Key Takeaways

- Technology leadership in automotive and industrial electrification, plus targeted product launches, position the company for strong future growth and margin expansion.

- Structural cost cuts and supply chain diversification increase profitability, operational resilience, and revenue stability in high-value, high-growth market segments.

- Reliance on China’s EV market, slow global EV adoption, pricing pressures, high restructuring risk, and intensifying competition threaten ON Semiconductor’s revenue stability and profitability.

Catalysts

About ON Semiconductor- Provides intelligent sensing and power solutions in the United States and internationally.

- ON Semiconductor’s technology leadership in silicon carbide and design wins with leading Chinese and U.S. automotive OEMs position the company to ride the accelerating shift toward electric vehicles and hybrid platforms, creating strong potential for increasing automotive revenue and higher margin sales as these new models ramp in late 2025 and beyond.

- Ongoing investments and product launches in the industrial and AI data center segments, particularly through differentiated power and sensing solutions, open new avenues for revenue growth and margin expansion as demand for efficient electrification, automation, and data center power rises across the globe.

- Large structural cost reductions, including a 12% reduction in internal fab capacity and a 9% workforce reduction, are set to lower fixed costs by tens of millions annually, driving sustained improvement in both gross and operating margins as market demand recovers and higher utilization rates directly flow through to profits.

- Proactive supply chain diversification and a global manufacturing footprint insulate ON Semiconductor from geopolitical shocks and tariffs, enhancing its ability to deliver stable, reliable service to leading OEM customers and bolstering revenue visibility and long-term growth prospects.

- The company's focused strategy of streamlining its product portfolio, prioritizing high-growth and high-value segments such as automotive SiC, industrial solutions, and the Treo platform—with targets of $1 billion annual revenue and 60% to 70% margins by 2030—could deliver outsized gains in gross margin and free cash flow, supporting bullish earnings and valuation outlooks.

