Key Takeaways

- AI-powered innovation and unified technology integration are driving higher customer retention, premium offerings, and improved operational efficiency for scalable, profitable growth.

- Expanding into financial wellness and identity markets enhances diversification, deepens recurring revenue streams, and supports accelerated growth beyond traditional cybersecurity offerings.

- Embedded operating system security, consumer skepticism, high churn, competition, and over-reliance on subscriptions threaten Gen Digital’s revenue growth, margins, and long-term stability.

Catalysts

About Gen Digital- Engages in the provision of cyber safety solutions for consumers in the United States, Canada, Latin America, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

- Sustained expansion of Gen Digital’s addressable market is being driven by rising digitization, global internet connectivity, and increasing frequency and sophistication of cyber threats, which is fueling secular tailwinds for demand. With a growing direct customer base (now at 40 million and growing over 1 million year-over-year), the company is positioned for ongoing multi-year revenue growth.

- The transition to AI-driven scam and threat detection, exemplified by the deployment of Norton Genie and integration of advanced machine learning models, is enabling Gen Digital to introduce differentiated, premium offerings within its security and identity platform. This innovation is increasing average revenue per user and customer retention, as evidenced by ARPU and industry-leading retention rate improvements, thereby supporting both top line and operating margin expansion.

- The rapid adoption of “all-in-one” membership models (such as Norton 360 with LifeLock and UltraVPN bundles) and a growing focus on cross-sell and upsell campaigns across the large installed customer base are increasing subscription values and customer lifetime value. This flywheel, combined with healthy international and mobile customer acquisition, is expected to drive higher net margins over time.

- The company’s next-generation unified technology stack, developed after the Avast acquisition, is generating operational efficiencies, allowing for hyperpersonalization, expanded feature deployment, and cost synergies across platforms. These tech-driven improvements are expected to result in scalable earnings growth and improved profitability as investments in innovation and customer engagement translate into higher retention and lower incremental cost.

- The expansion into the fast-growing financial wellness and identity market, accelerated by the pending MoneyLion acquisition, will not only double the addressable market size to over $50 billion, but also diversify the customer base, embed additional high-margin financial services, and reinforce predictable, recurring subscription revenue streams—collectively expected to accelerate revenue and earnings growth well beyond the core cybersecurity business.

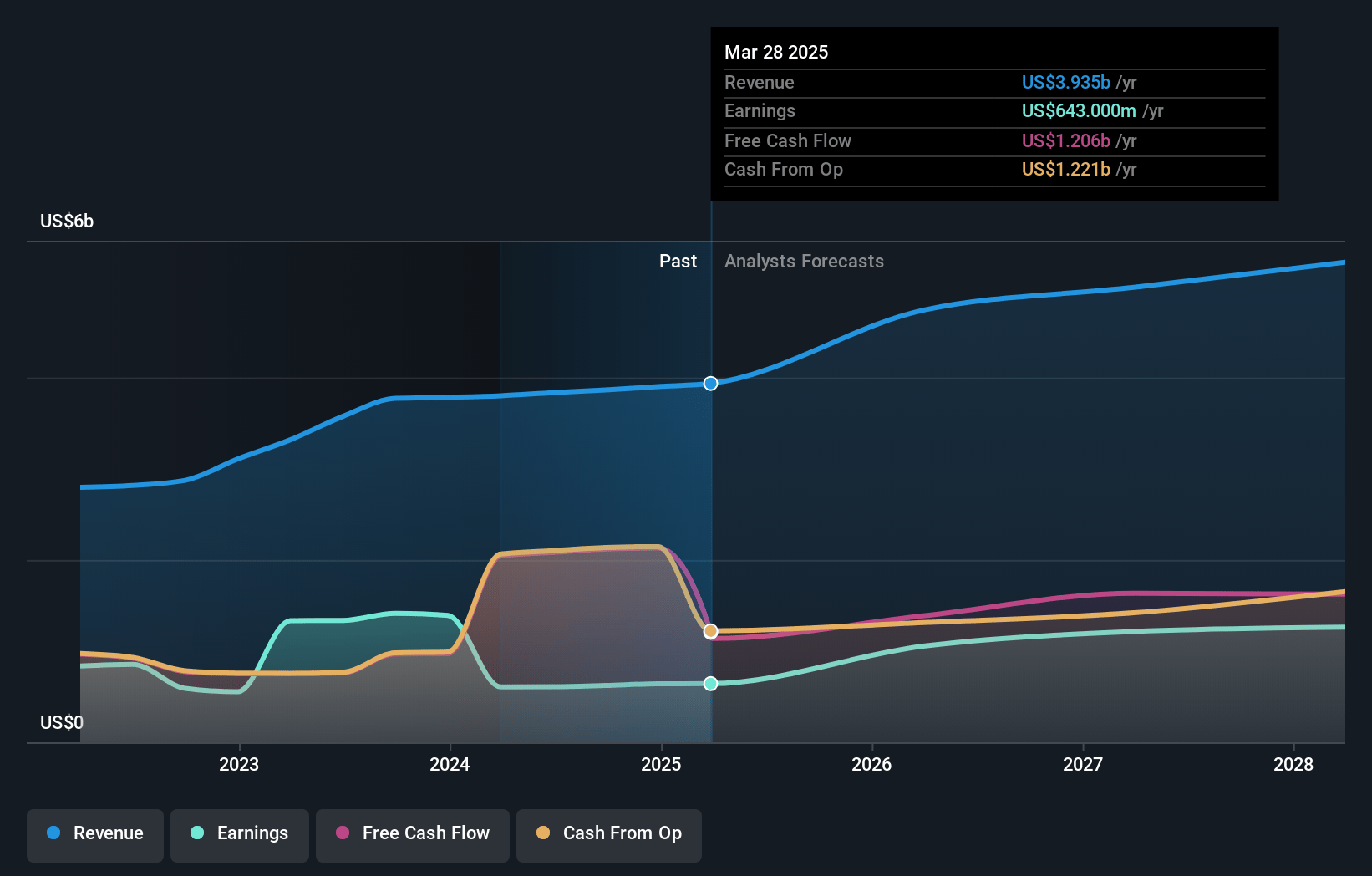

Gen Digital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Gen Digital compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Gen Digital's revenue will grow by 2.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.4% today to 28.6% in 3 years time.

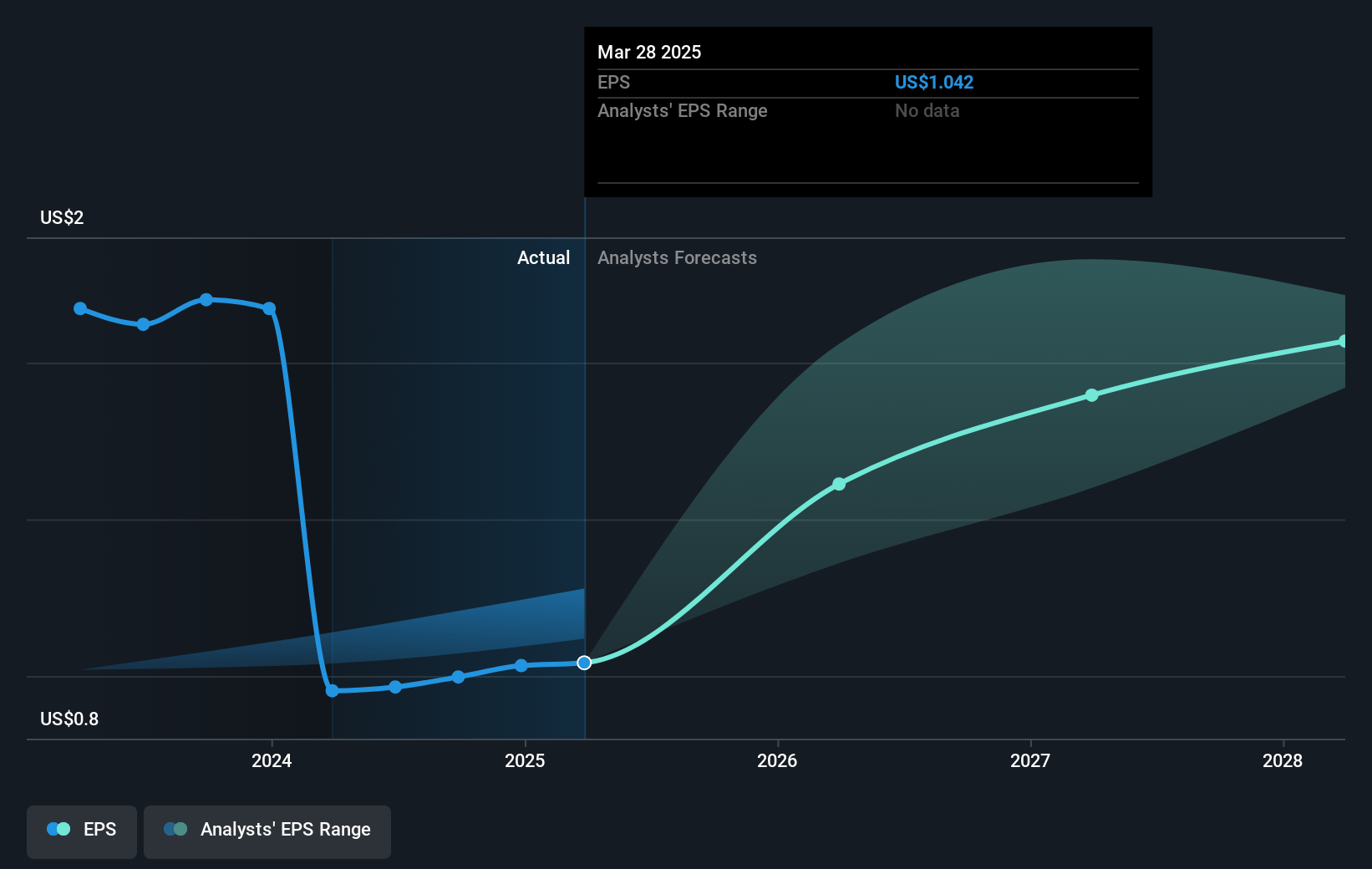

- The bullish analysts expect earnings to reach $1.2 billion (and earnings per share of $1.94) by about April 2028, up from $641.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 23.2x on those 2028 earnings, down from 23.4x today. This future PE is lower than the current PE for the US Software industry at 29.9x.

- Analysts expect the number of shares outstanding to decline by 1.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.08%, as per the Simply Wall St company report.

Gen Digital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increasing prevalence of security features embedded directly by major operating system vendors like Apple, Google, and Microsoft may erode long-term consumer demand for Gen Digital’s third-party cybersecurity products, putting its core consumer subscription revenues at risk and ultimately weighing on revenue growth.

- Waning consumer trust and skepticism around the effectiveness of digital security solutions, combined with cyber fatigue, could dampen customer adoption rates for Gen Digital's offerings, reducing the company's addressable market and constraining future revenue and earnings growth.

- High customer churn rates and relatively modest brand loyalty in consumer cybersecurity leave Gen Digital vulnerable to elevated customer acquisition costs and less predictable recurring revenue, which could flatten or compress net margins and earnings over the long term.

- Intensifying competitive pressures from both established cybersecurity vendors and innovative AI-driven startups may necessitate increased marketing and R&D spending, squeezing Gen Digital’s net margins and increasing the likelihood of slower earnings growth if market share slips or price competition intensifies.

- Dependence on subscription-based consumer revenue streams leaves Gen Digital especially exposed to economic downturns and rising price sensitivity among consumers, threatening top-line revenue and compressing earnings during periods of weaker demand.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Gen Digital is $37.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Gen Digital's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $37.0, and the most bearish reporting a price target of just $25.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.2 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 23.2x, assuming you use a discount rate of 9.1%.

- Given the current share price of $24.3, the bullish analyst price target of $37.0 is 34.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:GEN. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.