Catalysts

About Kopin

Kopin develops advanced microdisplay and optical solutions for defense, drone, and medical visualization systems.

What are the underlying business or industry changes driving this perspective?

- Although rising global defense budgets and modernization initiatives are expanding demand for advanced night vision and soldier wearable systems, Kopin is highly dependent on a limited number of large U.S. and NATO programs that could be delayed or re-scoped, which may constrain the timing of expected revenue growth and push out earnings inflection.

- While the projected surge in drone deployment and first person viewing systems could materially increase unit demand for microdisplays, heavy exposure to a still evolving procurement framework and potential competition for design wins means Kopin may not fully translate this volume opportunity into sustainable top line acceleration or scale driven margin expansion.

- Although long duration contracts, including IDIQ structures and programs with budget visibility out to 2030, support future revenue baselines, execution risk in ramping production, completing fab lite transition and integrating automation could keep cost of goods elevated and delay the improvement in gross margins.

- While emerging medical visualization partnerships and European defense collaborations create new end markets that can diversify revenue, these initiatives require additional R&D and commercialization investment, which may weigh on operating expenses and net income before they reach meaningful revenue contribution in 2027 and 2028.

- Although the development of sovereign color MicroLED and neural display technologies positions Kopin for next generation soldier and robotic systems, long qualification cycles, technical execution risk and competing solutions could slow adoption, limiting the near to midterm impact on revenue growth and overall earnings power.

Assumptions

This narrative explores a more pessimistic perspective on Kopin compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

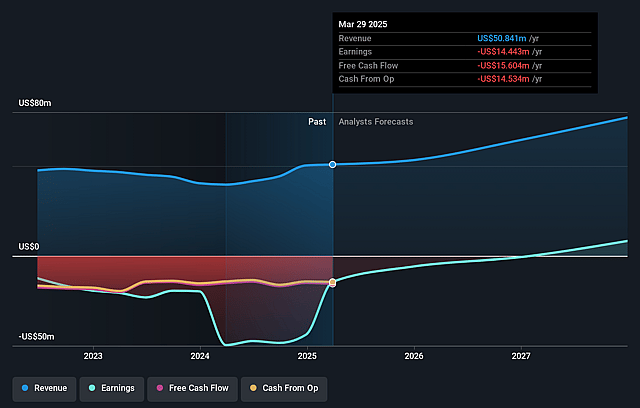

- The bearish analysts are assuming Kopin's revenue will grow by 24.8% annually over the next 3 years.

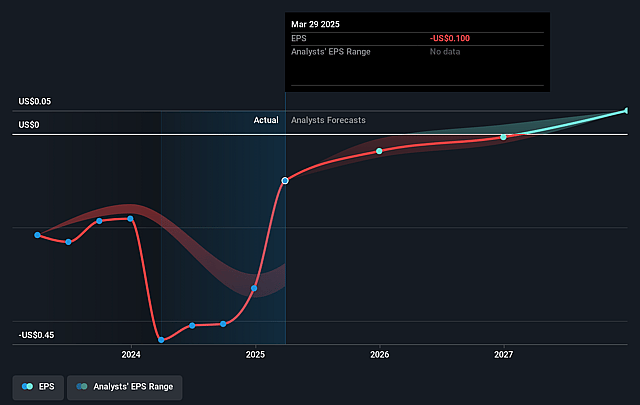

- The bearish analysts assume that profit margins will increase from -13.5% today to 0.1% in 3 years time.

- The bearish analysts expect earnings to reach $85.2 thousand (and earnings per share of $0.0) by about December 2028, up from $-6.1 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $8.9 million.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11063.5x on those 2028 earnings, up from -76.1x today. This future PE is greater than the current PE for the US Semiconductor industry at 38.1x.

- The bearish analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.43%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The company’s growth thesis is heavily tied to sustained increases in global defense and drone spending. Any de-escalation in geopolitical tensions or shift in government priorities toward non-defense areas could reduce procurement volumes for night vision, thermal imaging and drone related systems, pressuring long term revenue growth and limiting operating leverage in earnings.

- Despite a strong opportunity pipeline and multiple IDIQ and long dated programs, near term revenues are essentially flat year over year and research and development revenue has declined materially. This suggests that delays in converting development awards and pipeline items into high margin production could constrain revenue growth and keep net margins volatile.

- The strategy depends on successful execution of a fab lite transition, automation rollout and large scale ramp in advanced technologies such as color MicroLED and neural display. Any technical setbacks, yield issues or slower than expected automation benefits would keep cost of goods and operating expenses elevated, limiting improvement in gross margin and overall earnings.

- Management is targeting tens of millions of dollars in European and SBMC related revenues from a base of effectively zero defense revenue in Europe today. Setbacks in partner execution, competitive design losses or changes in program specifications could mean actual order flow falls short of expectations, weakening the anticipated revenue acceleration and profitability inflection.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Kopin is $3.25, which represents up to two standard deviations below the consensus price target of $4.85. This valuation is based on what can be assumed as the expectations of Kopin's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.0, and the most bearish reporting a price target of just $3.25.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be $88.6 million, earnings will come to $85.2 thousand, and it would be trading on a PE ratio of 11063.5x, assuming you use a discount rate of 10.4%.

- Given the current share price of $2.66, the analyst price target of $3.25 is 18.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Kopin?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.