Key Takeaways

- Strategic expansions and technology advancements could enhance efficiency and uniqueness, driving revenue growth and profitability.

- Strong contracted backlog and strategic cost optimizations suggest robust future revenue and improved net margins.

- Manufacturing issues and market pressures, combined with external operational challenges, pose significant risks to First Solar's revenue, margins, and reputation.

Catalysts

About First Solar- A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, Japan, Chile, and internationally.

- First Solar's recent expansions, such as the new facility in Alabama and ongoing construction in Louisiana, are projected to increase their global nameplate capacity to over 25 gigawatts by 2026. This expansion is likely to drive future revenue growth.

- With plans to launch the CuRe manufacturing line and further develop perovskite technology, First Solar aims to enhance its product offerings, potentially leading to increased revenue and margins due to higher product efficiency and uniqueness.

- The company's significant contracted backlog of 73.3 gigawatts as of the end of the third quarter indicates strong future revenue streams and market demand.

- First Solar's strategic utilization of the IRA domestic content bonus and potential benefits from the CHIPS ITC to optimize its supply chain could improve their net margins by reducing costs and increasing profitability.

- Intellectual property advancements and enforcement, specifically relating to their TOPCon patent portfolio, present opportunities for potential revenue streams through licensing deals, thus impacting earnings positively.

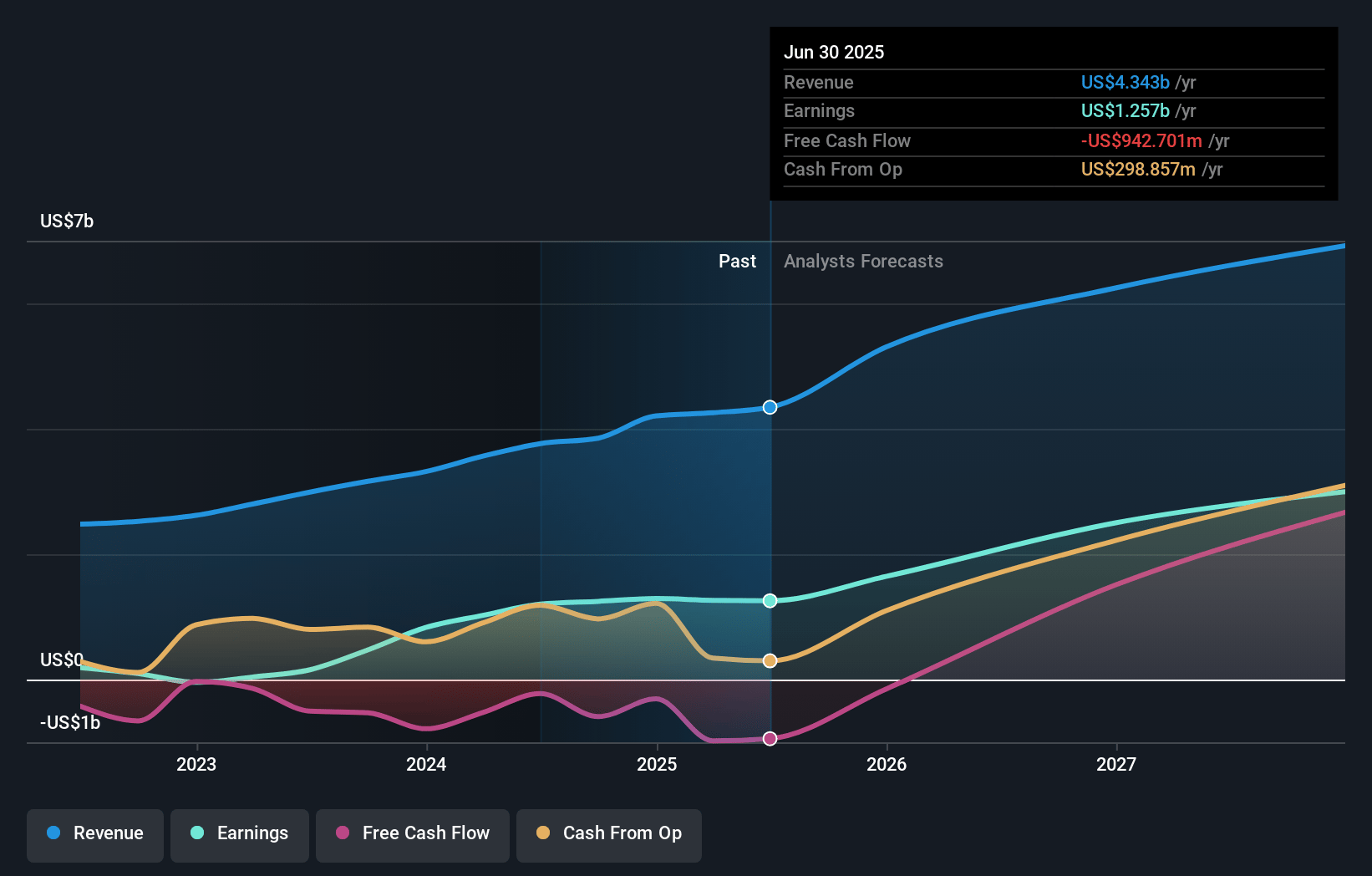

First Solar Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming First Solar's revenue will grow by 21.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 32.4% today to 48.6% in 3 years time.

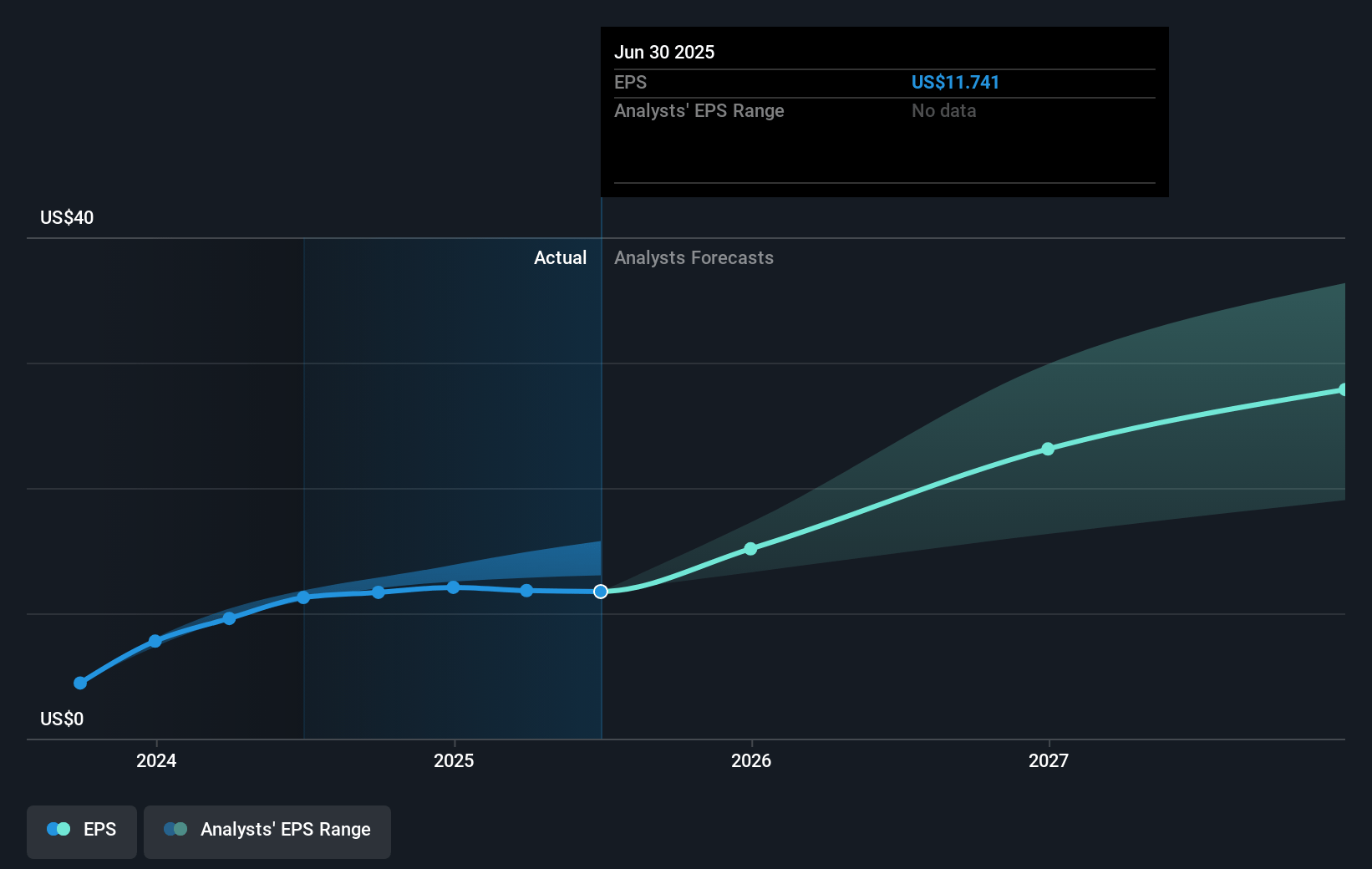

- Analysts expect earnings to reach $3.3 billion (and earnings per share of $31.07) by about January 2028, up from $1.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $2.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, down from 13.7x today. This future PE is lower than the current PE for the US Semiconductor industry at 31.2x.

- Analysts expect the number of shares outstanding to decline by 0.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.99%, as per the Simply Wall St company report.

First Solar Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- First Solar's third quarter was impacted by a $50 million product warranty charge due to manufacturing issues with their Series 7 product, which could affect net margins due to increased costs and potential reputational risk.

- The company experienced delays and operational challenges, such as hurricanes and strikes affecting its supply chain and logistics, which could pose risks to revenue as project timelines and deliveries are disrupted.

- There is significant pressure in the Indian market from Chinese competitors, leading to artificially low prices and impacting the ASP (Average Selling Price) of their products, which could hurt First Solar's overall revenue and profit margins.

- Ongoing intellectual property disputes in the solar industry could create legal and financial uncertainties for First Solar, potentially impacting their ability to execute and possibly affecting net margins and earnings due to legal costs or licensing issues.

- There are increasing concerns about project delays and development risks in the US, which could lead to further revenue deferrals or contract terminations, impacting First Solar's revenue recognition and cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $267.53 for First Solar based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $360.0, and the most bearish reporting a price target of just $190.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.8 billion, earnings will come to $3.3 billion, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 8.0%.

- Given the current share price of $160.24, the analyst's price target of $267.53 is 40.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

PA

parham

Community Contributor

lluminating the Path to Sustainable Growth

First Solar Inc. stands at the forefront of the renewable energy revolution, pioneering sustainable solutions in the global energy landscape.

View narrativeUS$331.88

FV

53.2% undervalued intrinsic discount24.48%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

2users have followed this narrative

6 months ago author updated this narrative