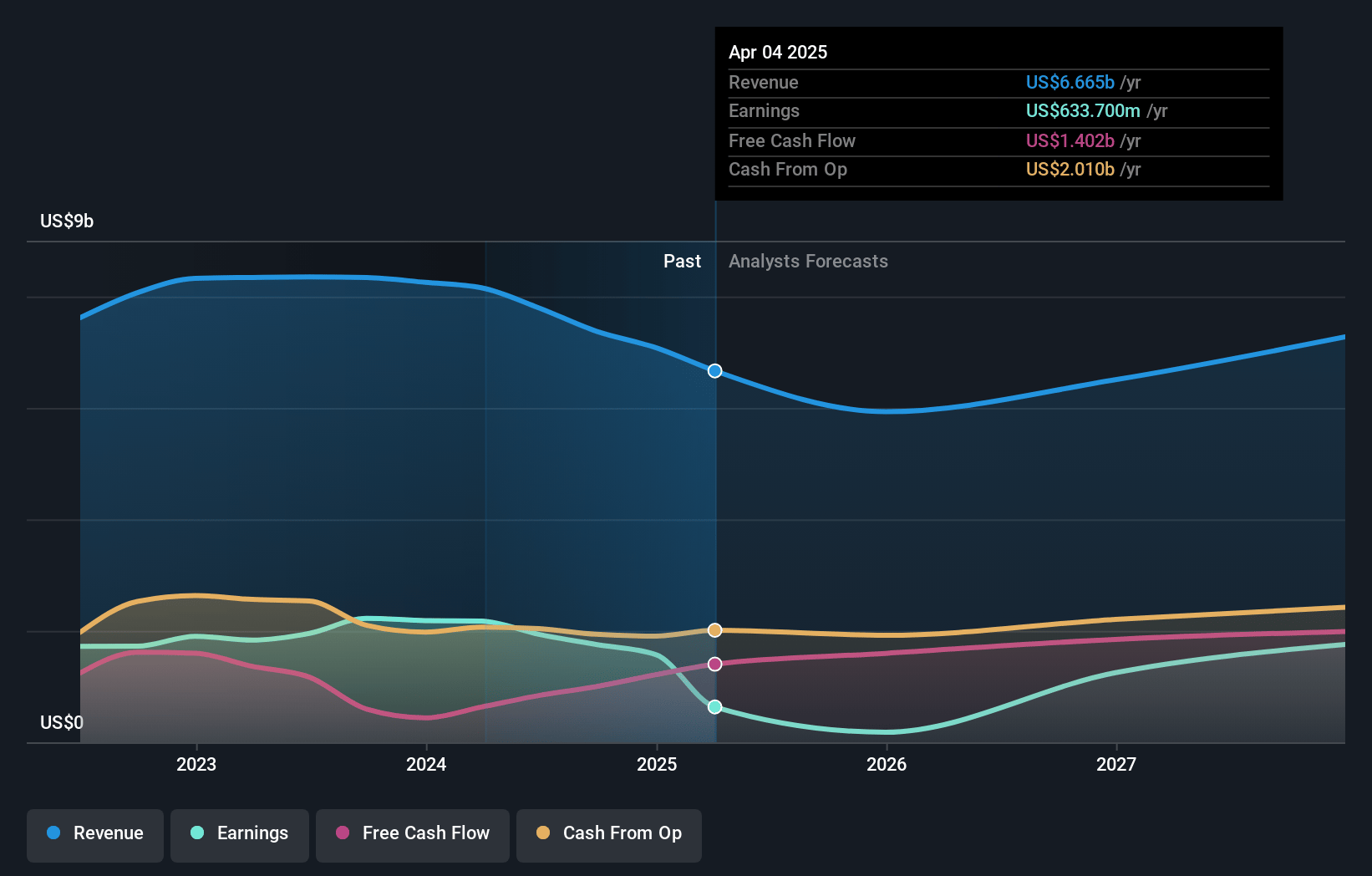

ON Semiconductor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on ON Semiconductor compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming ON Semiconductor's revenue will grow by 7.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.5% today to 31.2% in 3 years time.

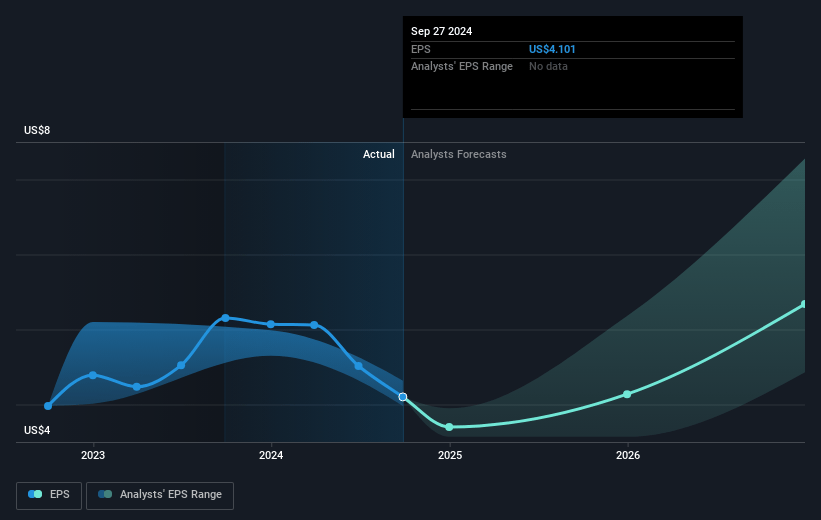

- The bullish analysts expect earnings to reach $2.6 billion (and earnings per share of $6.55) by about July 2028, up from $633.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.0x on those 2028 earnings, down from 41.2x today. This future PE is lower than the current PE for the US Semiconductor industry at 30.9x.

- Analysts expect the number of shares outstanding to decline by 2.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.03%, as per the Simply Wall St company report.

ON Semiconductor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Slow adoption of electric vehicles outside China and ongoing inventory digestion among automotive customers pose a risk to ON Semiconductor’s automotive revenue growth and could result in prolonged periods of lower revenue and earnings.

- Pricing declines due to extended downturns and competitive actions in both core and noncore businesses may compress gross margins, directly impacting net earnings and limiting the company’s ability to maintain profitability as pricing power erodes.

- Growing reliance on China’s EV market for silicon carbide product ramps highlights ON's exposure to regional geopolitical risks, such as tariffs and protectionism, which may disrupt supply chains or limit access to critical raw materials, ultimately affecting future revenues and gross margins.

- Capital intensity and restructuring—such as capacity realignment and workforce reductions—may not deliver the cost savings or utilization improvements expected, especially if demand recovery lags, putting pressure on free cash flow and net earnings over the long term.

- Intensifying competition from both established global peers and emerging local players in key areas like silicon carbide and power management increases the risk of product commoditization and technological obsolescence, threatening ON Semiconductor’s market share, revenue stability, and long-term margin expansion efforts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for ON Semiconductor is $75.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of ON Semiconductor's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $75.0, and the most bearish reporting a price target of just $33.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $8.3 billion, earnings will come to $2.6 billion, and it would be trading on a PE ratio of 15.0x, assuming you use a discount rate of 10.0%.

- Given the current share price of $62.45, the bullish analyst price target of $75.0 is 16.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.