Last Update 29 Nov 25

KOPN: Expanding Government Contracts Will Drive Increased Share Momentum Ahead

Narrative Update on Kopin

Analysts have raised their price targets for Kopin, with recent updates moving from $3.00 to $4.00. They cite the company's robust project pipeline and continued government support, despite ongoing funding headwinds.

Analyst Commentary

Bullish analysts have recently highlighted several key factors underpinning their positive outlook on Kopin. However, they have also identified several challenges and risks that could impact the company’s trajectory.

Bullish Takeaways- Recent increases in price targets reflect confidence in Kopin’s robust project pipeline and ongoing growth prospects.

- Government contracts, particularly with the Department of Defense, affirm Kopin’s standing as a preferred supplier of microdisplay technology.

- Strategic investments, such as the one from a global manufacturer of thermal and night vision systems, are viewed as transformational for Kopin’s long-term prospects.

- Resolution of major legal disputes, including reduced financial exposure from litigation, is perceived as risk mitigation that lowers risk for the investment story.

- Ongoing government funding headwinds continue to represent a near-term challenge to Kopin’s ability to execute on its project pipeline.

- While contract wins bolster investor confidence, dependence on government and defense contracts could limit exposure to broader commercial markets.

- Despite recent favorable litigation outcomes, further financial obligations from past lawsuits remain a risk to operational flexibility.

What's in the News

- Kopin will unveil a prototype of its new wireless simulated binoculars at the Interservice/Industry Training, Simulation and Education Conference (I/ITSEC) 2025. The device features high-resolution color OLED displays and advanced positional tracking (Key Developments).

- Kopin secured its first production order for MicroLED displays in combat aircraft from a tier one aerospace company. The order is valued at approximately $3 million, with delivery set for the second half of 2026 (Key Developments).

- The company closed a $15 million private placement transaction in October 2025 and received regulatory approval (Key Developments).

- Kopin was awarded a $15.4 million contract from the U.S. Army to accelerate development of ultra-bright, full-color MicroLED displays for ground soldier augmented reality applications (Key Developments).

- An appeal has been filed by Kopin regarding a $19.7 million judgment in the Blue Radios Inc. v. Kopin Corporation case. This appeal is backed by a $23 million bond to cover the judgment, legal expenses, and interest (Key Developments).

Valuation Changes

- Fair Value remains unchanged at $4.85 per share, reflecting stability in underlying assumptions.

- Discount Rate has fallen slightly from 10.51% to 10.39%, which indicates marginally lower perceived risk.

- Revenue Growth projection is steady at approximately 31.04%, with no change from the previous estimate.

- Net Profit Margin has risen slightly, increasing from 10.17% to 10.88%.

- Future P/E ratio has declined from 135.41x to 125.68x. This suggests improved earnings expectations relative to price.

Key Takeaways

- Strategic partnership and investments expand access to global defense markets, driving revenue growth and improving earnings reliability.

- Advanced manufacturing, automation, and display innovation boost efficiency, lower costs, and increase margins while strengthening technology leadership and market opportunities.

- Ongoing losses, reliance on volatile government funding, unproven cost-saving efforts, nonexclusive partnerships, and rapid tech shifts threaten Kopin's profitability, margins, and future relevance.

Catalysts

About Kopin- Develops, manufactures, and sells microdisplays, subassemblies, and related components for defense, enterprise, industrial, and consumer products in the United States, the Asia-Pacific, Europe, and internationally.

- The strategic partnership and $15 million investment from Theon International positions Kopin to broaden its reach into key defense markets in Europe, Southeast Asia, and NATO allied countries, allowing access to increased defense budgets and long-term military modernization programs; this is expected to drive significant revenue growth and improved earnings visibility.

- Application-specific solutions (such as DayVAS and DarkWAVE), developed in collaboration with Theon, and increased manufacturing utilization at the Dalgety Bay facility are likely to boost production efficiency and capacity absorption, thereby increasing gross margins and reducing operating costs.

- Acceleration in automation and optical inspection within Kopin's manufacturing line is set to yield material operating expense reductions by late 2025 and into 2026, raising profitability and net margins as volume scales.

- Major secular increases in global defense spending and a $22 billion+ pipeline of U.S. military technology upgrades (such as the SBMC/IVAS program), for which Kopin's microdisplays are integral, support a robust outlook for future contract wins, enhancing long-term revenue stability and growth.

- Ongoing innovation in OLED, MicroLED, and custom neural display hardware for AR, VR, and next-gen soldier vision systems strengthens Kopin's technology leadership, leading to new market opportunities and premium product mix, with the potential to improve both top-line revenue and gross profitability over time.

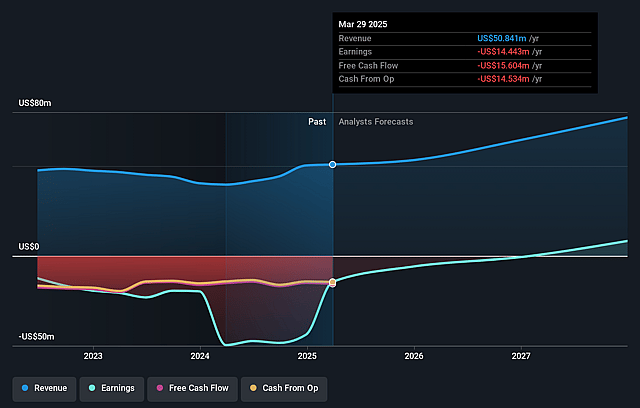

Kopin Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kopin's revenue will grow by 19.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -29.1% today to 14.6% in 3 years time.

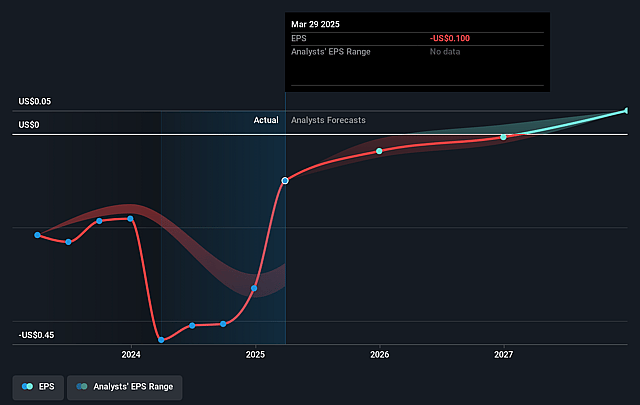

- Analysts expect earnings to reach $11.8 million (and earnings per share of $0.07) by about September 2028, up from $-13.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 46.3x on those 2028 earnings, up from -23.4x today. This future PE is greater than the current PE for the US Semiconductor industry at 30.1x.

- Analysts expect the number of shares outstanding to grow by 1.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.08%, as per the Simply Wall St company report.

Kopin Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent net losses (Q2 2025 net loss of $5.2 million on $8.5 million in revenue), high operating expenses, and negative cash flow ($7.6 million used in operating activities in H1 2025) raise concerns about long-term profitability and may require future capital raises, potentially diluting shareholders and impacting earnings per share.

- The company's significant reliance on government and defense sector funding exposes Kopin to budgeting delays and volatility, as seen in Q2 when government uncertainty led to a "sales vacuum"; continued dependency could destabilize revenue streams and limit margin visibility in the long term.

- Although new partnerships like Theon present opportunities, the manufacturing automation and cost-saving initiatives are not yet fully operational or proven, and delays or underperformance in these could keep gross margins low (94% cost of product revenues in Q2 2025), directly affecting net margins and profitability.

- Theon's supply agreements are nonexclusive and Kopin's competitors also have OLED supply deals with them; this lack of exclusivity risks limited market share gains, raises the threat of pricing competition, and could constrain Kopin's revenue growth and margin improvement if competitors outpace on technology or price.

- Market and technology trends suggest rapid evolution in display technologies (e.g., OLED, MicroLED, LCD), with the risk that if Kopin cannot match or surpass competitors in innovation, quality, and scalability, its core products may lose relevance and its long-term revenues and earnings potential could diminish.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.5 for Kopin based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $81.0 million, earnings will come to $11.8 million, and it would be trading on a PE ratio of 46.3x, assuming you use a discount rate of 10.1%.

- Given the current share price of $2.05, the analyst price target of $2.5 is 18.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Kopin?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.