Last Update 03 Dec 25

ALLT: S&P Index Inclusion Will Drive Future Upside Potential

Analysts have modestly reduced their price target on Allot to $13.38 from $13.38, reflecting slightly higher discount rate assumptions, marginally softer revenue growth expectations, and a lower projected future P/E multiple, partially offset by improved long term profit margin forecasts.

What's in the News

- Allot Ltd. raised its full year 2025 revenue guidance, now expecting between $100 million and $103 million in sales (Key Developments).

- The company called an annual shareholders meeting for December 15, 2025 in Hod Hasharon, Israel, with a key proposal to amend its Articles of Association and move to one year terms for most directors (Key Developments).

- Allot Ltd. was added to the S&P Global BMI Index, increasing its visibility among global institutional investors (Key Developments).

Valuation Changes

- Fair Value: Unchanged at $13.38 per share, indicating a stable central valuation estimate.

- Discount Rate: Has risen slightly from 10.62 percent to 10.66 percent, implying a marginally higher required return and risk assumption.

- Revenue Growth: Has eased slightly from 12.22 percent to 12.09 percent, reflecting modestly softer long term top line expectations.

- Net Profit Margin: Has increased moderately from 12.40 percent to 13.29 percent, signaling improved long run profitability assumptions.

- Future P/E: Has fallen significantly from 60.7x to 46.2x, pointing to a more conservative multiple applied to projected earnings.

Key Takeaways

- Strong growth in security services and major telecom partnerships are driving higher recurring revenue and earnings stability, positioning Allot for continued expansion.

- Shift toward software and recurring revenue is improving margins, while rising global data traffic sustains demand for Allot's network intelligence and security solutions.

- Heavy customer concentration, long sales cycles, and shifting market dynamics threaten Allot's revenue stability, growth prospects, and ability to transition to recurring cloud-based service models.

Catalysts

About Allot- Develops, sells, and markets network intelligence and security solutions in Israel, Europe, Asia, Oceania, the Americas, the Middle East, and Africa.

- Rapid expansion of Allot's Security-as-a-Service (SECaaS) revenue, evidenced by a 73% YoY increase in ARR and strong initial contribution from major telecom partners like Verizon and Vodafone, signals the company is effectively capturing the global surge in demand for bundled, carrier-grade cybersecurity services-supporting future revenue growth and greater earnings visibility as more subscribers migrate to bundled services.

- Major new customer wins, such as the landmark multi-year, multimillion-dollar contract with a Tier 1 EMEA telco-delivering both network intelligence and cybersecurity across converged fixed and 4G/5G mobile networks using Allot's SG-Tera III platform-open sizable new addressable markets and add high-quality, long-term recurring revenue, impacting top-line revenue growth and deferred revenue.

- SECaaS solutions are showing very high attach rates (in the 90%+ range) with business customers as telcos roll out default "opt-out" security offerings, leveraging long-term increases in cyber threat awareness and regulatory pressure for end-user security-this structural trend is likely to sustain elevated net margin and ARR expansion as market penetration deepens.

- Shift to a higher-margin, recurring-revenue product mix (SECaaS and software expansion deals now comprising a larger share of revenue) is directly driving gross margin improvement (now in the 71–73% range), with the expectation this will persist as more software-based contracts are landed and legacy hardware and services shrink in mix.

- Persistent global data traffic growth, spurred by increasing connectivity, 5G/IoT adoption, and cloud migration, is fueling service provider investment in advanced traffic management and security analytics, directly benefiting Allot's differentiated, inline network visibility and control solutions; this supports a strong pipeline of future large deals and underpins expectations for multi-year revenue and operating profit growth.

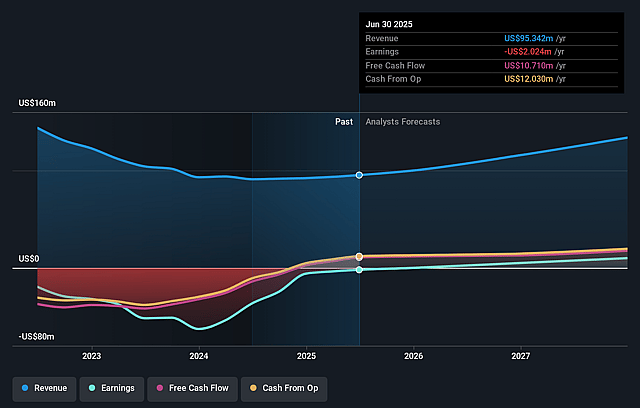

Allot Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Allot's revenue will grow by 14.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -2.1% today to 10.5% in 3 years time.

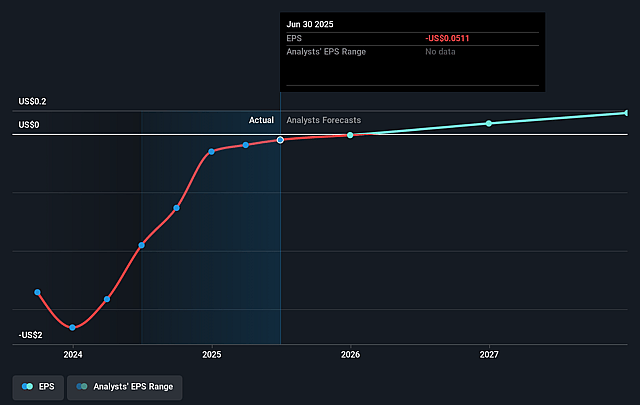

- Analysts expect earnings to reach $15.0 million (and earnings per share of $0.18) by about September 2028, up from $-2.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 68.0x on those 2028 earnings, up from -196.9x today. This future PE is greater than the current PE for the US Software industry at 36.6x.

- Analysts expect the number of shares outstanding to grow by 2.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.71%, as per the Simply Wall St company report.

Allot Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on a small number of major customers-most notably Verizon and Vodafone-for a significant portion of SECaaS recurring revenue exposes Allot to contract concentration risk; the loss or slower-than-expected ramp of these contracts could cause material volatility in revenue and earnings.

- Landmark deals, such as the tens-of-millions CapEx contract with a Tier 1 EMEA telco, are subject to very long (12–24+ month) sales cycles and multi-year execution timelines, increasing risk of project delays, customer deferrals, or non-renewal; this decreases revenue visibility and predictability in out-years.

- Shifting product mix between one-time CapEx deals (like Smart/Tera III) and growing recurring SECaaS revenues creates ongoing volatility and dependency on continued successful transition to SaaS/cloud models; any struggles or setbacks in this transition could hurt top-line growth, gross margins, and operating profitability.

- Allot's partners (telcos) retain full control over customer migration to new plans (such as Verizon's My Biz Plan) and associated go-to-market investment, limiting Allot's ability to accelerate penetration among end users; slower migration or strategic deprioritization by the telcos could significantly constrain revenue growth.

- Industry trends toward hyperscale cloud providers, integrated security offerings from major infrastructure players, and increasing end-to-end encryption could reduce demand for deep packet inspection and network-based security services; this threatens Allot's total addressable market, long-term revenue trajectory, and margin potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $15.0 for Allot based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $142.3 million, earnings will come to $15.0 million, and it would be trading on a PE ratio of 68.0x, assuming you use a discount rate of 10.7%.

- Given the current share price of $8.44, the analyst price target of $15.0 is 43.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.