Key Takeaways

- Strategic expansions and acquisitions in data centers and new sites set the stage for long-term revenue growth and operational enhancement.

- Shifting focus from bitcoin mining to HPC data centers diversifies revenue streams and strengthens future growth potential.

- The company's financial health is vulnerable to bitcoin price volatility, data center tenant delays, and expiring low electricity cost agreements.

Catalysts

About Cipher Mining- Develops and operates industrial-scale data centers in the United States.

- Cipher Mining plans to significantly increase its self-mining hash rate from 13.5 exahashes per second to at least 23 exahashes per second by the third quarter of 2025. This acceleration could have a positive impact on revenue as the company enhances its bitcoin production capabilities.

- The completion of Phase 1 of the Black Pearl data center in 2025 will expand Cipher’s operating capacity by 300 megawatts, contributing to an improved fleet-wide efficiency and offering potential for revenue and earnings growth.

- Cipher Mining's transition from solely bitcoin mining to developing high-performance computing (HPC) data centers presents an opportunity for diversified revenue streams. The 800-megawatt potential capacity expansion at Barber Lake, for example, signals a significant future growth catalyst in expanding their operations.

- The company's strategic acquisition of new land and development sites, such as 337 acres adjacent to the current Barber Lake site and the Stingray site in West Texas, positions it well for long-term revenue growth in the years 2026 and 2027 as these sites are energized.

- Potential collaboration with major investors like SoftBank and plans to secure credit lines for HPC development could offer financial leverage and reduce funding costs, which may positively impact net margins and overall profitability.

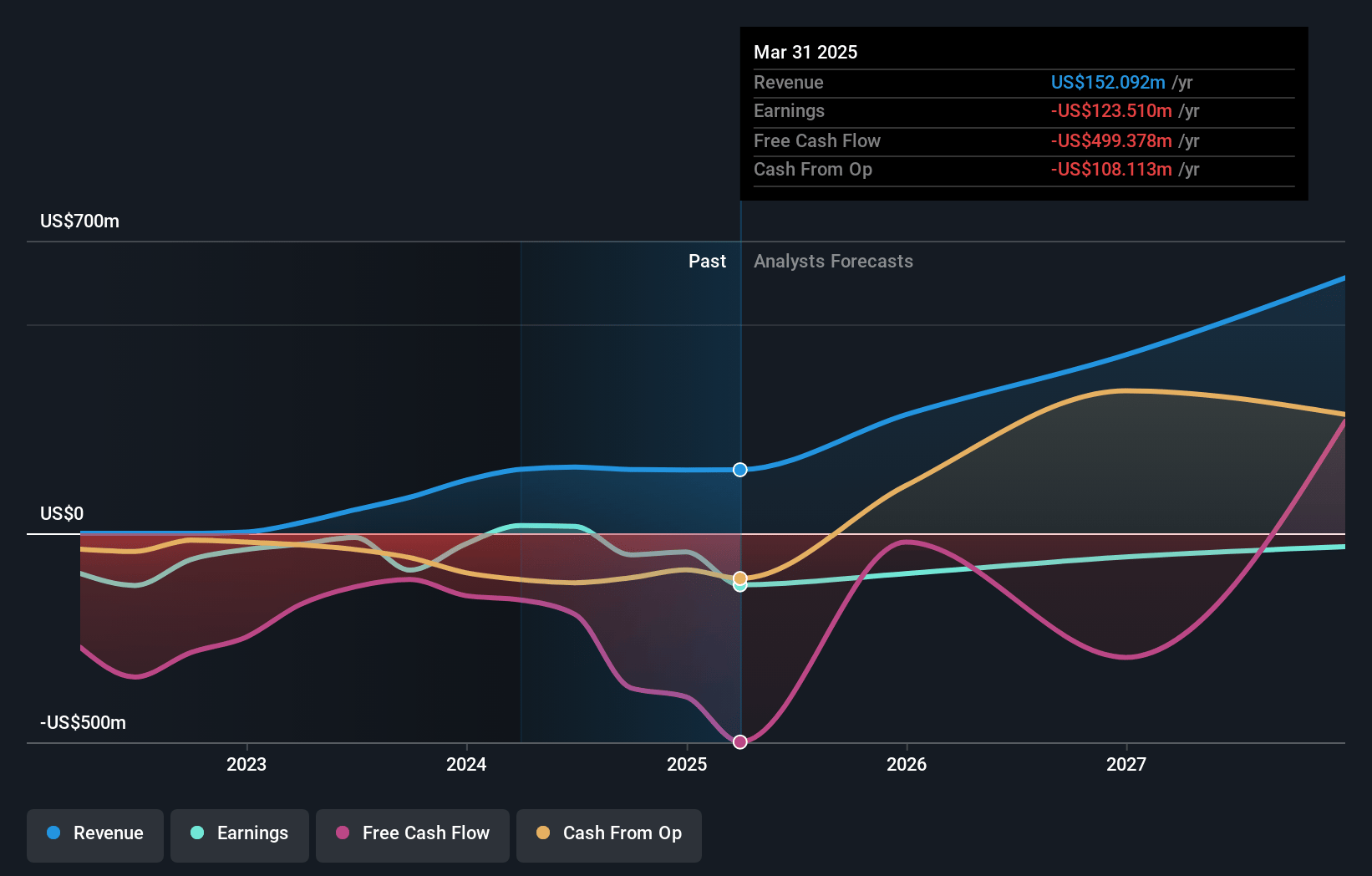

Cipher Mining Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cipher Mining's revenue will grow by 85.6% annually over the next 3 years.

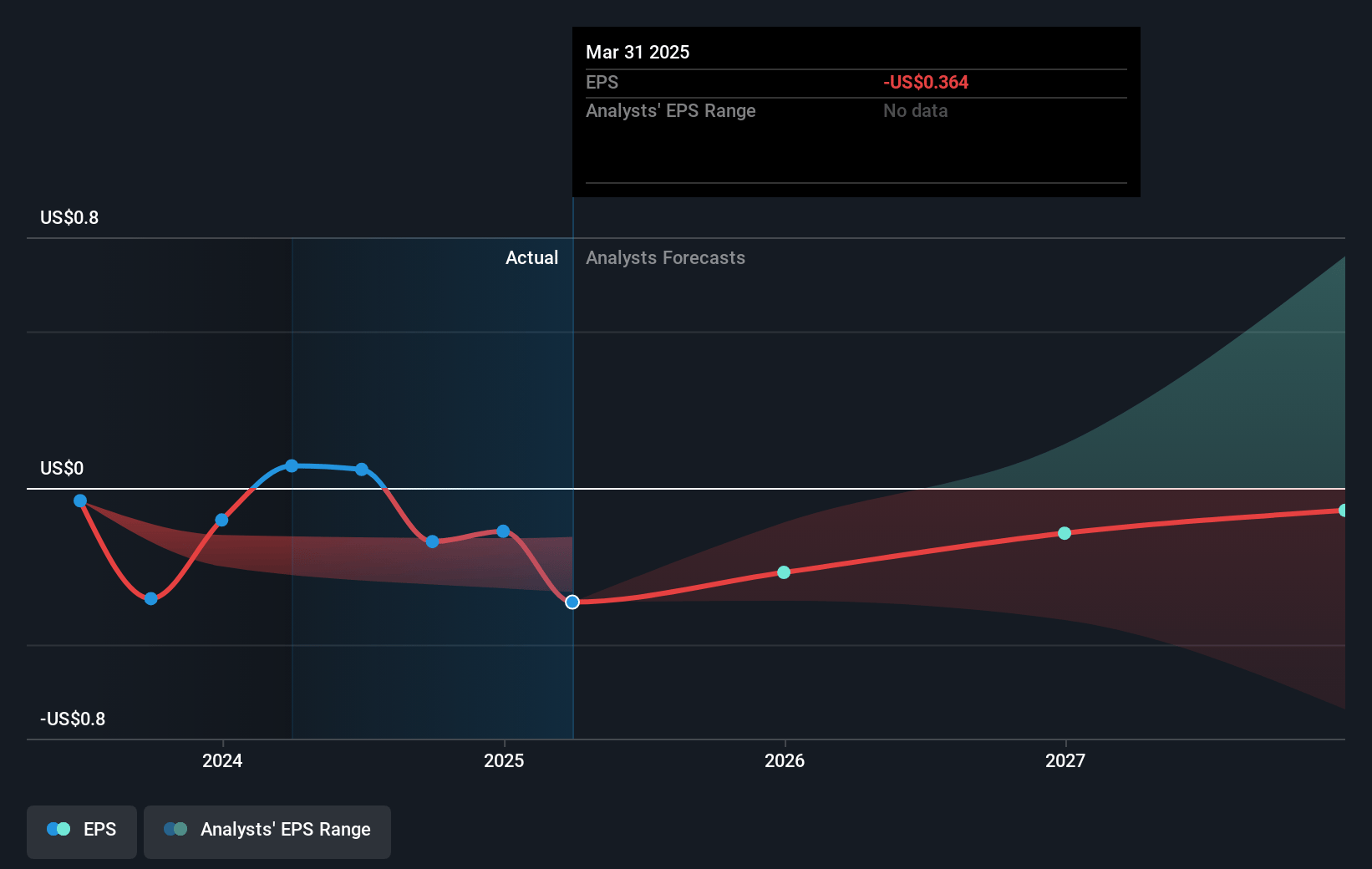

- Analysts are not forecasting that Cipher Mining will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Cipher Mining's profit margin will increase from -29.5% to the average US Software industry of 12.0% in 3 years.

- If Cipher Mining's profit margin were to converge on the industry average, you could expect earnings to reach $116.5 million (and earnings per share of $0.26) by about May 2028, up from $-44.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.9x on those 2028 earnings, up from -25.1x today. This future PE is greater than the current PE for the US Software industry at 31.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.78%, as per the Simply Wall St company report.

Cipher Mining Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The completion and funding of potential new data centers are contingent on securing tenants, which poses a risk to future revenue streams if agreements fall through or are delayed.

- The company's financial outlook heavily depends on fluctuating bitcoin prices, which can impact earnings if prices fall sharply.

- The current profitability of bitcoin mining is tied to low electricity costs secured through specific agreements, the expiration of which in 2027 could increase costs and reduce net margins if not renegotiated effectively.

- The construction of new data centers and expansion projects requires significant capital, and any missteps in financing strategies could lead to increased liabilities and pressure on cash flows.

- The broader macroeconomic environment and regulatory landscape for bitcoin mining and HPC data centers are unpredictable, potentially affecting future revenue and net margins if adverse regulations are introduced or if market conditions worsen.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $7.1 for Cipher Mining based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $9.0, and the most bearish reporting a price target of just $4.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $967.7 million, earnings will come to $116.5 million, and it would be trading on a PE ratio of 33.9x, assuming you use a discount rate of 7.8%.

- Given the current share price of $3.08, the analyst price target of $7.1 is 56.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.