Narratives are currently in beta

Key Takeaways

- Expansion into next-gen AI and increased customer product adoption support potential revenue growth through cross-selling and upselling.

- Strategic investments in sales and R&D for digital transformation and cloud migration could enhance demand for observability and security solutions.

- Revenue volatility and concentration risks emerge from dependency on AI-native customers, with new products and market expansion facing execution and margin pressures.

Catalysts

About Datadog- Operates an observability and security platform for cloud applications in North America and internationally.

- Datadog is expanding its platform capabilities, particularly in next-gen AI, which is gaining increased customer interest and starting to move into production. This expansion may drive future revenue growth as clients adopt and rely on these new AI observability products.

- The adoption of multiple Datadog products by customers is increasing, with a significant portion using 4 or more products. This broader product usage among clients is likely to enhance revenue through cross-selling and upselling opportunities.

- Datadog OnCall has shown strong market reception even in its limited availability, creating future potential for revenue growth as the product fully launches and integrates more deeply into customer operations, potentially improving net margins through higher-value service offerings.

- The move to digital transformation and cloud migration remains ongoing. With the company’s strategic investments in sales capacity and R&D, such environmental shifts could lead to increased demand for Datadog’s observability and security solutions, bolstering revenue and earnings.

- The adoption of AI will continue to benefit Datadog long-term. As AI native customers optimize their cloud and observability usage, there will be opportunities to enhance customer retention and potentially increase commitments, affecting both revenue and net margins positively over time.

Datadog Future Earnings and Revenue Growth

Assumptions

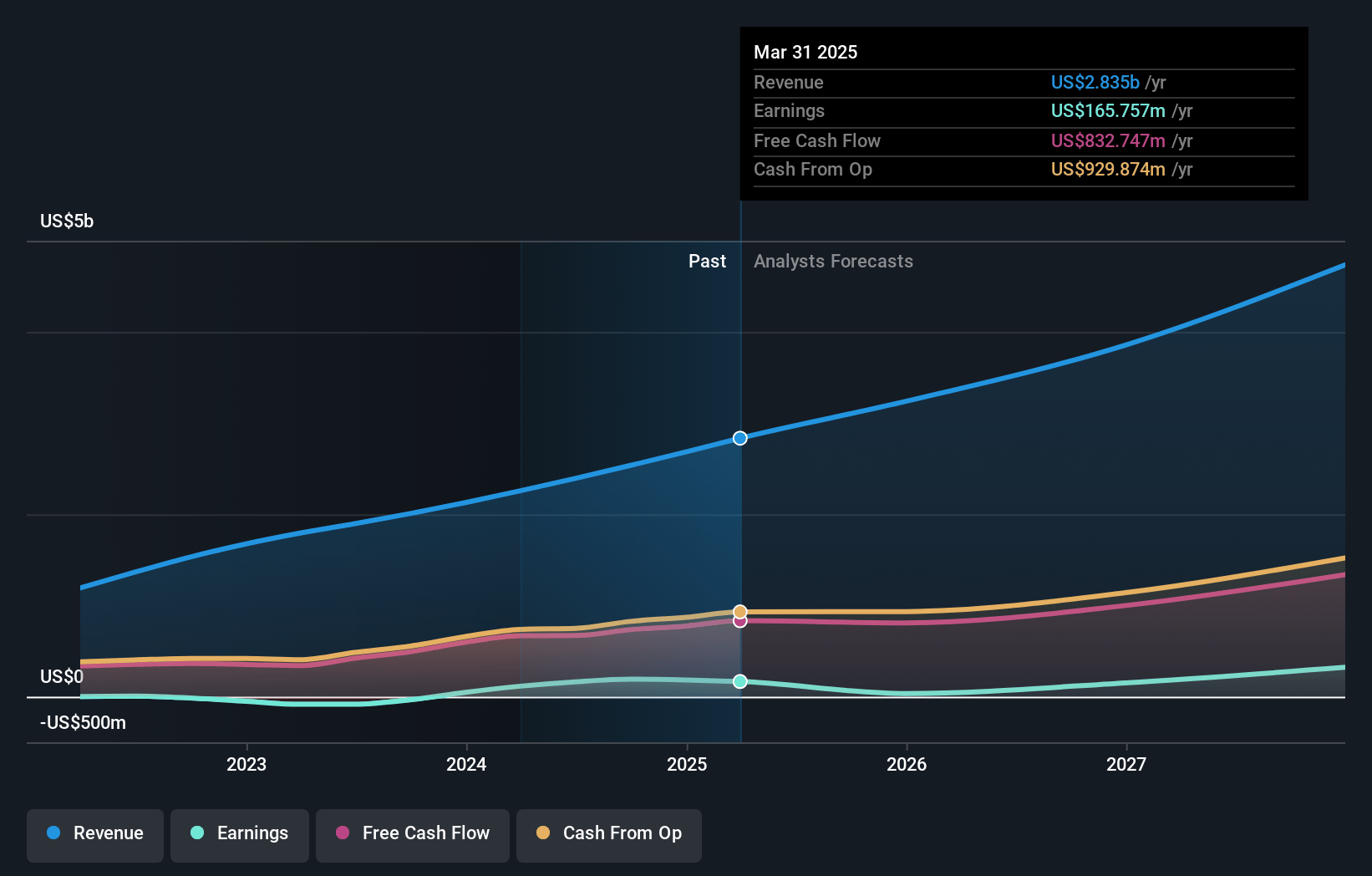

How have these above catalysts been quantified?- Analysts are assuming Datadog's revenue will grow by 22.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.6% today to 12.0% in 3 years time.

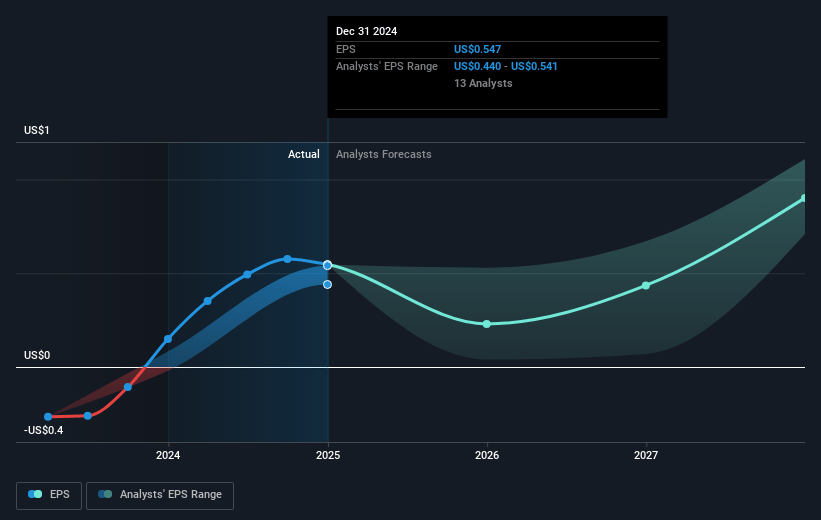

- Analysts expect earnings to reach $564.9 million (and earnings per share of $1.51) by about November 2027, up from $192.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 122.7x on those 2027 earnings, down from 235.9x today. This future PE is greater than the current PE for the US Software industry at 41.0x.

- Analysts expect the number of shares outstanding to grow by 3.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.93%, as per the Simply Wall St company report.

Datadog Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces potential revenue volatility from AI-native customers who have rapidly increased their usage and may optimize cloud and observability usage over time, potentially renegotiating for better terms, impacting revenue predictability.

- Gross margins could be pressured by the introduction of new products that may initially have higher costs or lower margins until they become more established and optimized, affecting net margins in the short term.

- Revenue concentrations in a small cohort of large AI-native customers increase risk, as any reduction in usage or change in contract terms from these customers could significantly impact overall revenue growth.

- While there is a positive trend in expanding markets like India and within federal agencies, there is execution risk in adequately growing and penetrating these markets, which could affect expected revenue growth.

- Usage growth trends, while currently stable, are subject to broader macroeconomic conditions and customer budget priorities, which could impact future revenue projections if cloud or digital transformation spending slows.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $151.9 for Datadog based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $230.0, and the most bearish reporting a price target of just $128.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $4.7 billion, earnings will come to $564.9 million, and it would be trading on a PE ratio of 122.7x, assuming you use a discount rate of 6.9%.

- Given the current share price of $133.41, the analyst's price target of $151.9 is 12.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives