Key Takeaways

- Rising chip complexity and industry onshoring trends are driving demand for Entegris’ advanced contamination control solutions and expanding its geographic and market share footprint.

- Technology leadership, ongoing R&D, and successful acquisitions are boosting recurring revenue, margins, and earning power through premium, innovative offerings and cross-selling opportunities.

- Geopolitical risks, slowing industry innovation, heavy investment, high debt, and stricter regulations threaten Entegris’ growth prospects, financial flexibility, and long-term profitability.

Catalysts

About Entegris- Provides advanced materials and process solutions for the semiconductor and other high-technology industries in North America, Taiwan, South Korea, Japan, China, Europe, and Southeast Asia.

- Entegris is set to benefit from surging wafer starts and capital investment by semiconductor manufacturers driven by the AI, cloud computing, and IoT boom; as chip complexity rises and new advanced logic and memory nodes ramp in the second half of 2025 and into 2026, Entegris’ specialized materials and contamination control solutions will see increasing content per wafer, fueling outsized revenue growth and supporting bullish top-line projections.

- Expanding investments in onshoring and regional supply chain diversification—including the ramp-up of new facilities in Taiwan and Colorado, as well as partnerships supported by CHIPS Act funding in the US—position Entegris to capture greater market share in localized semiconductor production, which should drive geographic sales expansion, higher customer retention, and substantial medium

- to long-term revenue gains.

- Accelerating complexity and miniaturization across advanced logic, AI-enabled chips, and next-generation device architectures (including EUV and 3D NAND/packaging) are sharply raising purity and contamination control requirements, areas where Entegris maintains clear technological leadership; this growing need for premium solutions is expected to improve average selling prices and increase recurring revenue, contributing to margin expansion.

- Ongoing and significant R&D investment, highlighted by a 14 percent increase in 2024, is already driving new Process of Record wins in high-growth areas such as molybdenum deposition and etch solutions for next-generation memory and advanced logic; these initiatives are yielding higher-margin, advanced product offerings and are expected to support sustained EBITDA margin expansion and improved earnings leverage as industry demand rebounds.

- Successful integration of strategic acquisitions like CMC Materials has created a broader, more vertically integrated portfolio, enabling cross-selling and a solution-selling strategy that is already fueling synergy-driven revenue outperformance versus the broader market, pointing to continued above-market revenue growth and stable improvement in both profitability and free cash flow margins in the coming years.

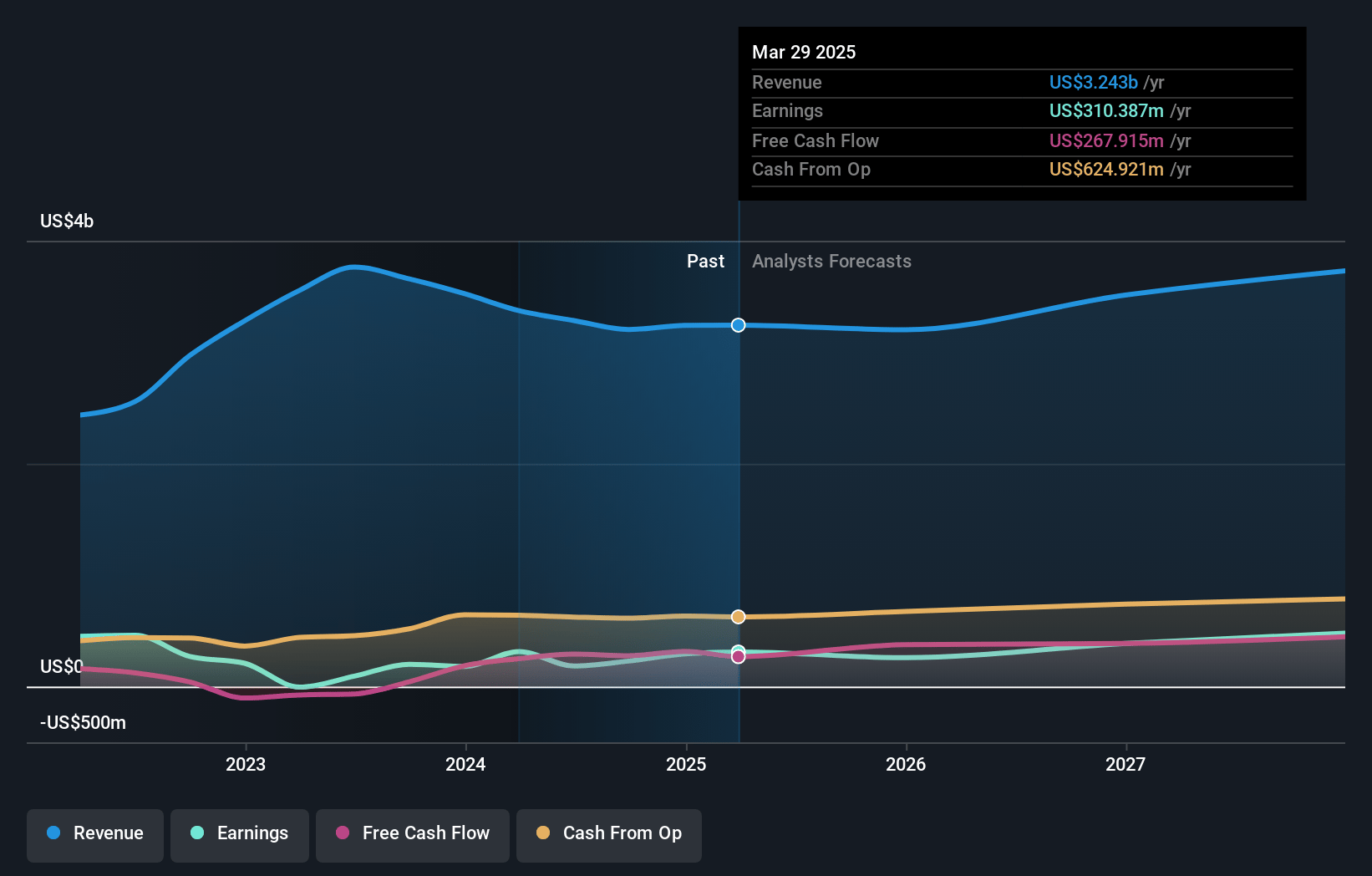

Entegris Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Entegris compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Entegris's revenue will grow by 7.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.0% today to 16.3% in 3 years time.

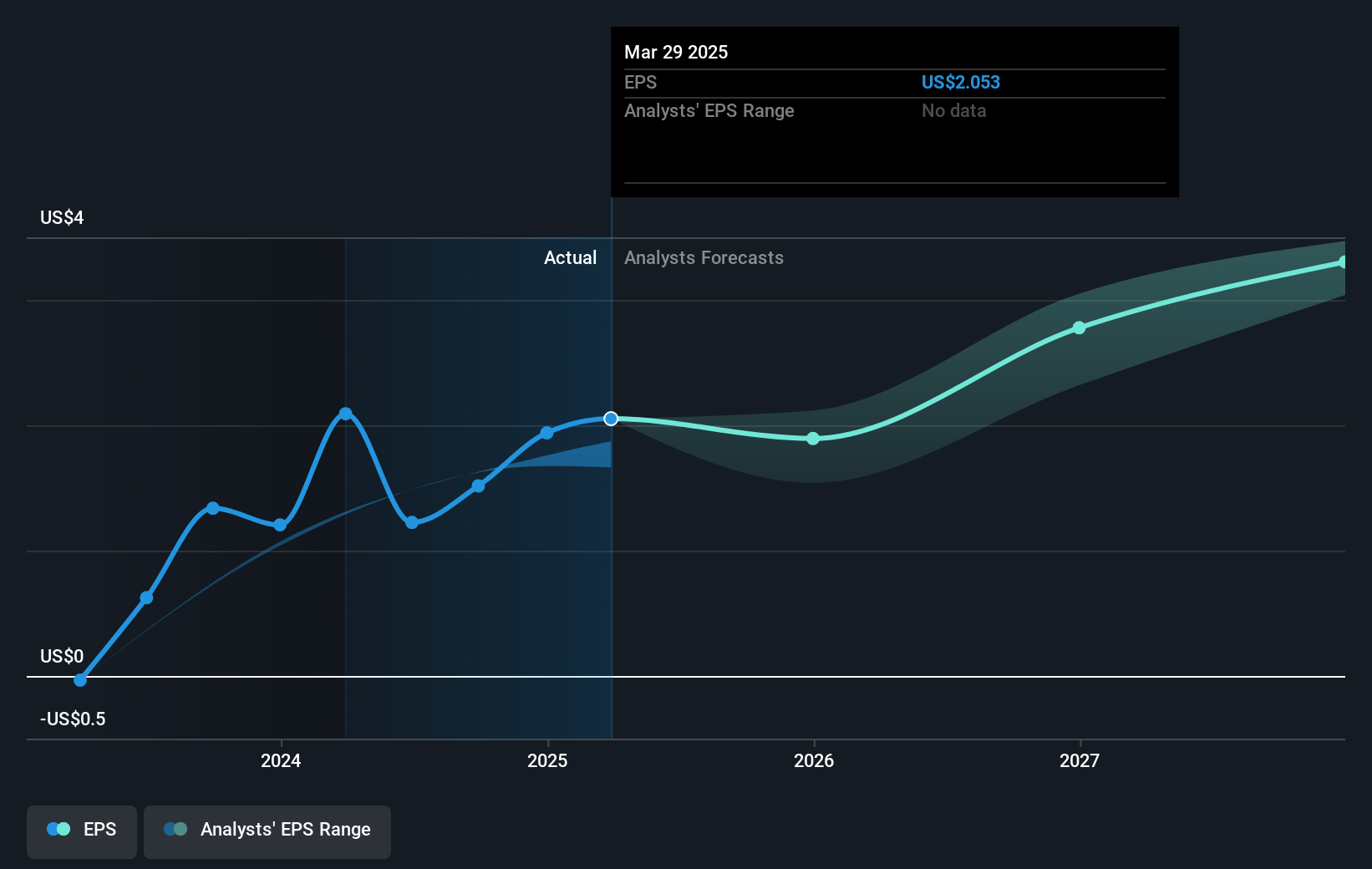

- The bullish analysts expect earnings to reach $664.4 million (and earnings per share of $3.53) by about April 2028, up from $292.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 46.0x on those 2028 earnings, up from 34.9x today. This future PE is greater than the current PE for the US Semiconductor industry at 22.3x.

- Analysts expect the number of shares outstanding to grow by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.23%, as per the Simply Wall St company report.

Entegris Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising geopolitical tensions and tightening export controls, particularly US restrictions impacting sales to Chinese customers, are expected to result in an annual incremental revenue loss of $30 million to $40 million in 2025; future escalations could further erode revenue and reduce Entegris’ access to key growth markets, especially since China comprised 21% of the company’s 2024 revenue.

- Industry-wide slowing in technology miniaturization, with no significant node transitions in 2024 and only second-half transitions expected in 2025, could diminish the frequency and scale of fab expansions, which would curtail content-per-wafer growth and suppress long-term revenue expansion for Entegris.

- The company’s heavy investments in R&D and capital expenditures, with CapEx targeted at 10% of sales and R&D investments up 14% in 2024, may pressure net margins and earnings if anticipated growth in new technology nodes or increased sales volumes do not materialize at forecasted rates.

- Entegris’ ongoing debt burden, with gross debt at approximately $4 billion and gross leverage at 4.3x at year-end 2024, could constrain financial flexibility, raise interest expenses, and limit its ability to invest in growth initiatives or respond to unexpected headwinds, thereby putting downward pressure on net earnings and free cash flow.

- Global trends toward sustainability and stricter regulation of hazardous chemicals could increase compliance costs and potentially limit Entegris’ ability to use certain materials in its products, reducing profitability and putting pressure on both gross margin and R&D effectiveness over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Entegris is $150.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Entegris's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $150.0, and the most bearish reporting a price target of just $85.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.1 billion, earnings will come to $664.4 million, and it would be trading on a PE ratio of 46.0x, assuming you use a discount rate of 10.2%.

- Given the current share price of $67.6, the bullish analyst price target of $150.0 is 54.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:ENTG. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.