Key Takeaways

- Strong growth in endpoint IC usage, especially in apparel and food, positions Impinj for revenue and market share expansion.

- Qualcomm's RAIN endorsement hints at future mobile integration, potentially boosting IC sales and earnings.

- Dependency on licensing deals and global expansion risks could lead to revenue volatility, affecting earnings consistency and financial stability.

Catalysts

About Impinj- Operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

- Strong secular growth in endpoint IC usage, especially in apparel and new market categories like perishable foods, positions the company for expanding revenue and increased market share.

- The ramp-up of M800 shipments and their market qualification, along with continued adoption, is expected to drive revenue growth and potentially improve gross margins due to product mix.

- Increased interest from large enterprises in solutions for retail, supply chain, and logistics, with a large enterprise account pipeline, suggests promising revenue expansion potential.

- Qualcomm's public statement on RAIN in mobile devices hints at future widespread adoption, likely accelerating endpoint IC sales and potentially enhancing earnings through new technology integrations and applications.

- Continued investment in enterprise solutions, including software and cloud services, aims to create incremental revenue streams, which, alongside improved efficiencies, could lead to better net margin performance.

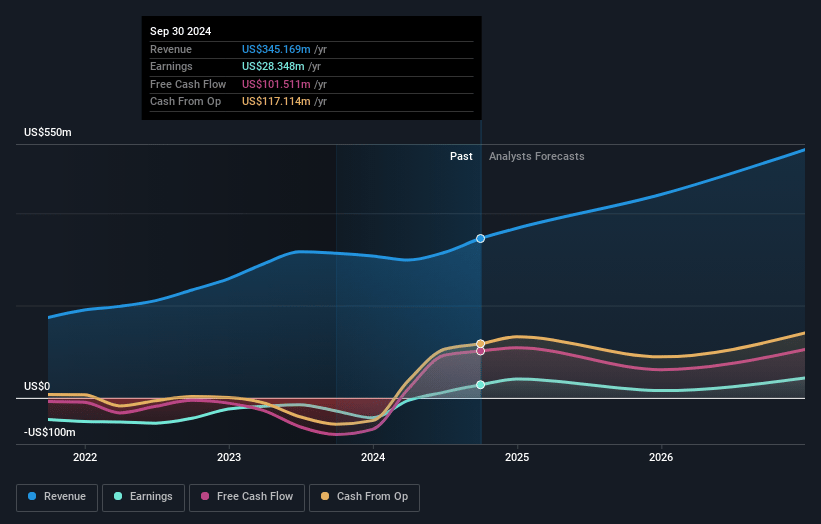

Impinj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Impinj's revenue will grow by 24.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.2% today to 13.5% in 3 years time.

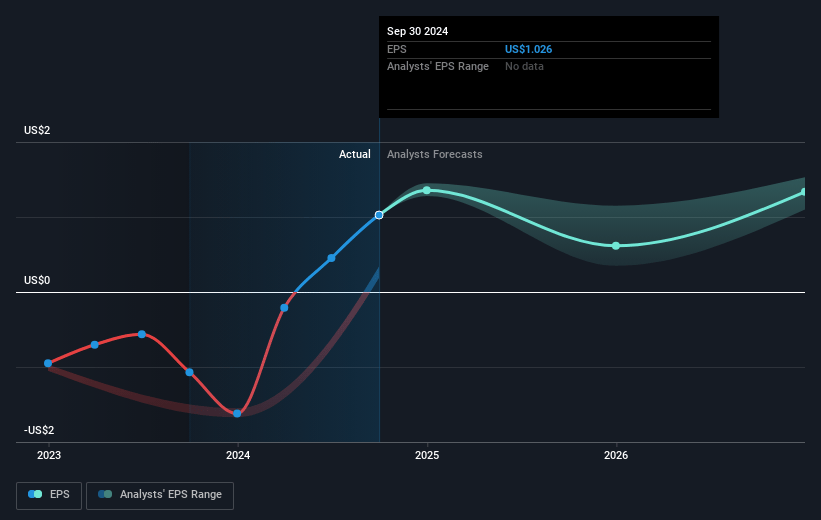

- Analysts expect earnings to reach $90.9 million (and earnings per share of $2.3) by about January 2028, up from $28.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 125.5x on those 2028 earnings, down from 132.4x today. This future PE is greater than the current PE for the US Semiconductor industry at 31.2x.

- Analysts expect the number of shares outstanding to grow by 11.74% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.11%, as per the Simply Wall St company report.

Impinj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Impinj's third quarter revenue of $95.2 million was down 7% sequentially, indicating potential volatility in revenue streams, which could impact consistent earnings growth in the future.

- The company is expecting a decline in endpoint IC revenue in the fourth quarter, driven by typical seasonal trends, which could potentially affect overall revenue and net margins.

- Gross margin decreased sequentially from 58.2% to 52.4%, primarily due to the absence of licensing revenue. This highlights a dependency on licensing deals for margin stability, which could affect net margins if such revenues are inconsistent.

- The global expansions, such as the European retailer rollout, are subjected to project timing risks, which could lead to revenue fluctuations and affect quarter-over-quarter earnings consistency.

- While the food tagging market presents a significant opportunity, the company acknowledges the early stage of adoption, pointing to potential delays in revenue realization, which could affect future revenue projections and financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $231.44 for Impinj based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $270.0, and the most bearish reporting a price target of just $182.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $672.5 million, earnings will come to $90.9 million, and it would be trading on a PE ratio of 125.5x, assuming you use a discount rate of 8.1%.

- Given the current share price of $132.66, the analyst's price target of $231.44 is 42.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives