Narratives are currently in beta

Key Takeaways

- Acquisition and integration strategies could enhance efficiency and improve net margins through expanded operations and increased revenue streams.

- Strategic partnerships and asset upgrades are poised to boost growth and earnings, potentially unlocking greater shareholder value through business separation.

- Bit Digital faces integration challenges and margin pressure from Enovum acquisition, competitive pressures in GPU services, chip allocation uncertainty, and risks in the Bitcoin mining segment.

Catalysts

About Bit Digital- Engages in the bitcoin mining business.

- The acquisition of Enovum allows Bit Digital to vertically integrate its HPC operations and expand its data center capabilities, which could lead to increased revenue and more efficient operations, improving net margins.

- The addition of colocation as a revenue line and the development of new sites, enabling Bit Digital to increase its data center capacity, is expected to significantly contribute to future revenue growth.

- The strategic partnership with Boosteroid and the planned deployment of up to 10,000 GPUs in 2025 could lead to substantial revenue growth, enhancing earnings potential.

- Upgrading their mining fleet by selling older, less efficient miners and acquiring newer models could improve mining margins and reduce operating costs, positively impacting net margins.

- A potential separation of the HPC business from the digital asset business may unlock higher valuations and provide more favorable financing opportunities, potentially improving earnings and shareholder value.

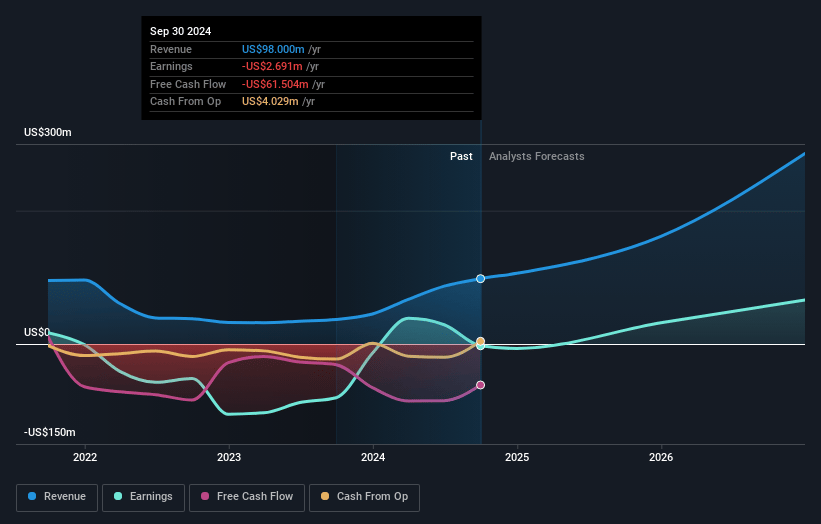

Bit Digital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bit Digital's revenue will grow by 59.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -2.7% today to 39.0% in 3 years time.

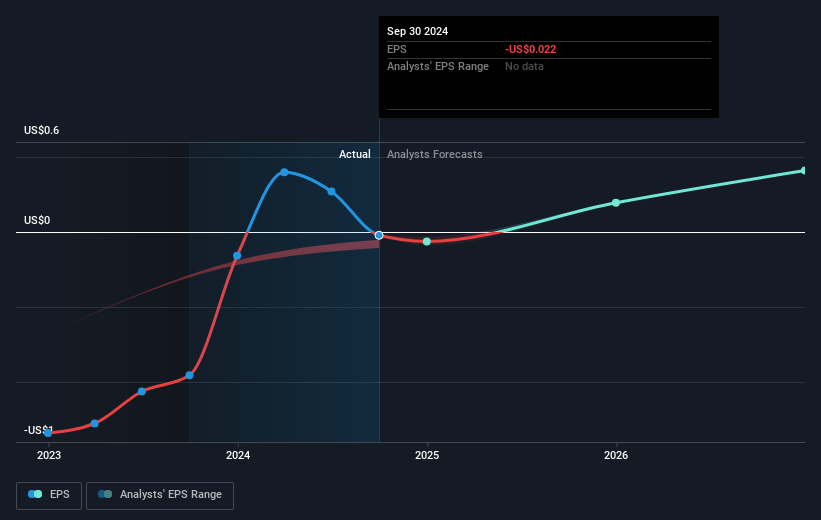

- Analysts expect earnings to reach $155.7 million (and earnings per share of $1.02) by about November 2027, up from $-2.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.3x on those 2027 earnings, up from -222.3x today. This future PE is lower than the current PE for the US Software industry at 41.0x.

- Analysts expect the number of shares outstanding to grow by 1.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.93%, as per the Simply Wall St company report.

Bit Digital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The acquisition of Enovum, while strategic, requires significant capital and may pose integration challenges, impacting Bit Digital's net margins and putting pressure on earnings during the transition period.

- Increased competition and compressed sales cycles in the GPU-as-a-Service market could lead to difficulty securing contracts quickly enough to meet demand, potentially impacting revenue growth and reducing earnings.

- The uncertainty in receiving early allocations of new NVIDIA chips like the Blackwell could delay timelines for contracts and deployment, which could negatively affect future revenue and earnings.

- Challenges in the Bitcoin mining segment, such as network hash rate increases and high electricity costs, may reduce mining margins and contribute negatively to overall earnings.

- The potential separation of HPC and Bitcoin mining businesses, while possibly unlocking value, could also introduce risks related to execution and market perception, potentially affecting revenue and shareholder value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.12 for Bit Digital based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.0, and the most bearish reporting a price target of just $5.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $399.6 million, earnings will come to $155.7 million, and it would be trading on a PE ratio of 7.3x, assuming you use a discount rate of 6.9%.

- Given the current share price of $4.05, the analyst's price target of $6.12 is 33.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives