Key Takeaways

- Geopolitical risks, regulatory pressures, and heavy customer concentration threaten Lam's revenue growth, profit margins, and supply chain stability.

- Rising R&D, sustainability costs, and disruptive tech shifts could outpace efficiency gains, leading to increased earnings volatility and a shrinking addressable market.

- Leadership in advanced semiconductor equipment, strong R&D and operational efficiency, and expanding service business collectively boost revenue stability, profit margins, and long-term growth resilience.

Catalysts

About Lam Research- Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits.

- Mounting geopolitical tensions and expanding export controls are likely to constrain Lam Research's access to key overseas markets-particularly in China, where restrictions on shipments to some customers removed approximately $700 million in expected second half revenue for 2025-with a resulting drag on revenue growth, higher compliance costs, and increased exposure to supply chain disruptions, all of which could pressure long-term net margins.

- The escalation of environmental regulations and intensifying ESG requirements are projected to force substantial increases in sustainability-related investments, raising operating expenses and diminishing future profitability as Lam contends with both higher direct costs and possible constraints on product sales.

- Lam's overreliance on a small number of major semiconductor manufacturers leaves its revenue and earnings vulnerable to fluctuations in customer capital expenditures and shifting vendor preferences; this concentration risk is amplified by the potential for foundry and NAND upgrade cycles-currently a core growth driver-to decelerate in coming years, resulting in increasing earnings volatility.

- Despite recent operational efficiency gains, persistent upward trajectory in research and development spending and a need to continually invest in advanced technology may outstrip the incremental margin improvements from cost discipline, threatening long-term operating margin stability if innovation cycles accelerate or competitive pressures intensify.

- The rapid adoption of alternative semiconductor architectures, such as advanced packaging or chiplet integration, threatens to erode demand for traditional etch and deposition equipment; coupled with escalating industry capital intensity-making advanced tools unaffordable for most smaller customers-Lam's addressable market could contract while pricing power and future revenue growth diminish.

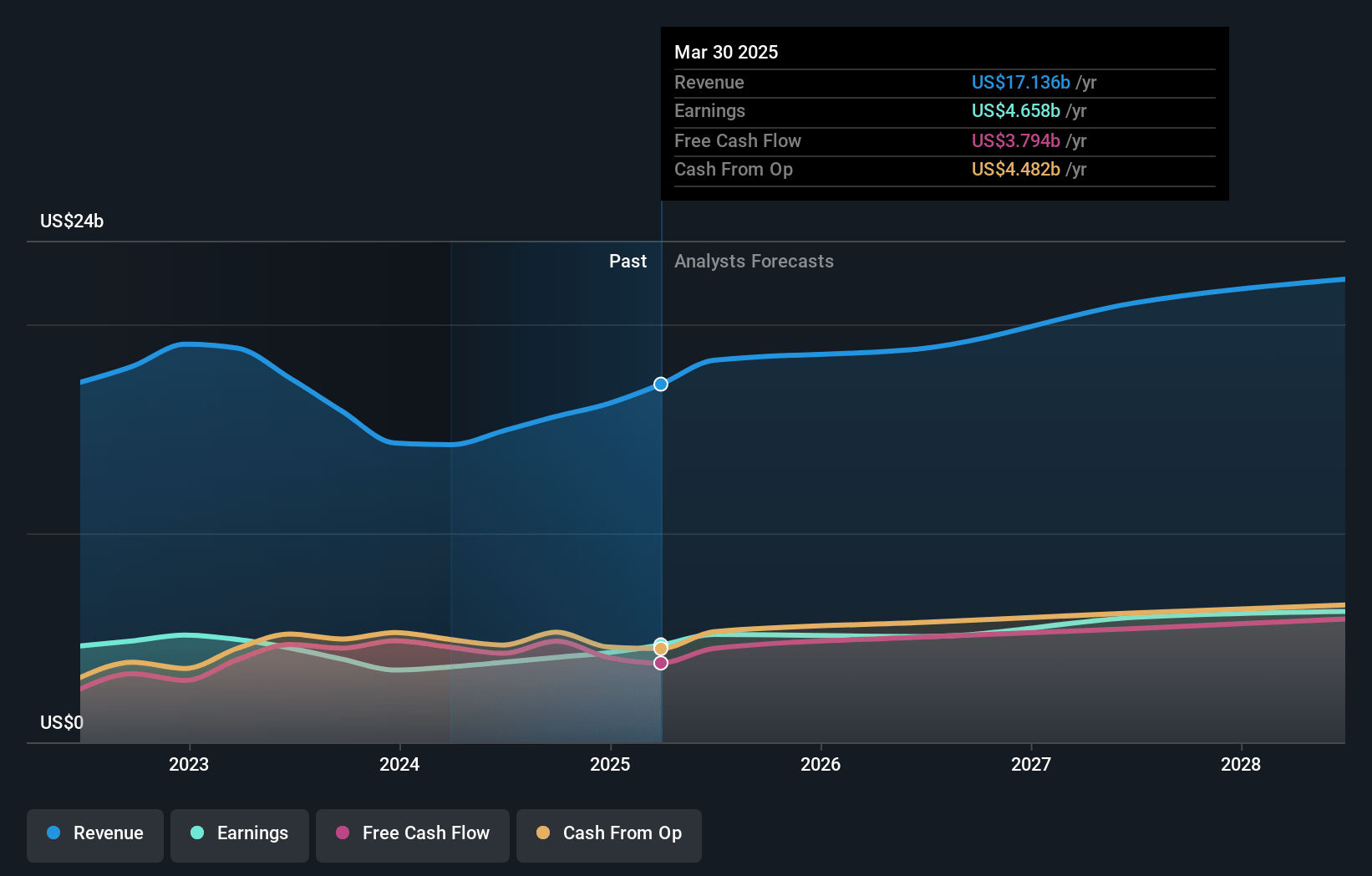

Lam Research Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Lam Research compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Lam Research's revenue will grow by 8.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 27.2% today to 29.0% in 3 years time.

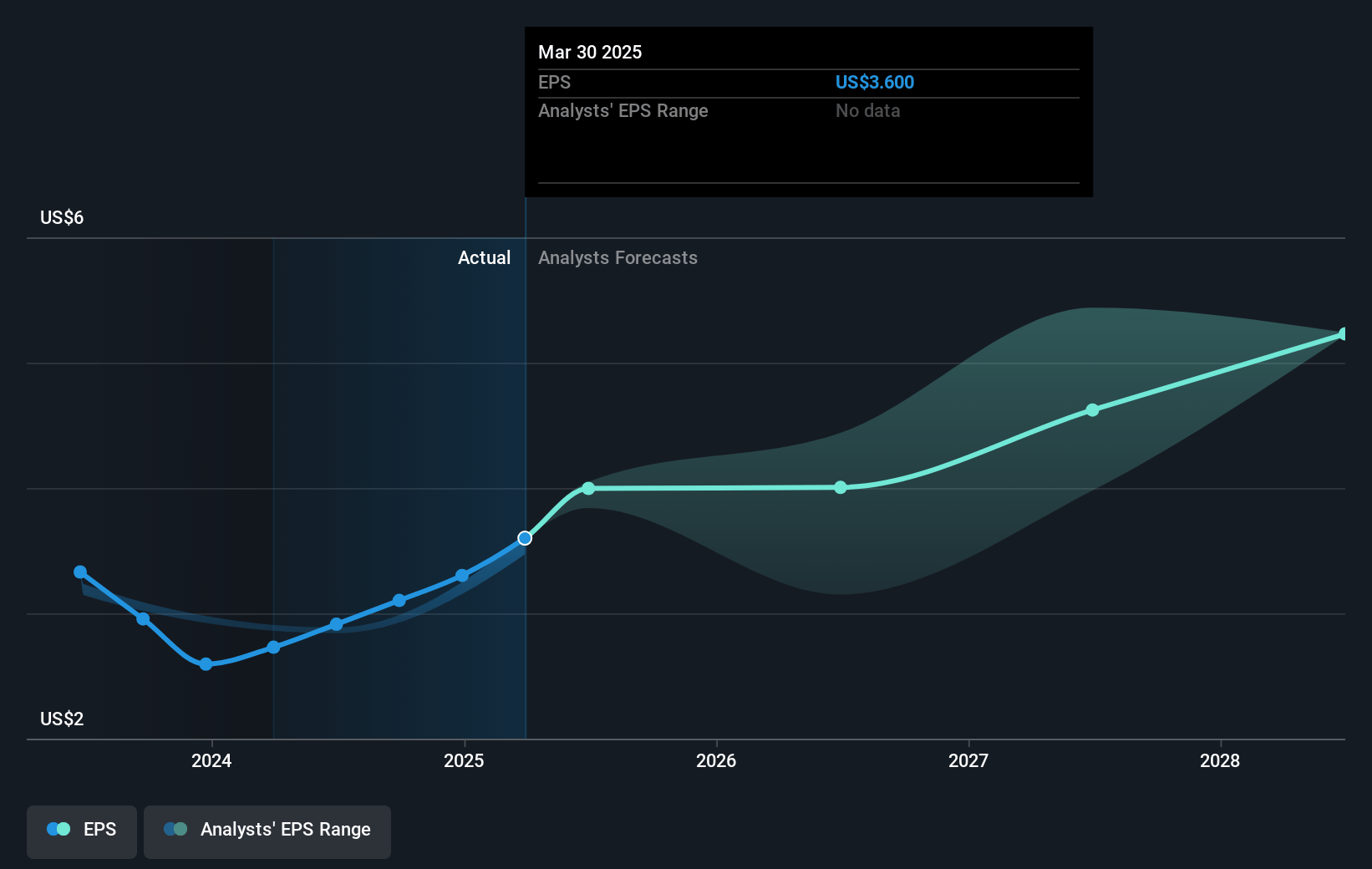

- The bearish analysts expect earnings to reach $6.3 billion (and earnings per share of $5.22) by about July 2028, up from $4.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.0x on those 2028 earnings, down from 27.6x today. This future PE is lower than the current PE for the US Semiconductor industry at 31.1x.

- Analysts expect the number of shares outstanding to decline by 1.51% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.6%, as per the Simply Wall St company report.

Lam Research Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The proliferation of AI, machine learning, and advanced data-centric applications is fueling a technology-driven upgrade and new equipment cycle, as evidenced by Lam's strong product momentum and customer wins in areas such as gate-all-around, backside power distribution, advanced packaging, and dry EUV photoresist processing, which is likely to bolster revenues and order pipeline for years to come.

- Lam Research's sustained investment in R&D and leadership in core etch and deposition technologies, highlighted by record gross margins (49 percent for the March quarter) and new product launches (like the Akara etch system and Halo molybdenum ALD), positions the company to expand its served addressable market and sustain or grow its net profit margins over the long term.

- The company's strong installed base and continued expansion of the Customer Support Business Group, including upgrades and long-term service contracts, increase revenue resiliency and reduce earnings volatility, as seen with record upgrade revenues and multiyear spares agreements signed with key customers.

- Lam's flexible global manufacturing and supply chain strategy, along with its operational efficiency initiatives (such as the close to customer approach), have materially improved profitability and margins since 2022, making it more resilient to tariff risks or regional disruptions and supporting long-term earnings growth.

- The ongoing migration to advanced semiconductor nodes (such as sub-5nm, 3D NAND, and advanced DRAM), alongside robust global fab investments and government incentives for onshoring, directly drive demand for Lam's equipment portfolio and support a growing and stable revenue base regardless of cyclical fluctuations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Lam Research is $70.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Lam Research's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $125.0, and the most bearish reporting a price target of just $70.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $21.6 billion, earnings will come to $6.3 billion, and it would be trading on a PE ratio of 18.0x, assuming you use a discount rate of 9.6%.

- Given the current share price of $100.37, the bearish analyst price target of $70.0 is 43.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.