Key Takeaways

- Veeco's growth in semiconductor and AI sectors, driven by advanced processing technologies, could boost future revenue and market share significantly.

- Investment in laser annealing and ion beam deposition is expected to drive earnings growth and market expansion with substantial business opportunities.

- Declines across China, storage, and semiconductor sectors may tighten margins and impact revenue due to slowing demand and customer investment delays.

Catalysts

About Veeco Instruments- Develops, manufactures, sells, and supports semiconductor and thin film process equipment primarily to make electronic devices in the United States, Europe, the Middle East, and Africa, China, Rest of the Asia-Pacific, and internationally.

- Veeco is experiencing strong growth in its semiconductor business, particularly driven by AI and advanced packaging wet processing, with significant orders showing visibility into 2025. This trend is expected to positively impact future revenue growth.

- The company's leadership in laser annealing and the introduction of next-generation nanosecond annealing technology expand opportunities, particularly as semiconductor geometries continue to shrink. This advancement is likely to contribute to increased revenue and potentially improved net margins due to technological differentiation.

- Veeco’s ion beam deposition technology is critical for EUV mask blanks, aligning with expanding ASML EUV lithography capacity. This alignment indicates a potential increase in revenue and market share in future years.

- The company foresees opportunities to grow its served available market (SAM) significantly, from advancements like gate-all-around architectures and backside power delivery, which are crucial in driving demand for laser annealing. This growth in SAM is expected to enhance both revenue and market expansion possibilities.

- Veeco plans to increase investments in laser annealing and ion beam deposition technologies, with evaluation programs indicating potential for follow-on business valued at $30 million to $60 million per application win. These investments are poised to drive earnings growth as these evaluations convert into sales.

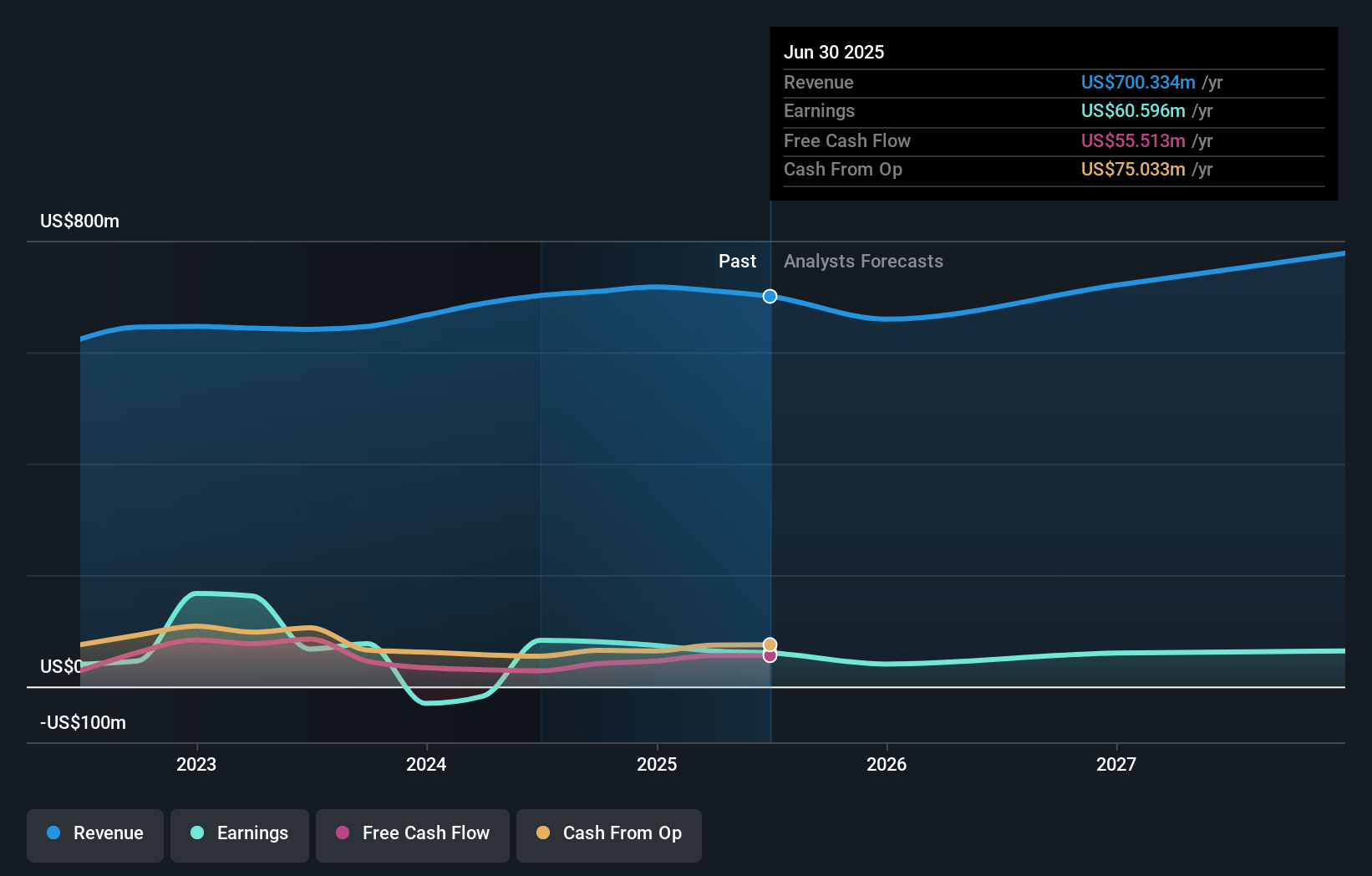

Veeco Instruments Future Earnings and Revenue Growth

Assumptions

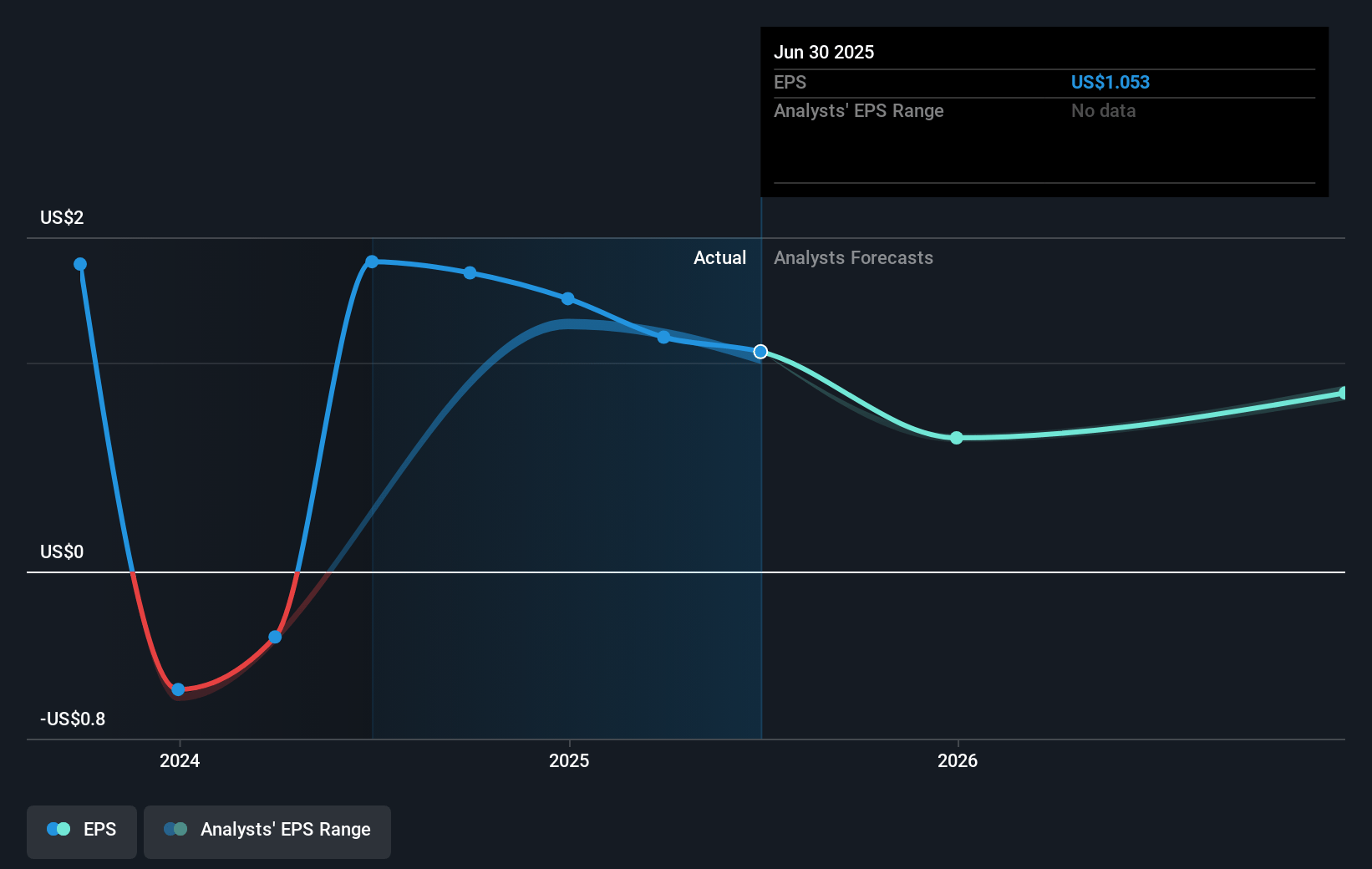

How have these above catalysts been quantified?- Analysts are assuming Veeco Instruments's revenue will grow by 3.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 11.3% today to 10.2% in 3 years time.

- Analysts expect earnings to reach $79.5 million (and earnings per share of $1.17) by about January 2028, down from $80.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.7x on those 2028 earnings, up from 16.7x today. This future PE is greater than the current PE for the US Semiconductor industry at 31.2x.

- Analysts expect the number of shares outstanding to grow by 6.04% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.57%, as per the Simply Wall St company report.

Veeco Instruments Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A decline in China revenue is expected in 2025 due to moderated recent customer engagements, which may impact overall revenue growth.

- There is a significant forecasted reduction in data storage revenue ($60 million to $70 million) in 2025, which could negatively affect total earnings and revenue.

- Weaker demand due to a slowdown in EV adoption may result in SiC power customers delaying investments, potentially impacting revenue and market expansion in that segment.

- Recent guidance suggests a potential decline in semiconductor revenue from record levels in previous quarters, which could impact future revenue and profitability.

- With moderated demand in the data storage and semiconductor segments, there is a risk of operating margins tightening, impacting overall net income and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $35.0 for Veeco Instruments based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $30.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $782.8 million, earnings will come to $79.5 million, and it would be trading on a PE ratio of 37.7x, assuming you use a discount rate of 8.6%.

- Given the current share price of $23.67, the analyst's price target of $35.0 is 32.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives