Key Takeaways

- Geopolitical tensions, deglobalization, and climate regulations are raising compliance, logistics, and operating costs, eroding profitability and increasing long-term risk.

- Intense competition, customer concentration, and rapid industry shifts threaten market share, pricing power, and future revenue stability.

- Strategic diversification, technology advancements, and industry partnerships position FormFactor for stronger margins and resilience despite geopolitical challenges and cyclical semiconductor volatility.

Catalysts

About FormFactor- Designs, manufactures, and sells probe cards, analytical probes, probe stations, thermal systems, cryogenic systems, and related services in the United States and internationally.

- Rising and persistent geopolitical tensions and increased supply chain deglobalization threaten to disrupt FormFactor's cross-border semiconductor equipment trade, introducing sustained operational uncertainty, elevated compliance costs, and potential customer attrition as multinational clients reevaluate logistics. These factors are likely to constrain revenue growth and could erode gross and net margins over the long term.

- Ongoing and potentially escalating climate regulation and requirements for robust, traceable sustainability practices in global supply chains are expected to raise compliance and operating costs for companies like FormFactor, pressing on net margins and increasing the overall cost of serving major chip manufacturers.

- Intensifying competition from lower-priced Asian probe card makers, combined with the threat of large semiconductor customers investing in in-house test solutions, could force FormFactor into repeated price reductions and depress gross profit margins, causing a long-term structural reduction in profitability.

- The company's continued dependence on a limited set of large customers, with recent revenue volatility and noted customer concentration (such as the risk of a single customer rising toward thirty percent of sales), makes FormFactor's revenues highly vulnerable to sharp declines if key customers shift to alternative suppliers or reduce purchases due to internalization of test or alternate sourcing strategies.

- Failure to maintain technological leadership amid the rapid pace of change-such as the shift toward advanced packaging, chiplet architectures, and shorter semiconductor development cycles-risks FormFactor falling behind competitors or missing critical qualification windows, resulting in lost market share, diminished addressable market, and long-term declines in both revenue and earnings power.

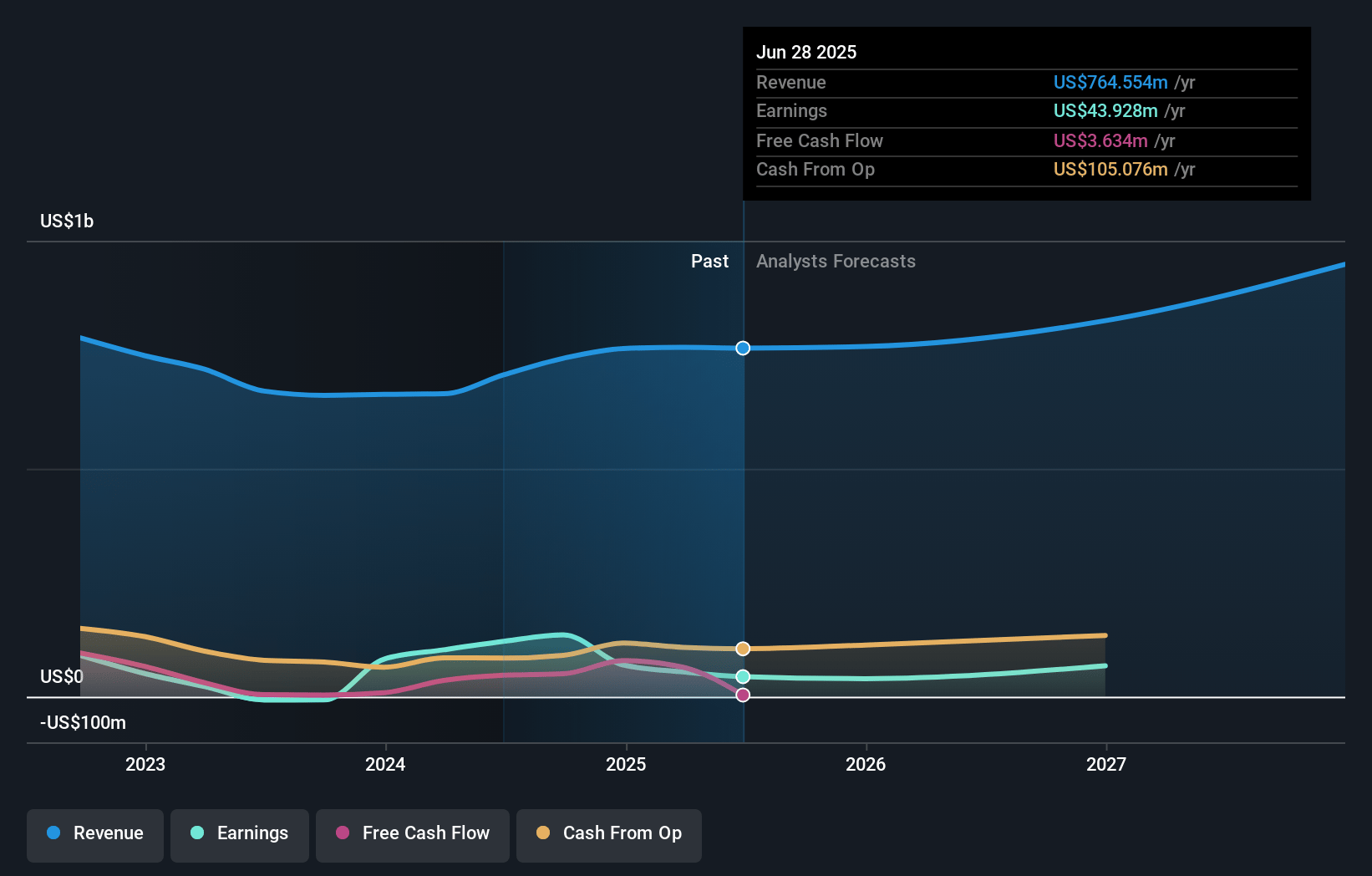

FormFactor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on FormFactor compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming FormFactor's revenue will grow by 5.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 7.1% today to 7.5% in 3 years time.

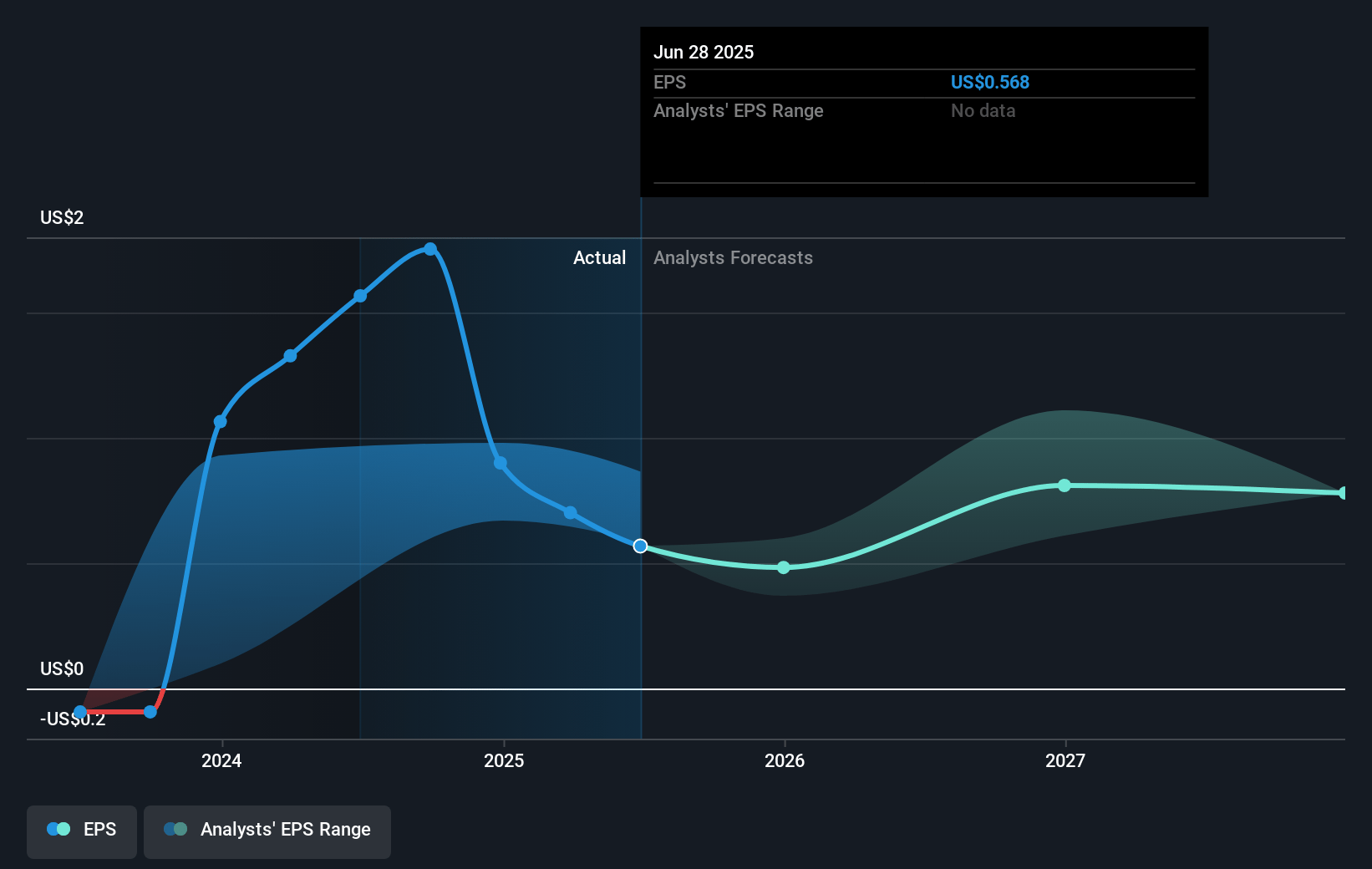

- The bearish analysts expect earnings to reach $68.0 million (and earnings per share of $0.97) by about July 2028, up from $54.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 44.0x on those 2028 earnings, down from 49.9x today. This future PE is greater than the current PE for the US Semiconductor industry at 31.1x.

- Analysts expect the number of shares outstanding to decline by 0.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.52%, as per the Simply Wall St company report.

FormFactor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid adoption of generative AI and advanced packaging technologies like high-bandwidth memory (HBM) and co-packaged optics is driving increased test intensity and complexity, which strongly positions FormFactor to capture more revenue and expand gross margins as these secular trends accelerate across the semiconductor industry.

- FormFactor's proactive diversification into key growth markets-including foundry, logic, HBM, and new opportunities with advanced probe cards for GPUs and photonics-reduces risk from customer concentration and cyclical exposure, supporting more stable and potentially expanding long-term revenue.

- The company's successful acquisition of FICT Limited, provider of multilayer organic substrates, enhances FormFactor's technology leadership and supply chain control in high-margin, advanced probe card markets, likely resulting in better profitability and competitive strength in the long-term.

- Ongoing partnerships and collaboration with leading ATE manufacturers and industry customers-including recent investment by Advantest-help FormFactor align R&D with the fastest-growing and most complex market demands, which may drive sustainable product differentiation and higher earnings over time.

- Despite current tariff and geopolitical headwinds, FormFactor's management continues to invest in cost reduction, automation, and lean manufacturing, with a clear target of improving margins back toward previous high-40 percent levels as volumes rebound, which should support stronger net income and shareholder returns if industry conditions normalize and secular tailwinds persist.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for FormFactor is $30.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of FormFactor's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $45.0, and the most bearish reporting a price target of just $30.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $909.6 million, earnings will come to $68.0 million, and it would be trading on a PE ratio of 44.0x, assuming you use a discount rate of 9.5%.

- Given the current share price of $35.1, the bearish analyst price target of $30.0 is 17.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.