Key Takeaways

- Expanding global manufacturing capacity and next-gen solar technologies likely to boost revenue growth and improve net margins.

- Strong U.S. market focus and IP enforcement could drive net sales and create additional revenue streams.

- Manufacturing issues, policy uncertainties, and tariffs create cost pressures, impacting margins, sales, revenue, and earnings with added risks from contract delays and U.S. election outcomes.

Catalysts

About First Solar- A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

- First Solar's continued investments in expanding its global manufacturing capacity, including new facilities in Louisiana and Alabama and throughput optimization, are expected to push the company's global nameplate capacity to over 25 gigawatts by 2026. This significant increase in production capacity is likely to drive future revenue growth.

- The development and commercial rollout of First Solar's next-generation solar technologies, such as CuRe and perovskite, are expected to enhance the efficiency and performance of their products. This technological advancement will potentially lead to higher average selling prices (ASPs) and improved net margins in the future.

- The substantial contracted backlog, totaling 68.5 gigawatts with a potential for increased ASPs through technology-related adjusters, provides a significant pipeline of future revenue. This backlog will likely support stable and predictable earnings over the coming years.

- First Solar's strategic focus on the U.S. market, bolstered by the Inflation Reduction Act's domestic content provisions, positions the company to benefit from favorable policy measures aimed at boosting domestic solar manufacturing. This is expected to drive net sales growth and contribute positively to earnings.

- Ongoing intellectual property (IP) enforcement initiatives against competitors exploiting infringing technology, such as the TOPCon patent enforcement against JinkoSolar, may result in licensing revenue streams, which could enhance net margins and contribute additional earnings over time.

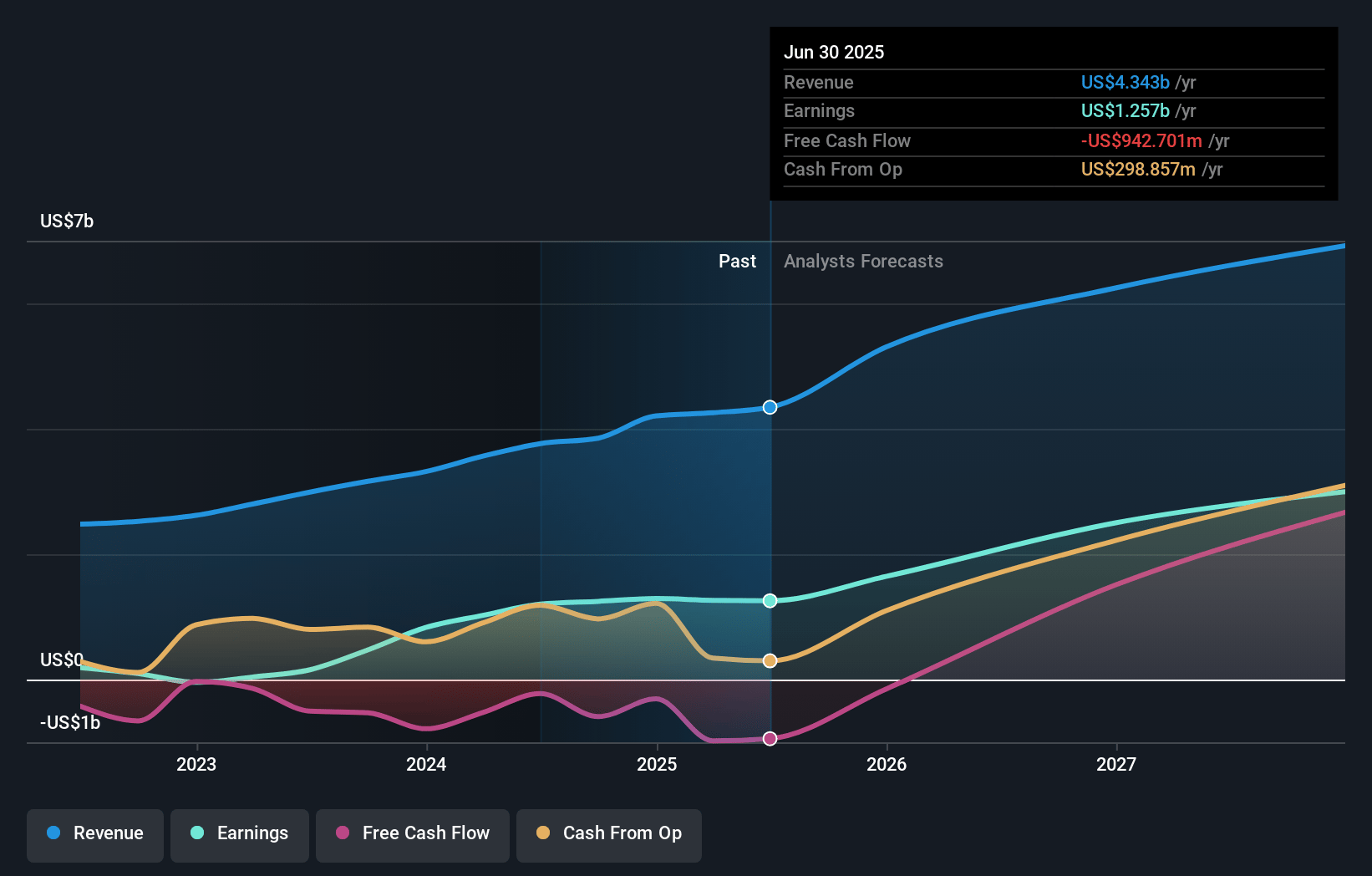

First Solar Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on First Solar compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming First Solar's revenue will grow by 22.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 30.7% today to 47.6% in 3 years time.

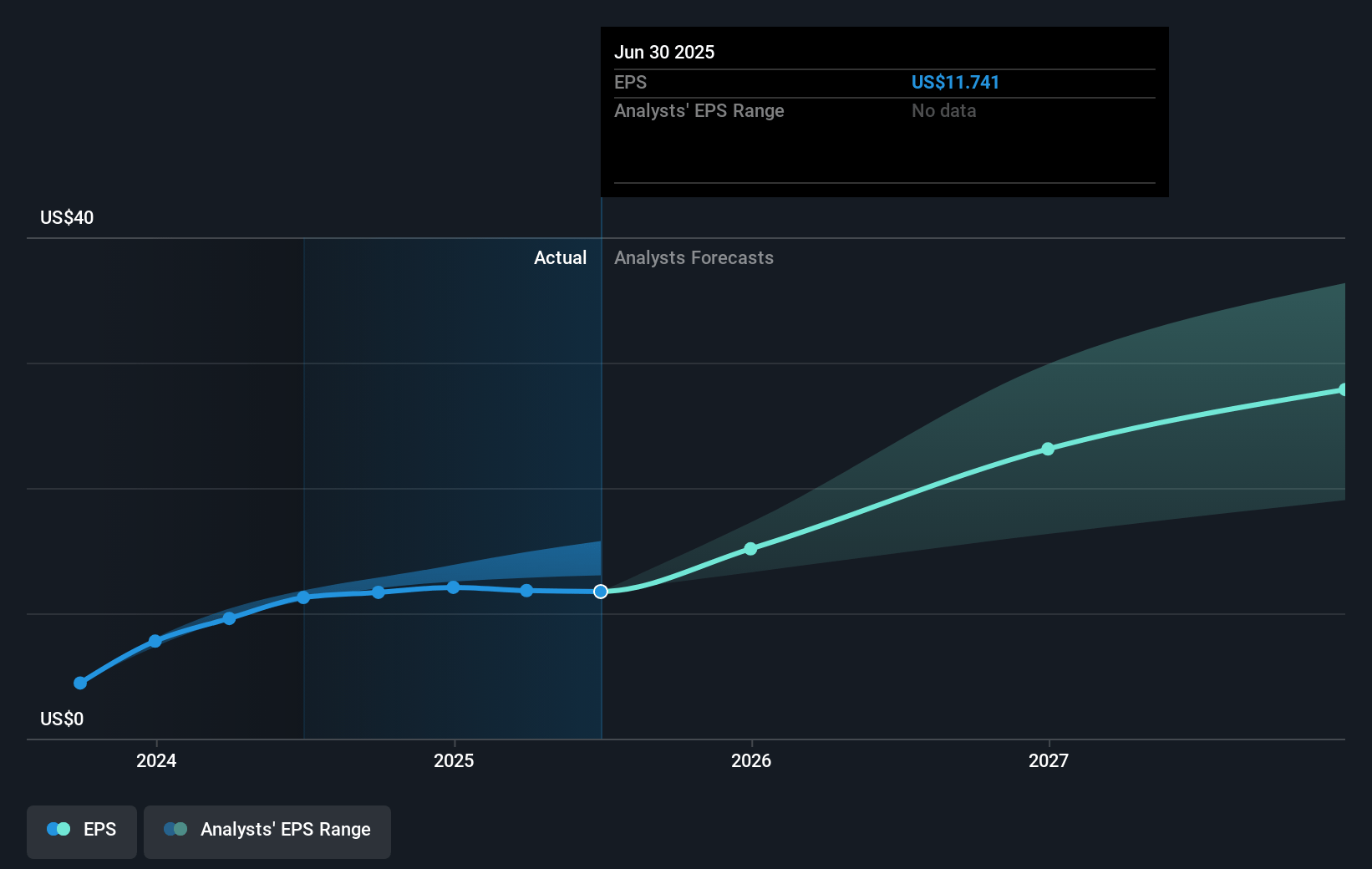

- The bullish analysts expect earnings to reach $3.7 billion (and earnings per share of $34.53) by about April 2028, up from $1.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.2x on those 2028 earnings, down from 10.9x today. This future PE is lower than the current PE for the US Semiconductor industry at 23.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.04%, as per the Simply Wall St company report.

First Solar Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Series 7 manufacturing issues have led to warranty charges estimated between 56 million and 100 million dollars, impacting the company's gross margins and potential earnings, with a risk of customer disputes which could affect future revenue.

- The uncertainty and delays in the current policy environment in key markets such as the U.S., Europe, and India, are leading to allocation challenges with international product, which could result in reduced sales and impact revenue.

- The imposition of new tariffs, such as the 25 percent Section 232 tariffs on aluminum imports, and the potential for further tariffs on Chinese-made products create additional cost pressures that will likely impact net margins.

- There is heightened uncertainty due to the U.S. elections and potential revisions to the IRA, which may delay domestic manufacturing expansions, affect demand, and ultimately create challenges to maintaining current revenue levels.

- Project development delays have led to contract terminations, which affect backlog stability and revenue visibility, creating risks that could deter earnings potential if replacement contracts are not secured under favorable terms.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for First Solar is $270.68, which represents one standard deviation above the consensus price target of $233.88. This valuation is based on what can be assumed as the expectations of First Solar's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $304.0, and the most bearish reporting a price target of just $145.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $7.8 billion, earnings will come to $3.7 billion, and it would be trading on a PE ratio of 10.2x, assuming you use a discount rate of 9.0%.

- Given the current share price of $131.26, the bullish analyst price target of $270.68 is 51.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:FSLR. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.