Key Takeaways

- Akamai's transformation to focus on cybersecurity and cloud computing is driving potential revenue growth and competitiveness in emerging tech markets.

- Strategic investments in AI and edge computing enhance scalability and profitability, with an emphasis on specialized sales to boost customer acquisition.

- Macroeconomic and geopolitical risks, coupled with integration and foreign exchange challenges, threaten Akamai's revenue growth, earnings stability, and long-term financial performance.

Catalysts

About Akamai Technologies- Engages in the provision of security, delivery, and cloud computing solutions in the United States and internationally.

- Akamai's transformation from a CDN provider to a cybersecurity and cloud computing company, with security now delivering the majority of revenue, suggests potential acceleration in revenue growth due to increased demand for comprehensive security solutions.

- The rapid expansion and strong growth of Akamai's cloud computing services, including substantial enterprise uptake and significant ARR growth, indicate a potential increase in revenue streams as they move to become a major cloud competitor.

- The successful integration of AI capabilities into Akamai's cloud offerings positions them for new revenue opportunities in the high-growth AI inferencing market, potentially boosting earnings through differentiated services.

- With Akamai's investments in enhancing its edge computing capabilities, and expanding global infrastructure, there is potential for margin improvement and increased profitability as operational efficiencies and scalability improve.

- Akamai's strategic shift in its go-to-market approach, focusing more on sales specialization and partner enablement, aims to accelerate customer acquisition and cross-sell opportunities, potentially enhancing revenue growth and net margins in the long term.

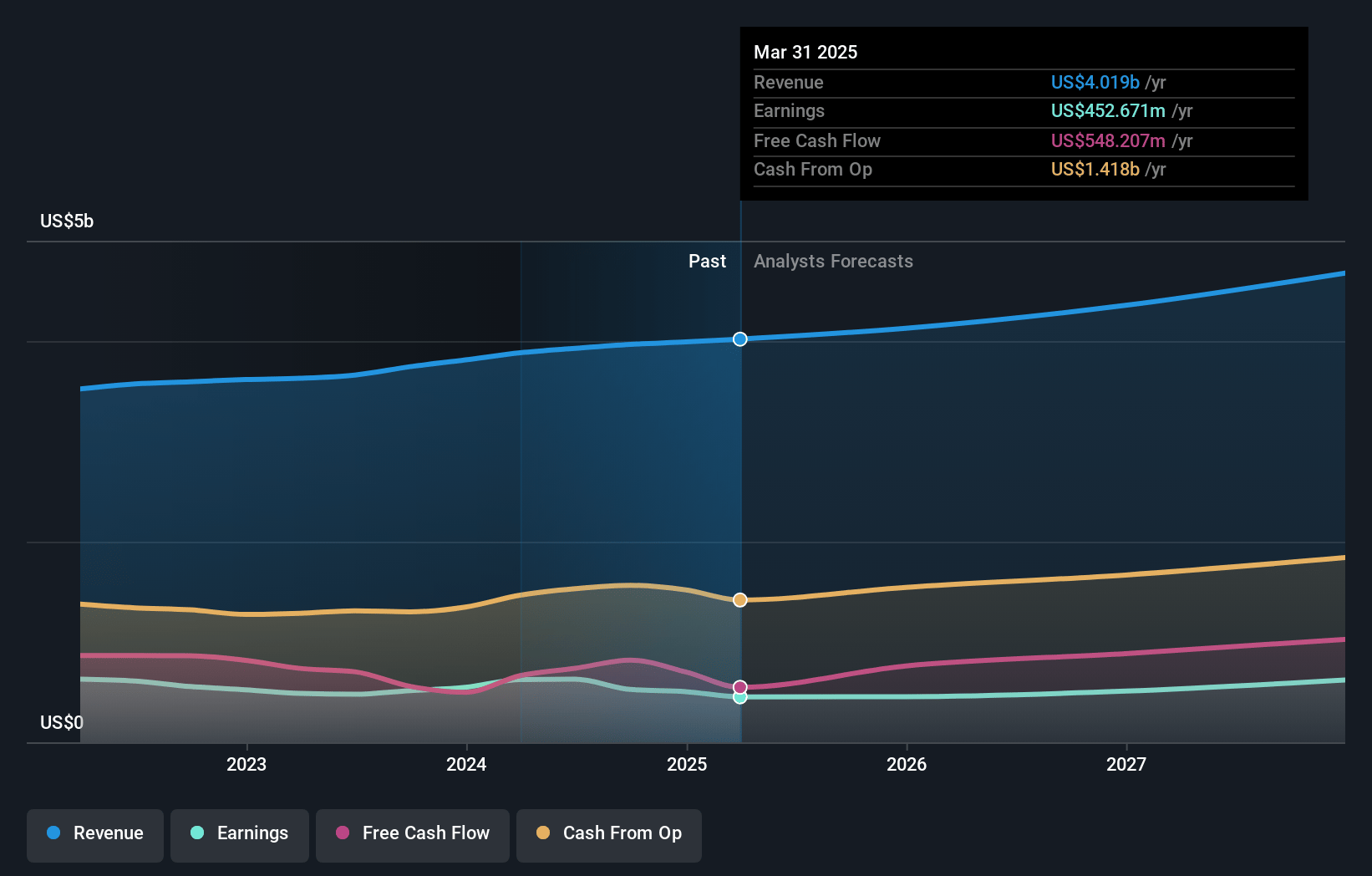

Akamai Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Akamai Technologies compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Akamai Technologies's revenue will grow by 7.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 12.7% today to 16.9% in 3 years time.

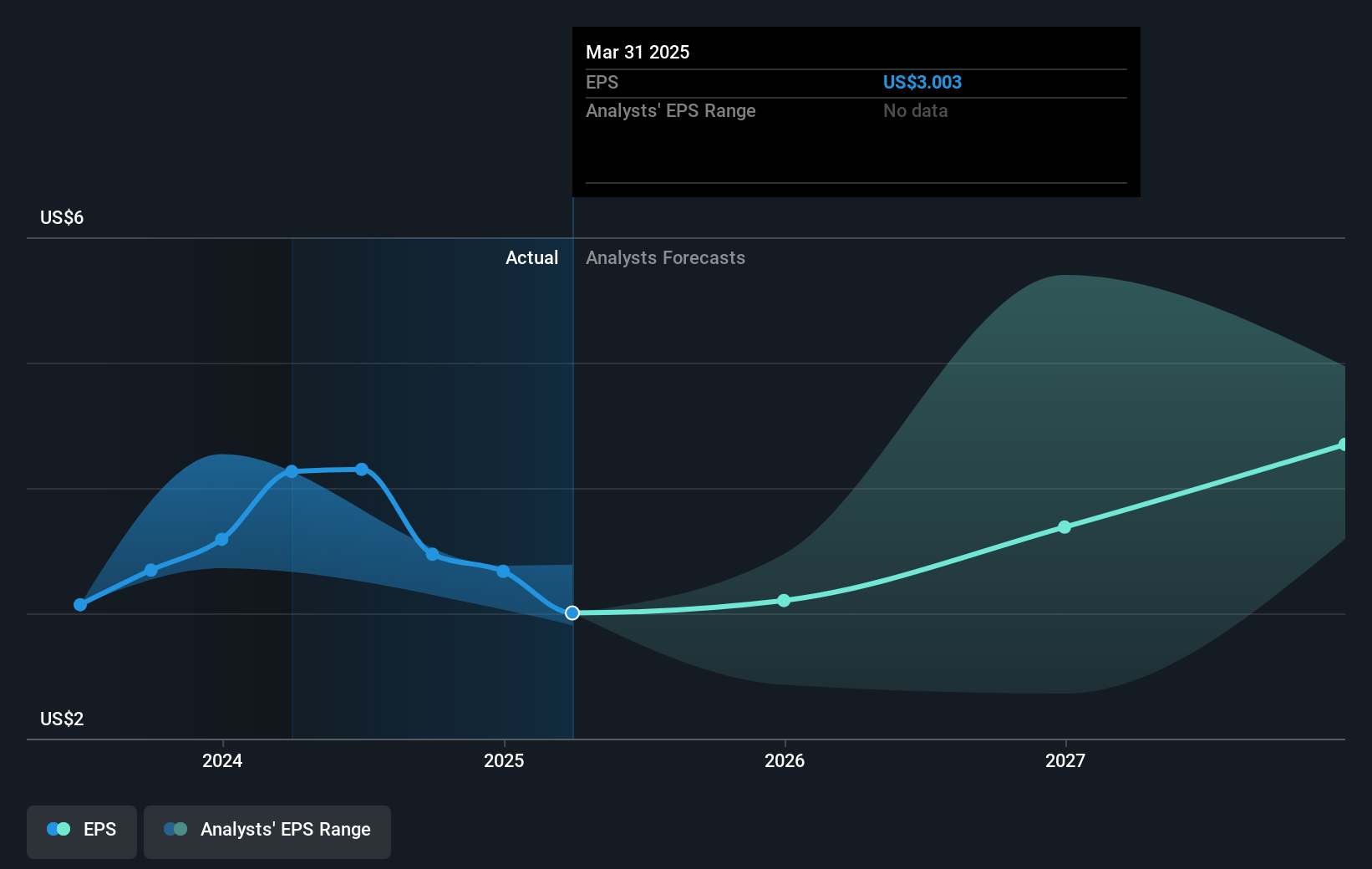

- The bullish analysts expect earnings to reach $844.9 million (and earnings per share of $5.39) by about April 2028, up from $504.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 29.2x on those 2028 earnings, up from 21.3x today. This future PE is lower than the current PE for the US IT industry at 32.6x.

- Analysts expect the number of shares outstanding to decline by 1.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.96%, as per the Simply Wall St company report.

Akamai Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Akamai faces headwinds from macroeconomic trends and geopolitical developments, which could impact revenue growth and stability in the broader market.

- The integration of acquisitions presents risks and the possibility that expected synergies or growth projections might not materialize, potentially affecting earnings and net margins.

- Foreign exchange volatility is anticipated to continue, with significant potential impacts on revenue and non-GAAP operating margin, leading to uncertainties in future financial performance.

- The delivery revenue segment is experiencing declines, which remain a drag on overall business growth and could challenge the company's ability to sustain revenue increases.

- Long-term revenue is under pressure from a major customer pursuing a DIY strategy and geopolitical risks like potential U.S. bans that could diminish revenue over time, thereby impacting the bottom line.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Akamai Technologies is $136.32, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Akamai Technologies's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $136.32, and the most bearish reporting a price target of just $72.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $5.0 billion, earnings will come to $844.9 million, and it would be trading on a PE ratio of 29.2x, assuming you use a discount rate of 9.0%.

- Given the current share price of $73.67, the bullish analyst price target of $136.32 is 46.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:AKAM. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.