Key Takeaways

- New agreements with major OTT providers and diversified customer additions indicate potential revenue growth in media and various market segments.

- Strategic IP and hybrid bonding technology development, alongside effective debt management, bolster long-term growth and financial stability.

- Increased legal expenses, uncertain semiconductor revenue, and a declining Pay-TV market present challenges, while debt reduction prioritization may limit growth opportunities.

Catalysts

About Adeia- Operates as a media and semiconductor intellectual property licensing company in the United States, Asia, Canada, Europe, the Middle East, and internationally.

- The signing of multiyear license agreements with major OTT providers like Amazon and ongoing litigation with Disney indicates potential growth in media revenue due to expansion in OTT markets and protection of intellectual property (IP).

- The introduction of new customers such as Canon and Neiman Marcus in diverse sectors like media, consumer electronics, and e-commerce highlights the prospect for increased future revenue from new market segments.

- The continued development and acquisition of IP portfolios, particularly in OTT and broadband connectivity, suggest potential for long-term revenue growth as portfolio expansion supports both existing renewals and new customer wins in key markets.

- The strategic focus on hybrid bonding technology, evidenced by new semiconductor deals and industry recognition, positions Adeia for potential revenue growth as demand for this critical technology in high-performance devices intensifies.

- Ongoing debt reduction efforts, successful repricing of term loans, and returning capital to shareholders through stock buybacks support better net margins and earnings, enhancing financial stability and potentially increasing EPS.

Adeia Future Earnings and Revenue Growth

Assumptions

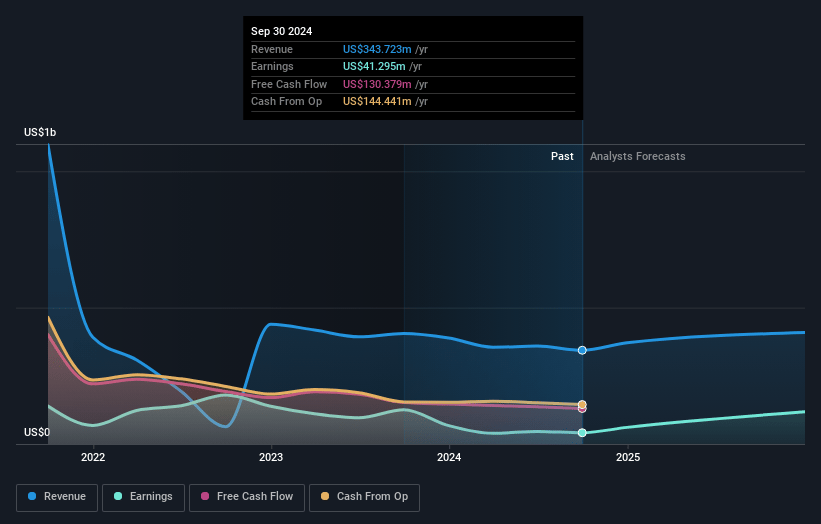

How have these above catalysts been quantified?- Analysts are assuming Adeia's revenue will grow by 6.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.2% today to 21.2% in 3 years time.

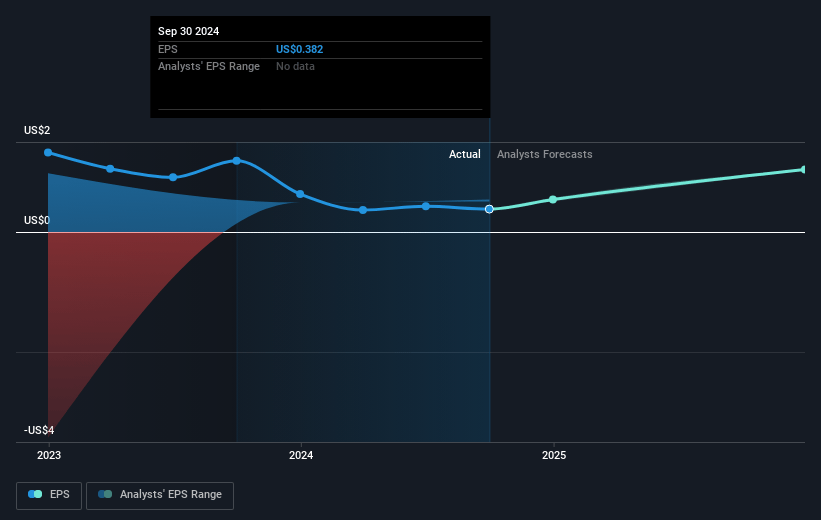

- Analysts expect earnings to reach $94.7 million (and earnings per share of $0.81) by about May 2028, up from $64.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.6x on those 2028 earnings, up from 21.0x today. This future PE is lower than the current PE for the US Software industry at 31.6x.

- Analysts expect the number of shares outstanding to decline by 0.92% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.63%, as per the Simply Wall St company report.

Adeia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Legal expenses are expected to significantly increase, particularly due to litigation against Disney and ongoing disputes with Canadian Pay-TV operators, which could negatively impact net margins.

- The revenue from certain semiconductor deals remains uncertain, as highlighted by delays and pushouts in expected timelines, which could impact the revenue stability and projections.

- There is a dependency on the outcome of large, complex deals which can introduce volatility and unpredictability into revenue streams, potentially affecting future earnings forecasts.

- The focus on debt reduction as a priority means that cash flow may not be as readily available for reinvestment into potentially higher ROI opportunities, which could affect long-term revenue growth.

- The market for Pay-TV is anticipated to decline, and while growth is expected in OTT and e-commerce, any slower-than-expected adoption in these areas could adversely affect expected revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.333 for Adeia based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $447.7 million, earnings will come to $94.7 million, and it would be trading on a PE ratio of 24.6x, assuming you use a discount rate of 8.6%.

- Given the current share price of $12.5, the analyst price target of $17.33 is 27.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.