Key Takeaways

- Supply-demand imbalances and policy uncertainties could limit international product allocation, affecting revenue potential.

- Increased costs from tariffs and manufacturing issues are impacting production costs and net margins.

- Production issues and policy uncertainties threaten First Solar's margins and earnings, compounded by trade disputes and tariff-induced cost increases.

Catalysts

About First Solar- A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

- First Solar is facing supply-demand imbalances due to uncertainties in the policy environment and customer project delays, which might lead to an underallocation of international products and consequently affect revenue potential.

- The company is experiencing increased costs due to tariffs on aluminum imports, and potential reciprocal tariffs could impact overall production costs, directly impacting net margins.

- The Series 7 manufacturing issues have led to warranty charges and shipment delays, which could result in ongoing additional costs and liabilities, affecting net income.

- Despite scaling operations, such as the ramping of new production facilities like the one in Louisiana, unforeseen expenses related to these expansions are likely to continue impacting First Solar's earnings.

- Challenges with the international policy environment, such as changes in Europe and India, are restricting market access for some products, which threatens revenue growth and limits the ability to optimize manufacturing capacity.

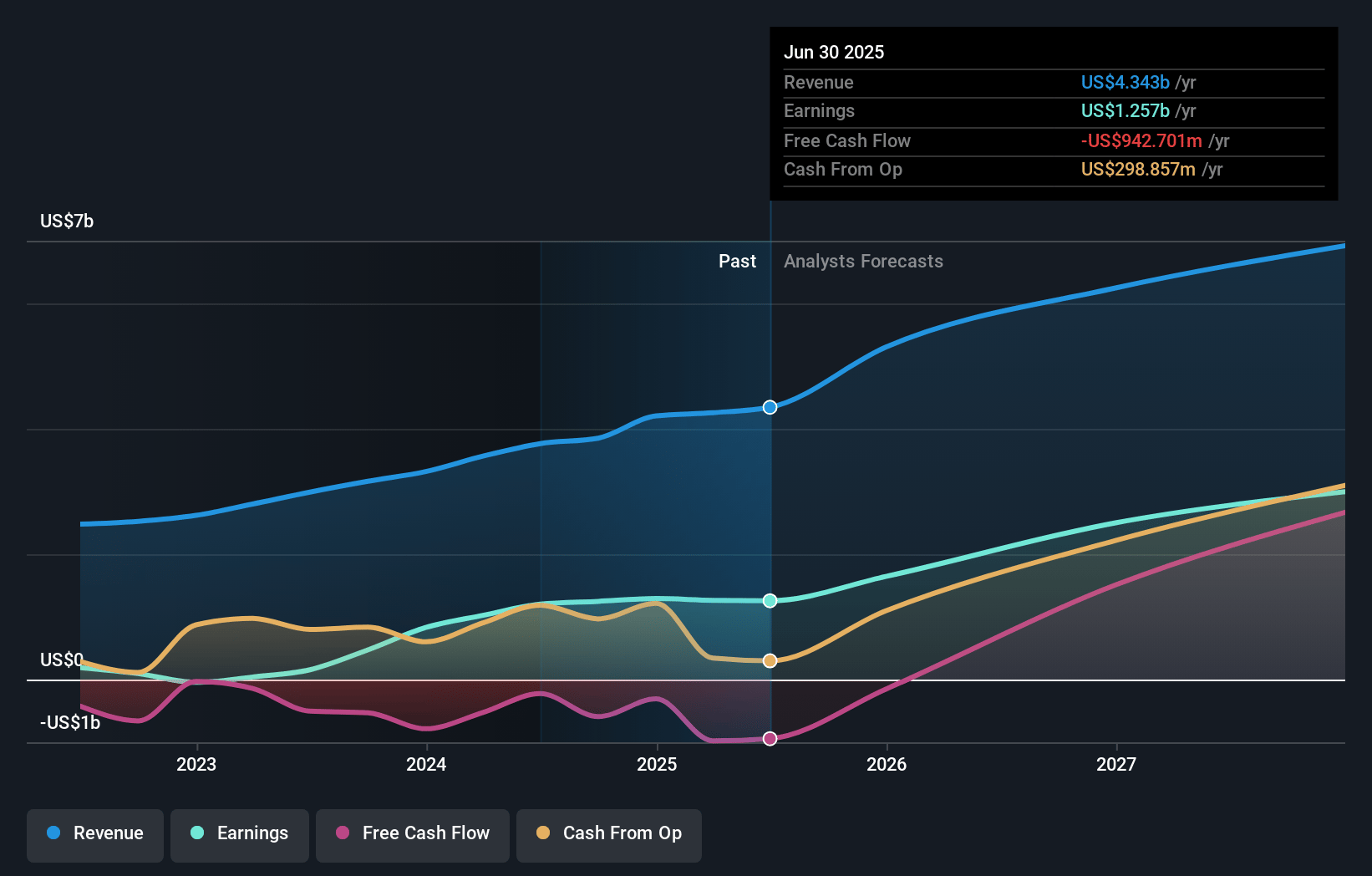

First Solar Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on First Solar compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming First Solar's revenue will grow by 14.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 30.7% today to 41.2% in 3 years time.

