Key Takeaways

- Unmatched chip innovation and a deeply integrated software ecosystem are strengthening customer loyalty, pricing power, and sustained margin expansion across NVIDIA’s core business.

- Diversifying into new AI-driven sectors like healthcare and robotics is opening substantial high-margin opportunities, further supporting long-term revenue growth and risk reduction.

- Geopolitical tensions, regulatory scrutiny, rising costs, customer shifts to in-house chips, and sustainability pressures threaten NVIDIA’s revenue growth, margins, and market leadership.

Catalysts

About NVIDIA- A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

- The accelerating global adoption of AI models and reasoning AI across multiple sectors is fueling massive, sustained demand for NVIDIA’s high-performance compute infrastructure, positioning the company for ongoing data center revenue and earnings growth over the long term.

- The rapid buildout and expansion of cloud and enterprise AI infrastructure worldwide is driving continued, multi-year increases in demand for NVIDIA’s next-generation GPUs and end-to-end accelerated computing, which points to a persistent, robust trajectory in top-line revenue and long-term margin expansion.

- NVIDIA’s unmatched pace of chip innovation—evidenced by the rapid ramp and performance superiority of Blackwell and the upcoming launch of Blackwell Ultra and Rubin architectures—enables it to maintain pricing power and extend its technological lead, directly boosting both revenues and net margins as customers prioritize NVIDIA for fast ROI and scale.

- High switching costs and deepening integration of NVIDIA’s proprietary CUDA software ecosystem drive customer lock-in, fostering recurring high-margin software and platform service revenues, which will result in sustainable improvements to gross margins and overall earnings quality.

- The emergence of new application verticals—including autonomous vehicles, healthcare, robotics, and physical AI—is opening up large, high-margin, diversified revenue streams for NVIDIA, supporting rapid growth and reducing end-market risk, which will materially benefit both long-term revenue and net income.

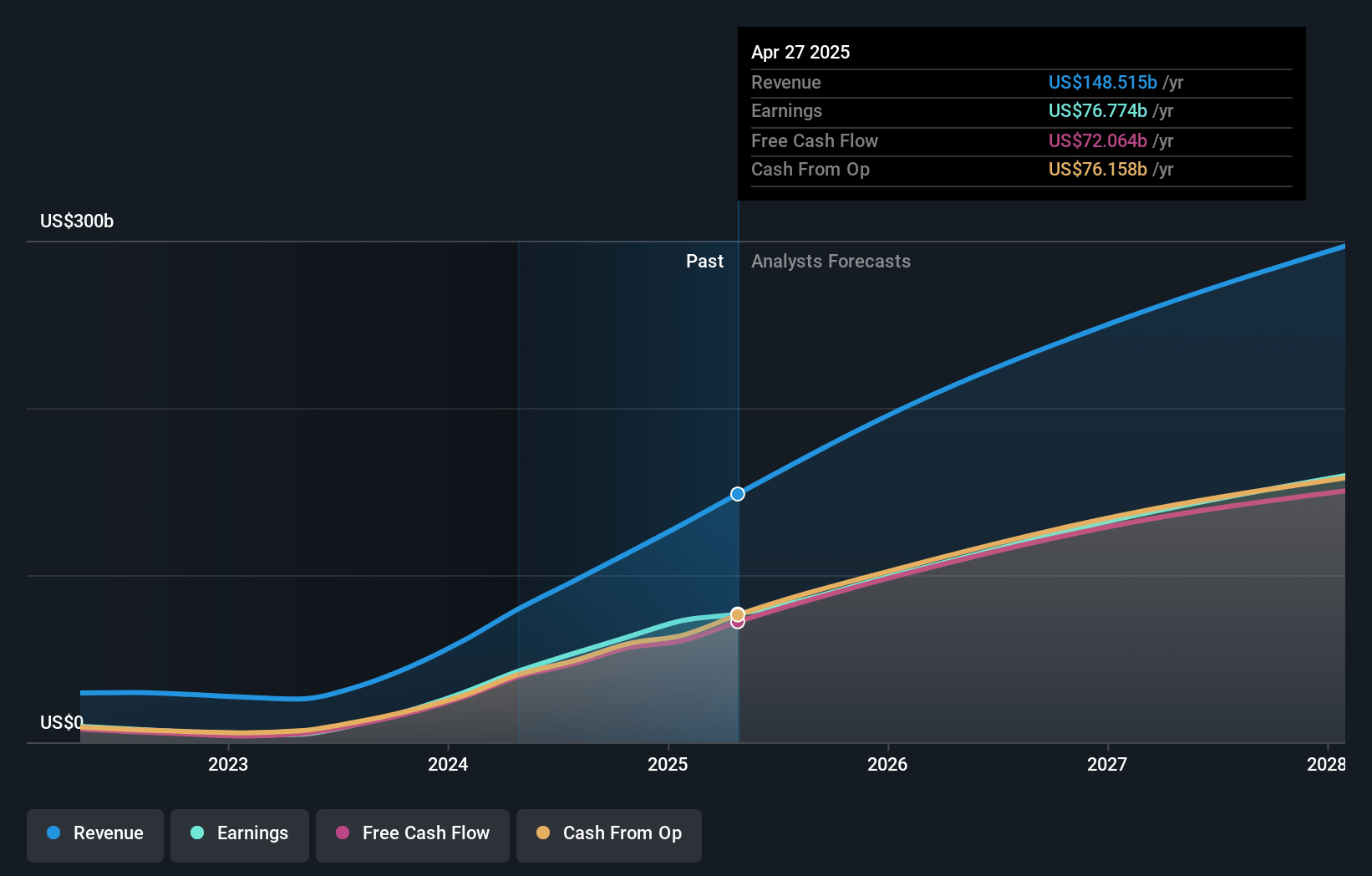

NVIDIA Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on NVIDIA compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming NVIDIA's revenue will grow by 48.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 55.8% today to 55.5% in 3 years time.

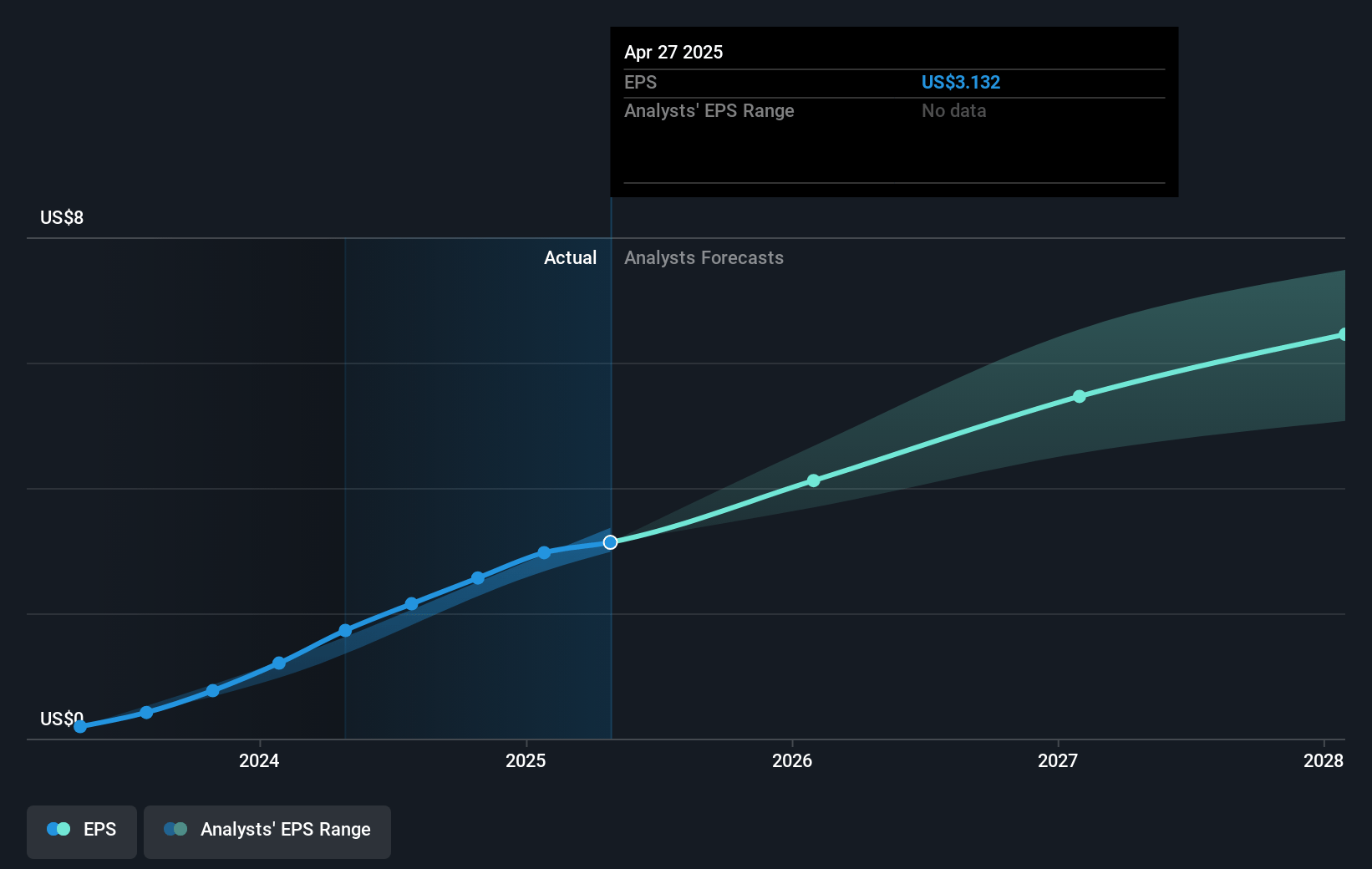

- The bullish analysts expect earnings to reach $237.5 billion (and earnings per share of $9.73) by about April 2028, up from $72.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 27.6x on those 2028 earnings, down from 37.2x today. This future PE is greater than the current PE for the US Semiconductor industry at 24.2x.

- Analysts expect the number of shares outstanding to decline by 0.81% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.83%, as per the Simply Wall St company report.

NVIDIA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying geopolitical tensions and ongoing export controls are restricting NVIDIA’s ability to sell high-value data center solutions in China, a major market where revenues remain well below pre-restriction levels; further escalation could meaningfully limit the company’s total addressable market and constrain future revenue growth.

- The rapid AI adoption that is fueling current demand is subject to increased regulatory scrutiny over data privacy, AI safety, and national security, particularly as regulations in the US, Europe, and other regions evolve, potentially slowing enterprise and government adoption and negatively impacting future revenue and earnings.

- The text highlights NVIDIA's significant R&D and capital expenditure requirements to maintain its technological leadership and keep pace with annual product cycles; if industry growth slows or competition intensifies, these rising costs may compress net margins and put pressure on future earnings.

- Hyper-scalers and large cloud service providers (CSPs), which currently represent about half of NVIDIA’s data center revenue, are increasingly investing in custom AI chips and potentially shifting workloads to in-house solutions, raising the risk of market share loss and depressed revenue and gross margins over time.

- The industry's strong focus on energy efficiency and sustainability could lead to stricter regulations or higher taxes on energy-intensive AI computing hardware, increasing costs for data centers and end-users and potentially reducing demand for NVIDIA's GPUs, which could negatively impact both revenue growth and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for NVIDIA is $213.26, which represents two standard deviations above the consensus price target of $164.29. This valuation is based on what can be assumed as the expectations of NVIDIA's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $220.0, and the most bearish reporting a price target of just $115.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $427.7 billion, earnings will come to $237.5 billion, and it would be trading on a PE ratio of 27.6x, assuming you use a discount rate of 8.8%.

- Given the current share price of $111.01, the bullish analyst price target of $213.26 is 47.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:NVDA. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.