Narratives are currently in beta

Key Takeaways

- Expansion and acquisitions, while opening new opportunities, may increase operational costs and compress net margins, impacting short-term earnings.

- Increased competition and end-of-life product cycles pose risks to revenue growth, necessitating competitive pricing and timely product refreshes.

- Fortinet's robust profitability, diversified growth strategy, and strategic investments position it for sustained revenue expansion and increased market share in emerging technologies.

Catalysts

About Fortinet- Provides cybersecurity and convergence of networking and security solutions worldwide.

- Fortinet's investment in expanding its global infrastructure, including 3 million square feet of facilities, could lead to increased operational costs, potentially impacting net margins despite potential long-term benefits.

- The company's focus on accelerating growth in security operations and Unified SASE with significant expansion efforts may require increased R&D and marketing expenses, which could compress net margins and affect short-term earnings.

- Fortinet's acquisition of Lacework and Next DLP, while opening up a new $20 billion market opportunity, is likely to impact current margins due to integration costs and potential inefficiencies, affecting earnings and net margins.

- The anticipated increase in competition within the SASE and secure networking sectors may pressure Fortinet to maintain competitive pricing and enhance customer incentives, potentially impacting revenue growth and net margins.

- The expected end-of-life cycle for a significant number of FortiGate firewalls by 2026 suggests forthcoming refresh needs that may not materialize on expected timelines, posing a risk to forward revenue projections and increasing uncertainty in the billings forecast.

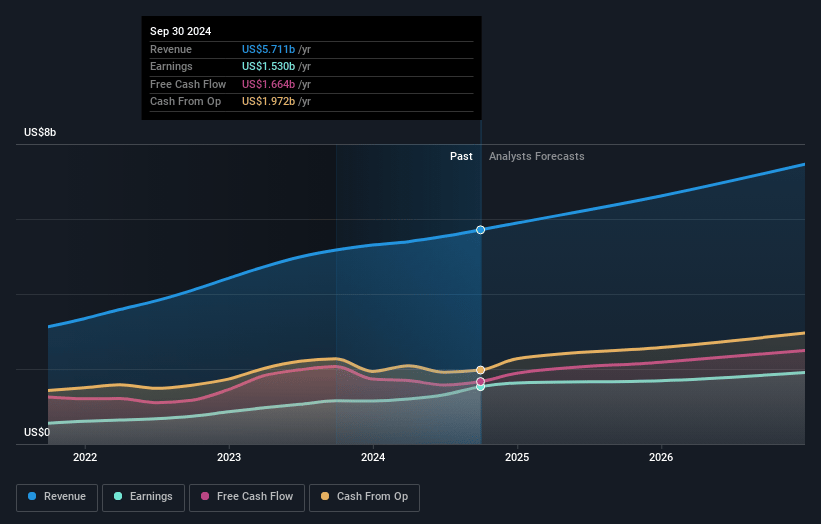

Fortinet Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Fortinet's revenue will grow by 14.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 26.8% today to 26.4% in 3 years time.

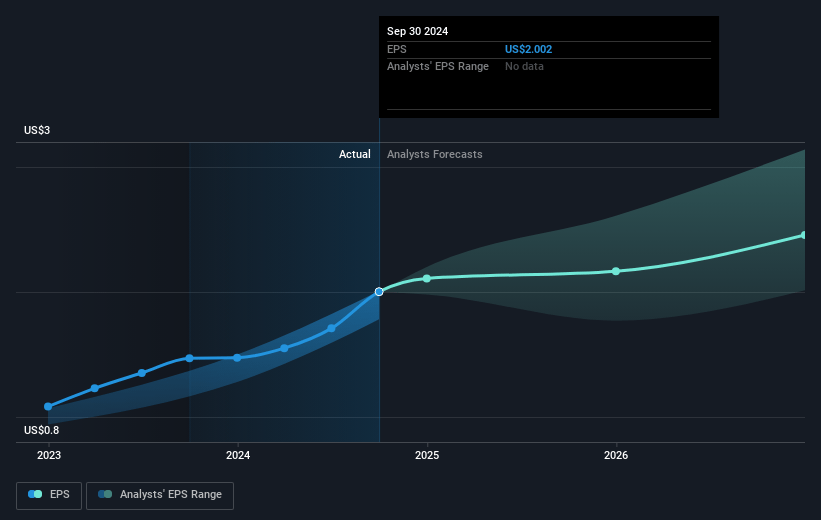

- Analysts expect earnings to reach $2.2 billion (and earnings per share of $2.7) by about November 2027, up from $1.5 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $1.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.5x on those 2027 earnings, down from 49.7x today. This future PE is lower than the current PE for the US Software industry at 41.2x.

- Analysts expect the number of shares outstanding to grow by 2.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.89%, as per the Simply Wall St company report.

Fortinet Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Fortinet reported a robust quarter with record gross margins at 83.2% and operating margins of 36.1%, which suggests potential for sustaining profitability and boosting earnings.

- The company highlighted a multi-layered growth strategy, including a 13% increase in total revenue driven by strong services revenue and a resurgence in product revenues. This indicates stability and potential for revenue growth.

- Fortinet demonstrated a consistent growth trajectory in emerging technological areas like Unified SASE and Security Operations, with growth rates of 14% and 32%, respectively. This diversification may amplify the company's revenue streams and market position.

- Fortinet's strategic investment in innovation and infrastructure, with over 3 million square feet for data centers and offices, presents a long-term cost advantage and potential margin improvement, impacting net margins positively.

- Fortinet's competitive edge, notably as a leader in the Gartner Magic Quadrant for SD-WAN and leveraging its existing large installed base, underscores its potential for capturing additional market share, thereby contributing to ongoing revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $87.24 for Fortinet based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $111.0, and the most bearish reporting a price target of just $62.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $8.5 billion, earnings will come to $2.2 billion, and it would be trading on a PE ratio of 39.5x, assuming you use a discount rate of 6.9%.

- Given the current share price of $99.15, the analyst's price target of $87.24 is 13.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives