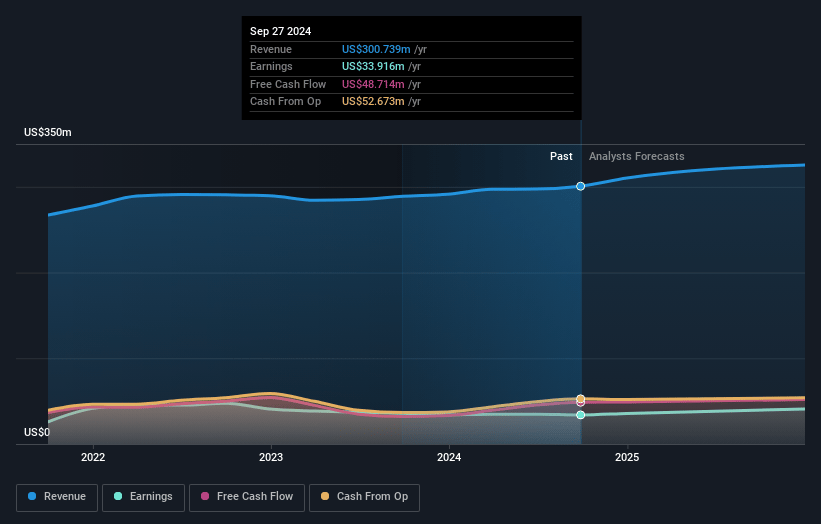

Hackett Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hackett Group's revenue will grow by 6.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.3% today to 14.4% in 3 years time.

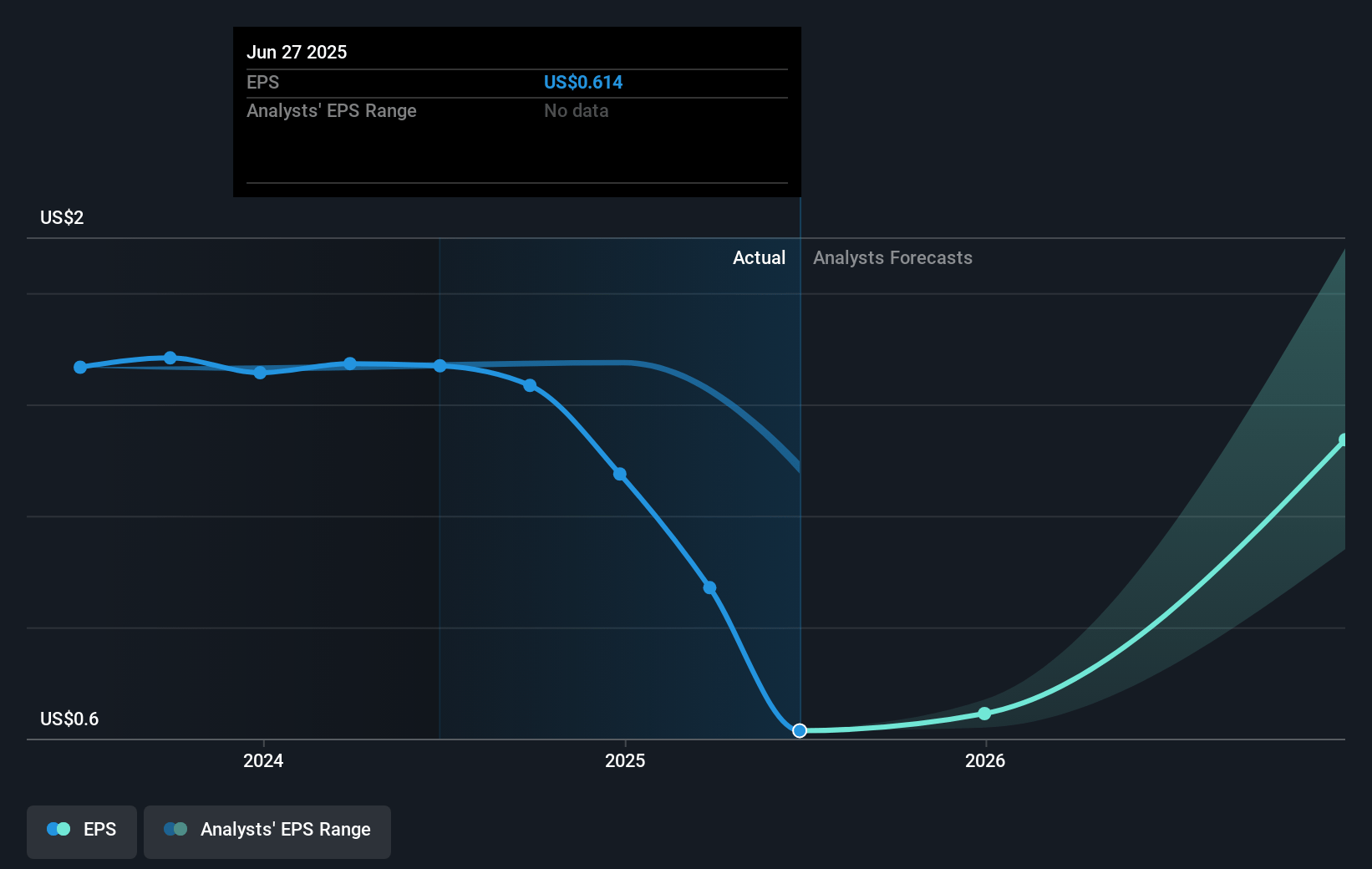

- Analysts expect earnings to reach $51.9 million (and earnings per share of $1.77) by about November 2027, up from $33.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.7x on those 2027 earnings, down from 24.7x today. This future PE is lower than the current PE for the US IT industry at 44.8x.

- Analysts expect the number of shares outstanding to grow by 2.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.33%, as per the Simply Wall St company report.

Hackett Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The flat growth in the GSBT segment, despite the emergence of GenAI revenues, was attributed to weakness in the eProcurement group, which could continue to affect revenues.

- There is an acknowledged increase in adjusted SG&A expenses due to foreign exchange fluctuations and commissions, which may compress net margins.

- The company's cash balance decreased significantly due to acquisition and debt-related payments, which could affect financial flexibility and future earnings.

- The DSO remained at 70 days; prolonged collection times could negatively impact cash flow and affect earnings.

- Potential economic concerns could lead to cautious client decision-making regarding digital transformation, which may moderate revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $30.0 for Hackett Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $360.9 million, earnings will come to $51.9 million, and it would be trading on a PE ratio of 20.7x, assuming you use a discount rate of 7.3%.

- Given the current share price of $30.39, the analyst's price target of $30.0 is 1.3% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives