Key Takeaways

- Expanding leadership in automotive and advanced display ICs, coupled with successful new product launches, supports sustained multi-year revenue and margin growth.

- Rapid growth in AI-powered sensing, AR, and diversified supply chain strengthens profit diversity and operational resilience across multiple technology markets.

- Heavy dependence on volatile display IC markets, rising competition, and uncertain diversification threaten margins and revenue stability, while costs and regulatory pressures risk long-term profitability.

Catalysts

About Himax Technologies- A fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, Korea, Japan, the United States, and internationally.

- Himax's growing leadership in automotive display ICs, including cutting-edge technologies like TDDI, LTDI and local dimming Tcon, positions it to capture increasing value per vehicle as automakers rapidly expand in-cabin displays and touch interfaces in both electric and autonomous vehicles. Over 500 design-in projects and several wins with global car brands are set to enter mass production from late 2025 onward, supporting strong multi-year revenue growth and incremental gains to gross margin due to higher content-per-unit.

- The accelerating adoption of OLED, MicroLED and advanced display technologies in premium notebooks, tablets and automotive applications, driven by the shift toward AI PCs and premium user experiences, enables Himax to expand its addressable market and capture higher ASPs with a full suite of display IC solutions—this underpins robust top-line growth and the potential for long-term margin expansion.

- Himax's WiseEye ultralow power AI sensing platform is seeing rapid design win momentum across AI PCs, smart retail, smart door locks, and AR glasses, directly benefiting from the proliferation of display

- and vision-centric IoT devices. As WiseEye products move into mass production in 2025-2026, the segment is on track to become a high-margin growth engine, increasing both revenue diversity and overall net profit.

- Recent advancements in LCoS microdisplays and co-packaged optics (CPO) solutions tap into surging demand for next-generation AR devices and data center infrastructure. Mass production of CPO products in 2026 and growing partnerships with technology leaders position Himax for outsized earnings growth in the high-performance computing and immersive display markets, with significant contributions to both revenue and margins expected.

- The company's ongoing diversification and localization of its supply chain, combined with its fabless model and strict cost management, ensure resilient operational efficiency and supply security in a volatile global environment. This supports the preservation or improvement of net margins while positioning the company to quickly capitalize on future demand surges across multiple high-growth technology sectors.

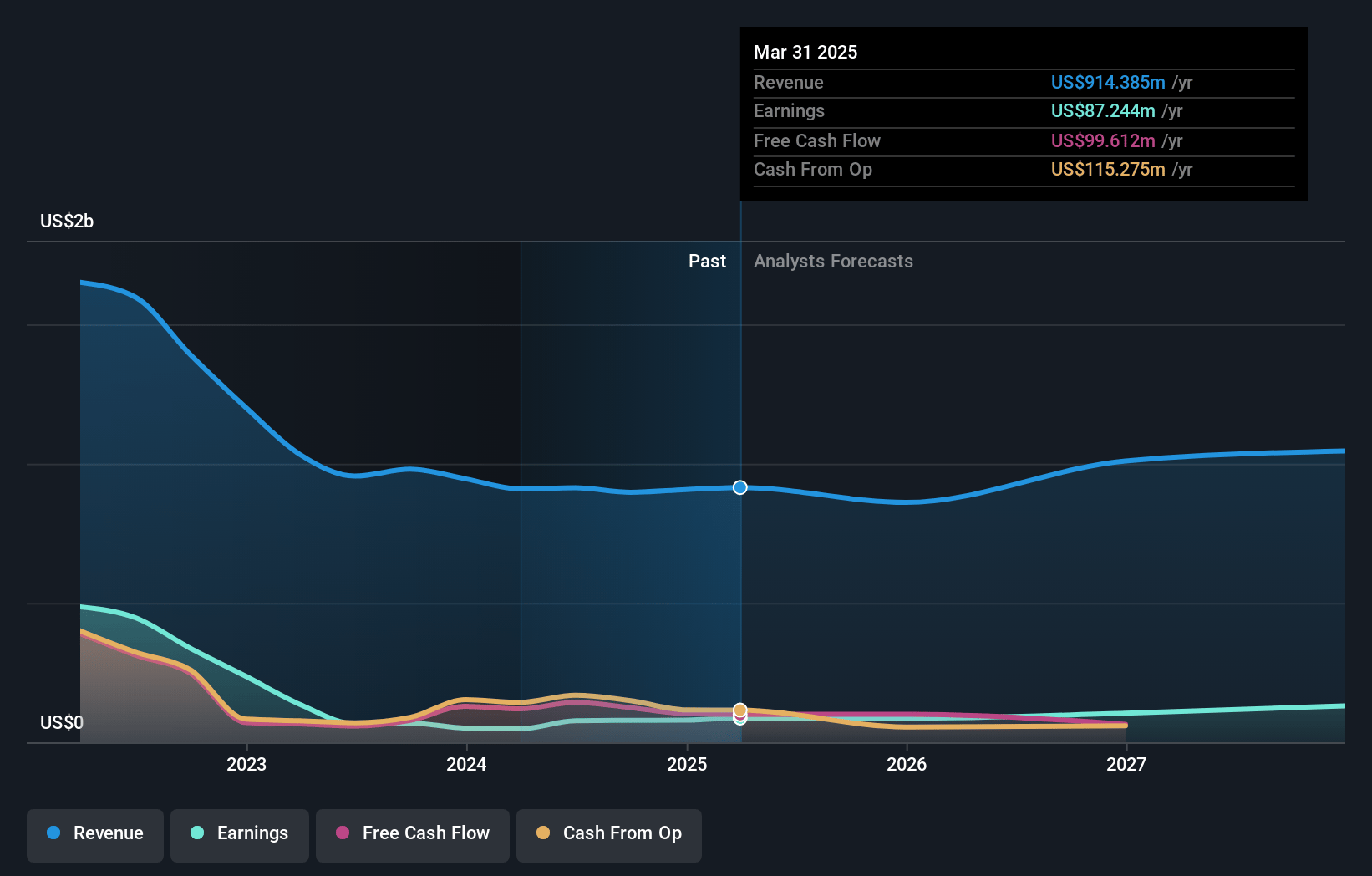

Himax Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Himax Technologies compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Himax Technologies's revenue will grow by 5.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.5% today to 13.0% in 3 years time.

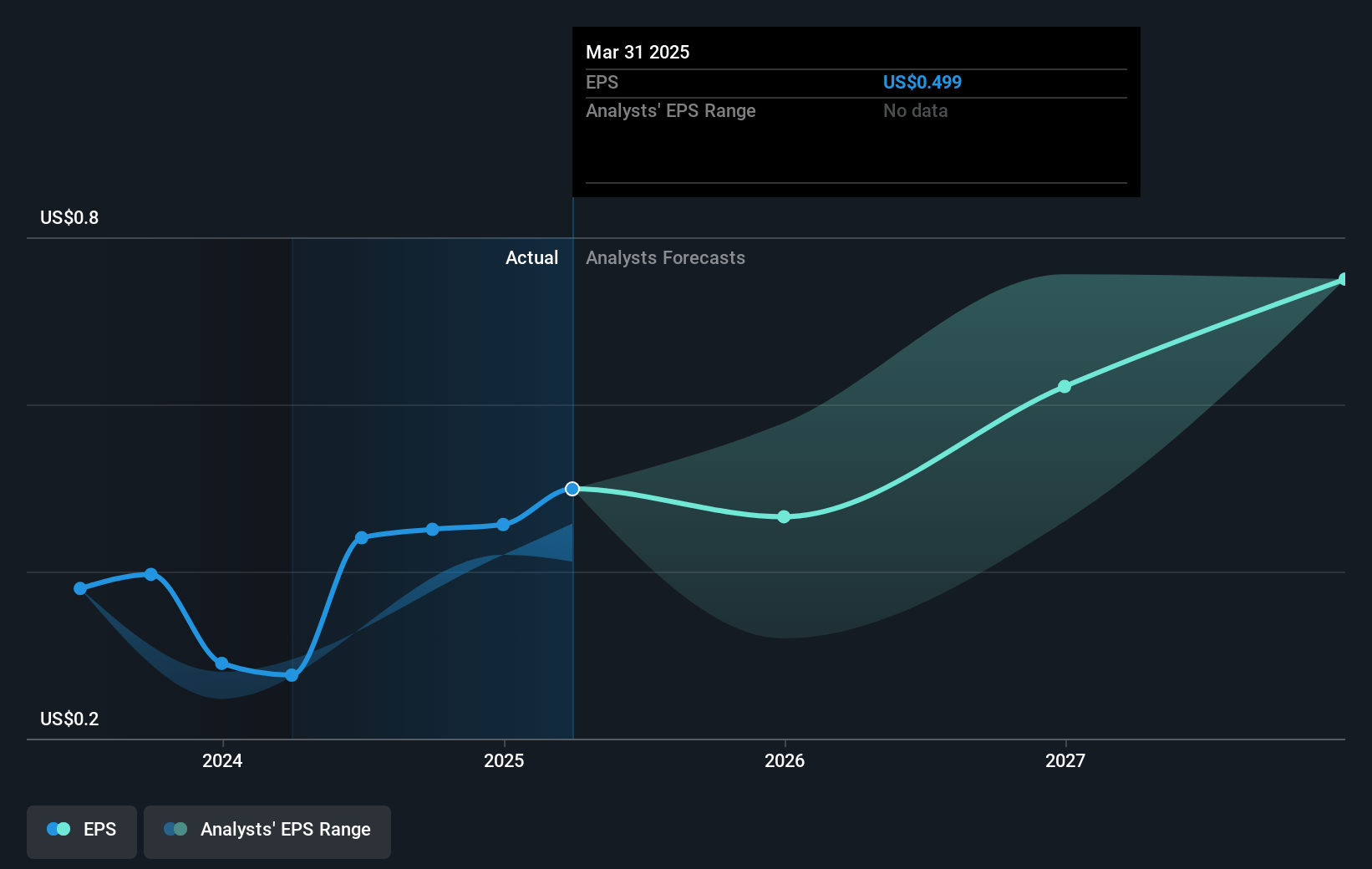

- The bullish analysts expect earnings to reach $139.5 million (and earnings per share of $0.8) by about July 2028, up from $87.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.8x on those 2028 earnings, up from 18.8x today. This future PE is lower than the current PE for the US Semiconductor industry at 31.6x.

- Analysts expect the number of shares outstanding to grow by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.21%, as per the Simply Wall St company report.

Himax Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Himax remains heavily reliant on the automotive and consumer electronics display IC market, exposing the company to cyclical demand fluctuations, changing consumer preferences, and muted global auto or smartphone sales, all of which could negatively impact long-term revenue stability and topline growth.

- The company’s core display driver IC business faces ongoing commoditization and increasing competition from larger, vertically integrated players and local Chinese rivals, which threatens pricing power and could erode gross margins and net profitability over time.

- Long-term secular shifts—such as the rise of system-on-chip integration by display panel makers, the acceleration of regional semiconductor supply chains outside of Taiwan, and a global pivot toward energy-efficient and display-less AI-driven devices—risk shrinking Himax’s total addressable market and weakening both revenues and margins.

- Despite ambitions to diversify into higher-margin or next-generation product segments like OLED, micro-LED, AR/VR, ultralow-power AI, and CPO, meaningful revenue contribution from these initiatives remains uncertain and subject to technology validation, slow ramp-up, and intense competition, limiting their impact on consolidated net income and revenue in the near and medium term.

- Elevated operating expenses for R&D and capital-intensive projects, alongside mounting environmental and regulatory requirements, may place increasing strain on Himax’s cost structure, pressuring operating margins and reducing long-term earnings growth if new product bets do not ramp successfully.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Himax Technologies is $12.3, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Himax Technologies's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.3, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $139.5 million, and it would be trading on a PE ratio of 21.8x, assuming you use a discount rate of 12.2%.

- Given the current share price of $9.38, the bullish analyst price target of $12.3 is 23.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.