Key Takeaways

- Investments in product development and European market strategies are driving ARR growth, enhancing revenue and international market expansion.

- New partnerships and platform features are poised to boost reseller contributions and improve customer retention, strengthening revenue and net margins.

- Market challenges and inflated expenses could hinder growth, profitability, and margins, while misleading claims and decreased customer counts may impact future revenue sustainability.

Catalysts

About AudioEye- Provides Internet content publication and distribution software and related services to Internet and other media to people regardless of their device, location, or disabilities in the United States.

- AudioEye's investment in product development and go-to-market strategies is generating strong results, with a building pipeline in both the U.S. and Europe, leading to a notable increase in ARR. This is expected to enhance revenue growth.

- The approaching European Accessibility Act deadline and expanded European sales team are expected to capture increased demand, likely accelerating revenue growth in the international market.

- Expanded partnerships with Finalsite and CivicPlus are expected to drive stronger contributions from the reseller business, contributing positively to revenue growth in the second half.

- New platform features, combining automation with human-assisted technology, are projected to enhance customer value and protection against legal claims, potentially increasing customer retention and improving net margins.

- Improved financial flexibility from recent debt refinancing, including strengthened cash position and decreased interest expenses, supports operational leverage and earnings growth, further enhancing net margins and free cash flow.

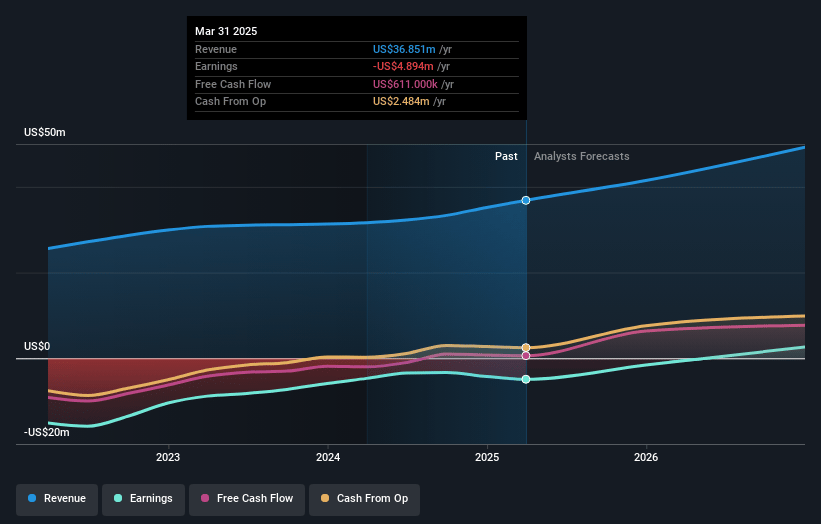

AudioEye Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AudioEye's revenue will grow by 17.0% annually over the next 3 years.

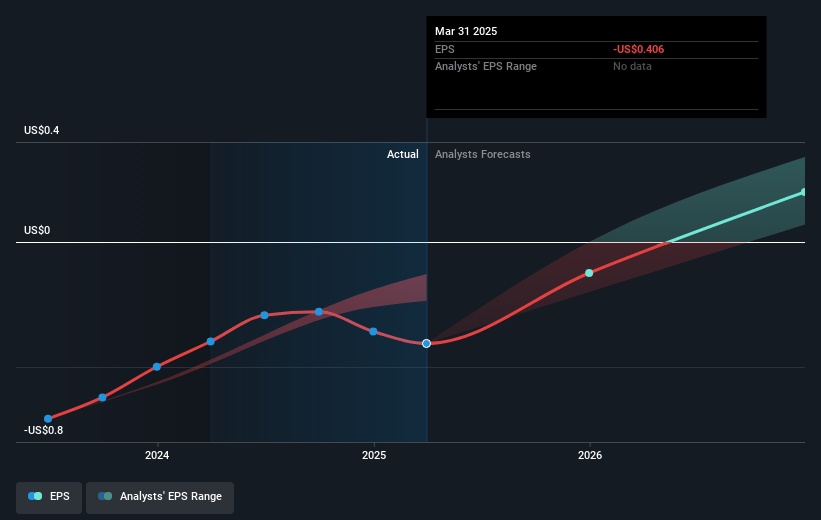

- Analysts are not forecasting that AudioEye will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate AudioEye's profit margin will increase from -13.3% to the average US Software industry of 13.6% in 3 years.

- If AudioEye's profit margin were to converge on the industry average, you could expect earnings to reach $8.0 million (and earnings per share of $0.54) by about May 2028, up from $-4.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 52.4x on those 2028 earnings, up from -31.7x today. This future PE is greater than the current PE for the US Software industry at 33.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.83%, as per the Simply Wall St company report.

AudioEye Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The challenges in the SaaS market since 2022 and a challenging macroeconomic environment could impact company growth, potentially affecting revenues and profitability.

- Increased litigation expenses and non-GAAP items led to higher operating expenses and net loss in Q1 2025, which could affect net margins and earnings.

- The new platform migration expected in Q2 is anticipated to reduce margins by 3-4 percentage points temporarily, impacting net margins in the short term.

- Misleading AI marketing claims in the digital accessibility market can create confusion among prospects, potentially impacting revenue growth due to misunderstandings about product capabilities.

- The decrease in customer counts and the influence of contract renegotiations could affect ARR growth and revenue sustainability in the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $22.4 for AudioEye based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $20.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $59.1 million, earnings will come to $8.0 million, and it would be trading on a PE ratio of 52.4x, assuming you use a discount rate of 7.8%.

- Given the current share price of $12.46, the analyst price target of $22.4 is 44.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.