Key Takeaways

- Strong sales in cloud services and AI initiatives are driving revenue growth, while operational improvements enhance profitability and net margins.

- Geographic diversification and high managed services renewal rates ensure stable revenue, reducing dependency on top customers.

- Amdocs faces potential revenue challenges from foreign currency impacts, phased-out businesses, European project timing, and reliance on cloud transformation projects.

Catalysts

About Amdocs- Through its subsidiaries, provides software and services to communications, entertainment, and media service providers worldwide.

- Amdocs is experiencing strong sales momentum in cloud services, with double-digit growth expected to continue, driven by ongoing digital transformation and multiyear cloud migration projects with large telecom providers. This is likely to positively impact future revenue growth.

- The phaseout of low-margin, non-core business activities has contributed to a significant improvement in operating margins, with further gains expected from ongoing operational excellence and automation initiatives. This should enhance net margins and improve overall profitability.

- Amdocs is leveraging its leadership in AI and data services to drive new growth opportunities. The acquisition of Profinit is set to strengthen its AI capabilities, potentially boosting both revenue and earnings as AI adoption grows in the telecom sector.

- The company's managed services agreements, which boast a nearly 100% renewal rate and high business visibility, contribute to a stable and recurring revenue stream. This stability supports ongoing revenue growth and earnings visibility.

- A concerted effort to diversify geographically and expand relationships beyond its top two customers, such as significant new engagements in Canada and Japan, positions Amdocs for broader revenue growth and decreased dependency on its largest customers.

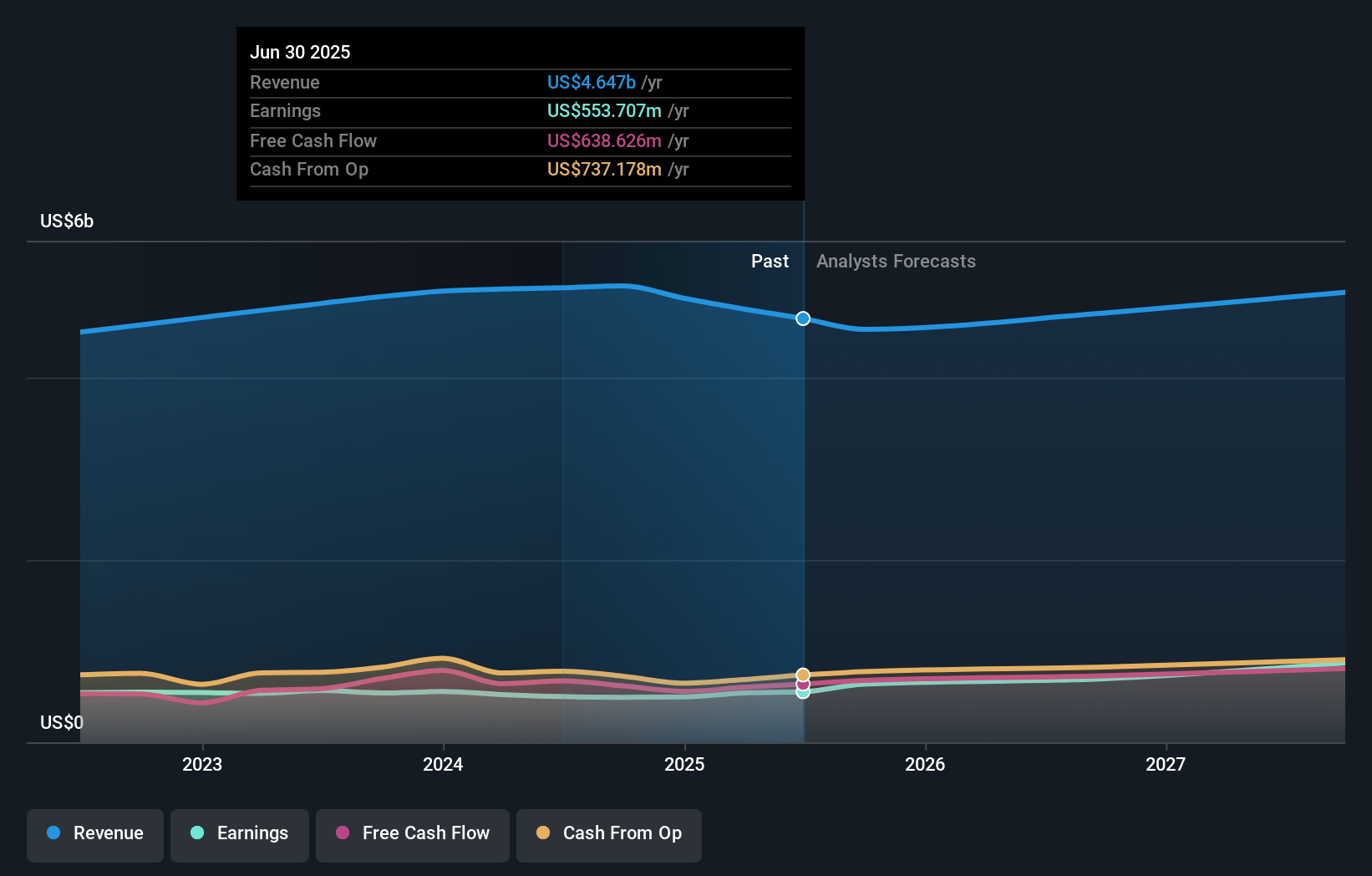

Amdocs Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Amdocs's revenue will grow by 1.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.2% today to 14.8% in 3 years time.

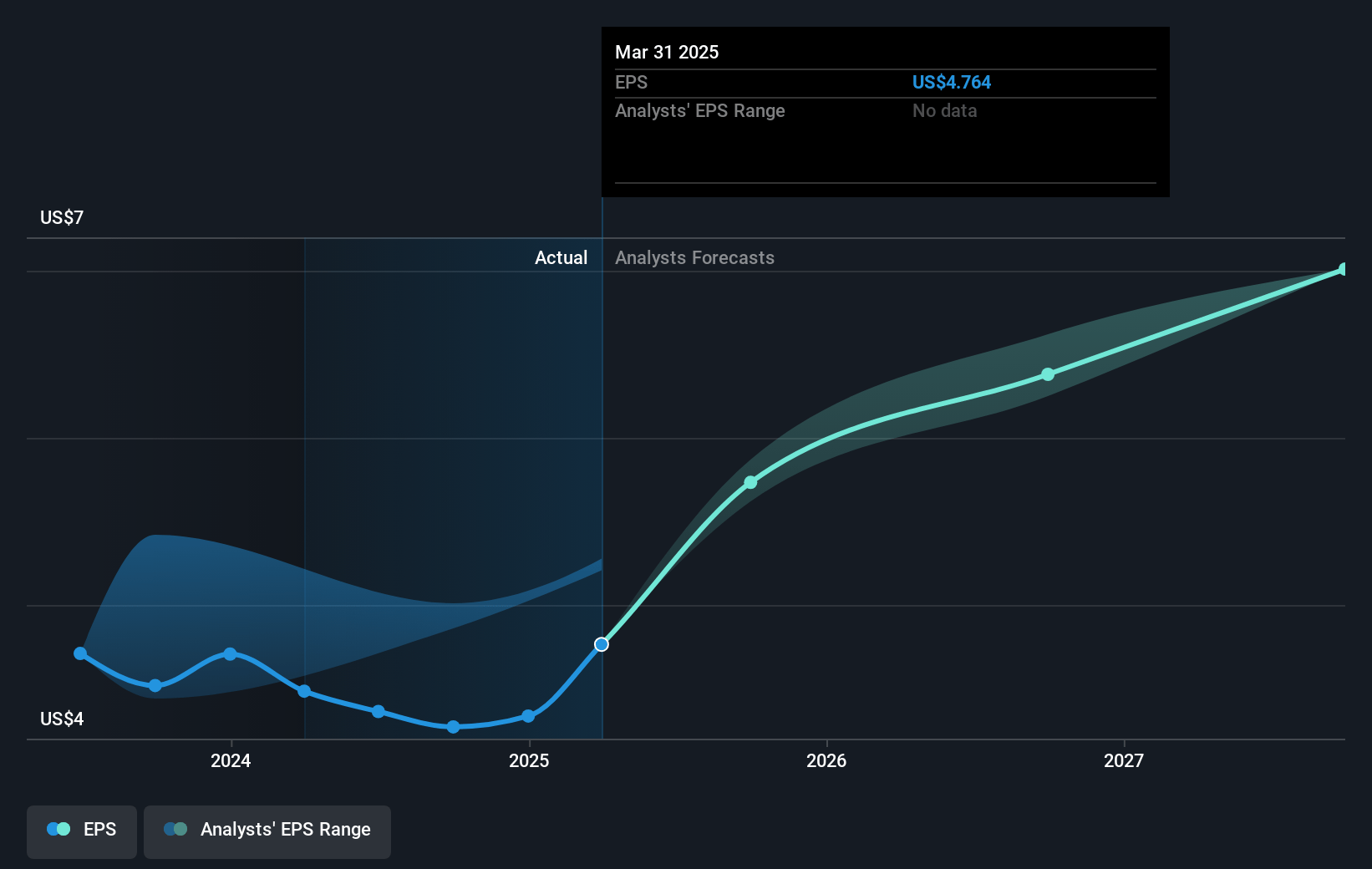

- Analysts expect earnings to reach $753.4 million (and earnings per share of $5.94) by about March 2028, up from $496.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.3x on those 2028 earnings, down from 20.2x today. This future PE is lower than the current PE for the US IT industry at 43.2x.

- Analysts expect the number of shares outstanding to decline by 3.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.91%, as per the Simply Wall St company report.

Amdocs Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Negative foreign currency movements were greater than anticipated, which could impact future reported revenues and profits if these currency trends continue.

- The phaseout of approximately $600 million in low-margin, non-core business activities from fiscal year 2024 presents a risk to total revenue levels and growth trajectory moving forward.

- European revenue weakness due to timing differences between project roll-offs and new deal ramp-ups could signal potential uncertainties in revenue realization in the region.

- A dependence on cloud and digital transformation projects for growth indicates execution risk. If these projects face delays or cancellations, it could significantly impact revenue growth targets.

- Despite a strong backlog, the minimal net revenue growth of 1.7% in Q1 (pro forma and constant currency) suggests that converting the backlog into realized revenues efficiently might be challenging, potentially impacting overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $102.92 for Amdocs based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.1 billion, earnings will come to $753.4 million, and it would be trading on a PE ratio of 17.3x, assuming you use a discount rate of 7.9%.

- Given the current share price of $89.28, the analyst price target of $102.92 is 13.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.