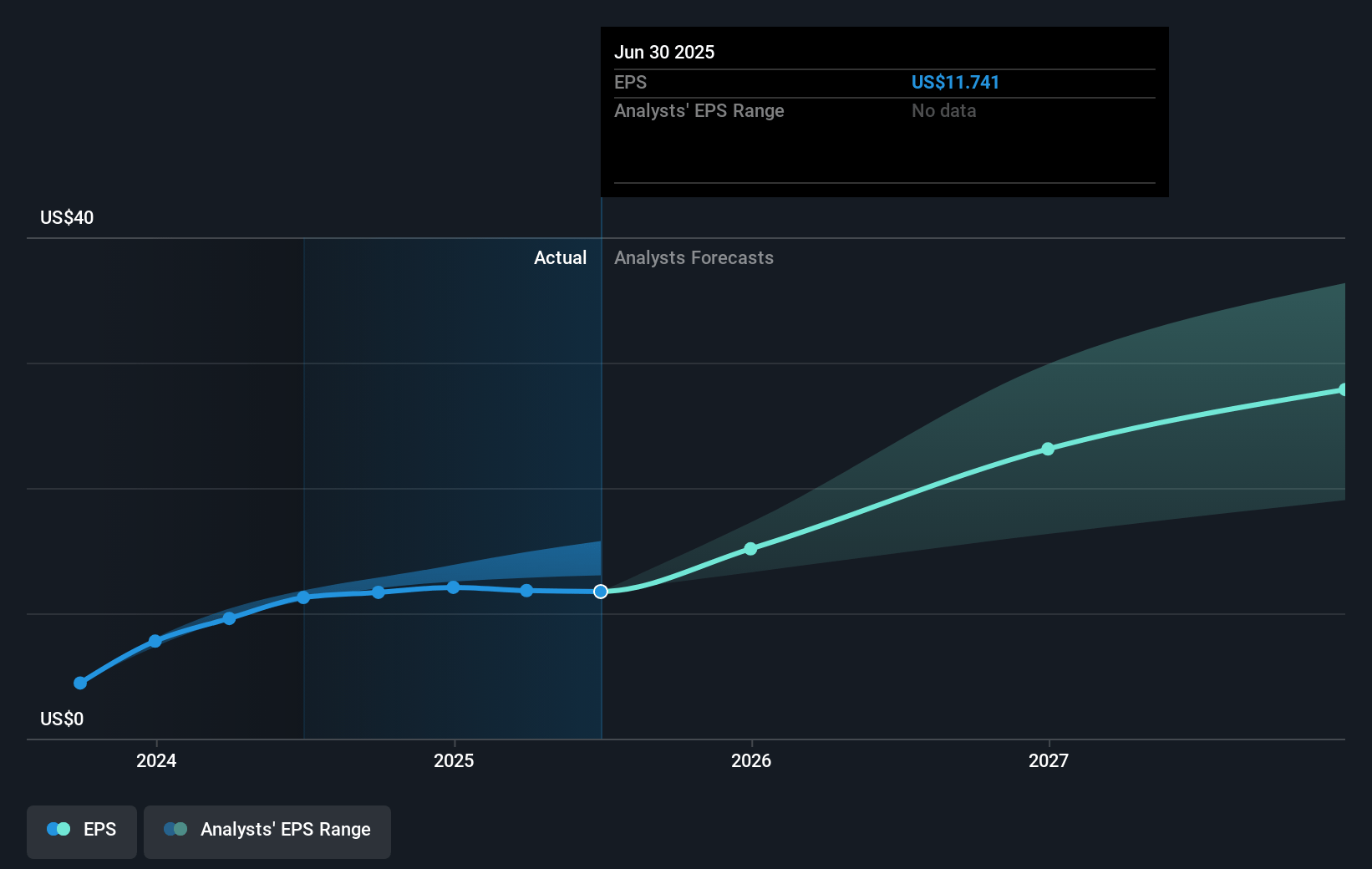

- The bearish analysts expect earnings to reach $2.6 billion (and earnings per share of $24.37) by about April 2028, up from $1.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.4x on those 2028 earnings, down from 10.6x today. This future PE is lower than the current PE for the US Semiconductor industry at 22.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.02%, as per the Simply Wall St company report.

First Solar Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- First Solar is dealing with warranty charges and production issues affecting its Series 7 modules, which are negatively impacting gross margins and could lead to increased costs if formal disputes arise. This presents a risk to net margins.

- With significant shipment delays and logistics costs stemming from manufacturing problems, the company might face challenges in meeting demand, affecting revenue predictions.

- Although First Solar shows a substantial contracted backlog, issues like uncertain policy environments post-U.S. elections have led to project delays and terminations, presenting a risk to future revenue and earnings consistency.

- The company has faced increased costs due to tariffs on imported materials such as aluminum, which could lead to higher production costs and negatively impact net margins.

- Ongoing trade and intellectual property disputes in the solar industry highlight potential risks that might involve First Solar, posing a threat to earnings stability and possibly increasing litigation expenses.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for First Solar is $194.9, which represents one standard deviation below the consensus price target of $232.12. This valuation is based on what can be assumed as the expectations of First Solar's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $304.0, and the most bearish reporting a price target of just $145.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $6.3 billion, earnings will come to $2.6 billion, and it would be trading on a PE ratio of 10.4x, assuming you use a discount rate of 9.0%.

- Given the current share price of $127.98, the bearish analyst price target of $194.9 is 34.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NasdaqGS:FSLR. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives